MSE Trading Report for Week ending 11 June 2021

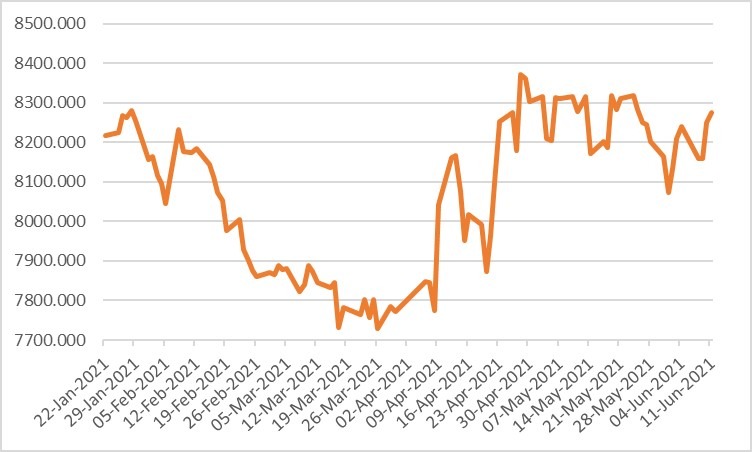

| MSE Equity Total Return Index: |

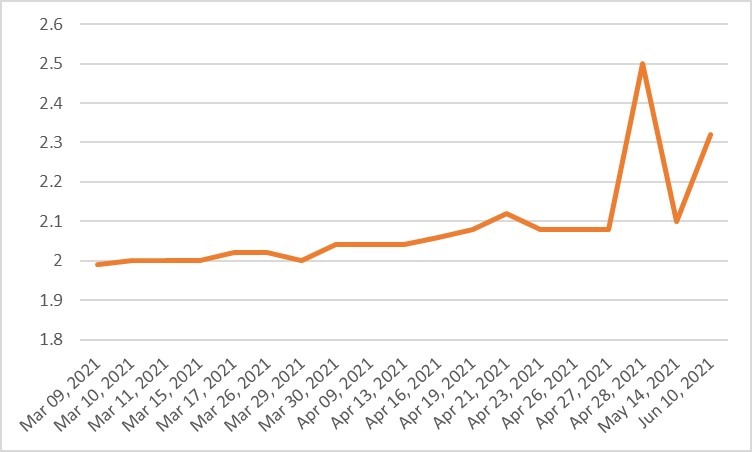

| Chart of the Week: PG plc |

| Highlights: |

- The MSE Equity Total Return Index registered a further 0.4% increase, to close higher for the fourth time in a row, as it reached 8,275.375 points. A total weekly turnover of €0.4m was generated over the four-day trading week. Out of 15 active equities, four headed north while another eight closed in the opposite direction.

- Malta International Airport plc (MIA) announced the traffic results for the month of May. As the Maltese islands edged closer to the reopening of travel and tourism,

- MIA registered 75,420 passenger movements during the month following this resumption. This total for May translates into a drop of 88.8% compared to the same month in 2019, but marks a slight improvement over the first four months of 2021, during which monthly passenger movements consistently remained below the 40,000 mark.

- The top markets for May were Italy, Germany, France, Poland and Turkey, with the results registered by these markets being driven by the relaxation of certain restrictions on travel from Malta and the resumption of flight operations to a number of regional airports. Turkey, on the other hand, remained an important connecting hub for passengers who could not travel directly to their final destination due to restrictions in place.

- The seat load factor for the month of May stood at 62%. The airport expects seat capacity deployed by airlines in June to increase by more than double the capacity for the month of May, as passenger demand is expected to gradually start recovering.

- The equity traded at a weekly low of €6.30 but managed to recover, as it closed flat at €6.40. A total of 11 deals involving 10,953 shares were executed.

- Bank of Valletta plc was the most liquid, as it generated a total weekly turnover of €0.1m. A 2.2% increase in price was recorded as it closed at €0.92 price level. This was the result of 136,794 shares spread across 18 transactions.

- Yesterday, HSBC Bank Malta plc announced a strategic initiative to further improve its operational structure, benefitting from the HSBC Group’s operating models, in order to drive efficiencies and enhance customer experience.

- The strategic initiative relates primarily to the transformation and automation of certain areas within the bank, and also to a planned transfer of a number of employees and activities to a local service provider.

- To achieve this, the bank is proposing the launch of two Voluntary Redundancy Schemes (the ‘schemes’) that will impact a limited number of areas in the bank, subject to MUBE agreement. The restructuring costs to deliver these changes will be booked in the 2021 financial results, but as the schemes are voluntary, the amount will depend on the number of applications. The bank will make a further company announcement at the appropriate time.

- Four deals involving 6,574 shares dragged the price by 2.9% to €0.825.

- Yesterday, FIMBank plc announced that Fitch Rating has published its latest rating on the Bank, downgrading the Long-Term Issuer Default Rating (IDR) to ‘B’ from ‘B+’ and Viability Rating (VR) to ‘b’ from ‘b+’.

- In Fitch’s view, the downgrade reflects heightened pressures on the Bank’s business model, performance and capitalisation. In particular, Fitch views increased pressure on the Bank’s performance from lower margins and due to business growth constraints given thin capital buffers over regulatory minima.

- Undoubtedly, last year was challenging for the Bank and the industry as a whole, but throughout the year, FIMBank plc maintained a strong CET1 capital of 18.5% as at December 31, 2020 and Liquidity Coverage Ratio of 241% as at December 31, 2020.

- Having weathered a turbulent year, the Bank believes that its defined strategy will deliver sustained growth and the continued success in recovering non-performing loans will further improve the robustness of the organization.

- No trading activity was recorded during the week.

- In the property sector, three equities were active. MIDI plc was the best performer, as it closed 20% higher at €0.42. Six deals involving 40,250 shares were executed.

- Retail conglomerate, PG plc, registered a double-digit gain of 10.5% on thin trading. From a year-to-date perspective, the equity is up by 16%. On the other hand, Simonds Farsons Cisk plc traded 2.8% lower to close the week at €8.70. Three deals involving 4,313 shares were executed.

- Last Thursday, International Hotel Investments plc held its 21st Annual General Meeting. All resolutions on the agenda were approved. The equity was not active during the week.

- The MSE MGS Total Return Index advanced by 0.29% to 1,120.05 points. A total of 16 issues were active, 10 of which registered gains while another five lost ground. The 2.4% MGS 2041 (I) headed the list of gainers, as it closed 5.7% higher at €130.00. On the other hand, the 2.1% MGS 2039 (I) closed 3.1% lower at €124.00.

- The MSE Corporate Bonds Total Return Index ended the week slightly lower at 1,123.36 points. Out of 37 active issues, 13 advanced while another 12 traded lower. The best performance was recorded by the 4.85% Melite Finance plc Unsecured 2028, as it closed 7.1% higher at €75.00. Conversely, the 3.8% Hili Finance plc Unsecured Bonds 2029 lost 1.6%, ending the week at €99.89.

- In the Prospects MTF market, eight issues were active. The 5.5% Testa Finance plc 2029 was the most liquid, as it generated a total weekly turnover of €28,508.

| Upcoming Events | ||||

| Best Performers: | ||||

| 1. MDI | +20.00% | |||

| 2. LOM | +12.24% | |||

| 15 JUN 2021 | MT: Tigne’ Mall plc – Annual General Meeting | 3. PG | +10.48% | |

| 17 JUN 2021 | MT: MIDI Mall plc – Annual Results | |||

| 23 JUN 2021 | MT: Plaza Centres plc – Annual General Meeting | Worst Performers: | ||

| 1. MMS | -6.84% | |||

| 2. MTP | -4.03% | |||

| 3. HSBC | -2.94% | |||

|

|

Price (€): 11.06.2021 | Price (€): 04.06.2021 | Weekly Change (%) | 2021 Performance (%) |

| MSE Equity Total Return Index | 8,275.375 | 8,240.708 | 0.42 | -2.31 |

| BMIT Technologies plc | 0.500 | 0.500 | 0.00 | 3.73 |

|---|---|---|---|---|

| Bank of Valletta plc | 0.920 | 0.900 | 2.22 | -3.16 |

| FIMBank plc (USD) | 0.376 | 0.376 | 0.00 | -26.00 |

| Grand Harbour Marina plc | 0.660 | 0.660 | 0.00 | -5.71 |

| GO plc | 3.360 | 3.400 | -1.18 | -5.09 |

| Harvest Technology plc | 1.530 | 1.560 | -1.92 | 3.38 |

| HSBC Bank Malta plc | 0.825 | 0.850 | -2.94 | -8.33 |

| International Hotel Investments plc | 0.680 | 0.680 | 0.00 | -5.56 |

| Lombard Bank plc | 2.220 | 1.960 | 12.24 | -6.78 |

| Loqus Holdings plc | 0.097 | 0.097 | 0.00 | -2.02 |

| LifeStar Holding plc | 0.600 | 0.600 | 0.00 | 20.00 |

| MIDI plc | 0.420 | 0.350 | 20.00 | -6.25 |

| Medserv plc | 0.830 | 0.830 | 0.00 | 4.43 |

| Malta International Airport plc | 6.400 | 6.400 | 0.00 | 3.23 |

| Malita Investments plc | 0.830 | 0.830 | 0.00 | -7.78 |

| Mapfre Middlesea plc | 2.180 | 2.340 | -6.84 | -11.38 |

| Malta Properties Company plc | 0.550 | 0.555 | -0.90 | 10.00 |

| Main Street Complex plc | 0.488 | 0.488 | 0.00 | -2.40 |

| MaltaPost plc | 1.190 | 1.240 | -4.03 | -10.53 |

| PG plc | 2.320 | 2.100 | 10.48 | 16.00 |

| Plaza Centres plc | 0.900 | 0.900 | 0.00 | -8.16 |

| RS2 Software plc Preference Shares* | 1.860 | 1.860 | 0.00 | 6.29 |

| RS2 Software plc | 1.950 | 1.980 | -1.52 | -2.50 |

| Simonds Farsons Cisk plc | 8.700 | 8.950 | -2.79 | 11.54 |

| Santumas Shareholdings plc | 1.390 | 1.390 | 0.00 | 0.00 |

| Tigné Mall plc | 0.750 | 0.750 | 0.00 | -11.77 |

| Trident Estates plc | 1.500 | 1.500 | 0.00 | -9.64 |

* Trading commenced on May 3, 2021.

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]