MSE Trading Report for Week ending 29 January 2021

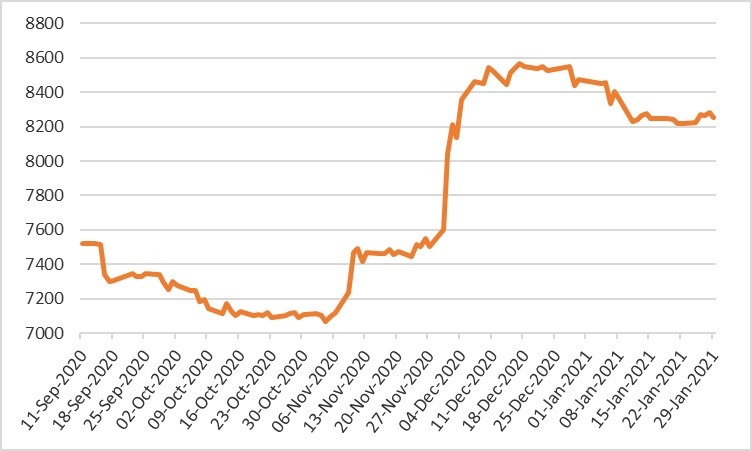

| MSE Equity Total Return Index: |

| Chart of the Week: International Hotel Investments plc |

| Highlights: |

- The MSE Equity Total Return Index ended the week 0.5% higher at 8,255.308 points. Out of 15 active issues, five headed north while another four closed in the opposite direction. A total weekly turnover of €0.5 million was generated across 97 transactions.

- This week was the last trading week for the month of January, during which the local equities index declined by 2.6%. Various equities from different sectors declined, however both LifeStar Holding plc and Malta Properties Company plc (MPC) gained 10%.

- The most liquid equity was Bank of Valletta plc, generating a total weekly turnover of €166,406.

- The equity started off the week on a positive note, as it traded 0.2% higher, but failed to sustain the gain by end of week, closing at the €0.94 price mark – equivalent to a 0.8% decline over the previous week.

- This was the result of 176,680 shares spread over 22 deals.

- During the month of January the banking equity declined by 1%.

- The bank announced that the relative USD correspondence relationship is being extended by two months to May 31, 2021. Meanwhile, the bank is making progress to source alternative arrangements for its USD correspondent transactions.

- Five deals involving 30,068 HSBC Bank Malta plc shares dragged the price by 1.2% into the red. The bank reached a low of €0.815 on Monday but ended the week at €0.83.

- During the month HSBC shares shed 7.8%.

- This week the bank announced that the board shall meet on February 23, 2021, to consider and approve the group’s and the bank’s final audited accounts for the financial year ended December 31, 2020.

- The declaration, or otherwise, of a final dividend shall also be considered, to be recommended to the bank’s Annual General Meeting, subject to regulatory guidelines and approvals.

- Meanwhile, RS2 Software plc provided the market with an update on the group’s 2020 performance and expectations for the next financial year. Despite the current economic challenges Covid-19 brought with it, 2020 has been a year where significant revenue contracts have been entered into and during which a number of strategic clients across regions in Asia-Pacific (APAC), North America, Europe and Latin America (LATAM) have transitioned from implementation phase to live processing.

- While the current COVID-19 environment in the short-term has been negatively impacting the payments market, the company expects that, in line with the forecasts being published by leading research institutes, the pandemic should accelerate the digital transformation into card payments. Payment systems have proved to be resilient and reliable, as they have been in earlier crises. Notwithstanding the fact that the importance of non-cash payments is growing rapidly, any projections on industry performance rest on assumptions surrounding overall economic activity. The COVID-19 pandemic can indeed be an accelerator for card payments globally with the right triggers in place from governments, retailers and consumers.

- RS2 reported an increase in the volume of transactions processed on its platform during 2020 when compared to those processed in 2019. This increase is expected to progress with a gradual increase from RS2’s current clients as well as the on-boarding of new clients.

- The Board reasonably expects the group to experience growth in its consolidated results for 2021, notwithstanding the current economic challenges resulting primarily from the pandemic. By the end of 2021, RS2 aims to have achieved important developmental milestones in key business areas pursued by the group.

- The equity traded six times over a spread of 12,030 shares, pushing the price €0.04 higher to €2.04 – equivalent to a 2% advancement on the week and year-to-date.

- In the hospitality sector, three deals involving 2,500 International Hotel Investments plc shares dragged the price by 3.5% into the red. The equity ended the week at a two-month-low of €0.695.

- Malta International Airport plc finished the week flat at €6.10 after trading at a weekly low of €6.05 and a high of €6.15. A total of 7,790 shares were spread across 12 transactions, worth €47,885.

- On Thursday, Medserv plc announced that following an international tender by BP Exploration (Delta) Limited, Medserv Egypt Oil & Gas Services JSC has been awarded a contract to provide materials and warehouse management services for BP’s drilling and gas production projects in Egypt.

- It is expected that this contract will be serviced through Medserv’s internal resources and will not require any major capital expenditure and is expected to contribute towards an improved financial performance of Medserv Egypt Oil & Gas Services JSC.

- This award is another major step to broaden Medserv’s oil and gas client portfolio within this region and together with already contracted business, further underpins the Company’s business pipeline.

- A sole deal of 2,000 shares resulted into a negative price movement of 1.3%, ending the week at €0.735.

- The MSE MGS Total Return Index declined by 0.37%, as it closed at 1,145.02 points. A total of 18 issues were active, four of which registered gains while another 10 lost ground. The 3% MGS 2040 (I) issue headed the list of gainers as it closed 0.7% higher at €143.50. On the other hand, the 2.3% MGS 2029 (II) closed 3.2% lower at €121.00.

- The MSE Corporate Bonds Total Return Index advanced by 0.1%, as it reached 1,101.20 points. Out of 45 active issues, 18 traded higher while another 14 closed in negative territory. The 3.5% Bank of Valletta plc € Notes 2030 S2 T1 registered the best performance, as it closed 3% higher at €101.99. Conversely, the 4.35% Hudson Malta Plc Unsecured € Bonds 2026 lost 2%, ending the week at €100.01.

- In the Prospects MTF market, five issues were active. The 5% Luxury Living Finance plc € Secured Bonds 2028 was the most active, as it generated a total turnover of €19,978. The bond closed 0.3% higher, as it reached its par value.

| Upcoming Events | ||||

| Best Performers: | ||||

| 1. MMS | +12.38% | |||

| 2. MPC | +7.84% | |||

| 12 FEB 2021 | MT: MaltaPost plc – Annual General Meeting | 3. SFC | +3.31% | |

| 23 FEB 2021 | MT: HSBC Bank Malta plc – Annual Results | |||

| 24 FEB 2021 | MT: Malta International Airport plc – Annual Results | Worst Performers: | ||

| 1. IHI | -3.47% | |||

| 2. MDS | -1.34% | |||

| 3. HSBC | -1.19% | |||

|

|

Price (€): 29.01.2021 | Price (€): 22.01.2021 | Weekly Change (%) | 2021 Performance (%) |

| MSE Equity Total Return Index | 8,255.308 | 8,216.186 | 0.48 | -2.55 |

| BMIT Technologies plc | 0.480 | 0.480 | 0.00 | -0.42 |

|---|---|---|---|---|

| Bank of Valletta plc | 0.940 | 0.948 | -0.84 | -1.05 |

| FIMBank plc (USD) | 0.500 | 0.500 | 0.00 | 0.00 |

| Grand Harbour Marina plc | 0.650 | 0.650 | 0.00 | -7.14 |

| GO plc | 3.460 | 3.460 | 0.00 | -2.26 |

| Harvest Technology plc | 1.490 | 1.480 | 0.68 | 0.68 |

| HSBC Bank Malta plc | 0.830 | 0.840 | -1.19 | -7.78 |

| International Hotel Investments plc | 0.695 | 0.720 | -3.47 | -3.47 |

| Lombard Bank plc | 1.980 | 1.980 | 0.00 | -16.10 |

| Loqus Holdings plc | 0.099 | 0.099 | 0.00 | 0.00 |

| LifeStar Holding plc | 0.550 | 0.550 | 0.00 | 10.00 |

| MIDI plc | 0.388 | 0.388 | 0.00 | -13.39 |

| Medserv plc | 0.735 | 0.745 | -1.34 | -6.96 |

| Malta International Airport plc | 6.100 | 6.100 | 0.00 | -1.61 |

| Malita Investments plc | 0.900 | 0.900 | 0.00 | 0.00 |

| Mapfre Middlesea plc | 2.360 | 2.100 | 12.38 | -4.07 |

| Malta Properties Company plc | 0.550 | 0.510 | 7.84 | 10.00 |

| Main Street Complex plc | 0.498 | 0.498 | 0.00 | -0.40 |

| MaltaPost plc | 1.160 | 1.160 | 0.00 | -12.78 |

| PG plc | 2.060 | 2.060 | 0.00 | 3.00 |

| Plaza Centres plc | 0.940 | 0.940 | 0.00 | -4.08 |

| RS2 Software plc | 2.040 | 2.000 | 2.00 | 2.00 |

| Simonds Farsons Cisk plc | 7.800 | 7.550 | 3.31 | 0.00 |

| Santumas Shareholdings plc | 1.390 | 1.390 | 0.00 | 0.00 |

| Tigné Mall plc | 0.820 | 0.820 | 0.00 | -3.53 |

| Trident Estates plc | 1.480 | 1.480 | 0.00 | -10.84 |

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]