MSE Trading Report for Week ending 08 May 2020

| MSE Equity Total Return Index: |

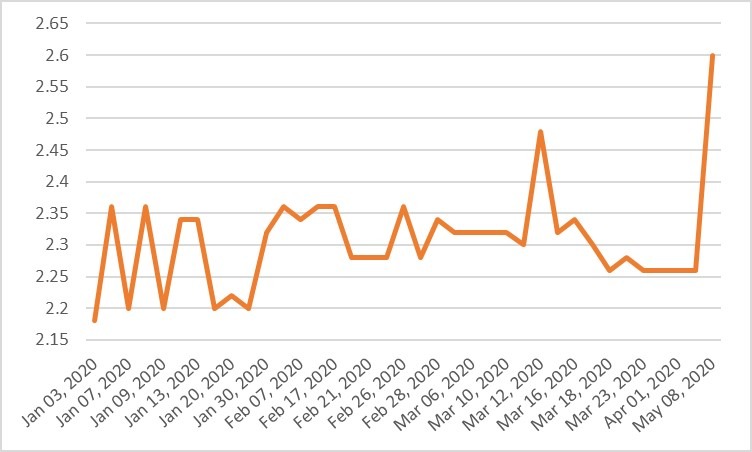

| Chart of the Week: Mapfre Middlesea plc |

| Highlights: |

- The MSE Equity Total Return Index closed higher by 1% at 8,366.239 points. Out of 19 active equities, nine headed north while another four closed in the red. During the week trading activity declined to €0.7 million, down from €1.4m a week ago.

- Last Thursday, Malta International Airport plc announced its traffic result for April 2020. Passenger numbers suffered a 99.64% drop in April when compared to the same month last year, further highlighting the overwhelming impact of the COVID-19 pandemic on the aviation industry. Likewise, passenger traffic had already decreased significantly in March 2020, the situation at Malta International Airport continued to deteriorate in April, which was the first full month to see air traffic to and from the airport come to an almost complete standstill.

- The decline in passenger numbers for the month of April was observed in parallel with drops of 94.3% in aircraft movements and 98.35% in seat capacity. Seat load factor (SLF) for the month of April stood at a very low 18.8%. Following the ban of all inbound commercial flights towards the end of March, the airport continued to focus on its role in facilitating essential travel. During April, there were 73 repatriation flights to and from eight countries including the United Kingdom, Germany, Italy and the Netherlands. Moreover, flights carrying freight registered a 39.8% increase over the same month in 2019 to total 186 aircraft movements.

- The equity was the most active, as total weekly turnover stood at €215,581. The share price of the airport operator closed 2% lower at €5, as 43,048 shares changed hands across 40 transactions.

- Last Wednesday, International Hotel Investments plc announced that given the current outlook, the scaling down process of the operations of the Azure Group has run its natural course, and a liquidation process has commenced. The company ensures that this is conducted in an orderly manner, and that timeshare owners will continue to enjoy the same service and benefits as they have for the past years. Any action taken regarding the curtailment of employees will be made in line with all local regulations.

- IHI owns 50% of the Golden Sands Resort and the Azure Group. The remaining half is owned by international investors specialising in timeshare resort operations. The shareholders remain committed to the future of the Golden Sands Resort as a high-end luxury destination. The shareholders have also reaffirmed that the Golden Sands Resort will fully honour all timeshare commitments arising from obligations entered into with existing members.

- The equity declined by 2% as seven deals involving 15,350 shares were executed. IHI closed the week at €0.59.

- Last Monday, Main Street Complex plc announced that following the authorisation by the Minister of Health and Superintendent of Public Health, the shopping mall re-opened its doors on May 4, 2020. This resumption of activity was subject to strict adherence of specific measures and procedures. Over the weekend, the management ensured that the complex is thoroughly cleansed and sanitised. Moreover, all necessary mitigation measures are in place including temperature measurement tools and sanitiser dispensers at all entry points. The management has also set access controls to limit the number of patrons allowed in at any given time.

- All outlet operators authorised to resume operations have been fully briefed by management as to the strict measures to be deployed in and around their respective outlets within the complex, including but not limitedly in respect of access controls, the compulsory use of protective masks and the application of social distancing measures. Such measures are to be maintained on a consistent basis with a view to safeguarding the health and wellbeing of patrons and staff.

- The equity was active but traded unchanged at €0.45. Eight deals involving 99,613 shares were executed.

- Likewise, Plaza Centres plc and Tigne’ Mall plc announced that both shopping malls have resumed business subject to restrictions imposed by the public health authorities. The management ensured that all the necessary measures are taken with a view to guarding against the spread of the COVID-19 virus. Plaza Centres plc was active on Thursday as it gained 1% while Tigne’ Mall plc recorded no trades

- Last Friday, Malita Investments plc announced that the AGM is tentatively setting July 28, 2020. The equity traded twice over 3,710 shares, resulting into a 6% increase, to close at €0.90.

- On Monday, Trident Estates plc announced that for the forthcoming 20th Annual General Meeting (AGM), nominations for the election of directors are to be submitted by not later than noon of May 18, 2020. The equity did not register any trading activity during the week.

- Similarly, Simonds Farsons Cisk plc announced that nominations for the election of directors at the forthcoming 73rd AGM, are to be submitted by not later than noon of May 18, 2020. The equity traded flat at €8.30, as 4,119 shares were spread over 10 deals.

- Last Thursday, Loqus Holdings plc announced that Loqus UK Ltd, a fully owned subsidiary of the company, has acquired 100% of the issued share capital of Simno Software Services Limited. This is a software company incorporated and registered in England and Wales, with five employees. Loqus UK has a three-year period to pay Simno, out of profits generated by Simno itself. This newly acquired company provides software support services to mainly one large customer, which is also a customer of Loqus Group. This acquisition is anticipated to find new synergies and efficiencies for Loqus and Simno, while delivering a better service to their common client.

- The equity registered the best performance, as two deals pushed the price 21% higher.

- Last Friday, GlobalCapital plc announced that during a meeting held the previous day, the board approved the audited consolidated annual financial statements for the financial year ended December 31, 2019, to be submitted for shareholders’ approval at the forthcoming Annual General Meeting. The group recorded a 75% increase in pre-tax earnings, amounting to €2.1 million for the year. An increase in the fair value gains on investment property was recognised through the income statement, which amounted to €0.5 million compared to an increase of €1.7 million in 2018. The net gain on financial investments recorded in the 2019 income statement amounted to €2.1 million versus the net loss of €2.3 million sustained in 2018.

- The group’s assets were up by 11.5% to €153.7 million in 2019 while shareholder funds also increased by 5.8%, versus a 1.3% increase registered in 2018. The net asset value at end of year stood at €19.5 million, translating into a 5.4% increase from the previous year’s figure. Meanwhile, the group’s debt to equity ratio stood at 51.4%, which remained relatively in line with the previous year’s ratio of 56%.

The directors did not recommend the payment of a dividend for 2019 as the company had no distributable reserves at the end of the reporting period. - The equity was not active during the week.

- The MSE MGS Total Return Index declined by 1% as it reached 1,110.33 points. Last Tuesday, three issues were admitted to the Malta Stock Exchange’s official list, of which trading commenced the following day. These are the 0.30% Malta Government Stock 2024 (IV), 0.40% Malta Government Stock 2026 (II) F.I. May 2020 and the 1.00% Malta Government Stock 2031 (II) F.I. May 2020. Moreover, on Friday, the 0.5% Malta Government Stock 2025 (II) FI November 2019 and the 0.5% Malta Government Stock 2025 (II), have been merged and deemed to be one stock.

- In the local sovereign market, out of 17 active issues, three advanced while another 11 closed in the red. The 4.8% MGS 2028 (I) headed the list of gainers as it closed 3.35% higher at €140.50. On the other hand, the 2.4% MGS 2041 (I) traded 6.27% lower, to close at €122.79.

- The MSE Corporate Bonds Total Return Index remained relatively flat at 1,059.28 points. A total of 43 issues were active, of which 23 registered gains while another eight lost ground. The best performance was recorded by the 5.1% 6PM Holdings plc Unsecured € 2025 as it closed 5.34% higher at €99.55. Conversely, the 5.3% United Finance Plc Unsecured € Bonds 2023 lost 2.45%, ending the week at €99.50.

- In the Prospects MTF market, all six active issues closed unchanged. The 5% JD Capital plc Unsecured € Bonds 2028 was the most liquid with a total weekly turnover of €24,650.

| Best Performers: | ||||

| 1. LQS | +21.25% | |||

| 13 MAY 2020 | MT: Trident Estates plc – Results | 2. MMS | +15.04% | |

| 27 MAY 2020 | MT: Simonds Farsons Cisk plc – Results | 3. MDI | +6.06% | |

| 29 MAY 2020 | MT: Medserv plc – Results | |||

| 04 JUN 2020 | EU: ECB – Monetary Policy Meeting | |||

| 10 JUN 2020 | US: FED – Monetary Policy Meeting | 1. MDS | -10.11% | |

| 2. RS2 | -2.91% | |||

| 3. MIA | -1.96% | |||

| Price (€): 08.05.2020 | Price (€): 30.04.2020 | Weekly Change (%) | 2020 Performance (%) | |

| MSE Equity Total Return Index | 8,366.239 | 8,283.810 | 0.995 | -12.994 |

| BMIT Technologies plc | 0.480 | 0.480 | 0.00 | -7.69 |

|---|---|---|---|---|

| Bank of Valletta plc | 1.050 | 1.050 | 0.00 | -0.94 |

| FIMBank plc (USD) | 0.470 | 0.470 | 0.00 | -21.67 |

| GlobalCapital plc | 0.230 | 0.230 | 0.00 | -17.86 |

| Grand Harbour Marina plc | 0.750 | 0.750 | 0.00 | 36.36 |

| GO plc | 3.860 | 3.700 | 4.32 | -9.39 |

| Harvest Technology plc | 1.460 | 1.460 | 0.00 | -2.67 |

| HSBC Bank Malta plc | 1.020 | 1.020 | 0.00 | -21.54 |

| International Hotel Investments plc | 0.590 | 0.600 | -1.67 | -28.92 |

| Lombard Bank plc | 2.100 | 2.000 | 5.00 | -7.89 |

| Loqus Holdings plc | 0.097 | 0.080 | 21.25 | 50.39 |

| MIDI plc | 0.420 | 0.396 | 6.06 | -22.22 |

| Medserv plc | 0.800 | 0.890 | -10.11 | -27.27 |

| Malta International Airport plc | 5.000 | 5.100 | -1.96 | -27.54 |

| Malita Investments plc | 0.900 | 0.850 | 5.88 | 0.00 |

| Mapfre Middlesea plc | 2.600 | 2.260 | 15.04 | 20.37 |

| Malta Properties Company plc | 0.550 | 0.550 | 0.00 | -12.70 |

| Main Street Complex plc | 0.450 | 0.450 | 0.00 | -25.00 |

| MaltaPost plc | 1.210 | 1.200 | 0.83 | -7.63 |

| PG plc | 1.880 | 1.850 | 1.62 | 2.17 |

| Plaza Centres plc | 0.980 | 0.970 | 1.03 | -2.97 |

| RS2 Software plc | 2.000 | 2.060 | -2.91 | -6.54 |

| Simonds Farsons Cisk plc | 8.300 | 8.300 | 0.00 | -27.83 |

| Santumas Shareholdings plc | 1.360 | 1.360 | 0.00 | -3.55 |

| Tigné Mall plc | 0.850 | 0.730 | 0.00 | -5.56 |

| Trident Estates plc | 1.550 | 1.550 | 0.00 | 0.00 |

* Trading commenced on January 7, 2020.

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected].