MSE Trading Report for Week ending 23 April 2021

| MSE Equity Total Return Index: |

| Chart of the Week: PG plc |

| Highlights: |

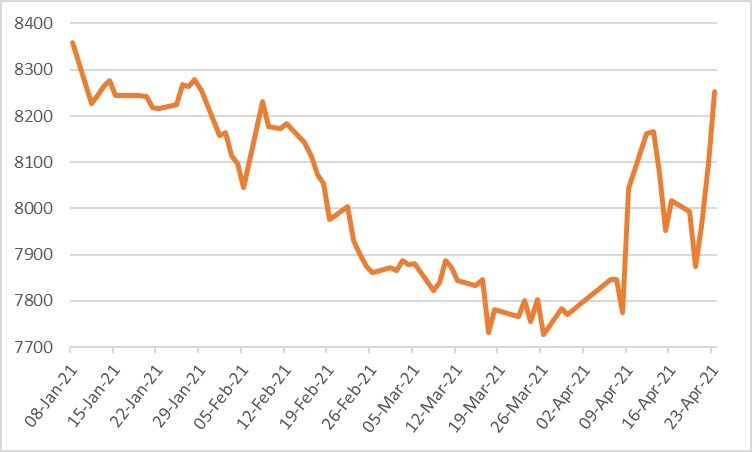

- The MSE Equity Total Return Index returned in positive territory, as it reached 8,252.192 points – equivalent to a 2.9% weekly change. During the week activity increased by 13%, as total turnover amounted to €1.04 million, generated across 134 transactions. Out of 19 active equities, 11 registered gains while another five lost ground.

- Retail conglomerate, PG plc reached an all-time-high of €2.12 last Wednesday but did not manage to sustain the gain, as it closed the week at €2.08 – translating into a 1% increase. Eight deals involving 20,072 shares were executed.

- Last Thursday, HSBC Bank Malta plc (HSBC) held its Annual General Meeting and approved all the proposed resolutions.

- The audited accounts for the year ended December 31, 2020 and the reports of the directors and auditors thereof were approved.

- The shareholders also approved the final gross dividend of €0.0116 per share, representing a final gross payment of €4,179,550.75 as recommended by the board.

- HSBC shares recorded a 1.2% decline in price, as they closed at €0.85. This was the result of 54,461 shares spread over 16 deals.

- Meanwhile, Bank of Valletta plc ended the week flat at €0.90, as a total of 14 deals involving 81,479 shares were executed.

- Last Thursday, Lombard Bank Malta plc’s board approved the audited financial statements for the financial year ended December 31, 2020 and resolved that these statements be submitted for approval at the forthcoming Annual General Meeting, to be held on May 28, 2021.

- The bank registered a profit before tax of €10.4 million for the financial year ended December 31, 2020 translating into a 32% decline when compared to 2019.

- Total assets rose to €1.1 million versus €1 million recorded in 2019.

- The CET1 ratio and total capital ratio stood at 15.8% exceeding the minimum regulatory requirements, while the group earnings per share decreased to €0.15c.

- The board resolved to recommend the payment of a final gross dividend of €0.03 (net dividend of €0.0195) per nominal €0.25 share which will be paid on June 9, 2021 to shareholders on the register as at April 28, 2021.

- Moreover, the board also resolved to recommend a bonus share issue of one share for every seventy-five shares held which will be allotted on June 24, 2021 to shareholders on the register as at June 23, 2021. The bonus issue will be funded by the capitalisation of reserves amounting to €147,000.

- Four deals involving 16,911 Lombard Bank plc shares pushed the price 4.7% higher to €2.00.

- Telecommunications company, GO plc, was the most liquid, as it generated a total turnover of €511,899. A total of 138,626 shares changed hands across 19 transactions, pushing the price 2.2% higher to €3.72.

- RS2 Software plc announced the results of the Preference Share Issue, with respect to the allocation of an issue of up to 28,571,400 new preference shares by the Company having a nominal value of €0.06 per preference share at an offer price of €1.75.

- The offer period closed on April 16, 2021 and applications for a total amount of 8,989,600 preference shares with a total value of €15,731,800 were received. All applications were met in full.

- These shares are expected to be admitted to the Official List of the Malta Stock Exchange by latest April 30, 2021 and trading may commence as from May 3, 2021.

- The equity advanced by 8.7%, as 23,250 shares were spread over seven transactions, to close €0.16 higher at €2.00.

- Moving on to the property sector, the board of Tigne’ Mall plc approved the audited financial statements for the year ended December 31, 2020.

- The board resolved that the audited financial statements shall be submitted for shareholders’ approval at the forthcoming Annual General Meeting, to be held on June 15, 2021.

- Operations during 2020 were adversely affected by the pandemic, resulting into a drop in revenue of 22% to €5.4 million when compared to the previous year.

- This decline had a direct impact on the profitability, as profit before tax declined to €2.2 million, equivalent to a 39.8% change.

- Similarly, earnings per share stood at €0.0235 versus €0.0451 recorded in 2019.

- In view of the prevailing uncertainty, the board has resolved not to recommend any dividend payments in respect of the 2020 financial results.

- One transaction of 1,000 shares was executed, resulting into a positive 2.1% movement in price. The equity closed at the €0.745 price level.

- Yesterday, the board of MIDI plc approved the audited consolidated financial statements for the year ended December 31, 2020.

- The board resolved that these shall be submitted for approval of the shareholders at the forthcoming Annual General Meeting to be held on June 17, 2021.

- The Group’s revenue declined from €27.7 million to €2.8 million. Similarly, a loss before tax of €1.6 million was recorded versus a profit before tax of €11.2 million in 2019.

- These results were anticipated since the company had a very limited number of properties available for sale during 2020 following the successful delivery of the Q2 apartments spanning over the previous two financial years.

- The Group’s net asset value has decreased from €104 million to €101.8 million as at December 31, 2020 equivalent to a net asset value per share of €0.476, compared to €0.486 as at end of 2019.

- The board did not recommend a dividend payment in respect of the year ended December 31, 2020 consistent with the position adopted in 2019. The aim is to preserve the Group’s cash resources, considering projected liquidity demands over the coming months.

- No trading activity was recorded during the week.

- Last Tuesday, Main Street Complex plc announced that the board approved the audited financial statements for the financial year ended December 31, 2020.

- Gross revenue for 2020 reached €517,469 which translates into a 37% decline when compared to the €819,540 recorded in 2019.

- Profit before tax stood at €224,102 in 2020, equivalent to a €292,226 decline from that of the previous year.

- The company’s balance sheet remained strong with total equity amounting to €11.7 million, financing 88% of the company’s total assets of €13.3 million.

- Considering the prevailing circumstances, the board has formulated the view that in this period of uncertainty, it would be prudent and in the best interest of the company not to recommend the declaration of a final dividend for the financial year ended December 31, 2020.

- Last Thursday, LifeStar Holding plc announced that an application for the admissibility of LifeStar Insurance’s ordinary shares to listing has been submitted to the Malta Financial Services Authority (MFSA) for approval.

- The company also announced that LifeStar Insurance intends to proceed with a public offer of subordinated bonds and that an application for the admissibility to listing has been submitted to the MFSA for approval.

- LifeStar Insurance also intends to offer holders of the €10,000,000 5.00% unsecured bonds maturing June 2, 2021 the option to exchange their bonds in the Company for Subordinated Bonds issued by LifeStar Insurance upon terms to be made available in the Subordinated Bond Prospectus.

- As part of the implementation of the LifeStar Group Restructuring, the Company no longer intends to pursue the roll-over of its €10,000,000 5.00% unsecured bonds maturing 2nd June 2021 which was previously announced in 2020.

- The board also approved the consolidated annual financial statements for the financial year ended December 31, 2020 and resolved that they be submitted for approval of the shareholders at the forthcoming Annual General Meeting.

- LifeStar Holding plc’s consolidated results registered a total comprehensive loss of €0.6 million versus a profit of €1.1 million generated in 2019.

- The pre-tax loss for the year amounted to €1.1 million, compared to a profit of €2.1 million in the previous year.

- Group assets increased by 8.2% from €153.7 to €166.3 million in 2020.

- The Group’s net asset value at end of the year stood at €18.4 million, translating into a 3.7% decline from the previous year.

- The board does not recommend the declaration of a dividend. No trading activity was recorded during the week.

- The MSE MGS Total Return Index remained relatively unchanged at 1,127.06 points. A total of 14 issues were active, of which gainers and losers tallied to seven-a-piece. The 2.1% MGS 2039 (I) headed the list of gainers, as it closed 4.8% higher at €130.00. On the other hand, the 2.4% MGS 2041 (I) closed 2.4% lower at €124.00.

- The MSE Corporate Bonds Total Return Index registered a further 0.17% increase, as it reached 1,114.16 points. Out of 51 active issues, 22 headed north while another 14 closed in the opposite direction. The best performance of a 2% rise in price, was recorded by the 5.8% International Hotel Investments plc 2023, as it closed at €102.99. Conversely, the 4.5% Shoreline Mall plc Secured € Bonds 2032 lost 2.3%, ending the week at €99.03.

- In the Prospects MTF market, six issues were active. The 5% FES Finance plc Secured € 2029 was the most active, as it generated a total weekly turnover of €22,329.

| Upcoming Events | ||||

| Best Performers: | ||||

| 1. SFC | +14.29% | |||

| 28 APR 2021 | MT: Plaza Centres plc – Annual Results | 2. MDS | +12.16% | |

| 29 APR 2021 | MT: RS2 Software plc – Annual Results | 3. IHI | +10.17% | |

| 30 APR 2021 | MT: Mapfre Middlesea plc – Annual General Meeting | |||

| 30 APR 2021 | MT: International Hotel Investments plc – Annual Results | Worst Performers: | ||

| 30 APR 2021 | MT: Medserv plc – Annual Results | 1. LQS | -27.22% | |

| 2. FIM | -6.45% | |||

| 3. BMIT | -3.85% | |||

|

|

Price (€): 23.04.2021 | Price (€): 16.04.2021 | Weekly Change (%) | 2021 Performance (%) |

| MSE Equity Total Return Index | 8,252.192 | 8,016.442 | 2.94 | -2.59 |

| BMIT Technologies plc | 0.500 | 0.520 | -3.85 | 3.73 |

|---|---|---|---|---|

| Bank of Valletta plc | 0.900 | 0.900 | 0.00 | -5.26 |

| FIMBank plc (USD) | 0.290 | 0.310 | -6.45 | -42.00 |

| Grand Harbour Marina plc | 0.660 | 0.660 | 0.00 | -5.71 |

| GO plc | 3.720 | 3.640 | 2.20 | 5.09 |

| Harvest Technology plc | 1.450 | 1.450 | 0.00 | -2.03 |

| HSBC Bank Malta plc | 0.850 | 0.860 | -1.16 | -5.56 |

| International Hotel Investments plc | 0.650 | 0.590 | 10.17 | -9.72 |

| Lombard Bank plc | 2.000 | 1.910 | 4.71 | -15.25 |

| Loqus Holdings plc | 0.066 | 0.090 | -27.22 | -33.84 |

| LifeStar Holding plc | 0.600 | 0.600 | 0.00 | 20.00 |

| MIDI plc | 0.430 | 0.430 | 0.00 | -4.02 |

| Medserv plc | 0.830 | 0.740 | 12.16 | 5.06 |

| Malta International Airport plc | 6.200 | 6.200 | 0.00 | 0.00 |

| Malita Investments plc | 0.880 | 0.865 | 1.73 | -2.22 |

| Mapfre Middlesea plc | 2.380 | 2.360 | 0.85 | -3.25 |

| Malta Properties Company plc | 0.555 | 0.550 | 0.91 | 11.00 |

| Main Street Complex plc | 0.498 | 0.498 | 0.00 | -0.40 |

| MaltaPost plc | 1.270 | 1.320 | -3.79 | -4.51 |

| PG plc | 2.080 | 2.060 | 0.97 | 4.00 |

| Plaza Centres plc | 0.880 | 0.880 | 0.00 | -10.20 |

| RS2 Software plc | 2.000 | 1.840 | 8.70 | 0.00 |

| Simonds Farsons Cisk plc | 10.000 | 8.750 | 14.29 | 28.21 |

| Santumas Shareholdings plc | 1.390 | 1.390 | 0.00 | 0.00 |

| Tigné Mall plc | 0.745 | 0.730 | 2.05 | -12.35 |

| Trident Estates plc | 1.600 | 1.600 | 0.00 | -3.61 |

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]