Marketing communication

Investing in the present for our future

The Global Sustainable Equity Team share a simple yet ambitious mission: To deliver outstanding investment returns to clients. To be leaders in sustainable investing. And, as active managers, to play a part in making the world a better place.

Why Invest in the Fund?

Highly Experienced, Interdisciplinary Team

Established strategy built on a 30-year history of sustainable investing and innovative

thought leadership.

Identifying Positive Impact

High-conviction portfolio with companies selected for their compounding* growth potential and positive impact on the environment and society.

We are who we say we are. We do what we say we do.

Commitment to provide clients with high standards of engagement, transparency

and measurement.

Fund Facts

Structure |

SICAV |

SFDR Categorization 1 |

Article 9 |

Inception date |

29 May 2019 |

AUM |

$1.45b (as at 30th Apr 2025) |

Benchmark |

MSCI World Index |

Sector |

Morningstar Global Flex-Cap Equity |

Expected tracking

|

300–600bps |

Holdings range |

50–70 |

Expected annual turnover |

< 30% |

Position size |

0.5% – 2.0% active at time of purchase with a maximum 3.0% active positions imposed by the managers |

Market cap* range |

Typically no more than 5% of NAV* would be invested in companies with a market cap < GBP 1b (at all times) |

Base currency |

USD |

Role in a Diversified Portfolio

Portfolio position |

Traditional equity Sustainable Equity Exposure |

Portfolio implementation |

Complement traditional equity strategies |

What this aims to offer

|

■ Long-term growth of capital ■ Experienced team |

1 In accordance with the Sustainable Finance Disclosure Regulation, the Fund is classified as an Article 9 and has sustainability as its objective. Investment into the fund will acquire units / shares of the fund itself and not the underlying assets owned by the fund. Note that any differences among portfolio securities currencies, share class currencies and costs to be paid or represented in currencies other than your home currency will expose you to currency risk. Costs and returns may increase or decrease as a result of currency and exchange rate fluctuations. Fund charges will impact the value of your investment. In particular, the ongoing charges applicable to each fund will dilute investment performance, particularly over time. For further explanation of charges please visit our Fund Charges page at www.janushenderson.com. Please note that these ranges are reflective of the portfolio managers’ investment process and style at time of publication. They may not be hard limits and are subject to change without notice. Please refer to the Prospectus for the broader parameters within which the strategy may operate. For a list of available share classes, please contact your local sales representative.

Investment Objective 2

The Fund aims to provide capital growth over the long term (5 years or more) by investing in companies whose products and services are considered by the investment manager as contributing to positive environmental or social change and thereby have an impact on the development of a sustainable global economy.

Investment Policy 2

The Fund invests at least 80% of its assets in shares (also known as equities) of companies, of any size, in any industry, in any country. The Fund will avoid investing in companies that the investment manager considers to potentially have a negative impact on the development of a sustainable global economy.

The Fund may also invest in other assets including cash and money market instruments.

The investment manager may use derivatives (complex financial instruments) to reduce risk or to manage the Fund more efficiently.

The Fund is actively managed with reference to the MSCI World Index, which is broadly representative of the companies in which it may invest, as this can provide a useful comparator for assessing the Fund’s performance.

The investment manager has discretion to choose investments for the Fund with weightings different to the index or not in the index, but at times the Fund may hold investments similar to the index.

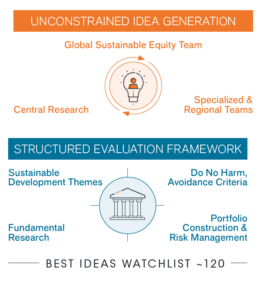

Unconstrained idea generation filtered through a rigorous evaluation framework

Source: Janus Henderson Investors

2 The value of an investment and the income from it can fall as well as rise as a result of market and currency fluctuations and you may not get back the amount originally invested. Potential investors must read the prospectus, and where relevant, the key investor information document before investing. This website is a Marketing Communication and does not qualify as an investment recommendation.

Risk Indicator

The risk indicator assumes that you keep the product for 5 years. The actual risk can vary significantly if you cash in at an early stage and you may get back less. The summary risk indicator is a guide to the level of risk of this product compared to other products. It shows how likely it is that the product will lose money because of movements in the markets or because we are not able to pay you. We have classified this product as 4 out of 7, which is a medium risk class. This rates the potential losses from future performance at a medium level, and poor market conditions could impact the capacity of the PRIIPs manufacturer to pay you.

If the product currency differs from your home currency, the following applies: Be aware of currency risk. You will receive payments in a different currency, so the final return you will get depends on the exchange rate between the two currencies. This risk is not considered in the indicator shown above. This product does not include any protection from future market performance so you could lose some or all of your investment. If we are not able to pay you what is owed, you could lose your entire investment.

Details of all relevant risks can be found in the Fund’s prospectus, available at www.janushenderson.com

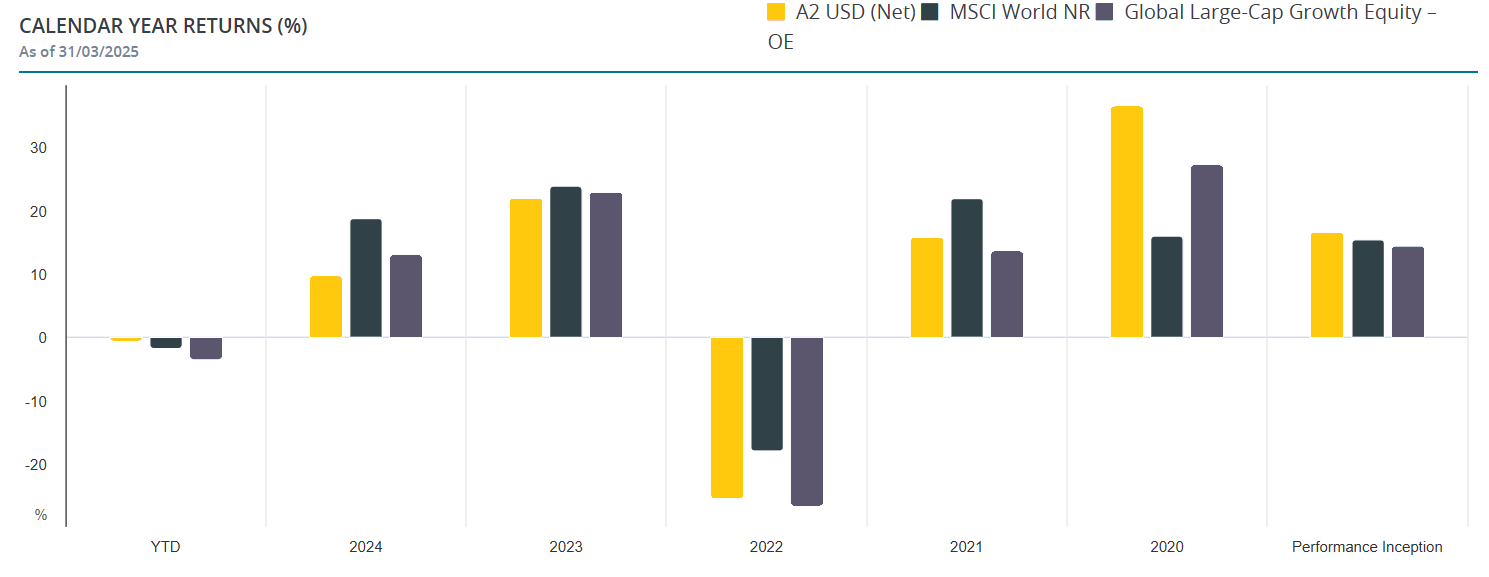

Calendar Year Performance

YTD |

2023 |

2022 |

2021 |

2020 |

PERFORMANCE INCEPTION29/05/2019 |

|

A2 USD (Net) |

16.18 | 21.91 | -25.64 | 15.71 | 36.57 | 16.50 |

MSCI World NR |

18.86 | 23.79 | -18.14 | 21.82 | 15.90 | 15.31 |

Global Large-cap Growth Equity – OE |

15.01 | 22.79 | -26.69 | 13.57 | 27.23 | 14.35 |

Past performance does not predict future returns. All performance data includes both income and capital gains or losses and reflects the deduction of any ongoing charges or other fund expenses. Performance/performance target related data will display only when relevant to the fund/share class inception date and the annualised target time period. © Morningstar 2022. All rights reserved. NAV-NAV, gross income reinvested where applicable.

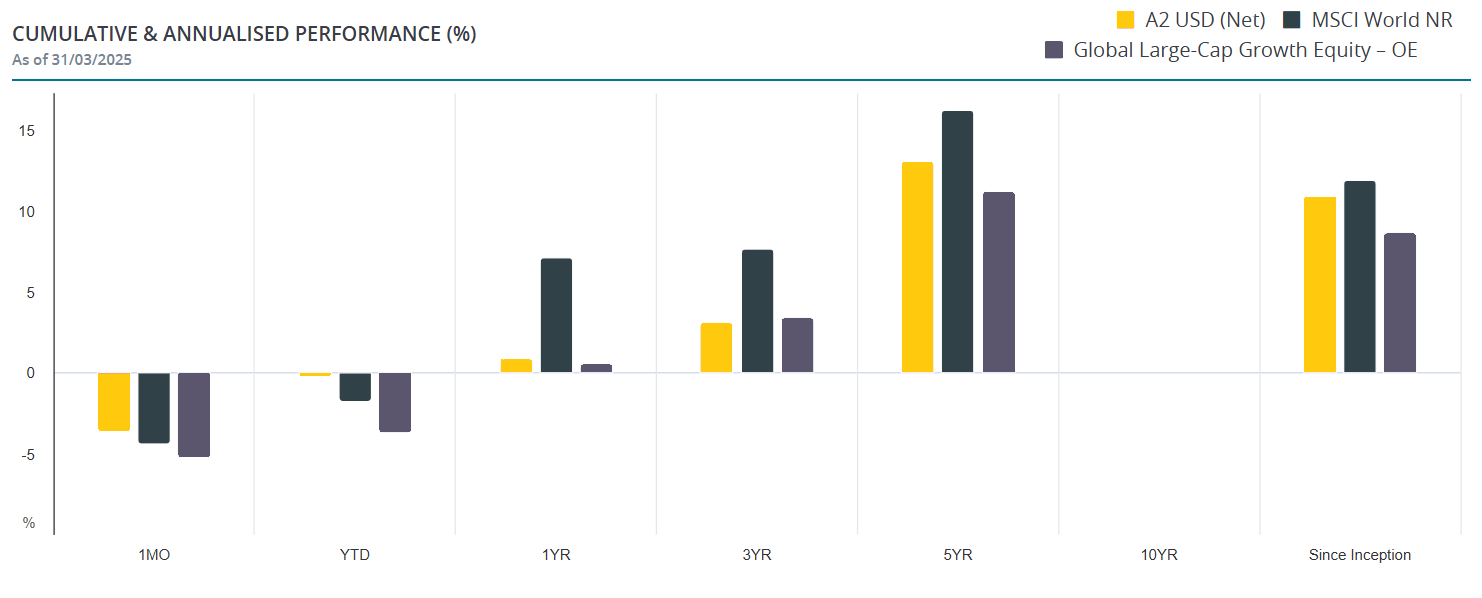

Cumulative and Annualised Performance

CUMULATIVE |

ANNUALISED |

1MO |

YTD |

1YR |

3YR |

5YR |

10YR |

SINCE INCEPTION29/05/2019 |

|

| A2 USD (NET) | 0.78 | 16.18 | 30.57 | 3.54 | 12.87 | – | 13.20 |

| MSCI World NR | 1.83 | 18.86 | 32.43 | 9.08 | 13.04 | – | 13.44 |

| Global Large-Cap Growth Equity – OE | 1.84 | 15.01 | 29.45 | 2.65 | 10.41 | – | 10.57 |

Past performance does not predict future returns. All performance data includes both income and capital gains or losses and reflects the deduction of any ongoing charges or other fund expenses. Performance/performance target related data will display only when relevant to the fund/share class inception date and the annualised target time period. © Morningstar 2022. All rights reserved. NAV-NAV, gross income reinvested where applicable.

Portfolio

TOP HOLDINGS(as of 30/05/2025) |

% of Fund |

Microsoft |

5.64 |

NVIDIA |

4.14 |

Schneider Electric |

3.32 |

Westinghouse Air Brake Technologies |

3.26 |

Progressive |

3.04 |

T-Mobile US |

2.73 |

Xylem |

2.50 |

Intact Financial |

2.49 |

Uber Technologies |

2.43 |

Humana |

2.41 |

The performance metrics shown above are as of end of September 2024 and refer to the Share Class-A2 USD (ISIN: LU1983259539). References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

*Net asset value (NAV) – The total value of a fund’s assets less its liabilities.

*Compounding – The process whereby interest is credited to an existing principal amount as well as to interest already paid. Compounding thus can be construed as interest on interest—the effect of which is to magnify returns to interest over time.

*Market capitalisation – The total market value of a company’s issued shares. It is calculated by multiplying the number of shares in issue by the current price of the shares. The figure is used to determine a company’s size, and is often abbreviated to ‘market cap’.

*Tracking error – This measures how far a portfolio’s actual performance differs from its benchmark index. The lower the number, the more closely it resembles the index.

Jesmond Mizzi Financial Advisors Limited is the local representative of Janus Henderson Investors in Malta.

Formed in 2017 from the merger between Janus Capital Group and Henderson Group, the company is committed to adding value through active management. For Janus Henderson, active is more than just an investment approach – it is the way ideas are translated into action, how it communicates its views and the partnerships that are built in order to create the best outcomes for clients.

Documentation

Find out how we can help harness the best risk-adjusted opportunities to create a diverse portfolio of high yielding bonds.

Kindly fill in the form below to request additional information about this investment opportunity.

Any investment application will be made solely on the basis of the information contained in the Fund’s prospectus (including all relevant covering documents), which will contain investment restrictions. This is a marketing communication. Please refer to the prospectus of the UCITS and to the KIID before making any final investment decisions. Information is provided on the Fund on the strict understanding that it is to – or for clients resident outside the USA. For sustainability related aspects please access Janushenderson.com. We may record telephone calls for our mutual protection, to improve customer service and for regulatory record keeping purposes. Nothing in this communication is intended to or should be construed as advice. This communication is not a recommendation to sell or purchase any investment. It does not form part of any contract for the sale or purchase of any investment. Past performance does not predict future returns. The performance data does not take into account the commissions and costs incurred on the issue and redemption of units. Deductions for charges and expenses are not made uniformly throughout the life of the investment but may be loaded disproportionately at subscription. If you withdraw from an investment up to 90 calendar days after subscribing you may be charged a Trading Fee as set out in the Fund’s prospectus. This may impact the amount of money which you will receive and you may not get back the amount invested. The value of an investment and the income from it can fall as well as rise significantly. Some Sub-Funds of the Fund can be subject to increased volatility due to the composition of their respective portfolios. Tax assumptions and reliefs depend upon an investor’s particular circumstances and may change if those circumstances or the law change. If you invest through a third party provider you are advised to consult them directly as charges, performance and terms and conditions may differ materially.

Investment should be based upon the details contained in the Prospectus and the Key Investor Information Document, both of which may be obtained in English from Jesmond Mizzi Financial Advisors Ltd, the local representative in Malta and distributor of the Fund.

The Janus Henderson Horizon Fund (the “Fund”) is a Luxembourg SICAV incorporated on 30 May 1985, managed by Janus Henderson Investors Europe S.A. A copy of the Fund’s prospectus and key investor information document can be obtained from Janus Henderson Investors UK Limited in its capacity as Investment Manager and Distributor. Issued by Janus Henderson Investors. Janus Henderson Investors is the name under which investment products and services are provided by Janus Henderson Investors Europe S.A. (reg no. B22848 at 2 Rue de Bitbourg, L-1273, Luxembourg and regulated by the Commission de Surveillance du Secteur Financier). Copies of the Fund’s prospectus, Key Investor Information Document, articles of incorporation, annual and semi-annual reports are available in English and other local languages as required from www.janushenderson.com.

This advert is issued by Jesmond Mizzi Financial Advisors Ltd (IS30176) of 67, Level 3, South Street, Valletta VLT1105, Malta licensed to conduct investment services business under the Investment Services Act by the MFSA, Mdina Road, Zone 1, Central Business District, B’Kara CBD 1010, Malta, and is a member rm of the Malta Stock Exchange, Garrison Chapel, Castille Place, Valletta VLT 1063, Malta. A commission may be charged by the distributor at the time of the initial purchase for an investment and may be deducted from the invested amount therefore lowering the size of your investment. The summary of Investors Rights is available in English from https://www.janushenderson.com/summary-of-investors-rights-english. Janus Henderson Investors Europe S.A. may decide to terminate the marketing arrangements of this Collective Investment Scheme in accordance with the appropriate regulation. Janus Henderson, Knowledge Shared and Knowledge Labs are trademarks of Janus Henderson Group plc or one of its subsidiaries. © Janus Henderson Group plc.