MSE Trading Report for Week ending 24 April 2020

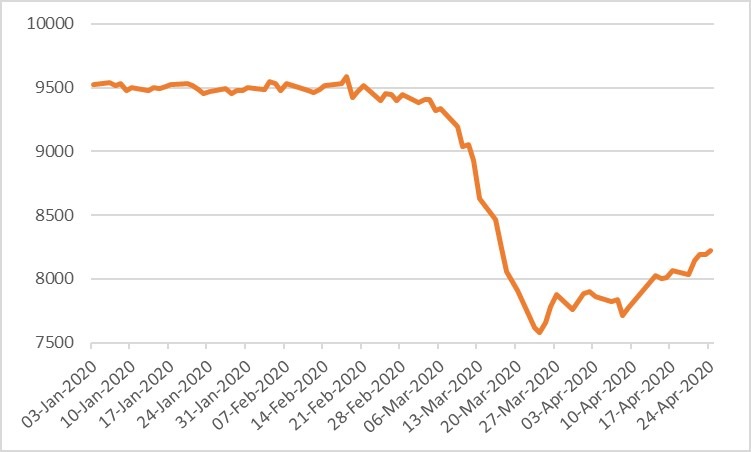

| MSE Equity Total Return Index: |

| Chart of the Week: Medserv plc |

| Highlights: |

- The MSE Equity Total Return Index advanced by a further 1.93% following last week’s 3.8% gain, as it closed the week at 8,224.722 points. A total of 18 equities were active, of which 15 registered gains while another two lost ground. A total weekly turnover of €1.9 million was generated across 293 transactions.

- In the banking sector, all three active equities closed in positive territory. Bank of Valletta plc continued its recent recovery, as it advanced by 4%, ending the week at €1.06. The equity has thus regained all losses incurred in 2020, having closed 2019 at the said price. During the week, a total of 82,248 shares changed hands over 34 deals.

- Similarly, its peer, HSBC Bank Malta plc was up by 3%, as 22 deals involving 135,973 shares were executed, worth €134,201. The equity traded at a low of €0.97 on Monday but managed to gain ground as it closed the week at the €1.00 price level.

- On Thursday, FIMBank plc announced that Fitch Ratings has downgraded its long-term Issuer Default Rating (IDR) and Viability Rating (VR) to B+ from BB-. At the same time, Fitch has confirmed the bank’s short-term IDR at B. Fitch Ratings is expecting a severe decline in this year’s global economy, particularly resulting from the disruption on operations caused by the COVID-19 outbreak.

- The downgrade in VR, which drives the long-term IDR, was driven by heightened pressures on the bank’s business model, continued asset-quality deterioration and weakened profitability, as reflected in the bank’s 2019 financial results. This negative outlook on the long-term IDR reflects Fitch Rating’s view that the economic and financial market fallout from the current Covid-19 outbreak shall add more downside risks to the bank’s business model stability, asset quality and earnings.

- The bank did not record any trading activity during the week.

- During an extraordinary board meeting held on Wednesday, Malta International Airport plc conducted a comprehensive assessment of the impact that the COVID-19 outbreak has had on the company and its business so far, and the likely impact this crisis will have going forward. Although it is still early, the company has evaluated several scenarios to enable it to assess the ramifications of the airport closure on the overall business and to identify measures that can be adopted with a view to mitigate the adverse impact on the company throughout the duration of the current situation.

- The directors have re-considered their original recommendation for the payment of a final net dividend to shareholders of €0.10 per share. In order to manage the company’s cash reserves and to maintain the organisational set-up to be able to recover immediately once the situation normalises, it is prudent to withdraw its recommendation for the declaration of a dividend, over and above the interim dividend already paid by the Directors in September 2019. The company is also implementing several strict cost-cutting measures to preserve liquidity, targeting an initial reduction in operating costs of 30%. A voluntary 30% reduction will be taken from the remuneration of the company’s board of directors, including the CEO and CFO. Moreover, MIA’s management team has accepted the proposed salary reductions, effective from April 1, 2020, which are expected to ease some of the pressure caused by the current crisis.

- Moreover, the company has made drastic adjustments to its original 2020 capital expenditure programme. All non-essential projects have been suspended with immediate effect. Focus has been shifted to the completion of major projects – mainly the construction of the new multi-storey car park and the expansion of the cargo village. The company will carry out projects and works that are essential to marinating the company’s assets, particularly the airfield infrastructure. The market guidance issued in January has been withdrawn since the company did not consider the possibility of a Covid-19 outbreak. It is still early for the company to provide forecasts that can give accurate guidance to the market. However, the board trust that with the measures taken so far, and with other planned measures should the situation get worse, the company is able to meet all of its financial obligations. As previously announced, the AGM shall be held on July 29, 2020.

- The equity registered the highest liquidity, as total turnover stood at €440,162. Price was up by 1% to €5.05, as 87,923 shares changed hands over 54 deals.

- On Monday, International Hotel Investments plc announced that although the audit work on the finalisation of the audited financial statements of IHI Magyarország Zrt for 2019 is ongoing, the current COVID-19 situation has put logistical constraints on the guarantor’s human resources and those of its auditors. Therefore, IHI Magyarország Zrt is now expecting to publish the audited financial statements for the year ended December 31, 2019, by end of June, 2020. The company once again reassured its stakeholders of its continued strength, more so after it has adopted a number of measures which have significantly lowered all operating costs and payroll expenses. In addition to this, the company has entered into ad-hoc arrangements with some of its principal lending banks to defer capital, and in some instances, interest payments too. Separate lines of credit with related parties have been created should there be any cashflow shortfalls. These actions will protect the company’s assets and liquidity during these extraordinary times where little or no income is expected to be generated from the company’s hotels and catering businesses. Based on such measures, and projecting a scenario of marginal income for the remaining months of 2020, the company has sufficient liquidity to honour its payment obligations – including bond interest payments as they arise through the course of the year.

- Eight deals involving 29,984 IHI shares pushed the equity’s price 0.84% higher, to close the week at €0.60.

- On Monday, RS2 Software plc and Grand Harbour Marina plc announced that the board is scheduled to meet on April 27, 2020, to consider and approve the company’s financial statements for the financial year ended December 31, 2019.

- On Friday, Simonds Farsons Cisk plc announced that the board shall meet on May 27, 2020, to consider and approve the audited financial results for the year ended January 31, 2020. The board shall also consider the declaration or otherwise of a final dividend, to be recommended to the forthcoming AGM – to be held when the situation permits.

- On a year-to-date basis, the equity recorded a 29.13% drop in price, as it reached the €8.15 price level. A total of 15,644 shares changed ownership over 25 deals this week, dragging the price by 4%.

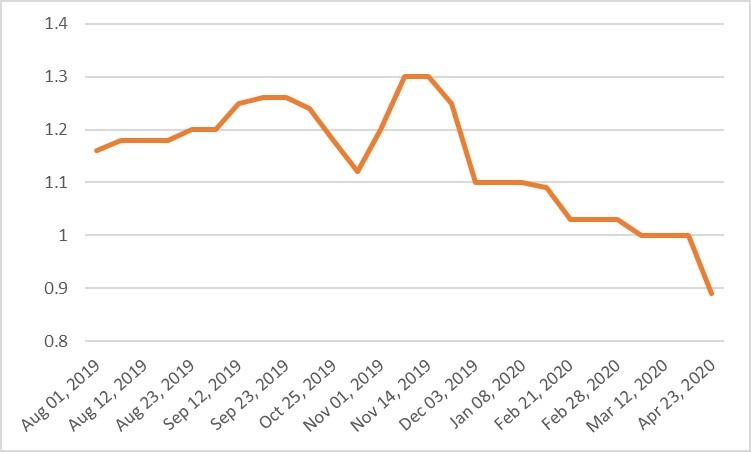

- Medserv plc headed the list of fallers with a double-digit decline of 11%. The equity closed at a low of €0.89, as 8,805 shares were spread across four transactions.

- On Friday, the company issued an announcement with reference to the Medserv €20 million 2023 6% Secured Notes guaranteed by Medserv Operations Limited, a wholly owned subsidiary. Due to the current unprecedented environment, the auditors of the aforementioned subsidiary have requested, and received an approval, for a one-month extension to finish their audit engagement. On May 29, 2020 the board of Medserv Operations Limited shall meet to consider and approve the annual financial statements for the financial year ended December 31, 2019.

- On Monday, Plaza Centres plc announced that the board shall meet on April 27, 2020, to consider, and if deemed fit, approve, the Group’s financial statements for the financial year ended 31 December, 2019.

- The equity registered a 3% increase in the price, as it ended the week at €0.97. Five deals involving 9,200 shares were executed.

- On Tuesday, Main Street Complex plc published its financial statements for the year ended December 31, 2020. The company registered a 10.4% increase in revenue, as it amounted to €819,540. Such increase was the result of new concessionaires contracted and an annual concession fee increase during the financial year under review. Operating expenses remained broadly flat while administrative expenses increased primarily as a result of costs related to the company’s stock exchange listing, the incidence of a full year’s charge for directors’ remuneration, while increased depreciation charges reflected capital expenditure incurred during the year 2019.

- Profit before tax was up to €516,328 from 2018’s figure of €439,371. This positive performance was the result of lower financial costs, from €45,687 reported in 2018, compared to €1,181 in 2019 due to the full repayment of the company’s bank loan facilities. Earnings per share increased from 0.016 to 0.020 Euro cents.

- Total dividends amounting to €350,958 were distributed in 2019, of which €190,163 was the final net dividend in respect of the year ended December 31, 2018. Meanwhile, the remaining €160,795 reflect the interim net dividend for this financial year. In light of the current unprecedented times, the board recommends a prudent approach with respect to the recommendation of a distribution of a final dividend for 2019. A decision as to the payment of such dividend is to be taken at a later date.

- No trading activity was recorded during the week.

- On Thursday, MIDI plc announced that the board has approved the audited consolidated financial statements for the year ended December 31, 2019. These shall be submitted for shareholders’ approval at the AGM. The group registered a turnover of €27.7 million, compared to €52.5million in 2018. This mainly resulted from the sales of the Q2 residential block apartments. A profit before tax of €8.2million was registered in 2019 compared to €11.6 million in 2018. Total assets increased by €14 million to €234.6 million while Net Asset Value per share, as at end of 2019, stood at €0.486 versus €0.455 during the previous year.

- Midi’s jointly controlled entity, Mid Knight Holdings Limited (MKH), had a positive impact on the financial results. The group’s 50% share of MKH profits for the year 2019 stood at €1.6 million – translating into a €0.3 million increase from the previous year. Moreover, the company’s focus on the development of Manoel Island has continued as it works towards finalising the design of the first phase of the project. Due to the current uncertain times, as a result of the Covid-19 pandemic, a number of cost-cutting measures have been implemented. Therefore, the board is not recommending the payment of any dividends during 2020 in respective to the financial year ending December 31, 2019.

- The equity reached the €0.45 price level during the week but closed slightly lower at €0.396, which translates to a weekly gain of 10%. A total of 180,750 shares were executed over 10 deals.

- On Monday, Tigne’ Mall plc announced that the board has approved the audited financial statements for the year ended December 31, 2019. These are to be approved by shareholders during the next Annual General Meeting (AGM). The company’s revenue has increased by 7.5% from the previous year to €7 million, which also brought with it a corresponding increase in direct costs. Operating profit increased by 6.5% over 2018 to €4.4 million. Earnings before interest, tax, depreciation and amortisation registered a 6.9% increase, as it stood at €6.2 million. The company’s finance costs were up by 28.4% to €815,101, of which €141,390 relate to the unwinding of the discount rate used to discount the lease liabilities to present value. Meanwhile, the rest was due to interest incurred on the additional loan taken out in December 2018 to partly finance the purchase of additional car parking spaces. This resulted into a profit before tax of €3,580,821. Earnings per share has also increased from €4.36 to €4.51 cents.

- During 2019, a distribution of €1,481,350 was made to the shareholders covering the final dividend attributable to 2018 (€740,675) and an interim dividend in 2019 (€740,675). The equity was not active during the week.

- On Wednesday, Harvest Technology plc announced that the board is scheduled to meet on April 24, 2020, to consider and, if deemed appropriate, approve the company’s audited financial statements for the year ended December 31, 2019. The board shall also be consider whether to declare a dividend. No trading activity was recorded during the week.

- The MSE MGS Total Return Index decreased by 0.948% as it closed at 1,121.98 points. A total of 16 issues were active, of which three headed north while another 10 closed in the opposite direction. The 5.1% MGS 2029 (I) registered the best performance as it closed 1.47% higher at €145.00. Conversely, the 3% MGS 2040 (I) lost 5.56%, ending the week at €139.30.

- The MSE Corporate Bonds Total Return Index recorded a 0.26% increase as it ended the week at 1,052.22 points. Out of 44 issues which were active 21 traded higher while another nine closed in the red. The 5.3% United Finance Plc Unsecured € Bonds 2023 headed the list of gainers with a 3.03% rise, to close at €102.00. Meanwhile, the 4.35% Hudson Malta Plc Unsecured € Bonds 2026 closed 2.42% lower at €101.00.

- In the Prospects MTF market, 12 issues were active. The 4.75% Orion Finance plc € Unsecured 2027 was the most liquid as the company purchased a nominal of 90,000 bonds from its bondholders at €99.50. These bonds shall be cancelled and may not be issued or sold again.

| Best Performers: | ||||

| 1. MTP | +33.33% | |||

| 27 APR 2020 | MT: Plaza Centres plc – Results | 2. MDI | +10.00% | |

| 27 APR 2020 | MT: RS2 Software plc – Results | 3. RS2 | +5.26% | |

| 27 APR 2020 | MT: Grand Harbour Marina plc – Results | |||

| 29 APR 2020 | US: FED – Monetary Policy Meeting | Worst Performers: | ||

| 30 APR 2020 | EU: ECB – Monetary Policy Meeting | 1. MDS | -11.00% | |

| 2. SFC | -4.12% | |||

| 3. | ||||

| Price (€): 24.04.2020 | Price (€): 17.04.2020 | Weekly Change (%) | 2020 Performance (%) | |

| MSE Equity Total Return Index | 8,224.722 | 8,069.366 | 1.925 | -14.466 |

| BMIT Technologies plc | 0.494 | 0.490 | 0.82 | -5.00 |

|---|---|---|---|---|

| Bank of Valletta plc | 1.060 | 1.020 | 3.92 | 0.00 |

| FIMBank plc (USD) | 0.470 | 0.470 | 0.00 | -21.67 |

| GlobalCapital plc | 0.230 | 0.230 | 0.00 | -17.86 |

| Grand Harbour Marina plc | 0.750 | 0.750 | 0.00 | 36.36 |

| GO plc | 3.920 | 3.880 | 1.03 | -7.98 |

| Harvest Technology plc | 1.460 | 1.460 | 0.00 | -2.67 |

| HSBC Bank Malta plc | 1.000 | 0.970 | 3.09 | -23.08 |

| International Hotel Investments plc | 0.600 | 0.595 | 0.84 | -27.71 |

| Lombard Bank plc | 2.120 | 2.100 | 0.95 | -7.02 |

| Loqus Holdings plc | 0.080 | 0.080 | 0.00 | 24.03 |

| MIDI plc | 0.396 | 0.360 | 10.00 | -26.67 |

| Medserv plc | 0.890 | 1.000 | -11.00 | -19.09 |

| Malta International Airport plc | 5.050 | 5.000 | 1.00 | -26.81 |

| Malita Investments plc | 0.840 | 0.800 | 5.00 | -6.67 |

| Mapfre Middlesea plc | 2.260 | 2.260 | 0.00 | 4.63 |

| Malta Properties Company plc | 0.550 | 0.525 | 4.76 | -12.70 |

| Main Street Complex plc | 0.480 | 0.480 | 0.00 | -20.00 |

| MaltaPost plc | 1.200 | 0.900 | 33.33 | -8.40 |

| PG plc | 1.820 | 1.800 | 1.11 | -1.09 |

| Plaza Centres plc | 0.970 | 0.940 | 3.19 | -3.96 |

| RS2 Software plc | 2.000 | 1.900 | 5.26 | -6.54 |

| Simonds Farsons Cisk plc | 8.150 | 8.500 | -4.12 | -29.13 |

| Santumas Shareholdings plc | 1.360 | 1.360 | 0.00 | -3.55 |

| Tigné Mall plc | 0.730 | 0.730 | 0.00 | -18.89 |

| Trident Estates plc | 1.350 | 1.320 | 2.27 | -12.90 |

* Trading commenced on January 7, 2020.

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected].