MSE Trading Report for Week ending 01 November 2019

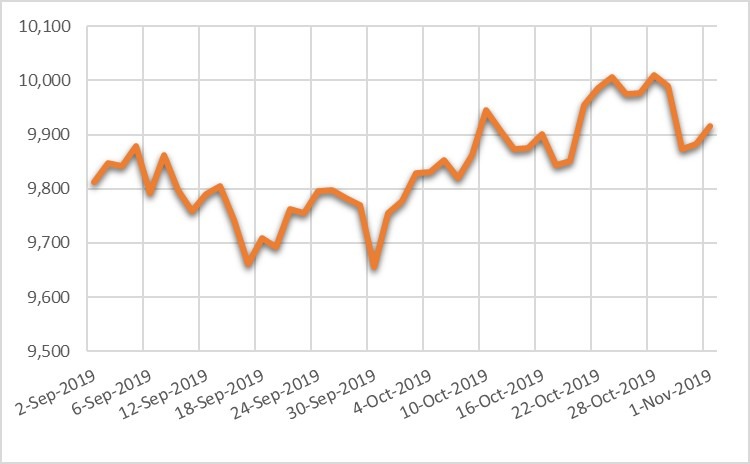

| MSE Equity Total Return Index: |

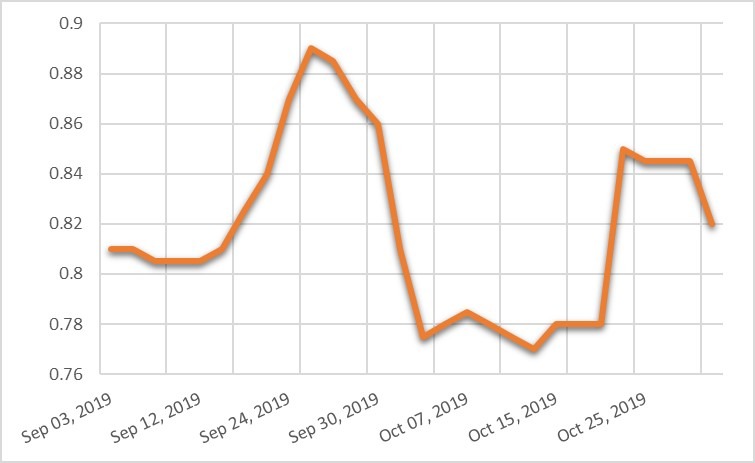

| Chart of the Week: International Hotel Investments plc |

| Highlights: |

- The local equities market lost part of its previous week’s loss, as it closed at 9,815.449 points, translating into a 0.62% decline. A total of 23 equities were active, of which four gained ground while another 12 traded lower. A total weekly turnover of €1.2 million was generated over 202 deals.

- Last Monday, Bank of Valletta plc issued its interim directors statement for the third quarter of the financial year, dating July 2019 to September 2019. Financial performance was consistent with expectations. The cost impact of the transformation programme which was undertaken earlier this year was reflected in the results. The bank aims to lower its risk profile and to ensure long-term sustainability. The bank was active over 36 deals as 120,204 shares changed ownership. Its previous week’s closing price of €1.10 was not altered. It kicked off the week in the red but managed to offset the loss on Thursday.

- The best performer was in the banking sector, as HSBC Bank Malta plc registered a further 2.31% increase to €1.33. A total of 21 deals involving 74,575 shares were executed.

- International Hotel Investments plc did not manage to sustain its previous week’s positive performance as four deals of 7,520 shares dragged its price 2.96% lower to €0.820.

- Another large cap equity trading in the red was Malta International Airport plc as its price was down by 0.68% to €7.25. During the week, five deals of 6,012 shares were executed.

- On October 24, 2019, PG plc held its third Annual General Meeting at the Corinthia Palace Hotel. All ordinary resolutions on the agenda were approved, including the audited financial statements for the year ended April 30, 2019. The equity was active last Monday as 9,850 share changed hands across three deals. Price was left unchanged at €1.87.

- On Friday, Medserv plc issued an announcement, as a follow-up to a previous issued on May 20, 2019. Following the receipt of the non-binding offers from interested offerors, its majority shareholders proceeded to select a preferred bidder. The majority shareholders are expected to enter into negotiations with the preferred bidder in order to conclude a binding offer. As a result, this will trigger the requirement for a bid by the offeror. Should the parties reach an agreement, an announcement will be published. The oil company registered a 1.69% gain, reaching a two-week high of €1.20. This was the result of 12 deals involving 87,574 shares.

- On Wednesday, Loqus Holdings plc approved its financial statements for the financial year ended June 30, 2019. A sole deal of 1,000 shares was executed last Monday, which resulted into a 24.12% fall in price to €0.065.

- On Tuesday, Santumas Shareholdings plc announced its approval by the Listing Authority for an additional 664,938 ordinary shares to be listed on the Malta Stock Exchange with a nominal value of €0.275 per share. On Wednesday, the company confirmed that such additional shares shall be admitted to the official list on November 4, 2019. Trading shall commence the next day, November 5, 2019.

- On Monday, MaltaPost plc announced that on December 20, 2019, a meeting shall be held to consider, and if deemed fit, approve its financial statements for the year ended September 30, 2019. It was active over nine deals involving 24,095 shares, resulting into a 2.34% decline to €1.25.

- The MSE MGS Total Return Index closed 0.051% lower at 1,131.17 points. Out of 23 active issues, five headed north while another 17 closed in the opposite direction.

- The MSE Corporate Bonds Total Return Index advanced by 0.409% to 1,085.81 points. A total of 46 issues were active, of 17 advanced while another 14 closed in the red.

| Upcoming Events: | ||||

| Best Performers: | ||||

| 1. HSBC | +2.31% | |||

| 07 NOV 2019 | UK: BoE – Interest Rate Decision | 2. MDS | +1.69% | |

| 11 DEC 2019 | US: FED – Interest Rate Decision | 3. MLT | +1.11% | |

| 12 DEC 2019 | EU: ECB – Interest Rate Decision | |||

| 19 DEC 2019 | UK: BoE – Interest Rate Decision | Worst Performers: | ||

| 20 DEC 2019 | MT: MaltaPost plc – Annual General Meeting | 1. LQS | -24.12% | |

| 2. GHM | -6.78% | |||

| 3. SFC | -4.96% | |||

| Price (€): 01.11.2019 | Price (€): 25.10.2019 | Weekly Change (%) | Year-to-date Change (%) | |

| MSE Equity Total Return Index | 9,815.449 | 9,877.082 | -0.624 | 9.072 |

| BMIT Technologies plc | 0.530 | 0.530 | 0.00 | 8.163 |

|---|---|---|---|---|

| Bank of Valletta plc | 1.100 | 1.100 | 0.00 | -9.016 |

| FIMBank plc (USD) | 0.640 | 0.640 | 0.00 | -14.67 |

| GlobalCapital plc | 0.270 | 0.270 | 0.00 | -18.67 |

| Grand Harbour Marina plc | 0.550 | 0.590 | -6.78 | -21.43 |

| GO plc | 4.340 | 4.360 | -0.46 | 9.60 |

| HSBC Bank Malta plc | 1.330 | 1.300 | 2.31 | -27.32 |

| International Hotel Investments plc | 0.820 | 0.845 | -2.96 | 36.26 |

| Lombard Bank plc | 2.240 | 2.260 | -0.88 | -8.20 |

| Loqus Holdings plc | 0.065 | 0.085 | -24.12 | -14.00 |

| MIDI plc | 0.710 | 0.715 | -0.70 | 5.97 |

| Medserv plc | 1.200 | 1.180 | 1.69 | 4.35 |

| Malta International Airport plc | 7.250 | 7.300 | -0.68 | 25.00 |

| Malita Investments plc | 0.910 | 0.900 | 1.11 | 3.41 |

| Mapfre Middlesea plc | 2.140 | 2.140 | 0.00 | 7.54 |

| Malta Properties Company plc | 0.660 | 0.670 | -1.49 | 15.79 |

| Main Street Complex plc | 0.600 | 0.600 | 0.00 | -7.69 |

| MaltaPost plc | 1.250 | 1.280 | -2.34 | -20.89 |

| PG plc | 1.870 | 1.870 | 0.00 | 40.60 |

| Plaza Centres plc | 1.030 | 1.030 | 0.00 | 0.98 |

| RS2 Software plc | 2.000 | 1.980 | 1.01 | 42.86 |

| Simonds Farsons Cisk plc | 11.500 | 12.100 | -4.96 | 31.43 |

| Santumas Shareholdings plc | 1.500 | 1.500 | 0.00 | 5.63 |

| Tigné Mall plc | 0.905 | 0.910 | -0.55 | -6.22 |

| Trident Estates plc | 1.510 | 1.520 | -0.66 | 0.67 |

This report which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected].