MSE Trading Report for Week ending 27 September 2019

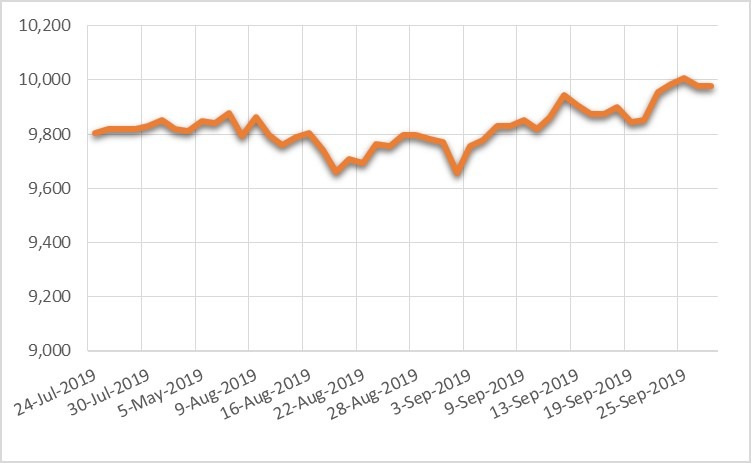

| MSE Equity Total Return Index: |

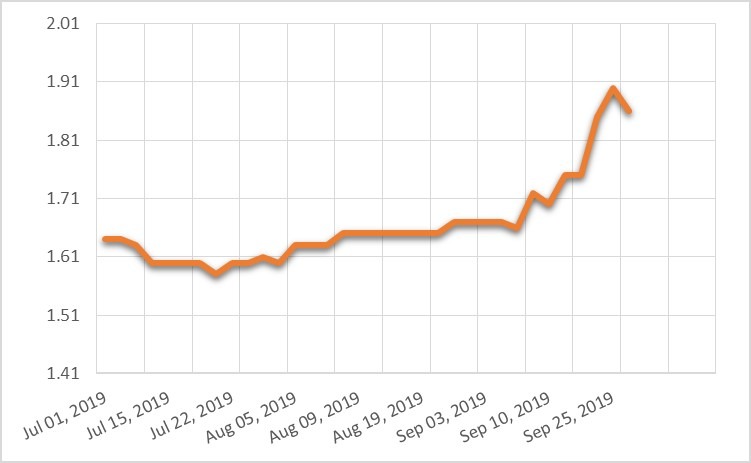

| Chart of the Week: PG plc |

| Highlights: |

- The MSE Equity Total Return Index recovered last week’s fall, as it closed 1.278% higher at 9,976.174 points. A total of 18 equities were active, of which eight headed north while three closed in the opposite direction. Total weekly turnover stood at €0.97 million as 137 deals were executed.

- Three equities were active in the banking sector, all of which ended in different territory. Bank of Valletta plc registered a further 1.30% gain as it reached an 11-week high of €1.17. A total turnover of €17,780 was generated as 40,476 shares changed hands over 25 deals.

- Its peer, HSBC Bank Malta plc, headed the list of fallers with a 1.41% decline to €1.40, reaching nearly a 16-year low. Six deals involving 12,603 shares were executed and total weekly turnover stood at €17,780.

- Meanwhile, FIMBank plc was active but closed unchanged at $0.620.

- On Wednesday, PG plc reached an all-time high of €1.90, but closed at €1.88, translating into a 7.43% rise in price. It recorded the best performance for the week as 16 deals involving 64,486 shares pushed its price into positive territory. Total weekly turnover amounted to €121,552.

- On Wednesday, the board of Simonds Farsons Cisk plc approved the Group’s unaudited financial statements and interim directors’ report for the six months ended July 31, 2019. Overall, a positive performance was recorded across the Group in terms of both turnover and profitability. Profit before tax increased by 5.2% to €6.9 million during the first six months of the year, when compared to the same period last year. Earnings per share also registered a 4.4% gain, as the six month period figure stood at €0.213. An interim dividend of €1 million, out of tax exempt profits, shall be distributed. No trading was recorded during the week.

- On Friday, the Board of Trident Estates plc announced that an Application for Authorisation for Admissibility to Listing to the Listing Authority has been made. Through such application, the company is requesting the approval of a prospectus in relation to the rights issue. The rights issue shall be offered to shareholders listed on the register of the Malta Stock Exchange as at October 4, 2019. If approved, shareholders shall be entitled to the subscription of two new ordinary shares for every five ordinary shares, or parts thereof – subject to rounding, at a rights issue price of €1.25 per new ordinary share. If fully subscribed, the rights issue shall raise circa €15 million gross proceeds which will be used to partly finance the Trident Park project development. Three deals involving 10,820 shares impacted price with a positive 5.11% change to €1.85, to end the week with a total turnover of €19,960.

- On the corporate debt front, out of 43 active issues, 18 registered gains while 16 closed in the red.

- In the sovereign debt market, 19 issues were active, of which 17 advanced while two lost ground.

| Upcoming Events: | ||||

| Best Performers: | ||||

| 11 OCT 2019 | MT: Santumas Shareholdings plc – AGM | 1. PG | +7.43% | |

| 24 OCT 2019 | EU: ECB – Interest Rate Decision | 2. IHI | +5.45% | |

| 30 OCT 2019 | US: FED – Interest Rate Decision | 3. TRI | +5.11% | |

| 07 NOV 2019 | UK: BoE – Interest Rate Decision | |||

| 11 DEC 2019 | US: FED – Interest Rate Decision | Worst Performers: | ||

| 12 DEC 2019 | EU: ECB – Interest Rate Decision | 1. HSB | -1.41% | |

| 19 DEC 2019 | UK: BoE – Interest Rate Decision | 2. MPC | -1.39% | |

| 3. GO | -0.91% | |||

| Price (€): 27.09.2019 | Price (€): 20.09.2019 | Weekly Change (%) | Year-to-date Change (%) | |

| MSE Equity Total Return Index | 9,976.174 | 9,9850.240 | -0.579 | 10.858 |

| BMIT Technologies plc | 0.530 | 0.530 | 0.00 | 8.163 |

| Bank of Valletta plc | 1.170 | 1.155 | 1.30 | -3.226 |

| FIMBank plc (USD) | 0.620 | 0.620 | 0.00 | -17.33 |

| GlobalCapital plc | 0.250 | 0.250 | 0.00 | -24.70 |

| Grand Harbour Marina plc | 0.670 | 0.670 | 0.00 | -4.29 |

| GO plc | 4.360 | 4.400 | -0.91 | 10.10 |

| HSBC Bank Malta plc | 1.400 | 1.420 | -1.41 | -23.50 |

| International Hotel Investments plc | 0.870 | 0.825 | 5.45 | 40.32 |

| Lombard Bank plc | 2.260 | 2.260 | 0.00 | -7.38 |

| Loqus Holdings plc | 0.080 | 0.080 | 0.00 | 6.67 |

| MIDI plc | 0.620 | 0.620 | 0.00 | -7.46 |

| Medserv plc | 1.260 | 1.260 | 0.00 | 9.57 |

| Malta International Airport plc | 7.400 | 7.200 | 2.78 | 27.59 |

| Malita Investments plc | 0.880 | 0.855 | 2.92 | 0.00 |

| Mapfre Middlesea plc | 2.200 | 2.160 | 1.85 | 10.55 |

| Malta Properties Company plc | 0.710 | 0.720 | -1.39 | 24.56 |

| Main Street Complex plc | 0.600 | 0.600 | 0.00 | -7.69 |

| MaltaPost plc | 1.350 | 1.350 | 0.00 | -14.56 |

| PG plc | 1.880 | 1.750 | 7.43 | 41.35 |

| Plaza Centres plc | 1.020 | 1.020 | 0.00 | 0.00 |

| RS2 Software plc | 1.910 | 1.910 | 0.00 | 36.43 |

| Simonds Farsons Cisk plc | 11.100 | 11.100 | 0.00 | 26.86 |

| Santumas Shareholdings plc | 1.620 | 1.620 | 0.00 | 14.08 |

| Tigné Mall plc | 0.940 | 0.935 | 0.53 | -2.59 |

| Trident Estates plc | 1.850 | 1.760 | 5.11 | 23.33 |

This report which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]