Value or value trap?

In August I had written about the divergence in performance between the US and European equity markets over the past decade, and how the different Tech sector weighting across the indices heavily contributed to such a discrepancy in performance. Today, I will be delving into the discrepancy in performances through time between value- and growth-style investment strategies.

In August I had written about the divergence in performance between the US and European equity markets over the past decade, and how the different Tech sector weighting across the indices heavily contributed to such a discrepancy in performance. Today, I will be delving into the discrepancy in performances through time between value- and growth-style investment strategies.

Starting off with a short definition, value investing relates to the investment in securities deemed to be trading at a price below what they are truly worth based on some form of fundamental analysis. An investment style which focuses on companies with low multiples, such as low price-to-book ratios (P/Bs) or price-to-earnings multiples (P/Es). Value investing goes back to the late 1920s as first taught by famous investors Benjamin Graham and David Dodd.

On the other side of the investment-style spectrum, one finds growth stocks. Growth stocks are those considered by analysts of having the potential to outperform the broader market or a specific sub-set within the market. Such stocks tend to be trading at higher P/E and P/B multiples. Companies classified as “growth” are believed to provide better opportunities for considerable expansion in the products and/or services offerings. This could either be the result of having a product range that is expected to sell more than their competitors’ or some other form of competitive advantage from which the company is predicted to gain an edge on the rest of the market.

Theoretically, value stocks are usually considered to experience a lower level of risk, whereas growth stocks might experience a higher level of volatility and sharp price falls on the back of negative news directly impacting the company’s products/services and its prospects for the foreseeable future. However, this might not necessarily always be the case in practice.

But is it better to opt for growth or value stocks?

There is no one correct answer, and one must remain objective prior to leaning towards one particular investment style over the other. From a historical point of view, empirical studies show that value outperforms growth on average. Nevertheless, this has varied across different time horizons, and one must also evaluate performance not just on an absolute return basis (i.e. performance alone), but on a risk-adjusted basis – taking into account the amount of volatility experienced.

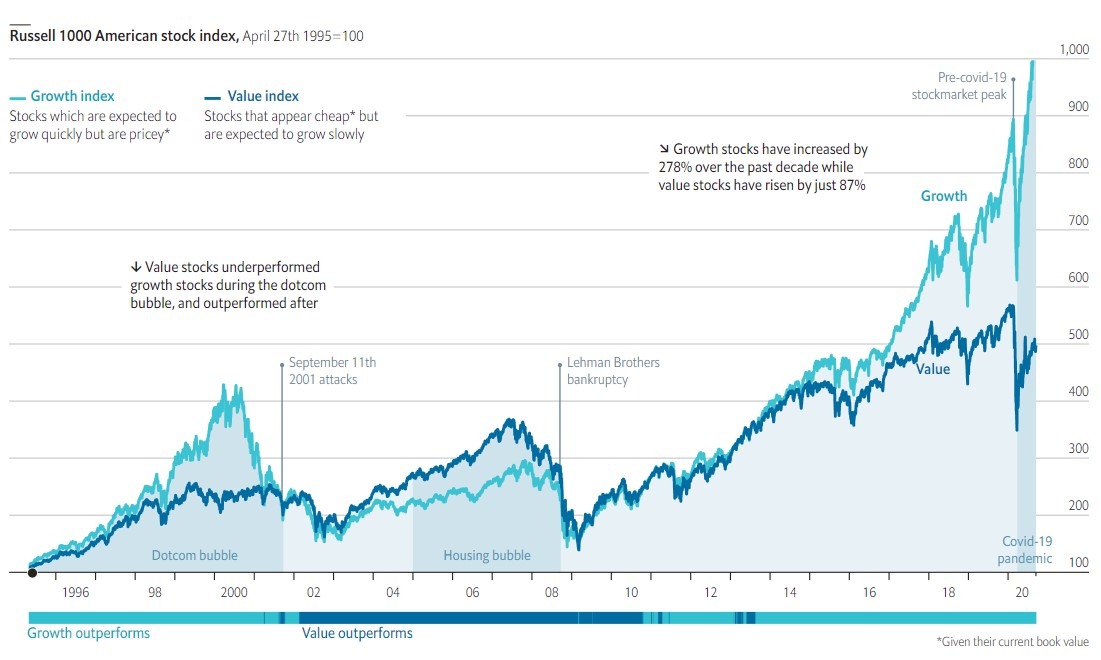

For instance, the past decade has been by far a much better one for growth enthusiasts than value seekers. As depicted in the chart below, based on data extracted from the Russell 1000 American stock index, value stocks increased by 87% over the past decade, whereas growth stocks are ahead by 191 percentage points, having appreciated by 278%. In fact, it has been relatively rough for high-profile proponents of value investing like Warren Buffett, whose stock portfolio, as shown through shares in Berkshire Hathaway, appreciated by circa 160% over the past ten years.

Source: The Economist

A study carried out by Stephen Penman and Francesco Reggiani (Dec 2018) take an interesting approach to explaining value and growth investing. Despite highlighting the outperformance of value stocks to growth stocks over the longer-term, they also explain the risks that can be derived from value investing – the so called “value trap”.

A company’s financial statements are showing history; what the company has generated over a particular period, and its statement of assets and liabilities at a particular point in time. When one is placing an investment in any one company, he/she is not (supposedly) buying just because of the company’s historical results, but rather, buying its future earnings. One can relate this to how markets have recovered substantially since last March – not because of an improving COVID-19 situation, but mostly on expectations that somehow, aided by fiscal and monetary measures, economies will eventually recover and pass-through this rough period.

Price multiples imply expectations of earnings growth. The earnings yield (E/P) or the P/E ratio try and predict/imply what kind of growth one ought to expect from a company’s future earnings. However, one should not overlook the fact that growth can indeed be risky, so the price (P) in the E/P multiple is discounting for that risk. To put it more simply, a high earnings yield multiple (low P/E), might not necessarily imply “value” (low-risk investing), but it could easily be a “value trap” in which one is buying a company with high growth expectations, in which said growth is very risky – for which the market is already discounting the company’s quoted share price.

Along side the E/P multiple, taking close consideration to the B/P multiple (or P/B ratio) is likewise important. A low B/P (high P/B) multiple, despite usually considered to signal growth, may not necessarily mean higher expected earnings growth. My two cents opinion is to therefore not just base an investment decision on screening low P/E and P/B multiples. Although instances of alpha can be found, “free lunch” is hard to find, and for every decision taken, there is always an opportunity cost linked to it.

Colin Vella, CFA is the Head of Wealth Management at Jesmond Mizzi Financial Advisors Limited. This article does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. Investors should remember that past performance is no guide to future performance and that the value of investments may go down as well as up. For further information contact Jesmond Mizzi Financial Advisors Limited of 67, Level 3, South Street, Valletta, on Tel: 2122 4410, or email [email protected]