MSE Trading Report for Week ending 30 October 2020

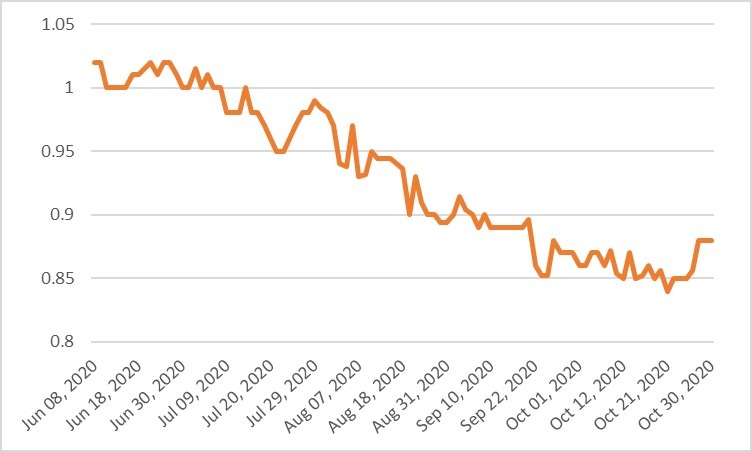

| MSE Equity Total Return Index: |

| Chart of the Week: Bank of Valletta plc |

| Highlights: |

- The MSE Equity Total Return Index gained 0.2%, finishing the month of October at 7,107.928 points. Over €0.7m were traded across 119. Transactions. Bank of Valletta plc (BOV) was the top performing equity among the large caps, while HSBC Bank Malta plc (HSBC) and GO plc headed south. On the week, seven equities gained while another five closed lower. A total of 14 equities were active.

- Yesterday also marked the final trading session for the month of October. On the month the local equity market declined by 2%, as a number of large cap equities dragged the broader index further in the red.

- In the banking industry BOV shares jumped by 3.5%, to end the week at €0.88, after trading at a weekly low of €0.85. Trading volume increased to 324,012 shares, up from nearly 72,000 shares last week. As a result, 25 deals worth just under €0.3m were executed. Over the month the banking equity gained 1.2%.

- Its peer, HSBC declined by 0.7%, to close the month at €0.71. The equity was the second most liquid, as 34 transactions worth €185,300 were recorded. The share price of the banking equity traded between a weekly high of €0.72 and a low of €0.70.

- On the month, HSBC shares lost 6.6% and are down by 45% since the beginning of the year.

- On Thursday the bank announced that its network will be making enhancements to its service offering and said that the pandemic accelerated the use of digital banking service, which led to further improvements in this area.

- The bank also ensured that its customers will still have access to its branch network, contact center and digital and remote banking channels.

- The bank announced that its branches in Mellieha, San Gwann, Zabbar and Zebbug will not be re-opening and confirms that its Gzira and Rabat branches, will reopen when the Covid-19 conditions permit. These two branches together with Swieqi and Zurrieq branches will operate as tellerless, however bank advisors will remain available. The bank announced also that it will be reviewing its branch opening hours which will commence with the new Qormi flagship branch that will be inaugurated early next year.

- Malta International Airport plc closed unchanged at €4.72 despite trading at a high of €4.78. However, demand for the equity was relatively shallow, as only four deals worth €7,500 were executed. On the month the equity closed unchanged.

- In the IT sector, RS2 Software plc shares lost nearly 4% to return to the €2 price level. The share price touched a weekly high of €2.10 after starting the week at €2.06. However, it failed to close higher despite a surge in trading value. Thirteen deals worth €0.1m were recorded. Throughout the month of October RS2 shares declined by 9%.

- Mapfre Middlesea plc gained 2.6% or €0.05 to end the week at €1.97, after trading at a weekly high of €1.99. Four deals worth €10,000 were executed. On Tuesday, the company’s Annual General Meeting was held where all resolutions and financial statements for the year ending December 31, 2019 have been approved.

- One deal of 5,000 Plaza Centres plc shares sent the equity lower by 4%.

- Last Wednesday Plaza Centres plc issued a company announcement to its shareholders to advise them that the company issued a tender to buy back 1 million ordinary shares at the price range of €0.90 to €1. The company will be receiving offers between November 2 and November 4, 2020.

- The MSE MGS Total Return Index closed marginally lower at 1,131.61 points. A total of 14 issues were active, as turnover reached €1.6m across 48 transactions. The 2.3% MGS 2029 was the most liquid issue, as turnover reached nearly €0.3m.

- The MSE Corporate Bonds Total Return Index lost another 0.3%, as it closed at 1,080.97 points. A total of 53 issues were active, as 216 deals worth €3.5m were executed. The 3.65% GAP Group plc Secured 2022 was the most liquid as nine deals of €1.7m were recorded.

| Upcoming Events | ||||

| Best Performers: | ||||

| 1. MTP | +15.69% | |||

| 11 NOV 2020 | MT: Malta International Airport plc – Annual General Meeting | 2. MPC | +6.12% | |

| 26 NOV 2020 | MT: Bank of Valletta plc – Annual General Meeting | 3. BOV | +3.53% | |

| 27 NOV 2020 | MT: HSBC Bank Malta plc – Annual General Meeting | |||

| 30 NOV 2020 | MT: FIMBank plc – Annual General Meeting | Worst Performers: | ||

| 02 DEC 2020 | MT: Lombard Bank Malta plc – Annual General Meeting | 1. PZC | -4.00% | |

| 2. RS2 | -3.85% | |||

| 3. GO | -3.33% | |||

|

|

Price (€): 30.10.2020 | Price (€): 23.10.2020 | Weekly Change (%) | 2020 Performance (%) |

| MSE Equity Total Return Index | 7,107.928 | 7,091.287 | 0.24 | -26.08 |

| BMIT Technologies plc | 0.488 | 0.488 | 0.00 | -6.15 |

|---|---|---|---|---|

| Bank of Valletta plc | 0.880 | 0.850 | 3.33 | -16.98 |

| FIMBank plc (USD) | 0.300 | 0.300 | 0.00 | -50.00 |

| GlobalCapital plc | 0.540 | 0.540 | 0.00 | 92.86 |

| Grand Harbour Marina plc | 0.700 | 0.700 | 0.00 | 27.27 |

| GO plc | 2.900 | 3.000 | -3.33 | -31.92 |

| Harvest Technology plc | 1.450 | 1.470 | -1.36 | -3.33 |

| HSBC Bank Malta plc | 0.710 | 0.715 | -0.70 | -45.38 |

| International Hotel Investments plc | 0.500 | 0.500 | 0.00 | -39.76 |

| Lombard Bank plc | 1.940 | 1.940 | 0.00 | -14.91 |

| Loqus Holdings plc | 0.065 | 0.065 | 0.00 | 0.78 |

| MIDI plc | 0.340 | 0.330 | 3.03 | -37.04 |

| Medserv plc | 0.500 | 0.500 | 0.00 | -54.55 |

| Malta International Airport plc | 4.720 | 4.720 | 0.00 | -31.59 |

| Malita Investments plc | 0.870 | 0.870 | 0.00 | -3.33 |

| Mapfre Middlesea plc | 1.970 | 1.920 | 2.60 | -8.80 |

| Malta Properties Company plc | 0.520 | 0.490 | 6.12 | -17.46 |

| Main Street Complex plc | 0.450 | 0.450 | 0.00 | -25.00 |

| MaltaPost plc | 1.180 | 1.020 | 15.69 | -9.92 |

| PG plc | 1.910 | 1.880 | 1.60 | 3.80 |

| Plaza Centres plc | 0.960 | 1.000 | -4.00 | -4.95 |

| RS2 Software plc | 2.000 | 2.080 | -3.85 | -6.54 |

| Simonds Farsons Cisk plc | 6.950 | 6.950 | 0.00 | -39.57 |

| Santumas Shareholdings plc | 1.490 | 1.490 | 0.00 | 5.67 |

| Tigné Mall plc | 0.795 | 0.795 | 0.00 | -11.67 |

| Trident Estates plc | 1.510 | 1.500 | 0.67 | -2.58 |

* Trading commenced on January 7, 2020

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]