MSE Trading Report for Week ending 04 June 2021

| MSE Equity Total Return Index: |

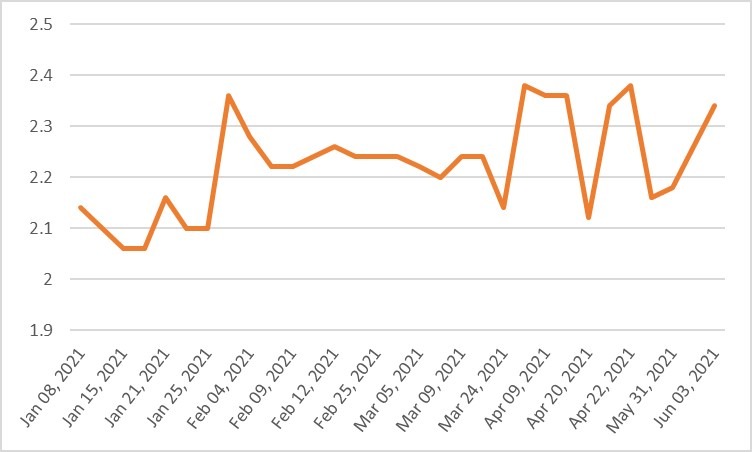

| Chart of the Week: Mapfre Middlesea plc |

| Highlights: |

- The MSE Equity Total Return Index headed north for the third time in a row, as it reached 8,240.708 points – translating into a 0.5% change. A total of 17 equities were active, six of which registered gains while another seven lost ground. Total activity declined by €0.1m to €0.4m, as a result of 111 transactions.

- The highest liquidity was recorded in the banking industry, as Bank of Valletta plc generated a total turnover of €0.14m. The equity started off the week in the green at €0.91 but ended the week flat at €0.90. A total of 152,109 shares changed ownership across 15 transactions.

- Its peer, HSBC Bank Malta plc kick started the week in the red but managed to recover, as it closed 1.2% higher at €0.85. This was the result of 13 deals involving 42,039 shares.

- Last Wednesday, Simonds Farsons Cisk plc announced that the 74th Annual General Meeting will be held on June 24, 2021.

- The income statement and statement of financial position for the year ended January 31, 2021 and the reports of the directors and the auditors shall be approved.

- Total turnover increased to €62,856 as the equity’s price declined by 0.6% to €8.95, as 7,855 shares changed hands across 11 transactions.

- From a year-to-date perspective, the equity is up by nearly 15%.

- Last Monday, Malta Properties Company plc announced that the Annual General Meeting is scheduled to be held on July 21, 2021.

- The annual report and financial statements for the year ended December 31, 2020 comprising the financial statements and the directors’ and auditor’s reports thereon, shall be received and approved.

- Moreover, the payment of a net dividend of €0.012 per share to all shareholders registered as at June 15, 2021 will be approved.

- The payment of this net dividend amounts to the sum of €1,215,726.

- Four deals involving 10,000 shares pushed the price 2.8% higher to €0.555.

- Last Thursday, Trident Estates plc announced that the 21st Annual General Meeting shall be held on June 25, 2021.

- The income statement and statement of financial position for the year ended January 31, 2021 and the reports of the directors and the auditors, shall be approved.

- The equity lost 3.9%, as 5,800 shares changed hands across three transactions, to close the week at €1.50.

- Last Wednesday, Main Street Complex plc (MSC) referred to United Finance plc’s announcement, whereby the board provided the market with an update on the operations of the United Department Stores Limited, which holds the franchise for the Debenhams brand for Malta.

- The market was informed that United Department Stores Limited had to take the difficult decision to also wind up the local outlets of the Debenhams franchise. United Department Stores Limited operates the largest store in Main Street Complex. The board of MSC has received notice of termination of the existing concession relative to such store, and discussions are underway between the respective management teams of the Company and United Department Stores Limited, with a view to determining the terms, timeline and process of the termination and ensuing vacating of the store.

- In parallel, the Company has commenced the process for identifying a suitable alternative tenant for the operation of the store in question, and further updates to the market will be provided as and when appropriate. At this juncture, the board would like to reassure shareholders that such termination is not expected to have any impact on the financial performance in the current financial year, principally as a result of the terms of the termination provisions contained in the concession agreement.

- Similarly, Tigne’ Mall plc also entered into a termination of lease agreement with United Department Stores Limited in respect of the Debenhams outlet situated at The Point Shopping Mall. The termination of the lease will be effective as of June 30, 2021.

- The Company also announced that it has concurrently negotiated and entered into a new lease agreement in respect of the vacated premises with the Classic Group, a leading retail group operating an extensive portfolio of prestigious brands in Malta. This new lease will commence on July 1, 2021. The board is pleased to note that the demand for premium retail space within The Point Shopping Mall remains robust and that the mall remains fully let even during this challenging period.

- Both equities were not active during the week.

- Last Tuesday, Plaza Centres plc announced that the forthcoming Annual General Meeting shall be held on June 23, 2021. No trading activity was recorded in the equity.

- The MSE MGS Total Return Index declined by 0.19% to 1,116.81 points. A total of 18 issues were active, six of which headed north while another eight closed in the opposite direction. The 4.3% MGS 2033 (I) and the 4.1% MGS 2034 (I) were the best performers, as they closed 0.3% higher at €142.02 and €141.39, respectively. On the other hand, the 3% MGS 2040 (I) lost 2.1%, ending the week at €132.10.

- The MSE Corporate Bonds Total Return Index remained relatively flat at 1,123.57 points. Out of 43 active issues, 12 advanced while another 14 closed in the red. The 4% Eden Finance plc Unsecured € 2027 closed 2.7% higher at €102.99 – registering the best performance of the week. Conversely, the 4.35% SD Finance plc Unsecured € 2027 headed the list of fallers, as it closed 1.5% lower at €100.50.

- In the Prospects MTF market, eight issues were active. The 5% Luxury Living Finance plc € Secured Bonds 2028 was the most active, as it generated a total turnover of €15,997.

| Upcoming Events | ||||

| Best Performers: | ||||

| 1. MMS | +8.33% | |||

| 10 JUN 2021 | MT: International Hotel Investments plc – Annual General Meeting | 2. IHI | +4.62% | |

| 11 JUN 2021 | MT: Medserv plc – Annual General Meeting | 3. MPC | +2.78% | |

| 15 JUN 2021 | MT: Tigne’ Mall plc – Annual General Meeting | |||

| 17 JUN 2021 | MT: MIDI plc – Annual Results | Worst Performers: | ||

| 23 JUN 2021 | MT: Plaza Centres plc – Annual General Meeting | 1. LOM | -11.71% | |

| 2. TRI | -3.85% | |||

| 3. MLT | -3.49% | |||

|

|

Price (€): 04.06.2021 | Price (€): 28.05.2021 | Weekly Change (%) | 2021 Performance (%) |

| MSE Equity Total Return Index | 8,240.708 | 8,202.788 | 0.462 | -2.72 |

| BMIT Technologies plc | 0.500 | 0.490 | 2.04 | 3.73 |

|---|---|---|---|---|

| Bank of Valletta plc | 0.900 | 0.900 | 0.00 | -5.26 |

| FIMBank plc (USD) | 0.370 | 0.376 | -1.60 | -26.00 |

| Grand Harbour Marina plc | 0.660 | 0.660 | 0.00 | -5.71 |

| GO plc | 3.400 | 3.400 | 0.00 | -3.96 |

| Harvest Technology plc | 1.560 | 1.550 | 0.65 | 5.41 |

| HSBC Bank Malta plc | 0.850 | 0.840 | 1.19 | -5.56 |

| International Hotel Investments plc | 0.680 | 0.650 | 4.62 | -5.56 |

| Lombard Bank plc | 1.960 | 2.220 | -11.71 | -16.95 |

| Loqus Holdings plc | 0.097 | 0.097 | 0.00 | -2.02 |

| LifeStar Holding plc | 0.600 | 0.600 | 0.00 | 20.00 |

| MIDI plc | 0.350 | 0.350 | 0.00 | -21.88 |

| Medserv plc | 0.825 | 0.860 | -0.60 | 4.43 |

| Malta International Airport plc | 6.400 | 6.400 | 0.00 | 3.23 |

| Malita Investments plc | 0.830 | 0.860 | -3.49 | -7.78 |

| Mapfre Middlesea plc | 2.340 | 2.160 | 8.33 | -4.88 |

| Malta Properties Company plc | 0.550 | 0.540 | 2.78 | 11.00 |

| Main Street Complex plc | 0.488 | 0.488 | 0.00 | -2.40 |

| MaltaPost plc | 1.240 | 1.240 | 0.00 | -6.77 |

| PG plc | 2.100 | 2.100 | 0.00 | 5.00 |

| Plaza Centres plc | 0.900 | 0.900 | 0.00 | -8.16 |

| RS2 Software plc Preference Shares* | 1.860 | 1.860 | 0.00 | 6.29 |

| RS2 Software plc | 1.980 | 1.990 | -0.50 | -1.00 |

| Simonds Farsons Cisk plc | 8.950 | 9.000 | -0.56 | 14.74 |

| Santumas Shareholdings plc | 1.390 | 1.390 | 0.00 | 0.00 |

| Tigné Mall plc | 0.750 | 0.750 | 0.00 | -11.77 |

| Trident Estates plc | 1.500 | 1.560 | -3.85 | -9.64 |

* Trading commenced on May 3, 2021.

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]