MSE Trading Report for Week ending 19 February 2021

| MSE Equity Total Return Index: |

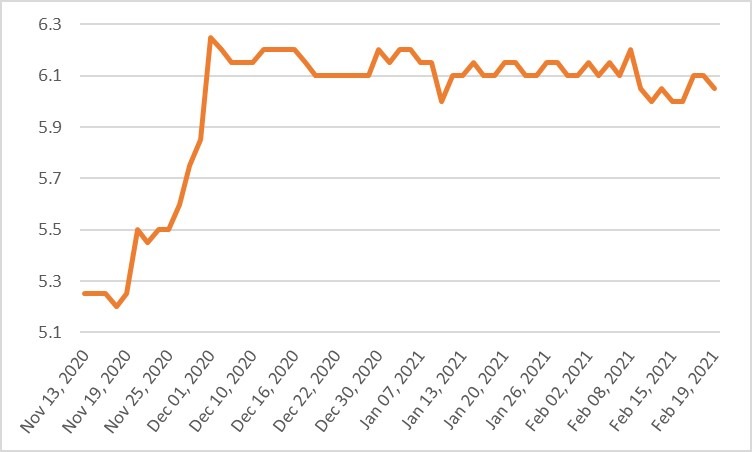

| Chart of the Week: Malta International Airport plc |

| Highlights: |

- The MSE Equity Total Return Index returned to negative territory, as it closed 2.5% lower, reaching 7,975.798 points – the lowest since November 2020. A total of 21 equities were active, five of which headed north while another 11 closed in the opposite direction. Total weekly turnover increased by €0.16 million, as it amounted to €1.1 million, generated across 171 transactions.

- The highest liquidity was recorded in the property sector, as turnover in Malita plc increased by more than ten times, amounting to €314,517. This was the result of five deals involving 349,463 shares, leaving no impact on the equity’s previous closing price of €0.90.

- Malta International Airport plc started off the week on a negative note, as the equity’s share price declined to €6.00. By end of week the equity gained ground and managed to close flat at €6.05 after touching a weekly high of €6.10. This was the result of 17 deals involving 34,745 shares.

- In the banking sector, three equities were active, all of which closed in the red. Bank of Valletta plc reached a weekly high of €0.95 but did not manage to sustain the gain, as it closed 1.5% lower at €0.916. A total of 118,055 shares changed hands over 35 deals.

- Its peer, HSBC Bank Malta plc traded 3.7% lower, as 66,654 shares were spread across 12 transactions. The equity ended the week at the €0.915 price level – which translates into a positive 1.7% year-to-date change.

- Lombard Bank Malta plc headed the list of fallers, as two deals involving 699 shares dragged the price by 11.5% to €2.00.

- Last Monday, RS2 Software plc (RS2) announced that the application for authorisation for admissibility to listing to the Listing Authority requesting the approval of a prospectus, is in relation to the issue of up to 28,571,400 preference shares, having a nominal value of €0.06 per preference share, at an offer price of €1.75 per preference share.

- Subject to the attainment of regulatory approval therefrom, the offer will be available for subscription by financial intermediaries through an intermediaries’ offer, preferred applicants and the general public.

- Preferred applicants include RS2 employees and shareholders appearing as at yesterday on the register of members.

- The equity’s turnover increased to €188,764, as 103,967 shares changed hands over 37 deals. A 9.1% fall in price was recorded as it reached a 10-month-low of €1.80. This is equivalent to a €0.18 movement in price.

- Last Thursday, GO plc announced that the board is scheduled to meet on March 11, 2021 to consider and approve the company’s audited financial statements for the financial year ended December 31, 2020.

- Moreover, the directors shall also consider the declaration of a final dividend to be recommended to the company’s Annual General Meeting.

- The equity lost 3.5%, as 5,662 shares were spread across four deals, to close at €3.32.

- Likewise, its subsidiary BMIT Technologies plc shall be meeting on March 9, 2021, for the same purpose. A 1.3% increase in price was registered as it closed at €0.486. A total of 22 deals involving 167,985 shares were executed.

- LifeStar Holding plc recorded a 9.1% increase, as it reached €0.60. This was the result of three deals involving 26,664 shares. On a year-to-date perspective, the equity is up by 20%.

- The best performance was recorded by Loqus Holdings plc, as it registered a double-digit gain of 18.8%. This was the result of two deals involving 30,501 shares. The equity closed the week at €0.095.

- Last Thursday, MIDI plc announced that it has submitted a revised masterplan for the restoration and redevelopment of Manoel Island to the Planning Authority (“PA”) for its consideration and a fresh Environment Impact Assessment (“EIA”) to the Environmental and Resources Authority (“ERA”).

- As previously announced, the Environment and Planning Review Tribunal (“EPRT”) had concluded that there was a breach in the EIA in respect of the revised outline development permit for Manoel Island which had been approved by the PA on March 20, 2019, and the EPRT determined that a fresh EIA must be submitted by the company to ERA in order for the PA to reconsider the application.

- Additional site investigations carried out by the company over the past twenty-four months under the supervision of an independent archaeologist approved by the superintendence of Cultural Heritage, have revealed that a part of the site, previously earmarked for development, is of archaeological importance.

- A revised masterplan was therefore necessitated to take into consideration these findings. The revised masterplan in fact envisages a reduction in development volumes from the previously approved 127,000sqm to 95,000sqm.

- Although the loss of development volumes impacts the profitability of the project, this impact is mitigated to some extent by provisions of the deed of emphyteusis entered into with Government on June 15, 2000, which provide for specific remedies in the event that the development is impacted by archaeological finds. MIDI is pursuing this matter with the Government.

- MIDI reiterates that it remains fully committed to the Manoel Island project and that it will keep the market updated with any developments as they arise in accordance with its regulatory obligations.

- No trading activity was recorded during the week.

- The MSE MGS Total Return Index lost a further 0.6%, as it reached 1,134.19 points. A total of 17 issues were active, five of which advanced while another 12 lost ground. The 2.1% MGS 2039 (I) headed the list of gainers, as it closed 0.8% higher at €131.50. On the other hand, the 2.2% MGS 2035 (I) closed 5.9% lower at €119.50.

- The MSE Corporate Bonds Total Return Index advanced by 0.2%, as it closed at 1,100.49 points. Out of 57 active issues, 23 closed higher while another 21 closed in the red. The best performance was recorded by the 3.75% Bortex Group Finance plc Unsecured € 2027, as it ended the week 2.5% higher at €102.50. Conversely, the 5.8% International Hotel Investments plc 2021 lost 2%, to close at €99.01.

- In the Prospects MTF market, five issues were active. The 5.75% Pharmacare Finance plc Unsecured EUR 2025-2028 was the most liquid, as it generated a total weekly turnover of €15,150 on two deals.

| Upcoming Events | ||||

| Best Performers: | ||||

| 1. LQS | +18.75% | |||

| 2. LSR | +9.09% | |||

| 23 FEB 2021 | MT: HSBC Bank Malta plc – Annual Results | 3. MTP | +1.72% | |

| 24 FEB 2021 | MT: Malta International Airport plc – Annual Results | |||

| 25 FEB 2021 | MT: Malta Properties Company plc – Annual Results | Worst Performers: | ||

| 1. LOM | -11.50% | |||

| 2. RS2 | -9.09% | |||

| 3. MDS | -4.92% | |||

|

|

Price (€): 19.02.2021 | Price (€): 12.02.2021 | Weekly Change (%) | 2021 Performance (%) |

| MSE Equity Total Return Index | 7,975.798 | 8,183.486 | -2.54 | -5.85 |

| BMIT Technologies plc | 0.486 | 0.480 | 1.25 | 0.83 |

|---|---|---|---|---|

| Bank of Valletta plc | 0.916 | 0.930 | -1.51 | -3.58 |

| FIMBank plc (USD) | 0.440 | 0.440 | 0.00 | -12.00 |

| Grand Harbour Marina plc | 0.650 | 0.650 | 0.00 | -7.14 |

| GO plc | 3.320 | 3.440 | -3.49 | -6.22 |

| Harvest Technology plc | 1.440 | 1.470 | -2.04 | -2.70 |

| HSBC Bank Malta plc | 0.915 | 0.950 | -3.68 | 1.67 |

| International Hotel Investments plc | 0.620 | 0.645 | -3.88 | -13.89 |

| Lombard Bank plc | 2.000 | 2.260 | -11.50 | -15.25 |

| Loqus Holdings plc | 0.095 | 0.080 | 18.75 | -4.04 |

| LifeStar Holding plc | 0.600 | 0.550 | 9.09 | 20.00 |

| MIDI plc | 0.422 | 0.422 | 0.00 | -5.80 |

| Medserv plc | 0.580 | 0.610 | -4.92 | -26.58 |

| Malta International Airport plc | 6.050 | 6.050 | 0.00 | -2.42 |

| Malita Investments plc | 0.900 | 0.900 | 0.00 | 0.00 |

| Mapfre Middlesea plc | 2.240 | 2.260 | -0.88 | -8.94 |

| Malta Properties Company plc | 0.560 | 0.560 | 0.00 | 12.00 |

| Main Street Complex plc | 0.498 | 0.498 | 0.00 | -0.40 |

| MaltaPost plc | 1.180 | 1.160 | 1.72 | -11.28 |

| PG plc | 2.000 | 2.040 | -1.96 | 0.00 |

| Plaza Centres plc | 0.920 | 0.920 | 0.00 | -6.12 |

| RS2 Software plc | 1.800 | 1.980 | -9.09 | -10.00 |

| Simonds Farsons Cisk plc | 7.900 | 8.000 | -1.25 | 1.28 |

| Santumas Shareholdings plc | 1.390 | 1.390 | 0.00 | 0.00 |

| Tigné Mall plc | 0.730 | 0.720 | 1.39 | -14.12 |

| Trident Estates plc | 1.470 | 1.470 | 0.00 | -11.45 |

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]