MSE Trading Report for Week ending 23 October 2020

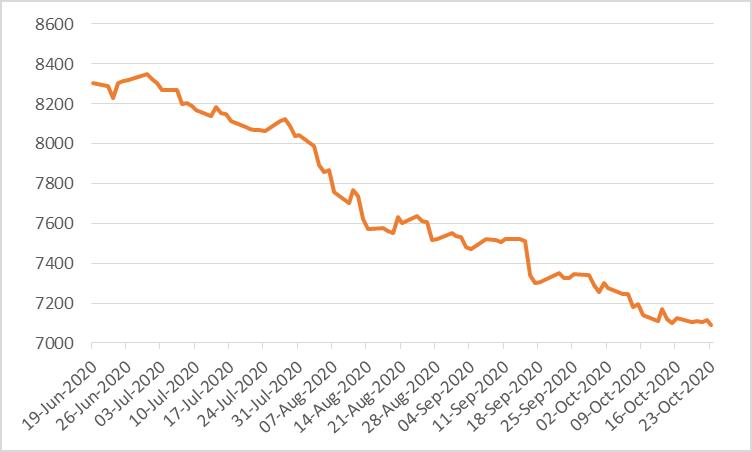

| MSE Equity Total Return Index: |

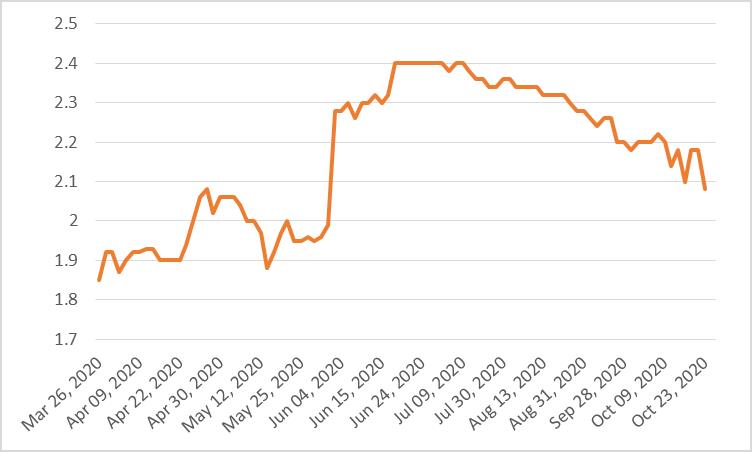

| Chart of the Week: RS2 Software plc |

| Highlights: |

- The MSE Equity Total Return Index lost a further 0.5%, as it reached 7,091.287 points. A total weekly turnover of €0.7 million was generated as 121 transactions were executed. Out of 19 active equities, eight closed higher while another seven ended the week in the red. Despite the noticeable increase in equities which finished the week higher, the local equities’ index failed to increase, as Bank of Valletta plc (BOV) and RS2 Software plc (RS2) closed lower.

- In the banking sector, BOV shares traded 23 times over a spread of 71,889 shares, dragging the price by 1.2% into the red, to €0.85.

- On Tuesday, the bank announced that having further considered the overall situation and the European Central Bank’s (ECB) subsequent recommendation, it has decided to withdraw its original recommendation to the Annual General Meeting to approve the payment of a final dividend in respect of financial year 2019, and to re-assess the situation during the first quarter of financial year 2021, as recommended by the ECB.

- Throughout the week, BOV shares traded at a weekly high of €0.86 and a low of €0.84.

- Meanwhile, RS2 lost 4.6% as 7,070 shares were spread across five transactions. This translates into a €0.10 decline in price, as it reached the €2.08 price level, after trading at a weekly high of €2.18.

- Retail conglomerate, PG plc’s total weekly turnover climbed exponentially to €200,000 this week, versus €4,500 recorded during the previous week. The equity traded at a weekly low of €1.85, but managed to recover, as it closed unchanged at €1.88. Eight deals involving 107,330 were executed.

- On Thursday, Malta International Airport plc announced that the Annual General Meeting shall be held remotely on November 11, 2020 in light of the current pandemic.

- MIA provided further clarification about the resolution proposing that the interim dividend declared, and paid earlier in 2019, be approved as a final dividend.

- As previously announced, the directors resolved to withdraw their recommendation for the payment of further dividends to shareholders. This was done in order to manage cash reserves in a moment of severe curtailment of revenue generation and to maintain the company’s organisational set-up and structures.

- Such strategy is aimed at preserving the company’s liquidity, which will help for a quick recovery when the situation normalises.

- This is one measure MIA has taken in an effort to preserve its liquidity and emerge from the crisis in a stable position, with the other measures being salary reductions affecting all its employees and ranging from 20% to 30% and the immediate suspension of all non-essential projects.

- MIA shares were the second most liquid, as total weekly turnover stood at €144,000. Yesterday, the equity was trading in the red, as it reached €4.50 but managed to recover, as it recorded a positive 2.6% weekly change.

- This was the result of 30,946 shares spread across 27 transactions, pushing the price to €4.72.

- The best performance was recorded in the banking industry, as Lombard Bank plc closed 10.2% higher. The banking equity traded twice over 2,200 shares, ending the week €0.18 higher at €1.94.

- On Thursday, Santumas Shareholdings plc held its 57th Annual General Meeting. The annual report and financial statements for the year ended April 30, 2020 comprising the financial statements and the directors’ and auditors’ report thereon were approved. No trading activity was recorded during the week.

- Yesterday, Medserv plc announced that OMV, a multinational integrated oil and gas company headquartered in Vienna has, through its subsidiary OMV of Libya Limited, awarded Medserv a contract to provide international freight forwarding services.

- Medserv will provide services for the transportation of goods and drilling related equipment from global sites to specified locations in Libya using the Medserv facilities at the Malta Freeport as a logistics hub in the supply chain. The Framework Agreement shall enter into force on October 30, 2020 for a term of three years, with the option for OMV to extend the term by a further two years.

- The equity saw 11,000 shares change hands across two transactions, leaving no impact on the previous closing price of €0.50.

- The MSE MGS Total Return Index did not manage to maintain its positive streak as it lost 1%, reaching 1,131.834 points. Out of 20 active issues, three headed north while another 17 closed in the opposite direction. The 2.3% MGS 2029 (II) was the best performer, as it closed 1.6% higher at €127.00. On the other hand, the 2.5% MGS 2036 (I) ended the week 5.8% lower at €130.00.

- The MSE Corporate Bonds Total Return Index gained another 0.3%, as it closed at 1,084.044 points. A total of 47 issues were active, 18 of which advanced while another 12 traded lower. The top performer was the 3.85% Hili Finance plc Unsecured Bonds 2028, as it registered a 1.9% increase, ending the week at €99.90. Conversely, the 3.75% Premier Capital plc Unsecured € 2026 lost 1.2%, as it reached the €100.25 price level.

- In the Prospects MTF market, three issues were active. The 5% Luxury Living Finance plc € Secured Bonds 2028 was the most liquid, as a total weekly turnover of €39,988 was generated. The bond was also the only positive performer, as it closed marginally higher at €99.98.

| Upcoming Events | ||||

| Best Performers: | ||||

| 1. LOM | +10.23% | |||

| 27 OCT 2020 | MT: Mapfre Middlesea plc – Annual General Meeting | 2. MTP | +6.25% | |

| 11 NOV 2020 | MT: Malta International Airport plc – Annual General Meeting | 3. MIA | +2.61% | |

| 26 NOV 2020 | MT: Bank of Valletta plc – Annual General Meeting | |||

| 27 NOV 2020 | MT: HSBC Bank Malta plc – Annual General Meeting | Worst Performers: | ||

| 30 NOV 2020 | MT: FIMBank plc – Annual General Meeting | 1. MDI | -9.84% | |

| 2. RS2 | -4.59% | |||

| 3. MMS | -4.00% | |||

|

|

Price (€): 23.10.2020 | Price (€): 16.10.2020 | Weekly Change (%) | 2020 Performance (%) |

| MSE Equity Total Return Index | 7,091.287 | 7,126.746 | -0.50 | -26.25 |

| BMIT Technologies plc | 0.488 | 0.478 | 2.09 | -6.15 |

|---|---|---|---|---|

| Bank of Valletta plc | 0.850 | 0.860 | -1.16 | -19.81 |

| FIMBank plc (USD) | 0.300 | 0.300 | 0.00 | -50.00 |

| GlobalCapital plc | 0.540 | 0.530 | 1.89 | 92.86 |

| Grand Harbour Marina plc | 0.700 | 0.700 | 0.00 | 27.27 |

| GO plc | 3.000 | 3.000 | 0.00 | -29.58 |

| Harvest Technology plc | 1.470 | 1.470 | 0.00 | -2.00 |

| HSBC Bank Malta plc | 0.715 | 0.705 | 1.42 | -45.00 |

| International Hotel Investments plc | 0.500 | 0.490 | 2.04 | -39.76 |

| Lombard Bank plc | 1.940 | 1.760 | 10.23 | -14.91 |

| Loqus Holdings plc | 0.065 | 0.065 | 0.00 | 0.78 |

| MIDI plc | 0.330 | 0.366 | -9.84 | -38.89 |

| Medserv plc | 0.500 | 0.500 | 0.00 | -54.55 |

| Malta International Airport plc | 4.720 | 4.600 | 2.61 | -31.59 |

| Malita Investments plc | 0.870 | 0.890 | -2.25 | -3.33 |

| Mapfre Middlesea plc | 1.920 | 2.000 | -4.00 | -11.11 |

| Malta Properties Company plc | 0.490 | 0.510 | -3.92 | -22.22 |

| Main Street Complex plc | 0.450 | 0.450 | 0.00 | -25.00 |

| MaltaPost plc | 1.020 | 0.960 | 6.25 | -22.14 |

| PG plc | 1.880 | 1.880 | 0.00 | 2.17 |

| Plaza Centres plc | 1.000 | 1.000 | 0.00 | -0.99 |

| RS2 Software plc | 2.080 | 2.180 | -4.59 | -2.80 |

| Simonds Farsons Cisk plc | 6.950 | 7.200 | -3.47 | -39.57 |

| Santumas Shareholdings plc | 1.490 | 1.490 | 0.00 | 5.67 |

| Tigné Mall plc | 0.795 | 0.795 | 0.00 | -11.67 |

| Trident Estates plc | 1.520 | 1.500 | 1.33 | -1.94 |

* Trading commenced on January 7, 2020

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]