MSE Trading Report for Week ending 18 March 2021

| MSE Equity Total Return Index: |

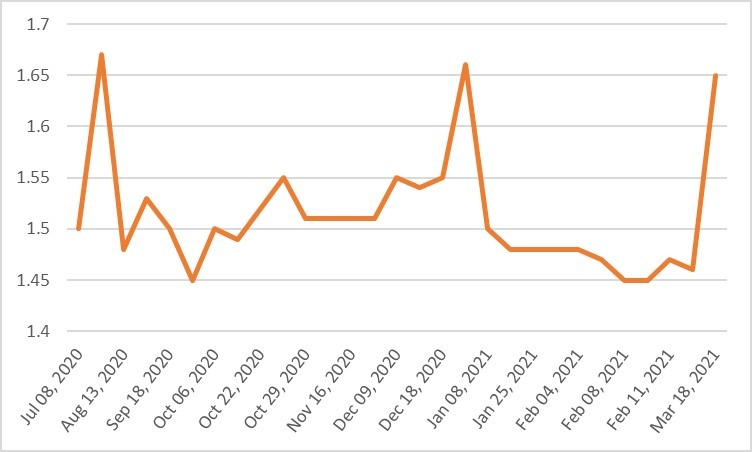

| Chart of the Week: Trident Estates plc |

| Highlights: |

- The MSE Equity Total Return Index extended its recent declines, as it reached 7,781.544 points – equivalent to a 0.8% change. A total of 17 issues were active, seven of which headed north while another six closed in the opposite direction. During this four-day trading week, total turnover was €0.4 million lower than the previous week, as it stood at €1 million – generated across 149 transactions.

- The highest liquidity was recorded by GO plc following last week’s approval of the payment of a final dividend of €0.16 net of tax per share, to be recommended during the Annual General Meeting on May 27, 2021. The equity generated a total weekly turnover of €247,850 as 70,744 shares change hands across 18 transactions. As a result, GO ended the week at a three-month-high of €3.56, translating into a 1.7% weekly increase.

- Following suit, its subsidiary, BMIT Technologies plc, recorded a total turnover of €219,690. Last week the board resolved to recommend the approval of the payment of a final dividend of €0.02922 net of tax per share during the AGM to be held on May 26, 2021. No change in price was recorded, as it closed flat at €0.53 despite trading 28 times over a spread of 414,850 shares.

- Last Tuesday, Bank of Valletta plc announced that the board of directors is scheduled to meet on March 30, 2021, to consider and approve the Group’s and the Bank’s audited financial statements for the financial year ended December 31, 2020.

- The equity was active only on Monday and Tuesday, as it lost 1.1%, to end the week €0.01 lower at €0.90. Nine deals involving 18,733 shares were executed.

- Its peer, HSBC Bank Malta plc, started off the week on a positive note, as it closed Monday’s session at €0.85 but closed at a 15-week low of €0.80 mid-week. On Thursday, the equity managed to recoup some lost ground, as it closed at €0.82 – translating into a 2.4% weekly decline. This was the outcome of 72,903 shares spread over 18 deals.

- Malta International Airport plc closed flat at €5.75, despite reaching an intra-week high of €5.80 last Wednesday. The equity saw 19,920 shares change hands across 20 transactions.

- The best performance was recorded by Trident Estates plc, as it registered a double-digit gain of 12.2%. The equity started off the week in the red but reached €1.65 last Thursday – the highest in 12 weeks. Eight deals involving 30,500 shares were executed.

- Last Tuesday, Harvest Technology plc announced that it shall meet on March 26, 2021 to consider and, if thought fit, approve, the audited financial statements for the financial year ended December 31, 2020. The board shall also consider whether to recommend a final dividend for the same financial year. The equity traded twice over 20,000 shares, resulting into a positive 0.7% movement in price, to close at €1.48.

- The MSE MGS Total Return Index managed to recoup some lost ground, as it closed 0.1% higher at 1,125.56 points. A total of 16 issues were active, four of which registered gains, while another nine closed in the red. The 2.5% MGS 2036 (I) headed the list of gainers, as it closed 1.6% higher at €126.00. On the other hand, the 2.3% MGS 2029 (II) ended the week 3.3% lower at €120.00.

- The MSE Corporate Bonds Total Return Index remained relatively unchanged at 1,099.14 points. Out of 40 active issues, 12 registered gains, while another 16 traded lower. The best performance of 5.3% was recorded by the 5.5% Mediterranean Investment Holding plc Unsecured 2023, as it closed at par. Conversely, the 4.5% Hili Properties plc Unsecured € 2025 closed at €100.01, translating into a 2.5% change.

- In the Prospects MTF market, five issues were active. The 5% Luxury Living Finance plc € Secured Bonds 2028 was the most liquid, as it generated a total weekly turnover of €19,955.

| Upcoming Events | ||||

| Best Performers: | ||||

| 1. TRI | +12.24% | |||

| 2. MPC | +2.86% | |||

| 25 MAR 2021 | MT: Mapfre Middlesea plc – Annual Results | 3. GO | +1.71% | |

| 26 MAR 2021 | MT: Harvest Technology plc – Annual Results | |||

| 30 MAR 2021 | MT: Bank of Valletta plc – Annual Results | Worst Performers: | ||

| 1. TML | -10.27% | |||

| 2. IHI | -9.48% | |||

| 3. MDI | -2.44% | |||

|

|

Price (€): 18.03.2021 | Price (€): 12.03.2021 | Weekly Change (%) | 2021 Performance (%) |

| MSE Equity Total Return Index | 7,781.544 | 7,844.819 | -0.81 | -8.14 |

| BMIT Technologies plc | 0.530 | 0.530 | 0.00 | 9.96 |

|---|---|---|---|---|

| Bank of Valletta plc | 0.900 | 0.910 | -1.10 | -5.26 |

| FIMBank plc (USD) | 0.440 | 0.440 | 0.00 | -12.00 |

| Grand Harbour Marina plc | 0.660 | 0.660 | 0.00 | -5.71 |

| GO plc | 3.560 | 3.500 | 1.71 | 0.57 |

| Harvest Technology plc | 1.480 | 1.470 | 0.68 | 0.00 |

| HSBC Bank Malta plc | 0.820 | 0.840 | -2.38 | -8.89 |

| International Hotel Investments plc | 0.525 | 0.580 | -9.48 | -27.08 |

| Lombard Bank plc | 1.940 | 1.940 | 0.00 | -17.80 |

| Loqus Holdings plc | 0.090 | 0.090 | 0.00 | -9.09 |

| LifeStar Holding plc | 0.600 | 0.600 | 0.00 | 20.00 |

| MIDI plc | 0.400 | 0.410 | -2.44 | -10.71 |

| Medserv plc | 0.630 | 0.630 | 0.00 | -20.25 |

| Malta International Airport plc | 5.750 | 5.750 | 0.00 | -7.26 |

| Malita Investments plc | 0.900 | 0.900 | 0.00 | 0.00 |

| Mapfre Middlesea plc | 2.240 | 2.240 | 0.00 | -8.94 |

| Malta Properties Company plc | 0.540 | 0.525 | 2.86 | 8.00 |

| Main Street Complex plc | 0.498 | 0.498 | 0.00 | -0.40 |

| MaltaPost plc | 1.160 | 1.150 | 0.87 | -12.78 |

| PG plc | 2.020 | 2.000 | 1.00 | 1.00 |

| Plaza Centres plc | 0.880 | 0.880 | 0.00 | -10.20 |

| RS2 Software plc | 1.800 | 1.770 | 1.69 | -10.00 |

| Simonds Farsons Cisk plc | 7.850 | 7.900 | -0.63 | 0.64 |

| Santumas Shareholdings plc | 1.390 | 1.390 | 0.00 | 0.00 |

| Tigné Mall plc | 0.655 | 0.730 | -10.27 | -22.94 |

| Trident Estates plc | 1.650 | 1.470 | 12.24 | -0.60 |

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]