MSE Trading Report for Week ending 22 November 2019

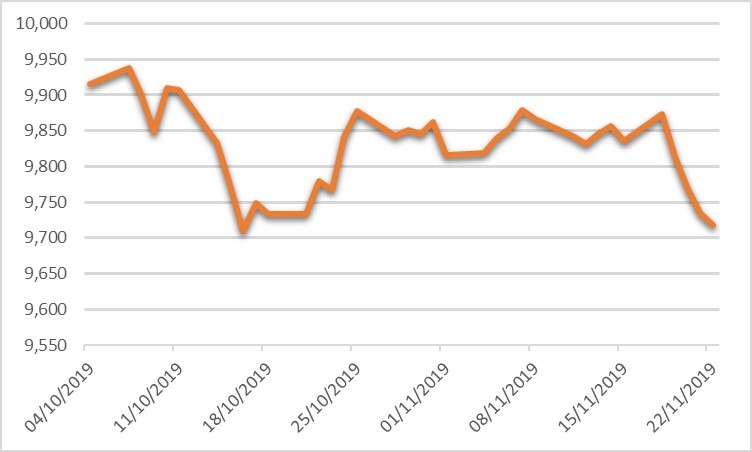

| MSE Equity Total Return Index: |

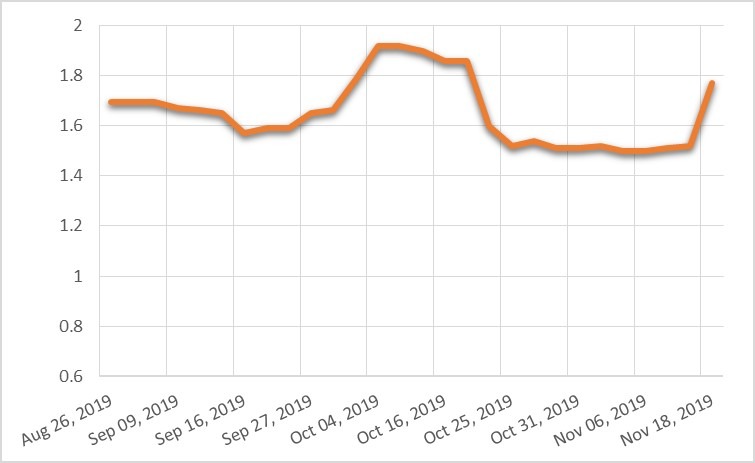

| Chart of the Week: Trident Estates plc |

| Highlights: |

- Last Tuesday, Harvest Technology plc announced the approval to listing on the official list of the Malta Stock Exchange of its entire issued share capital. Application forms for the shares shall be available from November 26, 2019. Preferred applicants may obtain Application Form ‘A’ from the company’s offices. Application Form ‘B’ may be obtained from any authorized financial intermediary by the general public. Application period ends on December 12, 2019 unless stated otherwise by the company.

- The local equities market declined by a further 1.325% as it ended the week at 9,717.441 points. A total of 17 equities were active, of which six traded higher while another nine lost ground. A total weekly turnover of €1 million was generated over 140 transactions.

- International Hotel Investments plc headed the list of fallers with a 5.88% change in price to €0.80 after trading at a weekly high of €0.85. This was the result of 14 deals involving 28,218 shares.

- Last Monday, HSBC Bank Malta plc announced that following its strategic plan to increase focus on digital banking services and to modernize the branch network, the application period for the related voluntary schemes has ended and employees will be soon contacted. The bank is expecting employee levels to decline by circa 180 persons. This will result into a restructuring charge of around €16million in the financial year ending December 31, 2019. In the long-run, the bank will benefit from ongoing cost savings.

- On Friday, the bank issued its interim directors’ report last Friday for the three-quarter period of the financial year ending December 31, 2019. The bank reported a higher profit before tax when compared to the same period last year. The bank was active over seven deals involving 12,738 shares. As a result, price declined by 2.31% to €1.27 despite reaching €1.29 during the week.

- Similarly, Bank of Valletta plc also closed in the red as it declined by a further 0.46%. The bank kicked-off the week on a positive note as it traded higher at €1.12 but did not manage to sustain the gain as the equity closed at €1.09. A total of 64,644 shares changed hands across 30 deals.

- The best performer for the week was Trident Estates plc as it registered a 16.45% increase, reaching a five-week high price of €1.77. Trading of the 12,000,003 new ordinary shares commenced during the previous week. The equity was only active last Monday as two deals involving 1,752 shares were executed. On a year-to-date basis, the equity is up by 18%.

- Last Thursday, BMIT Technologies plc issued their interim directors’ statement for the three-quarter period of the financial year ending December 31, 2019. The company announced a positive performance which is mainly reflected by the continued aim of the company to increase its service offerings.

- The equity closed the week with a positive 0.97% to €0.52. This was the result of 367,500 shares spread over 18 deals. On the other hand, its parent company, GO plc, ended the week in the opposite direction, as it closed 0.94% lower at €4.22. Eight deals involving 62,210 shares were executed.

- Last Wednesday, PG plc announced that the company shall be meeting on November 25, 2019, to consider, and if deemed fit, distribute an interim dividend to members listed on the company’s register of members as at November 25, 2019. If approved, the interim dividend shall be paid on December 5, 2019.

- The company is also scheduled to meet on December 18, 2019, to approve its interim unaudited financial statements for the half-year period ending October 31, 2019. The equity was active over six deals involving 22,750 shares, pushing the price 0.56% upwards to €1.80.

- The MSE MGS Total Return Index gained ground, as it closed 0.147% higher at 1,121.52 points. A total of 20 issues were active, of which 12 headed north while seven declined. The 2.4% MGS 2041 (I) headed the list of gainers with a 0.62% rise to €130.15. Conversely, the 5.25% MGS 2030 (I) ended the week 0.66% lower at €149.39.

- The MSE Corporate Bonds Total Return Index advanced by 0.323% to close at 1,083.12 points. Out of 55 active issues, 20 registered gains while another 16 lost ground. The 4% Stivala Group Finance plc Secured € 2027 registered the best performance, as it closed the week 2.80% higher at €103.95. On the other hand, the largest decline was registered by the 3.75% Tumas Investments plc Unsecured € 2027 as it lost 6.55% to close at par.

- Last Friday, AX Investments plc announced that its ultimate parent company, AX Group plc, has been granted approval by the MFSA to the listing of €25 million AX Group plc unsecured bonds with a nominal value of €100. Bonds may be issued at par in any one or a combination of 3.25% unsecured bonds 2026 and 3.75% unsecured bonds 2029. As previously announced, the aggregate amount is being reserved for subscription by preferred applicants. These include holders of the €40 million 6% unsecured bonds 2024 appearing on the register of bondholders as at November 14, 2019, hence last trading date being November 12, 2019. Preferred applicants also include employees and directors of any company forming part of the AX Group plc as at November 14, 2019. Application forms will be mailed to existing bondholders of the 6% unsecured bonds maturing in 2024 on November 26, 2019.

- In the Prospects MTF market, five issues were active. The 3.75% KA Finance plc Secured 2026-2029 was the most liquid issue as it traded three times over 283,000 nominal.

| Upcoming Events: | ||||

| Best Performers: | ||||

| 1. TRI | +16.45% | |||

| 25 Nov 2019 | MT: PG plc – Interim Dividend Decision | 2. MPC | +3.03% | |

| 11 Dec 2019 | US: FED – Interest Rate Decision | 3. BMIT | +0.97% | |

| 12 Dec 2019 | EU: ECB – Interest Rate Decision | |||

| 19 DEC 2019 | UK: BoE – Interest Rate Decision | Worst Performers: | ||

| 20 DEC 2019 | MT: MaltaPost plc – Annual General Meeting | 1. IHI | -5.88% | |

| 2. MDI | -5.80% | |||

| 3. MDS | -3.85% | |||

| Price (€): 22.11.2019 | Price (€): 15.11.2019 | Weekly Change (%) | Year-to-date Change (%) | |

| MSE Equity Total Return Index | 9,717.441 | 9,847.882 | -1.325 | 7.983 |

| BMIT Technologies plc | 0.520 | 0.515 | 0.97 | 6.12 |

|---|---|---|---|---|

| Bank of Valletta plc | 1.090 | 1.095 | -0.46 | -9.02 |

| FIMBank plc (USD) | 0.625 | 0.640 | -2.34 | -16.67 |

| GlobalCapital plc | 0.280 | 0.280 | 0.00 | -15.66 |

| Grand Harbour Marina plc | 0.550 | 0.550 | 0.00 | -21.43 |

| GO plc | 4.220 | 4.260 | -0.94 | 6.57 |

| HSBC Bank Malta plc | 1.270 | 1.300 | -2.31 | -30.60 |

| International Hotel Investments plc | 0.800 | 0.850 | -5.88 | 29.03 |

| Lombard Bank plc | 2.260 | 2.260 | 0.00 | -7.38 |

| Loqus Holdings plc | 0.065 | 0.065 | 0.00 | -14.00 |

| MIDI plc | 0.650 | 0.690 | -5.80 | -2.99 |

| Medserv plc | 1.250 | 1.300 | -3.85 | 8.70 |

| Malta International Airport plc | 7.200 | 7.200 | 0.00 | 24.14 |

| Malita Investments plc | 0.915 | 0.910 | 0.55 | 3.98 |

| Mapfre Middlesea plc | 2.140 | 2.140 | 0.00 | 7.54 |

| Malta Properties Company plc | 0.680 | 0.660 | 3.03 | 19.30 |

| Main Street Complex plc | 0.600 | 0.600 | 0.00 | -7.69 |

| MaltaPost plc | 1.310 | 1.310 | 0.00 | -17.09 |

| PG plc | 1.800 | 1.790 | 0.56 | 35.34 |

| Plaza Centres plc | 1.020 | 1.030 | -0.97 | 0.00 |

| RS2 Software plc | 2.100 | 2.160 | -2.78 | 50.00 |

| Simonds Farsons Cisk plc | 11.500 | 11.500 | 0.00 | 31.43 |

| Santumas Shareholdings plc | 1.400 | 1.400 | 0.00 | -1.41 |

| Tigné Mall plc | 0.900 | 0.905 | -0.55 | -6.74 |

| Trident Estates plc | 1.770 | 1.520 | 16.45 | 18.00 |

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. Jesmond Mizzi is a non-executive director of Hili Ventures Limited, which has a controlling interest in Harvest Technology plc. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected].