MSE Trading Report for Week ending 27 December 2019

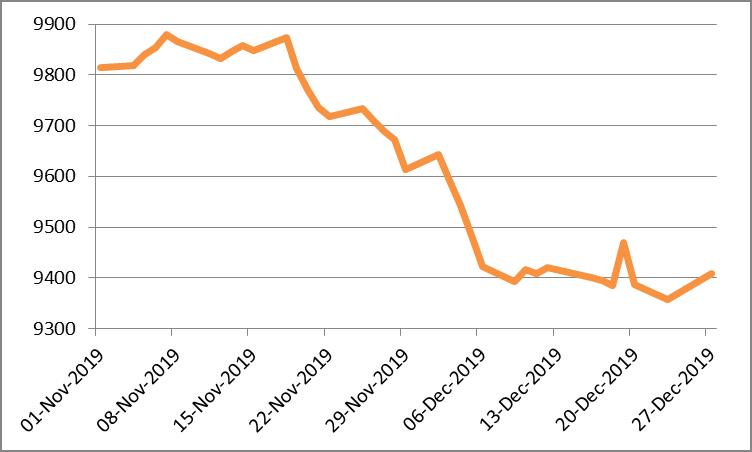

| MSE Equity Total Return Index: |

| Chart of the Week: International Hotel Investments plc |

| Highlights: |

- The local equities market closed the two-day trading week in positive territory with a marginal 0.23% gain. The MSE Equity Total Return Index (MSE) is now at 9,407.998 points which translates in a year-to-date gain of 4.5%. Back in September the local equities’ index briefly surpassed the 10,000 points level, which it failed to maintain as a number of large cap equities either lost further ground or trimmed some of their gains.

- Last week 10 equities were active as €0.2m were traded across 39 deals. Over half of the turnover took place in the two largest components of the local equities’ index while PG plc shares followed.

- In the banking sector Bank of Valletta plc (BOV) turned positive with a 2% gain. The banking equity was the most active as over €54,000 worth of BOV shares changed hands over 14 transactions. The Bank’s share price never dipped below last week’s close, as all trades were executed between €1.04 and a weekly high of €1.06. This was the highest closing price over the past three weeks.

- FIMBank plc topped the list of fallers with a 3.2% or $0.02 decline. The banking equity closed at $0.60 after three deals of 17,378 shares were recorded. Total turnover reached $9,500 as the equity’s price fluctuated in a tight range of $0.615 and $0.60.

- Retail conglomerate, PG plc added a further 0.6% to close at €1.84 after announcing an encouraging interim report the previous week. Eight deals of 16,440 shares were executed as the equity’s price fluctuated between a weekly low of €1.80 and a high of €1.84, a price reached on Friday during the session’s final hour. On a year-to-date basis PG plc is the second best performing equity with a 38% or €0.51 gain.

- Malta International Airport plc (MIA) shares traded flat at €6.90 as the equity was active during both sessions. Three trades worth nearly €52,000 were executed as 7,500 shares changed ownership. The equity is up by 19% since the beginning of the year. This is surely a positive return for MIA shareholders and a lift to investors’ sentiment, even though earlier in the year the equity’s year-to-date gain touched a high of 37%.

- In the bond market, the MSE MGS Total Return Index closed flat as it ended the week at 1,134.71 points. Activity was spread across 10 issues as turnover reached €0.5m. The long-dated issues were the most traded with the 10-year 2.3% MGS 2029 (II) being among the most active issues. The 2.2% MGS 2035 (I) jumped by 200 basis points to close the week at €125, while the 4.1% MGS 2034 (I) shed 81 basis points.

- The MSE Corporate Bonds Total Return Index added a further 0.3% to close at 1,078.31 points. Out of 23 active issues, seven gained and six declined. The 3.75% Premier Capital Unsecured 2026 headed the list of gainers with a 3.5% gain. Meanwhile, in the Prospects MTF market only one issue was active.

| Upcoming Events: | ||||

| Best Performers: | ||||

| 1. TRI | +3.33% | |||

| 2. BOV | +1.92% | |||

| 23 JAN 2019 | EU: ECB – Interest Rate Decision | 3. IHI | +1.32% | |

| 29 JAN 2019 | US: FED – Interest Rate Decision | |||

| 30 JAN 2019 | UK: BoE – Interest Rate Decision | Worst Performers: | ||

| 1. FIM | -3.23% | |||

| 2. BMIT | -1.94% | |||

| Price (€): 27.12.2019 | Price (€): 20.12.2019 | Weekly Change (%) | Year-to-date Change (%) | |

| MSE Equity Total Return Index | 9,407.998 | 9,386.871 | 0.225 | 4.545 |

| BMIT Technologies plc | 0.505 | 0.515 | -1.94 | 3.06 |

|---|---|---|---|---|

| Bank of Valletta plc | 1.060 | 1.040 | 1.92 | -12.32 |

| FIMBank plc (USD) | 0.600 | 0.620 | -3.23 | -17.81 |

| GlobalCapital plc | 0.280 | 0.280 | 0.00 | -15.66 |

| Grand Harbour Marina plc | 0.550 | 0.550 | 0.00 | -21.43 |

| GO plc | 4.160 | 4.160 | 0.00 | 5.05 |

| HSBC Bank Malta plc | 1.180 | 1.180 | 0.00 | -35.52 |

| International Hotel Investments plc | 0.770 | 0.760 | 1.32 | 24.19 |

| Lombard Bank plc | 2.280 | 2.260 | 0.88 | -6.56 |

| Loqus Holdings plc | 0.065 | 0.065 | 0.00 | -14.00 |

| MIDI plc | 0.500 | 0.500 | 0.00 | -25.37 |

| Medserv plc | 1.100 | 1.100 | 0.00 | -4.35 |

| Malta International Airport plc | 6.900 | 6.900 | 0.00 | 18.97 |

| Malita Investments plc | 0.900 | 0.900 | 0.00 | 2.27 |

| Mapfre Middlesea plc | 2.160 | 2.160 | 0.00 | 8.54 |

| Malta Properties Company plc | 0.630 | 0.630 | 0.00 | 10.53 |

| Main Street Complex plc | 0.600 | 0.600 | 0.00 | -7.69 |

| MaltaPost plc | 1.300 | 1.300 | 0.00 | -17.72 |

| PG plc | 1.840 | 1.830 | 0.55 | 38.35 |

| Plaza Centres plc | 1.010 | 1.010 | 0.00 | -0.98 |

| RS2 Software plc | 2.140 | 2.140 | 0.00 | 52.86 |

| Simonds Farsons Cisk plc | 11.500 | 11.500 | 0.00 | 31.43 |

| Santumas Shareholdings plc | 1.410 | 1.410 | 0.00 | -0.70 |

| Tigné Mall plc | 0.900 | 0.900 | 0.00 | -6.74 |

| Trident Estates plc | 1.550 | 1.500 | 3.33 | 8.50 |

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected].