MSE Trading Report for Week ending 21 August 2020

| MSE Equity Total Return Index: |

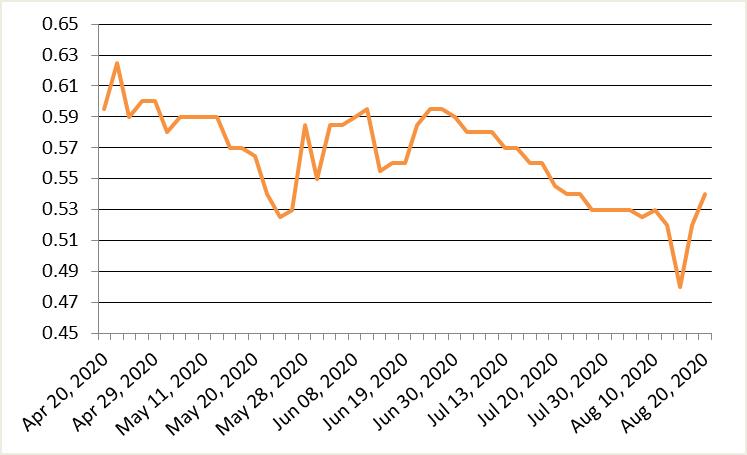

| Chart of the Week: International Hotel Investments plc |

| Highlights: |

- The MSE Equity Total Return Index managed to recoup some lost ground after seven consecutive weeks of negative performance, as it closed 0.4% higher at 7,600.667 points. A total of 12 equities were active, of five of which registered gains while six traded lower. Turnover declined by more than half when compared to the previous week, as it stood at €0.26 million, generated across 75 transactions.

- In the hospitality sector, International Hotel Investments plc (IHI) registered a double-digit gain of 12.5%, as it closed at a three-week high price of €0.54. Two small deals involving 1,750 shares were executed.

- On Friday, the board of IHI announced that they will review the half-yearly financial report for the period ended June 30, 2020 by end of August 2020.

- The highest liquidity was recorded by RS2 Software plc with a total turnover of €73,622. The equity reached an intra-week low price of €2.24 but managed to recover and closed flat at €2.32. A total of 32,785 shares were spread across 13 transactions.

- Malta International Airport plc succumbed to selling pressure mid-week following a lack of activity early in the week. The equity closed the week 3.6% lower at €4.82 after touching a weekly low of €4.80. Fourteen deals involving 10,103 shares were executed.

- In the banking industry, Bank of Valletta plc shares were the most liquid, as total turnover stood at €46,924. The bank ended the week in the red at €0.91 – the lowest price in over four months. A total of 51,097 shares changed ownership across 18 transactions, dragging the price lower by 3.6%.

- Its peer, HSBC Bank Malta plc reached €0.85 during the week but closed lower at €0.835 – translating into a positive 1.2% change in price. This was the outcome of 14 deals involving 50,054 shares. Similarly, Lombard Bank plc was up by 2.2%, as it traded twice over 4,403 shares. The bank ended the week at the €1.88 price level.

- On Tuesday, MIDI plc announced that the board is scheduled to meet on August 25, 2020, to consider and approve the interim unaudited financial statements for the half-year period ended June 30, 2020. The equity was active on Thursday, as a single transaction of 2,000 shares pushed the price by 11.5% to €0.368.

- On Monday, Grand Harbour Marina plc announced the financial analysis summary for 2020.

- Considering the current situation and travel restrictions imposed by the government of Malta, the Pontoon and Superyacht visitors’ segment are expected to be negatively impacted.

- As a result, forecasted total revenue stands at €3.8 million, versus the €4.1 million generated in 2019.

- Similarly, profit before tax is expected to decline by 17% in 2020, versus the €0.47 million generated during the previous year.

- Expected earnings forecast per share for this year stands at €0.007 versus €0.011 registered in 2019.

- Cash inflows from operations are expected to decline by €0.3 million to €0.9 million due to lower revenues as a result of the Covid-19 pandemic.

- Meanwhile, cash used for investing and financing activities is projected to amount to €0.5 million and €0.3 million respectively.

- Nonetheless, the total cash balance of the Company is expected to marginally increase to €4.2 million in 2020.

- No trading activity was recorded during the week.

- On Thursday, Main Street Complex plc announced that it is scheduled to meet on August 27, 2020, to consider, and if thought fit, approve, the interim financial statements for the six-month period ended June 30, 2020. The equity was not active during the week.

- The MSE MGS Total Return Index registered a 0.6% drop as it reached 1,124.49 points. A total of 19 issues were active, seven of which headed north while another eight closed in the opposite direction. The best performance was recorded by the 1.00% MGS 2031 (II) F.I. as it closed 5% higher at €108.75. On the other hand, the 2.5% MGS 2036 (I) traded 5.3% lower, to end the week at €125.00.

- The MSE Corporate Bonds Total Return Index ended the week with a positive 0.5% change at 1,076.27 points. Out of 36 active issues, 13 gained ground while another 12 closed in the red. The 5.1% 1923 Investments plc Unsecured € 2024 was the top performer as it closed 5.3% higher, reaching its par value. Conversely, the 5.8% International Hotel Investments 2021 lost 3.2%, to close at €97.

- In the Prospects MTF market, seven issues were active. The 5% Luxury Living Finance plc € Secured Bonds 2028 was the most liquid, as a total turnover of €24,995 was recorded.

| Upcoming Events | ||||

| Best Performers: | ||||

| 1. TML | +17.14% | |||

| 25 AUG 2020 | MT: MIDI plc – Interim Results | 2. IHI | +12.50% | |

| 27 AUG 2020 | MT: Santumas Shareholdings plc – Interim Results | 3. MDI | +11.52% | |

| 27 AUG 2020 | MT: Lombard Bank Malta plc – Interim Results | |||

| 28 AUG 2020 | MT: Tigne’ Mall plc – Interim Results | Worst Performers: | ||

| 03 SEP 2020 | MT: Malita Investments plc – Annual General Meeting | 1. MPC | -7.41% | |

| 2. MIA | -3.60% | |||

| 3. BOV | -3.60% | |||

|

|

Price (€): 21.08.2020 | Price (€): 14.08.2020 | Weekly Change (%) | 2020 Performance (%) |

| MSE Equity Total Return Index | 7,600.667 | 7,572.779 | 0.368 | -20.708 |

| BMIT Technologies plc | 0.476 | 0.480 | -1.23 | -8.46 |

|---|---|---|---|---|

| Bank of Valletta plc | 0.910 | 0.944 | -3.60 | -14.15 |

| FIMBank plc (USD) | 0.370 | 0.370 | 0.00 | -38.33 |

| GlobalCapital plc | 0.530 | 0.530 | 0.00 | 89.29 |

| Grand Harbour Marina plc | 0.720 | 0.720 | 0.00 | 30.91 |

| GO plc | 3.340 | 3.360 | -0.60 | -21.60 |

| Harvest Technology plc | 1.440 | 1.440 | 0.00 | -4.00 |

| HSBC Bank Malta plc | 0.835 | 0.825 | 1.21 | -35.77 |

| International Hotel Investments plc | 0.540 | 0.480 | 12.50 | -34.94 |

| Lombard Bank plc | 1.880 | 1.840 | 2.17 | -17.54 |

| Loqus Holdings plc | 0.097 | 0.097 | 0.00 | 50.39 |

| MIDI plc | 0.368 | 0.330 | 11.52 | -31.85 |

| Medserv plc | 0.650 | 0.650 | 0.00 | -40.91 |

| Malta International Airport plc | 4.820 | 5.000 | -3.60 | -30.14 |

| Malita Investments plc | 0.920 | 0.920 | 0.00 | 2.22 |

| Mapfre Middlesea plc | 2.000 | 2.000 | 0.00 | -7.41 |

| Malta Properties Company plc | 0.500 | 0.540 | -7.41 | -20.63 |

| Main Street Complex plc | 0.490 | 0.490 | 0.00 | -18.33 |

| MaltaPost plc | 1.100 | 1.100 | 0.00 | -16.03 |

| PG plc | 1.880 | 1.900 | -1.05 | 2.17 |

| Plaza Centres plc | 0.930 | 0.930 | 0.00 | -7.92 |

| RS2 Software plc | 2.320 | 2.320 | 0.00 | 8.41 |

| Simonds Farsons Cisk plc | 7.000 | 7.000 | 0.00 | -39.13 |

| Santumas Shareholdings plc | 1.490 | 1.490 | 0.00 | 5.67 |

| Tigné Mall plc | 0.820 | 0.700 | 17.14 | -8.89 |

| Trident Estates plc | 1.480 | 1.480 | 0.00 | -4.52 |

* Trading commenced on January 7, 2020.

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]