MSE Trading Report for Week ending 27 November 2020

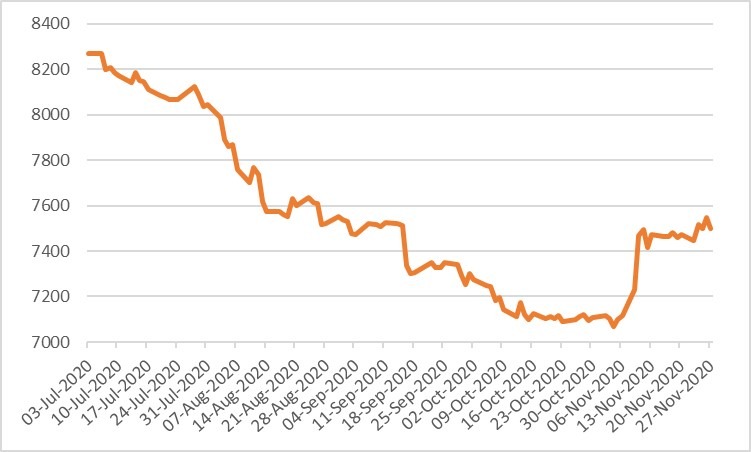

| MSE Equity Total Return Index: |

| Chart of the Week: MIDI plc |

| Highlights: |

- The MSE Equity Total Return Index closed higher yet again, this time at 7,500.602 points – a 0.4% gain. A total of 15 equities were active, of which eight headed higher and three closed in negative territory. The total weekly turnover surpassed the €0.9 million mark and was generated over 166 deals.

- The equity heading the list of fallers was Simonds Farsons Cisk plc (SFC), as two transactions worth less than a combined total of €2,900, dragged the price 11.6% down, to close at €7.25.

- The best performer was MIDI plc with an 11.8% increase over last week’s closing price. The price at the end of yesterday’s session read €0.36. The equity traded on five occasions, for a total turnover of €26,764.

- In the banking industry, HSBC Bank Malta plc (HSBC) closed in positive territory once again following a 2.6% increase in price, to close at €0.80. This result was achieved as 93,294 shares changed ownership over 16 transactions. Yesterday, the bank held its Annual General Meeting, where all resolutions put forward for approval were approved.

- Its peer, Bank of Valletta plc closed 1.1% in the red at €0.93. The equity featured in 25 deals worth a total of €125,255. On Thursday, Bank of Valletta plc held its 46th Annual General Meeting. The profit and loss account and balance sheet for the financial year ending December 31, 2019, and the directors’ and auditors’ reports thereon were approved.

- Medserv plc shares gained 7.3% as the equity closed the week at €0.515. Six deals worth nearly €5,000 were executed.

- On Friday, the company announced its interim results for the nine-month period ended September 2020.

- For the third quarter of the year, revenue and earnings before interest, tax, depreciation and amortisation (EBITDA) were significantly lower than that reported for the same period last year.

- The COVID-19 pandemic suspended most of the offshore drilling activity in the second quarter of 2020, mainly due to the inability of providing a safe working environment, consequent to travel bans and closure of ports imposed by Governments.

- EBITDA registered for the reporting period is in line with budget and adequately covers the Company’s finance costs. The Company expects the results for the year to be in line with the published forecasts.

- The company added that all operating companies, other than the UAE business unit, are registering positive EBITDA in 2020.

- The securing of the new business in Abu Dhabi announced on October, 14 2020 will allow the operation in the UAE to generate positive EBITDA by the second quarter of next year.

- In addition, the Company has significant growth potential in all its operating markets.

- mega development project for the installation of production platforms offshore Libya is on track to commence late next year. This project is expected to be completed over the coming years.

- Drilling in Cyprus is to resume in the second half of the year and to continue through to 2022.

- The order book in the Middle East is also forecasted to strengthen in the second quarter of 2021 to reach pre-COVID-19 levels.

- The large finds in Guyana, Trinidad and Tobago, as well as the recent discoveries and future planned activity in Suriname makes this region an exciting growth area for the oil and gas industry.

- The Company has signed a Memorandum of Understanding (MOU) with Kuldipsingh Port Facility N.V which will allow the Company to effectively participate in the upcoming business in this region. Kuldipsingh is the private port operator from which Medserv carried out the logistical support for the Staatsolie Nearshore Drilling project in Suriname last year.

- Medserv plc continued to secure work in the second half of the year and has participated in new tenders in Egypt and two new African markets which are at an advanced stage of being adjudicated.

- Malta International Airport plc was the most liquid over the week, as 40 deals worth a total of €204,749 saw 36,882 shares change hands. The equity rose by 4.6%, to close at €5.75.

- Yesterday, PG plc announced that the directors approved to distribute a net interim dividend of €2,000,000 equivalent to €0.0185 net per ordinary share. This dividend will be paid on Thursday December 10, 2020 to the ordinary shareholders who are on the Company’s Register of Members as at the close of business on Thursday December 3, 2020. Despite being active, the equity closed unchanged at €1.89.

- The MSE MGS Total Return Index was back in the red following last week’s increment. The index closed at 1,134.77 points which translates into a 0.4% decline. Out of 18 active issues, five registered gains, while 11 declined. The 3% MGS 2040 (I) issue was the top performer, as it closed 3.57% higher at €145. On the contrary, the 5.25% MGS 2030 (I) issue headed the list of fallers with a 2.21% decline, to close at €146.62.

- The MSE Corporate Bonds Total Return Index closed 0.9% higher at 1,089.79 points. A total of 51 issues were active, 27 of which gained, while another 12 declined. The 4% Shoreline Mall plc Secured Bonds 2026 headed the list of gainers, registering a 5.1% appreciation, to close at €105.10. On the other hand, the 3.5% Simonds Farsons Cisk plc Unsecured 2027 fell by 4.75%, to close the week at €100.20.

- In the Prospects MTF market, five issues were active, with the most active being the 5% Smartcare Finance plc Secured € 2029 issue, yet again. This week it has generated a total turnover of €50,000.

| Upcoming Events | ||||

| Best Performers: | ||||

| 1. MDI | +11.80% | |||

| 30 NOV 2020 | MT: FIMBank plc – Annual General Meeting | 2. MDS | +7.29% | |

| 02 DEC 2020 | MT: Lombard Bank Malta plc – Annual General Meeting | 3. MPC | +5.10% | |

| 15 DEC 2020 | MT: RS2 Software plc – Extraordinary General Meeting | |||

| 21 DEC 2020 | MT: MaltaPost plc – Annual Results | Worst Performers: | ||

| 14 JAN 2021 | MT: Loqus Holdings plc – Annual General Meeting | 1. SFC | -11.59% | |

| 2. MMS | -1.55% | |||

| 3. BOV | -1.06% | |||

|

|

Price (€): 27.11.2020 | Price (€): 20.11.2020 | Weekly Change (%) | 2020 Performance (%) |

| MSE Equity Total Return Index | 7,500.602 | 7,472.036 | 0.38 | -22.00 |

| BMIT Technologies plc | 0.476 | 0.470 | 1.28 | -8.46 |

|---|---|---|---|---|

| Bank of Valletta plc | 0.930 | 0.940 | -1.06 | -12.26 |

| FIMBank plc (USD) | 0.300 | 0.300 | 0.00 | -50.00 |

| Grand Harbour Marina plc | 0.700 | 0.700 | 0.00 | 27.27 |

| GO plc | 3.000 | 2.920 | 2.74 | -29.58 |

| Harvest Technology plc | 1.460 | 1.460 | 0.00 | -2.67 |

| HSBC Bank Malta plc | 0.800 | 0.780 | 2.56 | -38.46 |

| International Hotel Investments plc | 0.570 | 0.570 | 0.00 | -31.33 |

| Lombard Bank plc | 1.920 | 1.880 | 2.13 | -15.79 |

| Loqus Holdings plc | 0.065 | 0.065 | 0.00 | 0.78 |

| LifeStar Holding plc | 0.500 | 0.500 | 0.00 | 78.57 |

| MIDI plc | 0.360 | 0.322 | 11.80 | -33.33 |

| Medserv plc | 0.515 | 0.480 | 7.29 | -53.18 |

| Malta International Airport plc | 5.750 | 5.500 | 4.55 | -16.67 |

| Malita Investments plc | 0.900 | 0.900 | 0.00 | 0.00 |

| Mapfre Middlesea plc | 1.910 | 1.940 | -1.55 | -11.58 |

| Malta Properties Company plc | 0.515 | 0.490 | 5.10 | -18.25 |

| Main Street Complex plc | 0.450 | 0.450 | 0.00 | -25.00 |

| MaltaPost plc | 1.050 | 1.050 | 0.00 | -19.85 |

| PG plc | 1.890 | 1.890 | 0.00 | 2.72 |

| Plaza Centres plc | 0.925 | 0.925 | 0.00 | -8.42 |

| RS2 Software plc | 2.000 | 2.000 | 0.00 | -6.54 |

| Simonds Farsons Cisk plc | 7.250 | 8.200 | -11.59 | -36.96 |

| Santumas Shareholdings plc | 1.490 | 1.490 | 0.00 | 5.67 |

| Tigné Mall plc | 0.750 | 0.750 | 0.00 | -16.67 |

| Trident Estates plc | 1.510 | 1.510 | 0.00 | -2.58 |

* Trading commenced on January 7, 2020

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]