MSE Trading Report for Week ending 31 July 2020

| MSE Equity Total Return Index: |

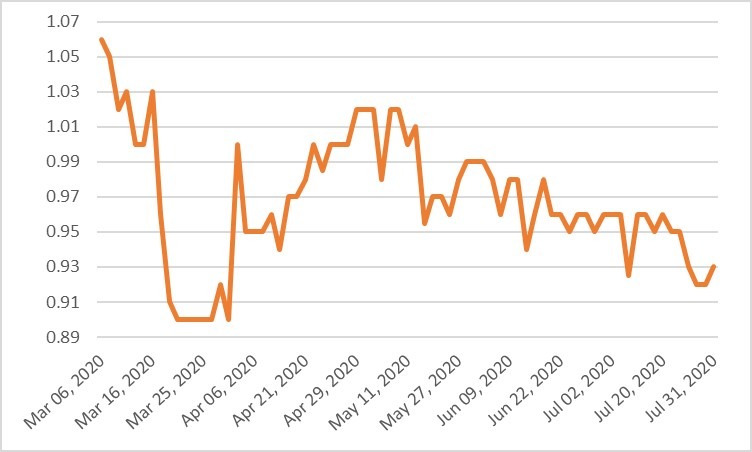

| Chart of the Week: HSBC Bank Malta plc |

| Highlights: |

- The MSE Equity Total Return Index lost 0.3%, as it closed at 8,043.488 points. A total of 18 equities were active, of which nine headed north while another eight closed in the opposite direction. A total weekly turnover of nearly €0.4 million was generated across 111 transactions. Yesterday also happened to be the final trading session for the month of July, during which the local equities’ index shed 3.6%. The negative performance across large caps weighed heavily on investors’ sentiment.

- On Friday, Bank of Valletta plc announced that the board approved the group’s and bank’s condensed interim financial statements for the six-month financial period commencing January 1, 2020 to June 30, 2020.

- Profit before tax for the six months declined by 74.6% to €13.8 million (June 2019: €54.3 million). This represents an annualised return on equity (pre-tax) of 2.6%. Results for the first half of the year inevitably include the negative impact of the Covid-19 as it caused more than half of the drop in profit, directly or indirectly.

- Operating profit declined by 70% from €41.2 million recording during the previous year’s half-year period to €12.4 million. Revenue was down across all streams as the pandemic adversely impacted most of the revenue generating areas coupled with the effect of de-risking as the bank exited business lines and customers outside the revised risk appetite.

- Net interest income was €5.3 million lower than 2019’s half-year figure as it stood at €72.3 million, which remains the main revenue driver.

- The group remains highly liquid with cash and short term funds increasing by 4.3% to €178.3 million since December 2019. The asset liquidity of the bank’s portfolio remains high with more than 90% in A- or higher.

- Equity as at end June 2020 is marginally higher than December 2019 and stands at €1.1 billion.

- The group’s capital position remains strong, with a CET 1 ratio as at June 2020 of 19.8%, in line with the group’s risk appetite and comfortably above the minimum regulatory requirements.

- The board announced that it has resolved not to declare an interim dividend. The bank reported that it shall be availing itself of the extension period granted and will be holding the Annual General Meeting on November 26, 2020.

- The banking equity finished the week 1% higher as it closed at €0.98. Nine deals involving 21,323 shares were executed.

- Meanwhile, its peers lost ground. HSBC Bank Malta plc reached a four-low-price of €0.92 but closed slightly higher at €0.93 – translating into a 2% decline. A total of 28,537 shares changed hands over 20 deals.

- On Wednesday, Malta International Airport plc (MIA) announced that the board approved the group’s interim financial statements for the six months ended June 30, 2020.

- The airport operator announced that the board approved the group’s interim financial statements for the six months ended June 30, 2020. A total of 1,017,850 passengers were welcomed during the first half of 2020, translating into a 68.7% drop when compared to the previous year.

- The year began on a positive note until the Covid-19 outbreak in Europe. Stringent travel restrictions also led to a 46.6% decline in aircraft movements and 48.1% drop in seat capacity.

- Traffic to and from Malta remained at an almost complete standstill until June, with just 822 take-offs and landings registered in the second quarter – of which 49% of the flights were humanitarian and repatriation operations. Meanwhile, the remaining were cargo flights, which registered a 3.7% increase in quarter two when compared to the same period of the previous year.

- Seat load factor declined to 67.7% versus the 79.9% recorded for the first half of 2019.

- During the period under review, total revenue declined by 67%, from €44.6 million to €14.9 million, reflecting the significant downturn in traffic. Revenue from the airport segment dropped by 73% to €8.4 million while revenue generated from the retail and property segment lost 51% as it stood at €6.5 million.

- Notwithstanding, EBITDA of the group decreased by 90.5% over the previous year, translating to a net loss of €2 million.

- Having evaluated the overall position of the company in light of the current situation, the group re-considered the recommendation for the payment of a final net dividend to shareholders of €0.10 per share, announced on February 26, 2020.

- The board believes that, with a view to manage the company’s cash reserves in a moment of significant curtailment of cash inflows and in effort to preserve the company’s organisational set-up and structures, it is not prudent to recommend the payment of an interim dividend to shareholders and this so as to preserve the sustainability of the business and its operations.

- The equity was the most liquid, as turnover reached €81,759. MIA shares closed the week at €5.40 after touching a low of €5.20 yesterday. A total of 16 trades involving 15,097 shares were recorded.

- On Monday, BMIT Technologies plc announced that during the Annual General Meeting (AGM), all resolutions on the agenda were approved. The equity closed 0.4% lower at €0.48. A total of 147,549 shares were spread across 15 transactions.

- On Tuesday, GO plc announced that during the AGM, all the resolutions on the agenda were approved. The AGM approved the payment of a final net dividend of €0.10 for the year ended December 31, 2019. Five deals involving 2,468 shares pushed the price 2.4% higher to €3.44.

- On Thursday, RS2 Software plc announced that during the AGM, the shareholders considered and approved all resolutions on the agenda. The equity reached a seven-week-low-price of €2.28 on Friday, but managed to recover as it registered a positive 1% movement in price. Seven deals involving 17,922 shares were executed. The equity closed the month 1.7% lower, yet on a year-to-date basis, the equity is still up 10.

- On Friday, International Hotel Investments plc announced that all resolutions on the agenda were approved. The equity lost 2% as 39,119 shares changed ownership over nine deals, to close the week at €0.53.

- On Wednesday, Trident Estates plc announced that further to an expression of interest, the lease proposal at Trident Park, Central Business District, Birkirkara submitted by its subsidiary Trident Park Limited, has been selected as the preferred bid to house the office premises for the Financial Intelligence Analysis Unit (FIAU). Moreover, other promise to lease agreements have also recently been confirmed with financial services and investment holding companies bringing the total area that has been committed at Trident Park to 4,298m2. The equity registered the best performance as a sole deal of 700 shares pushed the price up by 11.3% to €1.67.

- On Monday, Malita Investments plc announced that the board has decided to further postpone the AGM to September 3, 2020. Six deals involving 18,243 Malita shares pushed the price 1% higher to €0.92.

- On Wednesday, Malta Properties Company plc announced that all resolutions on the agenda were approved during the AGM. The equity reached €0.56, as 686 shares changed hands across three transactions.

- On Thursday, MIDI plc announced that it plans to hold the AGM on October 1, 2020. No trading activity was recorded during the week.

- Harvest Technology plc traded twice over 7,665 shares, resulting into a 0.7% fall in price. The equity ended the week at €1.48.

- The company announced that the board approved the company’s interim financial statements for the six-month period ended June 30, 2020. During the period under review, the group registered a 20% increase in revenue when compared to the previous half-year period, as it stood at €9 million.

- Similarly, profit before tax increased to €1.86 million – an improvement of 21% on the budget projection for H1 (€1.3 million) which constituted the first half of the annual projected consolidated net profit before tax of €3.1 million for 2020.

- The earnings per share increased from €0.042 to €0.052. The group’s net assets as at June 30, 2020 amounted to €11 million versus the €10 million recorded during the same period last year.

- The board also announced that it has resolved to distribute an interim net dividend of €546,785, equivalent to €0.024 per share, having a nominal value of €0.50 per share. All shareholders on the company’s register as at July 31, 2020 shall be entitled to receive their respective share of the dividend. Payment of the dividend shall be effected by not later than August 14, 2020.

- A sole deal of 4,202 MaltaPost plc shares pushed the price higher by 1% to €1.19.

- Mapfre Middlesea plc announced that AGM is scheduled to be held on October 27, 2020 remotely but will be streamed live. The equity was active but closed unchanged at €2.02.

- Plaza Centres plc announced that the board approved the interim financial statements for the six months ended June 30, 2020. The group’s results were significantly impacted by COVID-19.

- During the first six months of the year, the group generated revenue of €1,444,798 (2019: €1,716,479) a decrease of 15.8%, whilst EBIDTA decreased by 24.6% to €1,058,751 (2019: €1,404,290). Profit before tax decreased by 35.5% to €609,687 (2019: €944,522).

- The group’s occupancy at June 30, 2020 was 93% (June 30, 2019: 87%).

- During this period, Plaza had to take commercial decisions which negatively impacted its revenues, costs and hence profitability, in the form of lower rents and absorbing a higher percentage of common area costs.

- Furthermore, an increase of €72,900 in the general provision for doubtful debts has been recognised.

- The equity headed the list of fallers, as it closed 5.6% lower at €0.92. A sole deal of 4,000 shares was executed.

- Main Street Complex plc announced that the board approved the audited financial statements for the financial year ended December 31, 2019 and the directors’ and auditors’ report. A final net dividend of €0.00831 per share was also approved. The equity was not active during the week.

- On Friday, Medserv plc announced that the shareholders considered and approved the consolidated financial statements for the financial period ended December 31, 2019 and the directors’ and auditors’ report. No trading activity was recorded.

- The MSE MGS Total Return Index advanced by 0.7% to 1,123.19 points. A total of 19 issues were active, of which gainers and losers tallied to seven a-piece. The 4.3% MGS 2033 (I) headed the list of gainers, as it closed 6.71% higher at €150.00. Conversely, the 4.5% MGS 2028 (II) lost 2.2% to close at 132.00.

- The MSE Corporate Bonds Total Return Index lost 0.3% as it reached 1,080.61 points. Out of 35 active equities, 12 registered gains while another 12 lost ground. The top performer was the 5% Hal Mann Vella Group plc Secured Bonds € 2024, as it closed 3% higher at €106.00. On the other hand, the 3.85% Hili Finance plc Unsecured Bonds 2028 traded 3% lower, to end the week at €95.00.

- In the Prospects MTF market, eight issues were active. The 5% The Convenience Shop Holding plc Unsecured Callable € 2026-2029 was the most liquid, as total turnover amounted to €20,000.

| Upcoming Events | ||||

| Best Performers: | ||||

| 1. TRI | +11.33% | |||

| 03 AUG 2020 | MT: HSBC Bank Malta plc – Interim Results | 2. MPC | +4.67% | |

| 07 AUG 2020 | MT: GO plc – Interim Results | 3. GO | +2.38% | |

| 07 AUG 2020 | MT: BMIT Technologies plc – Interim Results | |||

| 10 AUG 2020 | MT: Malta Properties Company plc – Interim Results | Worst Performers: | ||

| 13 AUG 2020 | MT: FIMBank plc – Interim Results | 1. FIM | -9.52% | |

| 2. PZC | -5.64% | |||

| 3. HSB | -2.11% | |||

| Price (€): 31.07.2020 | Price (€): 24.07.2020 | Weekly Change (%) | 2020 Performance (%) | |

| MSE Equity Total Return Index | 8,043.488 | 8,065.408 | -0.27 | -16.35 |

| BMIT Technologies plc | 0.480 | 0.482 | -0.41 | -7.69 |

|---|---|---|---|---|

| Bank of Valletta plc | 0.980 | 0.970 | 1.03 | -7.55 |

| FIMBank plc (USD) | 0.380 | 0.420 | -9.52 | -36.67 |

| GlobalCapital plc | 0.390 | 0.390 | 0.00 | 39.29 |

| Grand Harbour Marina plc | 0.720 | 0.720 | 0.00 | 30.91 |

| GO plc | 3.440 | 3.360 | 2.38 | -19.25 |

| Harvest Technology plc | 1.480 | 1.490 | -0.67 | -1.33 |

| HSBC Bank Malta plc | 0.930 | 0.950 | -2.11 | -28.46 |

| International Hotel Investments plc | 0.530 | 0.540 | -1.85 | -36.14 |

| Lombard Bank plc | 2.040 | 2.060 | -0.97 | -10.53 |

| Loqus Holdings plc | 0.097 | 0.097 | 0.00 | 50.39 |

| MIDI plc | 0.380 | 0.380 | 0.00 | -29.63 |

| Medserv plc | 0.700 | 0.700 | 0.00 | -36.36 |

| Malta International Airport plc | 5.400 | 5.500 | -1.82 | -21.74 |

| Malita Investments plc | 0.920 | 0.910 | 1.10 | 2.22 |

| Mapfre Middlesea plc | 2.020 | 2.020 | 0.00 | -6.48 |

| Malta Properties Company plc | 0.560 | 0.535 | 4.67 | -11.11 |

| Main Street Complex plc | 0.570 | 0.570 | 0.00 | -5.00 |

| MaltaPost plc | 1.190 | 1.180 | 0.85 | -9.16 |

| PG plc | 1.960 | 1.940 | 1.03 | 6.52 |

| Plaza Centres plc | 0.920 | 0.975 | -5.64 | -8.91 |

| RS2 Software plc | 2.360 | 2.340 | 0.85 | 10.28 |

| Simonds Farsons Cisk plc | 8.000 | 7.950 | 0.63 | -30.43 |

| Santumas Shareholdings plc | 1.490 | 1.490 | 0.00 | 5.67 |

| Tigné Mall plc | 0.850 | 0.850 | 0.00 | -5.56 |

| Trident Estates plc | 1.670 | 1.500 | 11.33 | 7.74 |

* Trading commenced on January 7, 2020.

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]