MSE Trading Report for Week ending 20 December 2019

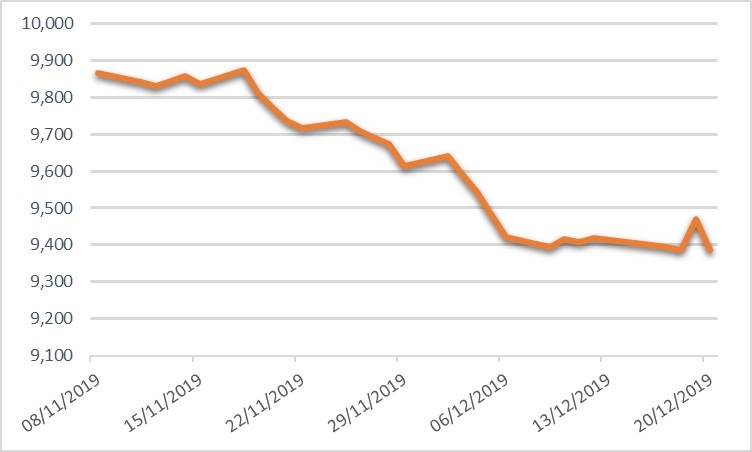

| MSE Equity Total Return Index: |

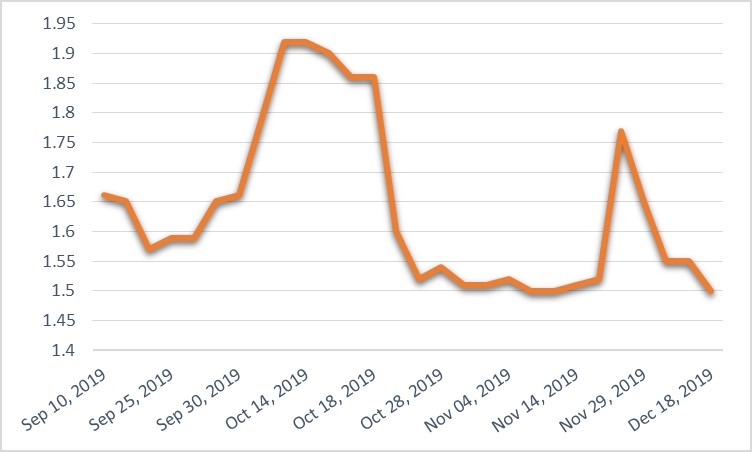

| Chart of the Week: Trident Estates plc |

| Highlights: |

- The local equities market ended the week in the red, as the index closed at 9,386.871 points, translating into a 0.35% decline. A total of 19 equities were active during the week, of which four headed north, while another six closed in the opposite direction. A total weekly turnover of just under €1 million was generated over a spread of 160 deals.

- PG plc, last Wednesday announced that the board has approved its unaudited financial statements and interim directors’ report for the half-year period ended October 31, 2019. The group registered a 16.8% growth, when compared to the same period last year, as total turnover stood at €58.1 million. Profit before tax increased to €7.3 million, translating into a 32% increase from the previous year’s figure. Pama and Pavi supermarkets’ operating margins have advanced. This resulted from higher turnover due to enhanced efficiency, as well as from an increase in rentals. Moreover, profit has improved as sales from franchise operations increased, which typically carry higher margins. One should highlight the fact that the Group’s main outlet under Zara and Zara Home segment was closed for expansion and refurbishment during the large part of the comparative period ended October 31, 2019. As anticipated by the Group, the expansion resulted in a substantial increase in turnover (+37.7%) when compared to the equivalent period in 2017, prior to commencement of works.

- The equity headed the list of gainers with a 1.67% increase on a relatively low turnover of 14,600 shares across four transactions, to close at €1.83.

- In the banking industry, three equities were active. Last Monday, Bank of Valletta plc announced its temporary limited services and its two days of closure for business during the Christmas period. The bank issued another announcement on Wednesday with reference to its interim directors’ statement dated October 28, 2019. This statement said that “the Bank is actively seeking to raise additional Tier 1 Capital by the end of the year which will further strengthen its regulatory capital.” The bank stated that such issue is still ongoing and hence, Tier 1 capital shall be issued in 2020.

- Moreover, last Thursday, the bank announced that on December 16, 2019, the Court of Appeal upheld the appeals filed by BOV and BOV Asset Management Ltd in a number of cases. Such cases related to an appeal BOV had filed last year, on March 14, 2018, relating to the decision given by the arbiter for financial services in relation to a number of La Valetta Multi Manager Property Fund claims.

- The equity reached €1.02 last Tuesday but managed to recoup losses by end of week, ending unchanged at the €1.04 price level. A total of 181,996 shares changed hands over 54 transactions.

- Its peer, HSBC Bank Malta plc was active over 12 deals of 18,802 shares. The equity reached an intra-week high of €1.25 to then decline back to €1.18 on Friday.

- Last Thursday, Lombard Bank Malta plc announced that the directors shall meet on March 23, 2020, to consider, and if deemed fit, approve its audited accounts for 2019. During this meeting, a final dividend declaration shall be considered, which will then be recommended to the bank’s Annual General Meeting (AGM.) The AGM will be held on April 23, 2020. The bank did not record any trades during the week.

- Plaza Centres plc announced that the company has entered into a preliminary agreement relating to the sale of Tigne’ Place. Such agreement is subject to a number of conditions which need to be satisfied before a definite deed of sale is executed, which is scheduled to take place in June 2020. The equity traded flat at €1.01 despite trading nine times over 138,000 shares.

- Last Thursday, GO plc announced that it has executed an agreement with PCCW Global Ltd, which is incorporated in Hong Kong. This company, together with third parties, is working to construct, maintain and commercialise an extension trunk system to a new high-speed fibre optic submarine cable system with branches to a number of countries. As per agreement, GO plc shall acquire from PCCW Global Ltd, the title and ownership and / or the indefeasible right of use of submarine and land infrastructure connecting Malta to France and Egypt and the associated operational and maintenance services, subject to the terms and conditions agreed to.

- Five deals involving 51,789 shares pushed the price 0.48% higher to €4.16.

- MaltaPost plc ended the week 0.76% lower at €1.30. This resulted from two deals involving 7,500 shares. Last Friday, the company announced that the board approved its audited financial statements for the year ended September 30, 2019. These shall be submitted for approval during the next AGM, to be held on February 26, 2020. The board agreed to recommend for the approval of the AGM, the payment of a final gross dividend of €0.0615 per share. If agreed, such dividend shall be paid on March 20, 2020 to shareholders on the company’s share register as at January 27, 2020.

- Despite registering a 14% decline in revenue to €34.48 million, there was a reduction in total expenses of 15.9%, as it stood at €31.7 million. An increase of 13% in profit before tax was recorded, as it amounted to €2.98 million.

- The MSE MGS Total Return Index traded 0.129% lower, as it ended the week at 1,134.64 points. A total of 21 issues were active, of which eight registered gains while another 10 closed lower. The 4.5% MGS 2028 (II) headed the list of gainers as it closed 1.82% higher at €139.50.

- The MSE Corporate Bonds Total Return Index ended the week in positive territory as it closed 0.124% higher at 1,074.77 points. Out of 52 active issues, of which 23 advanced while another 17 lost ground. The best performance was registered by the 6% AX Investments Plc € 2024 as it closed 2.55% higher at €112.95. Meanwhile, in the Prospects MTF market 11 issues were active in a relatively busy week on the fixed-income front.

| Upcoming Events: | ||||

| Best Performers: | ||||

| 1. PG | +1.67% | |||

| 2. BMIT | +0.98% | |||

| 23 JAN 2019 | EU: ECB – Interest Rate Decision | 3. MMS | +0.93% | |

| 29 JAN 2019 | US: FED – Interest Rate Decision | |||

| 30 JAN 2019 | UK: BoE – Interest Rate Decision | Worst Performers: | ||

| 1. TRI | -9.09% | |||

| 2. FIM | -3.13% | |||

| 3. MPC | -3.08% | |||

| Price (€): 20.12.2019 | Price (€): 12.12.2019 | Weekly Change (%) | Year-to-date Change (%) | |

| MSE Equity Total Return Index | 9,386.871 | 9,420.014 | -0.352 | 4.310 |

| BMIT Technologies plc | 0.515 | 0.510 | 0.98 | 5.10 |

|---|---|---|---|---|

| Bank of Valletta plc | 1.040 | 1.040 | 0.00 | -13.98 |

| FIMBank plc (USD) | 0.620 | 0.640 | -3.13 | -17.33 |

| GlobalCapital plc | 0.280 | 0.280 | 0.00 | -15.66 |

| Grand Harbour Marina plc | 0.550 | 0.550 | 0.00 | -21.43 |

| GO plc | 4.160 | 4.140 | 0.48 | 5.05 |

| HSBC Bank Malta plc | 1.180 | 1.180 | 0.00 | -35.52 |

| International Hotel Investments plc | 0.760 | 0.765 | -0.65 | 22.58 |

| Lombard Bank plc | 2.260 | 2.260 | 0.00 | -7.38 |

| Loqus Holdings plc | 0.065 | 0.065 | 0.00 | -14.00 |

| MIDI plc | 0.500 | 0.515 | -2.91 | -25.37 |

| Medserv plc | 1.100 | 1.100 | 0.00 | -4.35 |

| Malta International Airport plc | 6.900 | 6.900 | 0.00 | 18.97 |

| Malita Investments plc | 0.900 | 0.900 | 0.00 | 2.27 |

| Mapfre Middlesea plc | 2.160 | 2.140 | 0.93 | 8.54 |

| Malta Properties Company plc | 0.630 | 0.650 | -3.08 | 10.53 |

| Main Street Complex plc | 0.600 | 0.600 | 0.00 | -7.69 |

| MaltaPost plc | 1.300 | 1.310 | -0.76 | -17.72 |

| PG plc | 1.830 | 1.800 | 1.67 | 37.59 |

| Plaza Centres plc | 1.010 | 1.010 | 0.00 | -0.98 |

| RS2 Software plc | 2.140 | 2.140 | 0.00 | 52.86 |

| Simonds Farsons Cisk plc | 11.500 | 11.500 | 0.00 | 31.43 |

| Santumas Shareholdings plc | 1.410 | 1.410 | 0.00 | -0.70 |

| Tigné Mall plc | 0.900 | 0.900 | 0.00 | -6.74 |

| Trident Estates plc | 1.500 | 1.650 | -9.09 | 0.00 |

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected].