MSE Trading Report for Week ending 25 September 2020

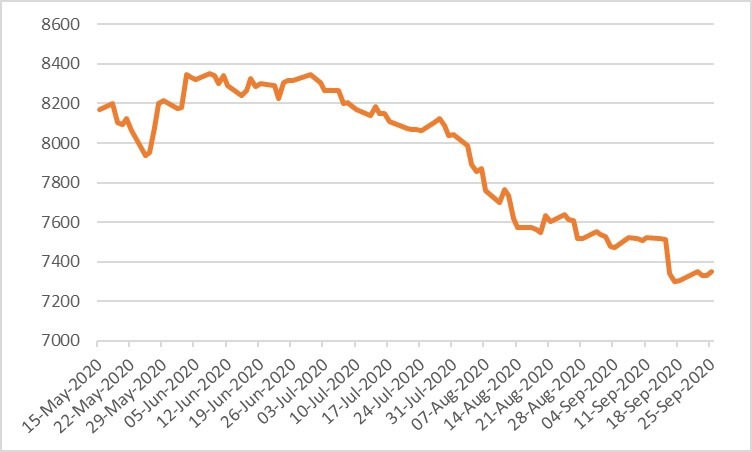

| MSE Equity Total Return Index: |

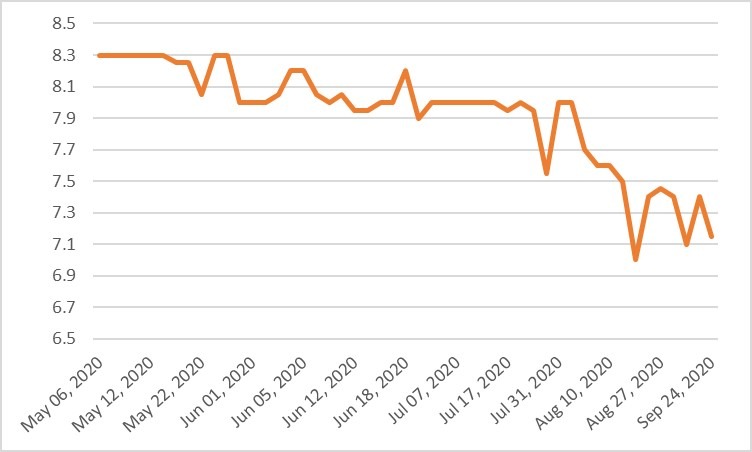

| Chart of the Week: Simonds Farsons Cisk plc |

| Highlights: |

- The MSE Equity Total Return Index closed the week higher by 0.6% at 7,348.194 points. Out of 11 active equities, gainers and losers tallied to four-a-piece. During this four-day trading week, total weekly turnover declined by €0.6 million, to €0.2 million, as 75 transactions were executed.

- The best performance was recorded by International Hotel Investments plc (IHI) despite its low turnover, as the price spiked by 18.4%. Three deals involving 4,858 shares pushed the price back to €0.535. The equity was active only during Tuesday’s session. The share price of IHI is down by 35.5% since the beginning of the year.

- HSBC Bank Malta plc headed the list of fallers, with a 5% decline, as it closed €0.04 lower at €0.76. This was the result of 34,116 shares spread across 14 transactions.

- Similarly, Bank of Valletta plc ended the week at €0.88 – equivalent to a 1.8% decline. During the week the banking equity also traded at a weekly low of €0.852. Nineteen deals involving 35,410 shares were recorded.

- On Wednesday, Simonds Farsons Cisk plc approved the Group’s unaudited interim financial statements and Directors’ Report for the six months ended July 31, 2020.

- Turnover amounted to €36.8 million, equivalent to a 31% drop when compared to €53.3 million recorded during the same period of 2019.

- The reduction in turnover was experienced across all segments with the highest drop being registered in the operation of franchised food retailing establishments.

- A 77% decline in profit before tax was recorded when compared to the €7 million generated in July 2019.

- Earnings per share decreased to €0.053 for the six-month period when compared to €0.213 the previous year.

- Given the current situation, the board does not deem that it would be appropriate to declare an interim dividend at this time.

- The extent of a final dividend distribution, if any, shall be determined on the basis of the full year results and the circumstances prevailing at that time.

- The equity closed the mid-week session up by 4.2% or €0.30 but partially reversed this gain on Thursday to close the week at €7.15 – translating into a 0.7% positive change in price.

- Six deals involving 2,058 shares were executed.

- On Wednesday, PG plc announced that the fourth Annual General Meeting shall be held on October 15, 2020. The audited financial statements for the financial year ended April 30, 2020, and the Auditors’ report shall be considered and if thought fit, approved. No trading activity was recorded during the week.

- On Thursday, Plaza Centres plc announced that the 20th Annual General Meeting shall be held on October 14, 2020.

- The annual report for the financial year ended December 31, 2019, including the financial statements for the year ended December 31, 2019 and the directors’ and auditors’ reports will be considered, and if thought fit, approved.

- Moreover, a net dividend of €0.0113 per share, which represents a net amount of €320,000 as recommended by the directors which was paid, as an interim dividend on August 4, 2020 is to be approved as a final dividend.

- The board also announced that between September 25, 2020 and October 24, 2020, the company intends to stand in the market with a view to repurchasing up to a further €2 million in the 3.9% unsecured bonds 2026, at a fixed price of €103.50 per bond.

- Depending on the level of acceptances of the said offer to purchase bonds, the company may elect to extend or repeat such offer in future.

- The equity was active only yesterday. A sole deal of 8,076 shares pushed the price 3.7% higher to €0.97 – the highest price in two months.

- Yesterday, GlobalCapital plc announced that the forthcoming Annual General Meeting shall be held on October 9, 2020. No trading activity was recorded during the week.

- The MSE MGS Total Return Index closed relatively flat at 1,130.96 points – equivalent to a 0.1% gain. Out of 21 active issues, 10 headed north while another nine lost ground. The 2.5% MGS 2036 (I) headed the list of gainers, as it closed 4.6% higher at €136.00. On the other hand, the 4.1% MGS 2034 (I) closed 3.6% lower at €142.75.

- The MSE Corporate Bonds Total Return Index lost a further 0.4%, as it reached 1,072.72 points. A total of 38 issues were active, 14 of which advanced, while another 11 closed in the red. The best performer was the 3.9% Plaza Centres plc Unsecured € 2026, as it closed 3.5% higher, following the cancellation of €250,000 bonds due to a buy-back by the issuer – Plaza Centres plc. Conversely, the 5% Hal Mann Vella Group plc Secured Bonds € 2024 ended the week 2.7% lower at €103.00.

- In the Prospects MTF market, five issues were active. The 4.875% AgriHoldings Plc Senior Secured € 2024 registered the highest liquidity, as total turnover amounted to €6,565.

| Upcoming Events | ||||

| Best Performers: | ||||

| 1. IHI | +18.36% | |||

| 01 OCT 2020 | MT: MIDI plc – Annual General Meeting | 2. PZC | +3.74% | |

| 08 OCT 2020 | MT: Simonds Farsons Cisk plc – Annual General Meeting | 3. GO | +1.25% | |

| 09 OCT 2020 | MT: Trident Estates plc – Annual General Meeting | |||

| 09 OCT 2020 | MT: GlobalCapital plc – Annual General Meeting | Worst Performers: | ||

| 14 OCT 2020 | MT: Plaza Centres plc – Annual General Meeting | 1. HSB | -5.00% | |

| 2. MPC | -2.91% | |||

| 3. RS2 | -2.65% | |||

|

|

Price (€): 25.09.2020 | Price (€): 18.09.2020 | Weekly Change (%) | 2020 Performance (%) |

| MSE Equity Total Return Index | 7,348.194 | 7,305.931 | 0.58 | -23.58 |

| BMIT Technologies plc | 0.468 | 0.468 | 0.00 | -10.00 |

|---|---|---|---|---|

| Bank of Valletta plc | 0.880 | 0.896 | -1.79 | -16.98 |

| FIMBank plc (USD) | 0.300 | 0.300 | 0.00 | -50.00 |

| GlobalCapital plc | 0.550 | 0.550 | 0.00 | 96.43 |

| Grand Harbour Marina plc | 0.700 | 0.700 | 0.00 | 27.27 |

| GO plc | 3.240 | 3.200 | 1.25 | -23.94 |

| Harvest Technology plc | 1.450 | 1.450 | 0.00 | -3.33 |

| HSBC Bank Malta plc | 0.760 | 0.800 | -5.00 | -41.54 |

| International Hotel Investments plc | 0.535 | 0.452 | 18.36 | -35.54 |

| Lombard Bank plc | 2.000 | 2.000 | 0.00 | -12.28 |

| Loqus Holdings plc | 0.065 | 0.065 | 0.00 | 0.78 |

| MIDI plc | 0.368 | 0.368 | 0.00 | -31.85 |

| Medserv plc | 0.615 | 0.615 | 0.00 | -44.09 |

| Malta International Airport plc | 4.780 | 4.780 | 0.00 | -30.72 |

| Malita Investments plc | 0.895 | 0.895 | 0.00 | -0.56 |

| Mapfre Middlesea plc | 1.900 | 1.900 | 0.00 | -12.04 |

| Malta Properties Company plc | 0.500 | 0.515 | -2.91 | -20.63 |

| Main Street Complex plc | 0.490 | 0.490 | 0.00 | -18.33 |

| MaltaPost plc | 1.000 | 1.000 | 0.00 | -23.66 |

| PG plc | 1.900 | 1.900 | 0.00 | 3.26 |

| Plaza Centres plc | 0.970 | 0.935 | 3.74 | -3.96 |

| RS2 Software plc | 2.200 | 2.260 | -2.65 | 2.80 |

| Simonds Farsons Cisk plc | 7.150 | 7.100 | 0.70 | -37.83 |

| Santumas Shareholdings plc | 1.490 | 1.490 | 0.00 | 5.67 |

| Tigné Mall plc | 0.795 | 0.795 | 0.00 | -11.67 |

| Trident Estates plc | 1.500 | 1.500 | 0.00 | -3.23 |

* Trading commenced on January 7, 2020

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]