MSE Trading Report for Week ending 05 June 2020

| MSE Equity Total Return Index: |

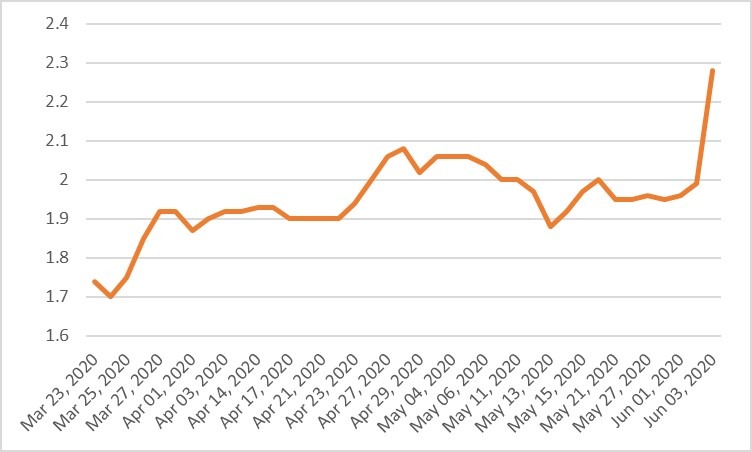

| Chart of the Week: RS2 Software plc |

| Highlights: |

- The MSE Equity Total Return Index extended its gain by a further 1.3% as it reached 8,322.868 points. Out of 19 active equities, gainers and losers tallied to eight-a-piece. A total weekly turnover of €1.9 million was generated across 329 transactions.

- On Monday, RS2 Software plc announced that the annual general meeting shall be held on July 30, 2020. The following day, the company announced that one of its subsidiaries has concluded a major processing outsourcing agreement with one of the largest acquirers in the US for a ten-year term with the option to renew. This is a milestone achievement, in line with the RS2’s expansion strategy of extending its operations in the US. Further details will be announced in due course.

- The equity registered the best performance as it reached a 12-week high price of €2.30 – translating into an 18% increase. It was also the most liquid, as total turnover stood at €665,668. This was the result of 80 deals involving a total of 316,897 shares. Such positive performance translates into a 7.48% increase on a year-to-date basis.

- On Monday, GO plc announced that Cablenet Communication Systems Limited, a Cypriot telecommunications provider operating in and from Cyprus and in which the company holds 60.26% of the issued share capital, is in advanced preparations in respect of a proposed public issue in Malta of 4% unsecured bonds with an aggregate principal amount of up to €40,000,000. Subject to board approval of Cablenet, an application shall be submitted to the Maltese Listing Authority to request the admissibility to listing of the bonds and to the Malta Stock Exchange to be admitted to the official list of the Exchange. Moreover, a yet to be determined portion of the Bonds will be available for subscription by the Company’s shareholders on a preferential basis.

- The equity declined by 1% as it closed at €3.60. A total of 32,365 shares changed hands over 26 deals. On the other hand, its subsidiary, BMIT Technologies plc was up by 1.7%, as 26 deals involving 213,363 shares were executed. The equity ended the week at €0.486.

- Six deals involving 9,090 HSBC Bank Malta plc shares dragged the price by 1% into negative territory. The equity was trading flat all week but closed one cent lower on Friday at €0.98.

- Bank of Valletta plc lost 2% as 224,972 shares were spread across 36 transactions. The equity reached €1.04 on Wednesday but did not manage to sustain the gain as it closed in the red at €1.00 on Friday.

- Malta International Airport plc gave up its previous week’s gains as it closed 1% lower at €5.75. A total of 56,239 shares were spread over 79 deals. On Tuesday, the equity closed at a three-month high price of €5.95 – and also reached an intra-day high price of €6.00.

- Retail conglomerate, PG plc, reached the €2.00 price level – the highest price in three months. Six deals involving 17,076 shares pushed the price 2.6% higher. On a year-to-date basis, the equity recorded positive 8.7% movement in price.

- On May 29, Medserv plc approved the audited consolidated financial statements for the financial year ended December 31, 2020. Total revenue for the year amounted to €68.73 million, as against a forecast of €64.22 million. Such increase is mainly attributable to the nearshore drilling project in Suriname which ended prematurely in December 2019. As a result, the ILSS reported an increase in revenue of €30.73 million, representing an increase of 143% over the previous year. The Oil Country Tubular Goods (OCTG) segment has also registered an increase in revenue of €1.83 million, which is equivalent to 13% increase when compared with last year.

- Adjusted Earnings before interest, taxation, depreciation and amortization (EBITDA) of the group amounted to €12.72 million – a significant improvement of 74% over the previous year, as a result of the revenue growth. Forecast results published on May 22, 2019 showed an EBITDA of €14.13 million. A significant part of the variance in EBITDA is due to the transactional costs recognised during the reporting year in respect of the acquisition of AMT S.A. which was terminated on April 16, 2020.

- After deducting the net finance costs amounting to €5.64 million, the group registered a loss before tax of €2.55 million, versus an €8.83 million loss before tax recorded in 2018. The Group registered negative earnings per share of €0.05c4 versus a negative earnings per share of €0.16c8 during the previous year.

- These audited consolidated financial statements shall be submitted for the approval of the shareholders at the forthcoming Annual General Meeting, the date of which is yet to be determined due to the COVID-19 restrictions.

- Last Saturday, Medserv also published its interim report for 2020. Revenue for the first quarter of year 2020 was 29.6% lower than that the previous year’s figure. Such loss in revenue was expected to be recovered from the new drilling projects that were scheduled to commence in Cyprus in the second quarter of year 2020. Due to the Covid-19 pandemic, this was postponed, resulting into the company revising downwards its budget revenue for the year 2020 to €26.5 million. Moreover, EBITDA for 2020 is estimated at €5.5 million, adjusted to reflect the impact of the postponement of drilling. These figures represent the company’s projections for the current year however investors ought to be aware of the full effect of this pandemic on the group and the market in which it operates are still very fluid. More detailed forecasts will be issued by the company in line with its obligation to publish a financial analysis summary by June 30, 2020.

- The company’s facilities remain operating uninterruptedly and continue servicing clients. The COVID-19 pandemic coupled with both the collapse in price and demand for oil, as well as geopolitical events resulted in international oil companies (IOCs) cutting back on capital expenditure and demanding discounts.

- Medserv’s budgeted earnings for year 2020 were impacted and had to be re-adjusted. Offshore drilling activity in Libya has been suspended, while Cyprus postponed drilling effecting the provision of Integrated Logistics Support Services (ILSS)/shore base services. Drilling and project development in Egypt remained ongoing and are expected to be maintained at current levels.

- As the drilling campaign in Suriname ended, the company is committed to maintain its presence in the region. The large finds in Guyana, Trinidad and Tobago, as well as future activity planned in Suriname itself makes this region an exciting area for exploration in the oil and gas industry.

- The current global downturn had minimal effect on earnings from the supply chain management of OCTG segment of the Company which is driven by onshore drilling activity in the Middle East. Demand for supply chain management services remain strong as National Oil Companies of this region did not suspend any onshore drilling and continue to confirm their commitment to approved projects.

- The rest of the year is expected to be a challenging period for the Company, as it manages the economic impact of COVID-19. The Company’s objective is to preserve its liquidity and ensure that it continues to register positive EBITDA during this period. Immediate cost containment measures have been put in place across the Company. These include restructuring to the new norm and postponing any capital expenditure plans. Such measures ensure that the Company will have sufficient funds to meets its obligations as they arise and fall due throughout the course of the year.

- The Company still enjoys a strong business pipeline across its core markets, being North Africa, Eastern Mediterranean and the Middle East. Once travel bans are lifted, the long-term energy projects for which the company is already contracted to service will resume. The main reason for resumption being that the cost of commercialising these projects are low as the investment in the required infrastructure has already been done. Furthermore, they are located close to the market or are needed for national consumption.

- Additionally, the Company is awaiting adjudication of several tenders including ILSS services to an IOC operating offshore Egypt and Supply Chain Management for OCTG contracts in the United Arab Emirates.

- The equity declined by 4.3% as two deals involving 10,000 shares were executed.

- In the property sector, four equities were active. Malta Properties Company plc displayed strength as it closed 14.8% higher at €0.62. This was the outcome of 11 deals involving 105,319 shares.

- Two deals involving 7,000 MaltaPost plc shares did not impact the equity’s previous closing price of €1.17. On Friday afternoon, the company announced that regulatory approval has been received for a proposed change in the shareholding structure of Untours Insurance Agency Limited and which will effectively result in MaltaPost plc acquiring 49% of the share capital of Untours Insurance Agency Limited.

- The MSE MGS Total Return Index advanced by a further 0.154% as it closed at 1,116.93 points. On Thursday, the European Central Bank announced a €600 billion expansion of its Pandemic Emergency Purchase Programme. The increase was not expected to be as large, and resulted in the central bank’s total bond buying reaching €1.35 trillion. Meanwhile, in the US, the Labor Department announced that the month of May saw a surprising €2.5 million gain in employment, translating into the largest gain on record. Meanwhile, the unemployment rate decreased to 13.3%, which raises hope for the beginning of a recovery from the Covid-19 pandemic.

- In the local sovereign market, out of 16 active issues, seven headed north while another eight closed in the opposite direction. The 5.25% MGS 2030 (I) headed the list of gainers with a 3.45% increase, to close at €150.00. On the other hand, the 2.4% MGS 2041 (I) lost 6.46%, ending the week at €123.00.

- The MSE Corporate Bonds Total Return Index registered a 1.055% increase as it reached 1,071.04 points. A total of 41 issues were active, of which 20 registered gains while four lost ground. The 4% International Hotel Investments plc Unsecured € 2026 registered the best performance as it closed 9.02% higher, at par. Conversely, the 4.4% Von der Heyden Group Finance plc Unsecured € 2024 traded 1.75% lower, at €98.25.

- In the Prospects MTF market, 13 issues were active. The 5% Busy Bee Finance Company plc Unsecured € 2029 was the most liquid as total turnover amounted to €15,075 over one deal of 15,000 shares.

| Upcoming Events | ||||

| Best Performers: | ||||

| 1. RS2 | +17.95% | |||

| 10 JUN 2020 | US: FED – Monetary Policy Meeting | 2. MPC | +14.81% | |

| 15 JUN 2020 | MT: MIDI plc – Annual General Meeting | 3. STS | +9.56% | |

| 28 JUL 2020 | MT: Malita Investments plc – Annual General Meeting | |||

| 28 JUL 2020 | MT: Plaza plc – Annual General Meeting | Worst Performers: | ||

| 29 JUL 2020 | MT: MaIta International Airport plc – Annual General Meeting | 1. MDI | -7.32% | |

| 2. FIM | -5.00% | |||

| 3. MDS | -4.29% | |||

| Price (€): 05.06.2020 | Price (€): 29.05.2020 | Weekly Change (%) | 2020 Performance (%) | |

| MSE Equity Total Return Index | 8,322.868 | 8,213.194 | 1.335 | -13.445 |

| BMIT Technologies plc | 0.486 | 0.478 | 1.67 | -6.54 |

|---|---|---|---|---|

| Bank of Valletta plc | 1.000 | 1.020 | -1.96 | -5.66 |

| FIMBank plc (USD) | 0.380 | 0.400 | -5.00 | -36.67 |

| GlobalCapital plc | 0.330 | 0.330 | 0.00 | 17.86 |

| Grand Harbour Marina plc | 0.720 | 0.720 | 0.00 | 30.91 |

| GO plc | 3.600 | 3.640 | -1.10 | -15.49 |

| Harvest Technology plc | 1.470 | 1.490 | -1.34 | -2.00 |

| HSBC Bank Malta plc | 0.980 | 0.990 | -1.01 | -24.62 |

| International Hotel Investments plc | 0.585 | 0.585 | 0.00 | -29.52 |

| Lombard Bank plc | 2.180 | 2.060 | 5.83 | -4.39 |

| Loqus Holdings plc | 0.097 | 0.097 | 0.00 | 50.39 |

| MIDI plc | 0.380 | 0.410 | -7.32 | -29.63 |

| Medserv plc | 0.670 | 0.700 | -4.29 | -39.09 |

| Malta International Airport plc | 5.750 | 5.800 | -0.86 | -16.67 |

| Malita Investments plc | 0.890 | 0.890 | 0.00 | -1.11 |

| Mapfre Middlesea plc | 2.280 | 2.280 | 0.00 | 5.56 |

| Malta Properties Company plc | 0.620 | 0.540 | 14.81 | -1.59 |

| Main Street Complex plc | 0.496 | 0.496 | 0.00 | -17.33 |

| MaltaPost plc | 1.170 | 1.170 | 0.00 | -10.69 |

| PG plc | 2.000 | 1.950 | 2.56 | 8.70 |

| Plaza Centres plc | 0.980 | 0.980 | 0.00 | -2.97 |

| RS2 Software plc | 2.300 | 1.950 | 17.95 | 7.48 |

| Simonds Farsons Cisk plc | 8.200 | 8.000 | 2.50 | -28.70 |

| Santumas Shareholdings plc | 1.490 | 1.360 | 9.56 | 5.67 |

| Tigné Mall plc | 0.800 | 0.780 | 2.56 | -11.11 |

| Trident Estates plc | 1.550 | 1.550 | 0.00 | 0.00 |

* Trading commenced on January 7, 2020.

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected].