MSE Trading Report for Week ending 10 January 2020

| MSE Equity Total Return Index: |

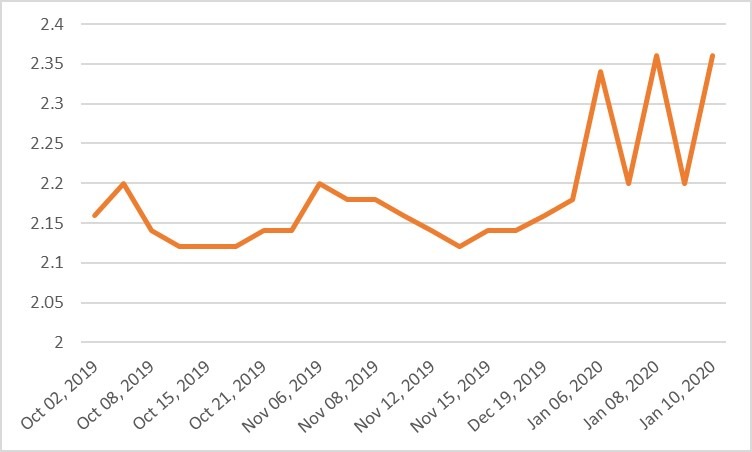

| Chart of the Week: Mapfre Middlesea plc |

| Highlights: |

- The local equities market lost a further 0.318% as it ended the week at 9,497.858 points. A total of 20 equities were active, of which four headed north while another ten closed in the opposite direction. A total turnover of €1.2 million was generated across 202 deals.

- RS2 Software plc reached an all-time high price of €2.34, translating into an 8.33% increase from last week’s figure. The equity was the most liquid as it registered a total weekly turnover of €553,077 spread over 53 deals. The equity headed the list of gainers and has already recorded a 9.35% increase in 2020, following 2019’s yearly advance of 72.03%.

- Last Wednesday, RS2 Software plc (RS2) announced the acquisition of KALICOM Liebers Zahlungssysteme KG, a very successful commercial network operator. This company, which is located in Germany, is one of the leading commercial network operators for electronic, card-based payments systems with several thousand payment terminals. It offers products including POS terminals, girocard/direct debit processing, routing of credit card transactions and referral of acquiring services to small-to-medium sized enterprises across Germany.

- RS2’s product portfolio shall be enhanced, as this acquisition shall give a quick start into the direct acquiring business with immediate capabilities of selling, installing and servicing terminals and processing card transactions in the German market. It will provide the company with an attractive entry portfolio, with more than 4,000 terminals as well as an existing merchant book. This is in line with RS2’s strategic shift from continuing to provide perpetual Licenses of its platform to Managed Services, Merchant Acquiring Services and Issuing Services throughout Europe, Middle East, North America, Latin America and Asia Pacific, resulting in international growth and expansion.

- In the banking industry, all four banks were active. Bank of Valletta plc reached a high of €1.085 during the week but closed at €1.065. This was the outcome of 51 deals involving 205,054 shares. The equity managed to recover the previous week’s loss, as it closed 0.95% higher.

- Last Wednesday, HSBC Bank Malta plc announced that it is scheduled to meet on February 18, 2019, to approve its final audited accounts for the financial year ended December 31, 2019. Moreover, the board shall also consider the declaration of a final dividend, which is to be recommended during the bank’s AGM, to be held on April 8, 2020.

- The bank did not manage to sustain its previous weeks’ gain, as it closed 3.33% lower at €1.16. A total of 54,502 shares changed ownership over 21 transactions.

- Last Wednesday, Malta International Airport (MIA) announced its full-year results for 2019, marking the tenth year of traffic growth for the airport. The airport ended 2019 with a record of 7,310,289 passenger movements, equivalent to a 7.4% increase when compared to 2018. Such rise was in line with a 7.3% increase in seat capacity. Seat load factor remained unchanged from 2018, as it stood at 81.8%.

- One of the main drivers for this positive performance was the improvement in flight schedules, for both winter and summer months. During 2019, MIA welcomed a new airline, inaugurated 18 new routes spanning three continents, and introduced other developments with the intention of further enhancing the islands’ connectivity, particularly in the off-peak months. During the peak summer months, a 7.6% increase in passenger movements was recorded while a 7.2% increase was recorded for the winter months. The fastest-growing months for the year were December, April, June and October, with three of these top performers being winter and shoulder months. Meanwhile, August was the main driver for the full year traffic as it registered more than 823,000 passenger movements.

- The top drivers of traffic for the year were Spain, France, Germany, Italy and the United Kingdom. These all benefitted from route developments that continued to reinforce their popularity during 2019. MIA shall soon publish their traffic forecast for the new year, 2020. Notwithstanding such announcement, the equity declined over the week, by 1.45% to €6.80 as 17 deals involving 15,480 shares were executed.

- Trading in Harvest Technology plc commenced last Tuesday. No trading activity was recorded during the week.

- The MSE Corporate Bonds Total Return Index closed 0.045% lower at 1,080.63 points. A total of 48 issues were active, of which 19 registered gains while another 15 lost ground. The best performer was the 5% Tumas Investments plc Unsecured € 2024 as it closed 2.91% higher at €104.99. On the other hand, the 5.8% International Hotel Investments plc 2023 closed 4.15% lower at €104.

- On the Sovereign debt front, the MSE MGS Total Return Index saw a lot of negative performers as yields headed north, to close 1.520% lower at 1,115.31 points. Out of 19 active issues only one advanced while another 16 lost ground. The 2.1% MGS 2039 (I) registered the largest decline in price which dropped by 6.57%, as it ended the week at €121.51. Meanwhile, the 5.1% MGS 2029 (I) ended the week with a marginal increase, at €144.44.

- In the Prospects market, seven issues were active. The 4.75% Orion Finance plc € Unsecured 2027 registered the highest liquidity with the bond closing unchanged at €101.50.

| Upcoming Events: | ||||

| Best Performers: | ||||

| 1. RS2 | +8.33% | |||

| 2. MMS | +7.34% | |||

| 23 JAN 2019 | EU: ECB – Interest Rate Decision | 3. LQS | +1.55% | |

| 29 JAN 2019 | US: FED – Interest Rate Decision | |||

| 30 JAN 2019 | UK: BoE – Interest Rate Decision | Worst Performers: | ||

| 1. MSC | -8.33% | |||

| 2. MDI | -7.41% | |||

| 3. LOM | -4.39% | |||

| Price (€): 10.01.2020 | Price (€): 03.01.2020 | Weekly Change (%) | 2020 Performance (%) | |

| MSE Equity Total Return Index | 9,497,858 | 9,528.184 | -0.318 | -1.226 |

| BMIT Technologies plc | 0.510 | 0.520 | -1.92 | -1.923 |

|---|---|---|---|---|

| Bank of Valletta plc | 1.065 | 1.055 | 0.95 | 0.472 |

| FIMBank plc (USD) | 0.600 | 0.600 | 0.00 | 0.00 |

| GlobalCapital plc | 0.280 | 0.280 | 0.00 | 0.00 |

| Grand Harbour Marina plc | 0.550 | 0.550 | 0.00 | 0.00 |

| GO plc | 4.220 | 4.280 | -1.40 | -0.94 |

| Harvest Technology plc | 1.500 | 1.500 | 0.00 | 0.00 |

| HSBC Bank Malta plc | 1.160 | 1.200 | -3.33 | -10.77 |

| International Hotel Investments plc | 0.780 | 0.810 | -3.70 | -6.02 |

| Lombard Bank plc | 2.180 | 2.280 | -4.39 | -4.39 |

| Loqus Holdings plc | 0.066 | 0.0645 | 1.55 | 1.55 |

| MIDI plc | 0.500 | 0.540 | -7.41 | -7.41 |

| Medserv plc | 1.100 | 1.100 | 0.00 | 0.00 |

| Malta International Airport plc | 6.800 | 6.900 | -1.45 | -1.45 |

| Malita Investments plc | 0.900 | 0.900 | 0.00 | 0.00 |

| Mapfre Middlesea plc | 2.340 | 2.180 | 7.34 | 8.33 |

| Malta Properties Company plc | 0.650 | 0.650 | 0.00 | 3.17 |

| Main Street Complex plc | 0.550 | 0.600 | -8.33 | -8.33 |

| MaltaPost plc | 1.310 | 1.310 | 0.00 | 0.00 |

| PG plc | 1.800 | 1.840 | -2.17 | -2.17 |

| Plaza Centres plc | 1.010 | 1.010 | 0.00 | 0.00 |

| RS2 Software plc | 2.340 | 2.160 | 8.33 | 9.35 |

| Simonds Farsons Cisk plc | 11.400 | 11.500 | -0.87 | -0.87 |

| Santumas Shareholdings plc | 1.410 | 1.410 | 0.00 | 0.00 |

| Tigné Mall plc | 0.900 | 0.900 | 0.00 | 0.00 |

| Trident Estates plc | 1.550 | 1.550 | 0.00 | 0.00 |

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected].