MSE Trading Report for Week ending 06 December 2019

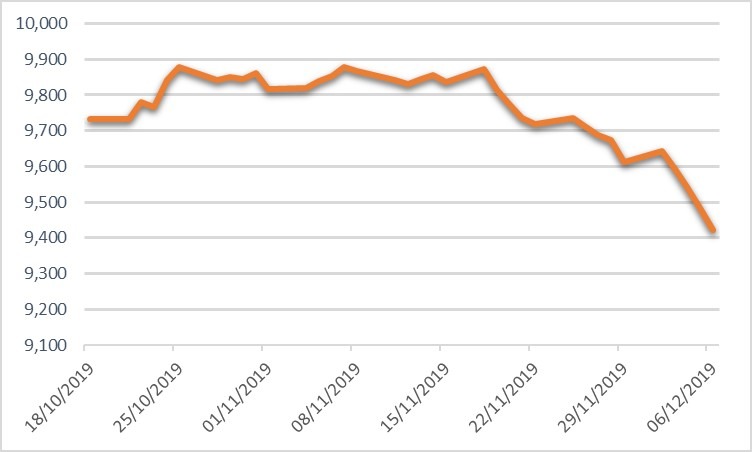

| MSE Equity Total Return Index: |

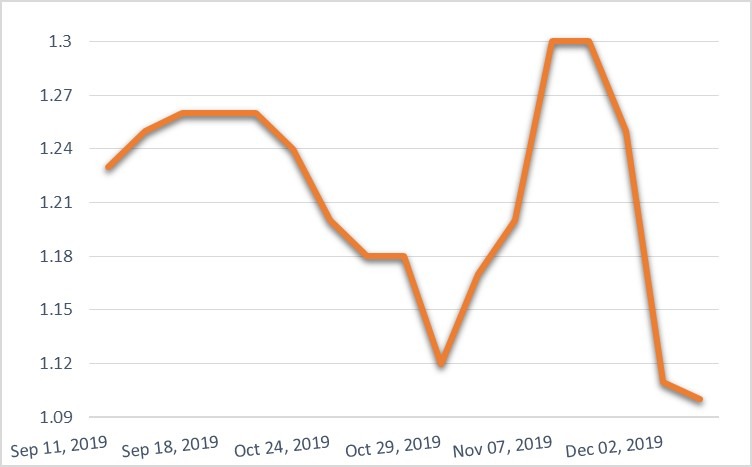

| Chart of the Week: Medserv plc |

| Highlights: |

- The local equities market extended its negative trend as it closed 1.986% lower at 9,422.439 points – a 32-week low. A total of 18 equities were active, of which two headed north while another nine closed in the opposite direction. A total weekly turnover of around €1.2 million was generated across 220 transactions.

- In the banking industry, all four equities were active. Bank of Valletta plc kicked off the week on a positive note having reached the €1.075 price level on Monday, to then end the week 0.94% lower at a 10-year low of €1.05. A total of 71 deals involving 249,560 shares were executed.

- Meanwhile, its peer, HSBC Bank Malta plc, closed the week unchanged at €1.20 despite reaching an intra-week high of €1.26. The bank was active over eight deals spread over 5,538 shares.

- The best performance was registered by FIMBank plc with a 2.40% increase to $0.64. This was the result of five deals involving 104,236 shares.

- Last Monday, MIDI plc announced that the discussions with Tumas Group Company Limited regarding the possibility of a joint venture in relation to the development of Manoel Island have ceased. However, the company remains fully committed to this project and development works shall commence following the issue of the required planning permits.

- The equity headed the list of fallers as it ended the week 20.16% lower at €0.515 – lowest price in 15 months. A total of 276,550 shares changed ownership over 32 deals.

- On Saturday, Medserv plc announced that on November 29, 2019, they entered into a conditional agreement with AMT S.A. Advanced Maritime Transports (AMT), to merge the two companies. AMT shall issue a voluntary bid in cash to acquire the entire issued share capital of the company while the majority shareholders shall transfer their shares in the company to AMT, subject to terms and conditions set out therein. AMT then intends to launch a voluntary bid to all shareholders of Medserv, whereby a cash consideration of €1.102 per share will be offered to all remaining minority shareholders. This is a Swiss registered company which is an integrated transport and logistics provider with a global reach and strong prominence in the oil and gas sector. Subject to the transaction being successfully concluded, the new entity will have an operational presence in 26 countries on four continents. It will bring a workforce of approximately 900 employees and a global network of preferred partners. It is intended to accelerate and further supplement the group’s growth and internationalisation strategy. AMT, Medserv and METS will become the largest Maltese listed company in terms of global presence.

- The company issued an interim report, in which it was highlighted an increase in turnover by 130% to €19.3M in quarter three 2019 when compared to the same period in 2018. This has improved EBITDA by 113% when compared to the same quarter of 2018, from €1.5M to €3.2 million. Medserv plc expects to reach an EBITDA of €14.1 million for the entire financial year ending December 31, 2019, resulting into a 93% increase from the amount generated in the previous year.

- The equity closed the week in the red at €1.10, translating into a 12% decline. The equity was active over 14 deals spread over 71,580 shares.

- Last Friday, Malta International Airport plc published its traffic results for November 2019. An 8.7% increase in passenger movements was registered when compared to the same month last year. This month’s growth rate was one of the strongest year-to-date increases as a result of the airport’s strategy of stimulating further traffic growth in the off-peak months. During November, passenger movements stood at 493,201 on the back of increases in both aircraft movements and seat capacity. Seat load factor for the month was recorded at 78.1%.

- November’s top markets were Spain, France, Germany, Italy and the UK. The growth rate for both Italy and Spain may be partly due to the introduction of Trieste and Santiago de Compostela routes for the season. The airport also launched two other routes, being Paphos in Cyprus and Nis in Serbia, as part of the winter schedule. In total, these four new routes resulted into over 10,460 passenger movements to November’s total traffic.

- A total of 16,245 shares were executed across 23 deals, dragging the price 2.10% lower to €7.00.

- Last Friday, GO plc announced that Innovative Software Limited, its fully-owned subsidiary, shall be amalgamated with the company itself through a merger procedure. The equity registered the highest liquidity, as 13 deals involving 64,460 shares generated a total weekly turnover of €268,948. This resulted into a 0.96% fall in price, to close the week at €4.14.

- The MSE MGS Total Return Index ended the week 1.707% higher at 1,140.30 points. A total of 20 issues were active, of which 12 registered gains while the rest lost ground. The 2.4% MGS 2041 (I) registered the best performance, as it closed 4.62% higher at €136, above the central bank’s indicative price.

- The MSE Corporate Bonds Total Return Index gained ground, as it closed at 1,074.63 points, translating into a 0.202% increase. Out of 50 active issues, 19 traded higher while another 18 closed in the red. The 4% Stivala Group Finance plc Secured € 2027 headed the list of gainers as it recorded a 2.55% increase, to close at €104.50. On the other hand, 4.5% Hili Properties plc Unsecured € 2025 registered the largest fall in price, as it closed 2.37% lower at €102.50.

- In the Prospects MTF market, eight issues were active, of which the most liquid bond was the 5% Luxury Living Finance p.l.c. Secured Bonds 2028, as a total turnover of €19,360 was generated. The prospect bond ended the week at €101.90.

| Upcoming Events: | ||||

| Best Performers: | ||||

| 1. FIM | +2.40% | |||

| 11 DEC 2019 | US: FED – Interest Rate Decision | 2. PG | +1.71% | |

| 12 DEC 2019 | EU: ECB – Interest Rate Decision | |||

| 18 DEC 2019 | MT: PG plc – Annual General Meeting | |||

| 19 DEC 2019 | UK: BoE – Interest Rate Decision | Worst Performers: | ||

| 20 DEC 2019 | MT: MaltaPost plc – Annual General Meeting | 1. MDI | -20.16% | |

| 2. MDS | -12.00% | |||

| 3. MPC | -4.41% | |||

| Price (€): 06.12.2019 | Price (€): 29.11.2019 | Weekly Change (%) | Year-to-date Change (%) | |

| MSE Equity Total Return Index | 9,422.439 | 9,613.402 | -1.986 | 4.705 |

| BMIT Technologies plc | 0.510 | 0.510 | 0.00 | 4.082 |

|---|---|---|---|---|

| Bank of Valletta plc | 1.050 | 1.060 | -0.94 | -13.15 |

| FIMBank plc (USD) | 0.640 | 0.625 | 2.40 | -14.67 |

| GlobalCapital plc | 0.280 | 0.280 | 0.00 | -15.66 |

| Grand Harbour Marina plc | 0.550 | 0.550 | 0.00 | -21.43 |

| GO plc | 4.140 | 4.180 | -0.96 | 4.55 |

| HSBC Bank Malta plc | 1.200 | 1.200 | 0.00 | -34.43 |

| International Hotel Investments plc | 0.755 | 0.800 | -5.63 | 21.77 |

| Lombard Bank plc | 2.260 | 2.260 | 0.00 | -7.38 |

| Loqus Holdings plc | 0.065 | 0.065 | 0.00 | -14.00 |

| MIDI plc | 0.515 | 0.645 | -20.16 | -23.13 |

| Medserv plc | 1.100 | 1.250 | -12.00 | -4.35 |

| Malta International Airport plc | 7.000 | 7.150 | -2.10 | 20.69 |

| Malita Investments plc | 0.900 | 0.900 | 0.00 | 2.27 |

| Mapfre Middlesea plc | 2.140 | 2.140 | 0.00 | 7.54 |

| Malta Properties Company plc | 0.650 | 0.680 | -4.41 | 14.04 |

| Main Street Complex plc | 0.600 | 0.600 | 0.00 | -7.69 |

| MaltaPost plc | 1.310 | 1.310 | 0.00 | -17.09 |

| PG plc | 1.780 | 1.750 | 1.71 | 33.83 |

| Plaza Centres plc | 1.010 | 1.020 | -0.98 | -0.98 |

| RS2 Software plc | 2.080 | 2.160 | -3.70 | 48.57 |

| Simonds Farsons Cisk plc | 11.500 | 11.500 | 0.00 | 31.43 |

| Santumas Shareholdings plc | 1.400 | 1.400 | 0.00 | -1.41 |

| Tigné Mall plc | 0.900 | 0.900 | 0.00 | -6.74 |

| Trident Estates plc | 1.650 | 1.650 | 0.00 | 10.00 |

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected].