MSE Trading Report for Week ending 13 March 2020

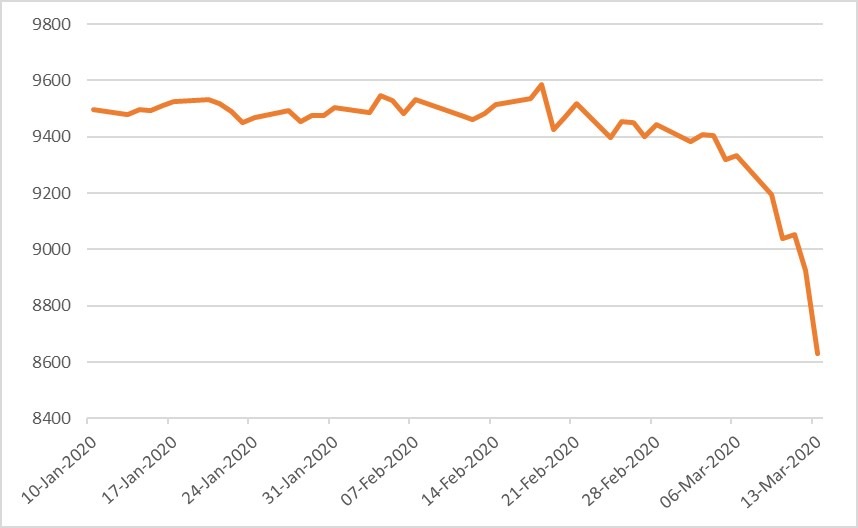

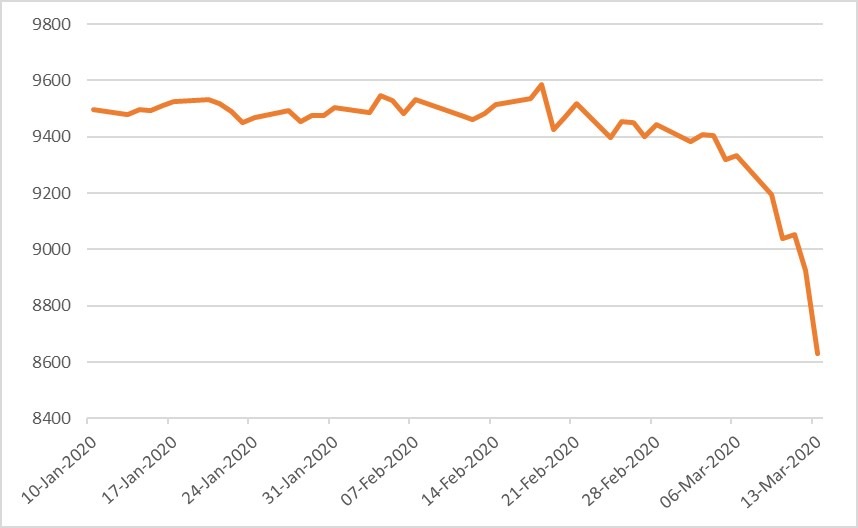

| MSE Equity Total Return Index: |

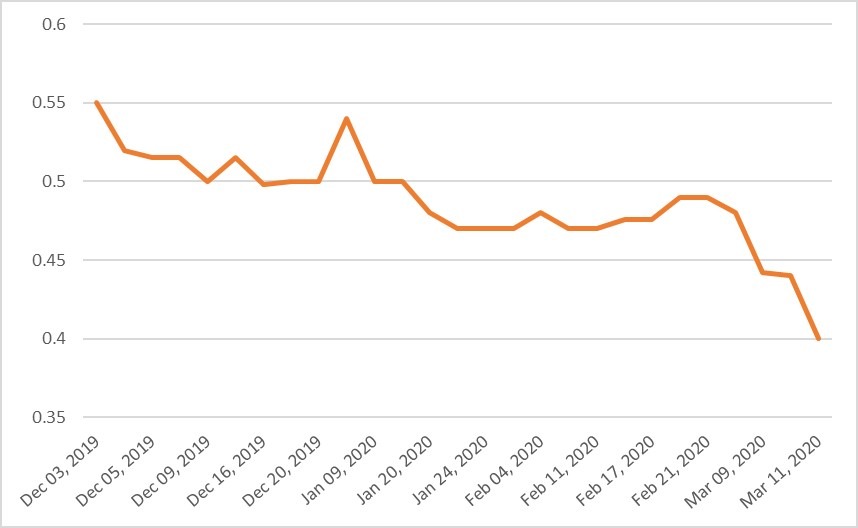

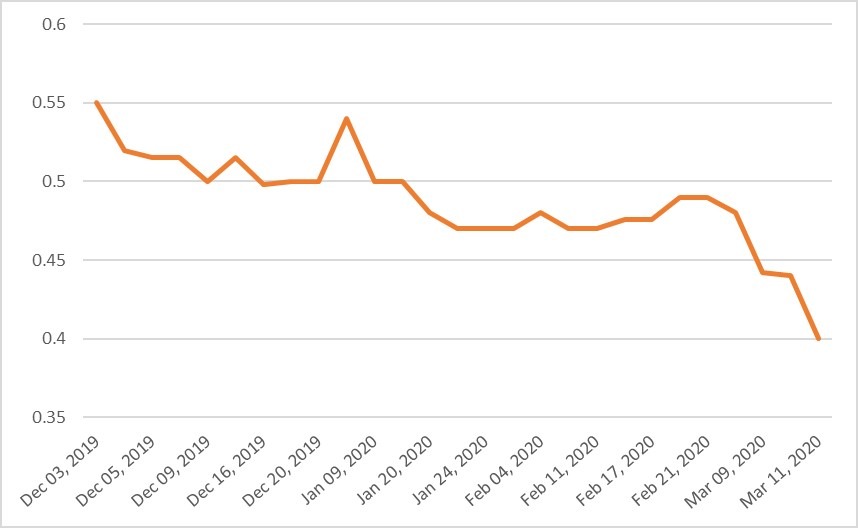

| Chart of the Week: MIDI plc |

| Highlights: |

- In light of the current global issues, as the coronavirus was declared a pandemic by the World Health Organisation, the MSE Equity Total Return Index dropped by a substantial 7.539%, reaching close to a 16-month low of 8,630.297 points. This compares to an 18.7% decline registered across the broader European equity market, as per the Eurostoxx 600 Index. A total of 23 issues were active, of which one advanced while another 18 lost ground. This week’s session saw a high level of trading, as a total weekly turnover of over €3.45 million was generated across 395 transactions.

- On Monday, Malta International Airport plc (MIA) announced its traffic results for February 2020. Passenger movements amounted to 421,567, equivalent to a 17.3% growth from the same month last year. This leap year allowed an additional day of operations, boosting the month’s total traffic with 16,986 passenger movements. The main drivers for the month’s traffic were the United Kingdom, Italy, Germany, France and Spain amongst others, apart from Germany which declined by 5%. Despite February’s overall traffic result being a positive one, however, Seat Load Factors (SLF), particularly on Italian routes, saw a significant decline during the last week of the month due to the Covid-19 outbreak in Europe, and declining travel demand. – The SLF, which measures the occupancy of seats available on flights operated to and from MIA, stood at 75.8%.

- The airport’s CEO claimed that the virus will bring with it challenging months, as passenger demand for air travel plummets and airlines cut capacity across the board. The company’s focus right now is on the safety and wellbeing of its guests, employees working on the airport campus, and the general public. On Friday, the company issued another announcement to reassure its shareholders that all necessary measures are being taken to mitigate the inevitable negative impacts of this unprecedented situation. MIA will be revising and updating its traffic forecasts and financial guidance as more certainty and stability are restored. The equity plummeted over coronavirus fears, as it reached its lowest level since July 2018 of €5.05, translating into a 16.53% decline over the week. This was the result of 223,643 shares spread over 152 transactions, registering the largest weekly turnover of €1.18 million.

- The banking industry was also negatively impacted, as all four active equities closed in the red. On Tuesday, FIMBank plc approved the consolidated audited financial statements for the financial year ended December 31, 2019. These shall be submitted for approval by the shareholders at the forthcoming Annual General Meeting (AGM), which shall be held on May 7, 2020. During the AGM, the board will not be recommending a dividend. The Group’s net operating results declined by 32.5% to $14.3 million, upon the implementation of a de-risking process in order to strengthen the quality of the portfolio. Net operating income also dropped by 13% as it stood at $51.3 million. Revenues decreased due to economic conditions and certain measures which were carried out. This led the Group to de-risk its main portfolio due to a number of non-performing loans identified in prior years, resulting into a drop in income generated from these portfolios. The Group improved its funding structure to offset the drop in revenues through various asset and liability measures. As a result, net interest income increased by almost 3.5% to $32.3 million. As at December 31, 2019, the Group’s CET1 ratio was down by seven percentage points to 16.9%. Similarly, total capital ratio decreased to 16.9%, versus 18% recorded in 2018. The equity price reached $0.63 on Tuesday but declined to $0.50 on Friday. Eight deals involving 86,675 shares resulted into a 13.79% decline in price.

- Bank of Valletta plc was down by 2.86% as it closed the week at €1.02. This was the outcome of 46 deals involving 296,716 shares. The Board is scheduled to meet on March 18, to consider and approve the audited financial statements for the year ended December 31, 2019. Its peer, HSBC Bank Malta plc lost 5.66% as it reached a multi-year low of €1.00. A total of 844,779 shares changed hands over 39 transactions.

- On Thursday, Malita Investments plc approved the financial statements for the year ended December 31, 2019. These shall be submitted for the approval of the shareholders at the next AGM, to be held on May 6, 2020. The board agreed to recommend a final gross dividend of €0.0350 per share, translating into a final net dividend of €0.02711 per share. This consists of the interim net dividend paid on August 7, 2019 of €0.00858 per share and an additional net dividend of €0.01853 per share. Should the additional dividend be approved, all shareholders listed on the register of the company as at April 6, 2020 shall be paid on May 12, 2020. The company has a low working capital ratio, in line with the previous year at 0.1:1. In 2019, the company had a positive bank balance versus an overdrawn bank balance in the previous year. This was due to the short-term financing for the Affordable Housing project which increased the total current liabilities for 2019. Capital expenditure for the aforementioned project continued in 2019. Profit before tax increased considerably from €13.7million registered in 2018 to €41.3 million as at December 31, 2019. Similarly, earnings per share were up to 25.08 from 7.88. Revenue was also up by almost 0.7% to €8.07- million from the previous year’s figure. The equity was active on Thursday as four deals involving 40,000 shares were executed but closed unchanged at €0.90.

- On Thursday, International Hotel Investments plc announced its precautionary measures with respect to the evolving Covid-19 to reassure its shareholders. The company addressed a series of first-wave cost cutting and cost containment measures, such as the shutting down of hotels’ entire wings or floors. The company instructed no new CAPEX, no new employments, no payroll shifts and banned travelling. Costs are being monitored while amenities, energy and consumables are being conserved. The equity registered a considerable decline of 16.67% as it closed at €0.625. This was the result of 130,786 shares spread over 22 transactions.

- On Thursday, GO plc approved the preliminary statements of annual results for the financial year ended December 31, 2019. During the AGM, which shall be held on June 2, 2020, a final net dividend of €0.14 per share will be recommended. This payment sums up to a total net dividend of €14.18 million, which will be paid on June 4, 2020 to all shareholders on the register as at April 30, 2020. The company registered a 3.5% increase in revenue from 2018, as it stood close to €177.8 million. Higher costs were incurred to provide a better service, which resulted into a decline in operating profits of 21.8% to €25.8 million. Group earnings before interest, tax, depreciation and amortisation (EBITDA) was up by 5.3% to €73.2 million from the previous year. When taking into account the effect of IFRS 16, the adjusted EBTIDA reduced by 4.2% to €66.6 million. At company level, the adjusted EBITDA would amount to €43.5 million, translating into a 7.3% decline. This downward trend is expected to be reversed in the near future as the company reaps the benefit of the investment in the sports package. A 28% decline in profits before tax was recorded from the previous year, as it stood at €22.8 million. One of the main drags was the adoption of the IFRS 16, as it reflects a €1.2 million decline. Meanwhile, the gain on sale of 49% share in BMITT left a positive impact on profit before tax. Group’s current assets increased by 5.6% to €57.4 million, which is mainly made up of trade and other receivables (€36.5 million), inventories (€6.1 million) and cash (€13.2 million). Similarly, total liabilities were also up by 33% to €202.2 million from the previous year’s figure. The equity closed 1.41% lower at €4.20, as seven deals involving 9,240 shares were executed.

- On Thursday, its subsidiary, BMIT Technologies plc, announced their annual report and financial statements for the financial year ended December 31, 2019. These shall be submitted for shareholders’ approval at the forthcoming AGM on June 1, 2020. A final dividend payment of €0.02157 net of tax per share shall be recommended, to be paid on June 4, 2020 to all shareholders on the register as at April 29, 2020. This resulted into a net dividend payment of €4,391,000. The BMIT Technologies Group registered a positive performance in 2019 as revenues were up by 4.8% from 2018 to €22.4 million. Profit before tax amounted to €7.2 million, translating into a 2.9% increase from the previous year’s figure. This resulted into earnings per share of €0.02 versus €0.04 for 2018. The Group’s earnings before interest, tax, depreciation and amortisation amounted to €10 million. Current assets amounted to €8.5 million versus €3.2 million recorded in the previous year. This is mainly made up of trade and other receivables, as well as cash and cash equivalents. Total liabilities were also up to €11.8 million from €6.7 million registered in 2018. This was mostly due to the implementation of IFRS 16 and the recognition of lease liabilities. The equity closed 3.64% lower at €0.53, as 155,600 shares changed ownership over 16 transactions.

- On Thursday, Mapfre Middlesea plc announced the approval of the audited financial statements for the financial year ended December 31, 2019. These are to be submitted for approval of the shareholders at the next AGM, which shall be held on April 24, 2020. During the AGM, the board will be recommending the payment of a final gross dividend of €0.16745 per share. If approved, this will be paid on May 22, 2020 to all shareholders listed on the company’s register as at May 6, 2020. The company’s profit before tax more than doubled to €23.82 from the previous year’s figure. On a similar note, a 6.7% increase in turnover from 2018 was registered, as it stood at €74.38 million. The company maintained a strong balance sheet, as its shareholders’ equity stood at €72.8 million. This reflects the company’s strong regulatory solvency position for the year ended December 31, 2019 under the Solvency II regime. The equity was active on 17 deals of 33,157 shares and closed unchanged at €2.32.

- Medserv plc was active on Thursday on a couple of deals of 6,000 shares but did not register any movement in price, as it closed at €1.00. On Friday, in light of the Covid-19 crisis, the company announced the deployment of its business continuity plan to safeguard the well-being of its employees. The company’s business is still operating without interruption as it has carried out a risk assessment for the continuity of its operations in all countries.

- In the Corporate Bond market, 47 issues were active, of which eight headed north while another 31 closed in the opposite direction. The 3.5% Bank of Valletta plc € Notes 2030 S1 T1 headed the list of gainers as it closed 2.63% higher at €103.00. Conversely, the 5.8% International Hotel Investments plc 2023 closed 4.15% lower at €104.00.

- In the Prospects MTF market, 15 issues were active of which two registered gains while the rest closed unchanged. The two positive performers were the 5.35% D Shopping Malls Finance plc € Unsecured 2028 and the 4.75% Gillieru Investments plc Secured Bonds 2028 as they closed at €99.40 and €102.50, respectively.

- In the Sovereign Debt market, out of 18 active issues, three advanced while another 15 lost ground. The 4.3% MGS 2033 (I) was up by 0.34% to €151.94. On the other hand, the 2.4% MGS 2041 (I) traded 2.42% lower, ending the week at €130.00. This reflects the broader European sovereign debt market, as yields ticked higher – following disappointment by the European Central Bank, having kept interest rates unchanged on Thursday, despite market expectations for a rate cut.

| Upcoming Events: | ||||

| Best Performers: | ||||

| 1. GCL | +6.48% | |||

| 2. | ||||

| 18 MAR 2019 | MT: Bank of Valletta plc – Results | 3. | ||

| 11 MAR 2019 | MT: Lombard Bank Malta plc – Results | |||

| 12 MAR 2019 | Uk: BOE – Monetary Policy Meeting | Worst Performers: | ||

| 1. IHI | -16.67% | |||

| 2. MIDI | -16.67% | |||

| 3. MIA | -16.53% | |||

| Price (€): 13.03.2020 | Price (€): 06.03.2020 | Weekly Change (%) | 2020 Performance (%) | |

| MSE Equity Total Return Index | 8,630.297 | 9,334.004 | -7.539 | -10.248 |

| BMIT Technologies plc | 0.530 | 0.550 | -3.64 | 1.923 |

|---|---|---|---|---|

| Bank of Valletta plc | 1.020 | 1.050 | -2.86 | -3.774 |

| FIMBank plc (USD) | 0.500 | 0.580 | -13.79 | -16.67 |

| GlobalCapital plc | 0.230 | 0.216 | 6.48 | -17.86 |

| Grand Harbour Marina plc | 0.550 | 0.550 | 0.00 | 0.00 |

| GO plc | 4.200 | 4.260 | -1.41 | -1.41 |

| Harvest Technology plc* | 1.500 | 1.500 | 0.00 | 0.00 |

| HSBC Bank Malta plc | 1.000 | 1.060 | -5.66 | -23.08 |

| International Hotel Investments plc | 0.625 | 0.750 | -16.67 | -24.70 |

| Lombard Bank plc | 2.140 | 2.220 | -3.60 | -6.14 |

| Loqus Holdings plc | 0.080 | 0.080 | 0.00 | 24.03 |

| MIDI plc | 0.400 | 0.480 | -16.67 | -25.93 |

| Medserv plc | 1.000 | 1.000 | 0.00 | -9.09 |

| Malta International Airport plc | 5.050 | 6.050 | -16.53 | -26.81 |

| Malita Investments plc | 0.900 | 0.900 | 0.00 | 0.00 |

| Mapfre Middlesea plc | 2.320 | 2.320 | 0.00 | 7.41 |

| Malta Properties Company plc | 0.600 | 0.610 | -1.64 | -4.76 |

| Main Street Complex plc | 0.520 | 0.570 | -8.77 | -13.33 |

| MaltaPost plc | 1.210 | 1.300 | -6.92 | -7.63 |

| PG plc | 1.900 | 1.950 | -2.56 | 3.26 |

| Plaza Centres plc | 0.980 | 1.040 | -5.77 | -2.97 |

| RS2 Software plc | 2.340 | 2.540 | -7.87 | 9.35 |

| Simonds Farsons Cisk plc | 10.000 | 11.000 | -9.09 | -13.04 |

| Santumas Shareholdings plc | 1.500 | 1.500 | 0.00 | 6.38 |

| Tigné Mall plc | 0.860 | 0.880 | -2.27 | -4.44 |

| Trident Estates plc | 1.550 | 1.570 | -1.27 | 0.00 |

* Trading commenced on January 7, 2020.

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected].