Managed

Portfolio

Services

Let us manage your portfolio while you focus on what you do best.

Our dedicated teams of asset managers and investment advisors strive to make your investment journey a pleasant one and which helps you achieve your investment goals in an efficient and transparent manner. We will help you choose the strategy which best fits your investment objective and risk profile. Our team will actively manage your portfolio to reflect our market outlook. We will keep you updated with quarterly performance valuations, while an annual review will ensure that the investment strategy of your choice is still suitable for you.

Is building wealth through financial assets complex?

Over time cash has generated meagre returns, yet many still opt to accumulate money in the bank. Investing wisely helps your money work, instead of laying idle in a savings account. If you have a long- term investment time horizon, investing through a diversified strategy will provide you with peace of mind and returns in line with your risk profile and investment objective.

Investing with an objective in mind

Investing is not speculating. Investing in a disciplined manner help you achieve your goals without taking unnecessary risks, while avoiding timing the market. With interest rates at record low levels and inflation rising, your money will be worth less in the future. Just think about how much more money will you need in 10 or 20 years’ time to buy the same products/services a €1,000 will buy you today.

The earlier you start the better

Investing at an early stage teaches financial independence and discipline. The earlier you start the more money you will have in the future. At a young age investors tend to have a higher risk tolerance, and the higher the risk, the higher the reward over the long-term.

If you watch the financial news, you may question when the right time is to invest. The political and economic climate affect financial markets continuously. From time-to-time market setbacks occur, however, these are always followed by periods of recovery. As advocates of long-term investing, we believe investors should remain invested and avoid market timing, which could deprive investors from the best buying opportunities.

Many wonder where to start from…

The problem of accumulating money in the bank is usually the result of the complexity which comes with investing. Many investors struggle to decide from where to start, which investments to choose, how to decide when to make portfolio changes and how to monitor performance.

These are the concerns of many investors. Our thorough client assessments and investment processes aim to tackle these concerns and provide investors with peace of mind along the way.

4 Strategies to choose from

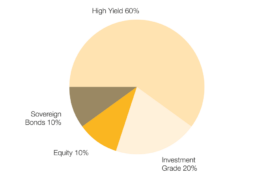

Balanced Income Strategy

This strategy consists of a diversified pool of assets, with a strong weighting in fixed-income securities, and most suitable to those investors whose primary investment objective is income return. The strategy will be composed of high-yielding bonds, investment-grade bonds, government bonds, and equity securities to a lesser extent.

The income generated from this strategy will be distributed to investors, and is suitable to investors having a balanced risk-profile, and a time horizon of 5 years and over. The strategy’s targeted annualized volatility (risk) will vary between 5% and 10% (SRRI Level 4).

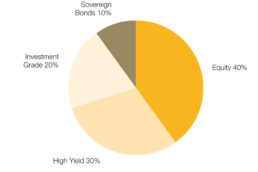

Balanced Growth Strategy

This strategy is likewise suitable to those investors having a balanced-risk profile, but whose primary objective is capital growth over the medium-to-long term. The strategy will be composed of a diversified pool of assets, with a targeted strategic equity allocation of circa 40%. The higher equity allocation will imply a higher level of expected volatility, while also increasing the possibility of achieving a higher level of capital growth over the medium-to-long term.

Income generated from this strategy will be automatically re-invested (compounding returns) and is suitable to investors having a balanced risk-profile, and a time horizon of 5 years and over. The strategy’s targeted annualized volatility (risk) will vary between 7% and 10% (SRRI Level 4).

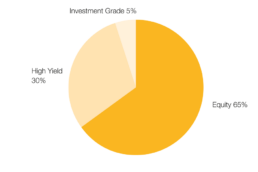

Balanced Aggressive Strategy

This strategy is most suitable for those investors whose primary objective is growth over the long-term, and having a balanced-aggressive risk profile, A higher equity allocation of circa 65% will entail a higher level of volatility, but a corresponding higher level of growth potential over the long-term.

Any income generated from this strategy will be automatically re-invested (compounding returns) and is most appropriate for investors having a balanced-aggressive risk-profile, and a time horizon of 10 years and over. The strategy’s targeted annualized volatility (risk) will vary between 10% and 15% (SRRI Level 5).

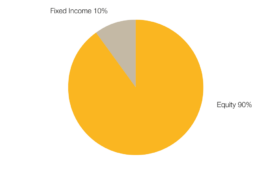

Aggressive Growth Strategy

This strategy will be equity-driven, with a targeted strategic equity allocation of 90%. With the remaining 10% allocated across fixed-income securities and cash. This strategy is most suitable to investors having a long-term time horizon, 10 years and over, with no income requirements over the medium-to-long term. One is to expect a higher level of risk when compared to the other three strategies, with a compensating capital growth potential over the long-term.

Income generated from this strategy will be automatically re-invested (compounding returns) and is most appropriate for investors having a balanced-aggressive risk-profile, and a time horizon of 10 years and over. The strategy’s targeted annualized volatility (risk) will vary between 15% and 25% (SRRI Level 6).

A diversified portfolio is key.

The selection of assets which make up the portfolio is key for investors to reach their investment objective, while staying within the desired risk profile. Our managed strategies provide investors with exposure to multi-asset strategies made up of different investment funds which give investors a global exposure to asset classes. No asset class will outperform all others year in year out, therefore diversification is key to help investors reach goals, while keeping portfolio volatility in check. Our managed strategies give investors exposure to global investment grade bonds, sovereign bonds, high yield bonds, local bonds, emerging markets, equities, and cash. Through a well-diversified portfolio, investors should expect steady and long-term returns across different market conditions.

Main Features

- Minimum portfolio amount of €50,000 and minimum top-up of €5,000

- Diversified strategies through renowned international fund house

- At the outset, assessments are carried out to determine the most suitable strategy

- Designed for investors with an investment time horizon of at least 5 years.

- Access to well diversified actively managed funds

- Quarterly detailed valuation reports

- Entry fee of 2% and management fee of 1% on non-Merill Funds

- Rebate of any trailer fees received from third-party fund managers

- Access to institutional share classes, with reduced management fees.

- Online access to your portfolio

Legal disclosure

The information provided on this website is being provided for informational purposes and the products/services referred to herein may not be suitable or appropriate for every investor. Investment advice should always be based on the particular circumstances of the person to whom it is directed. The Company is licensed to conduct investment services by the MFSA, under the Investment Services Act. Investors should remember that past performance is no guide to future performance and that the value of investments may go down as well as up. For further information contact Jesmond Mizzi Financial Advisors Limited of 67, Level 3, South Street, Valletta, on Tel: 2122 4410, or email [email protected]