MSE Trading Report for Week ending 02 July 2021

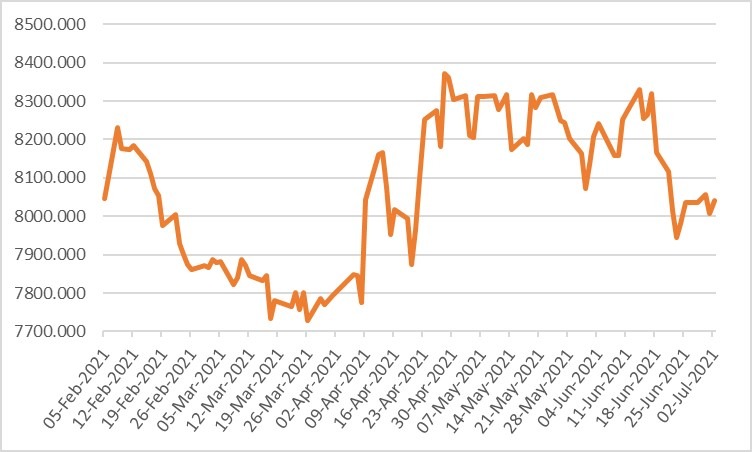

| MSE Equity Total Return Index: |

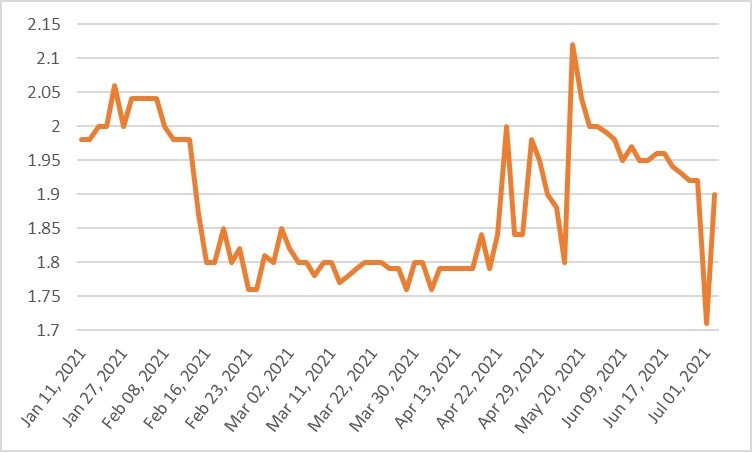

| Chart of the Week: RS2 Software plc |

| Highlights: |

- The MSE Equity Total Return Index eked out a marginal gain, as it closed 0.05% higher at 8,040.399 points. A total of 13 equities were active, where gainers and losers tallied to five-a-piece. Total weekly turnover increased by over three times, as it reached €0.9m – generated across 78 transactions.

- In the banking industry, Bank of Valletta plc started off the week on a negative note but managed to recover, as it reached a weekly high of €0.90 at which it closed. This is equivalent to a positive 0.6% movement. A total of 16 deals involving 66,626 shares were executed.

- Its peer, HSBC Bank Malta plc ended the week 1.3% higher, as 31,570 shares changed ownership across seven transactions. The Bank ended the week at €0.80.

- Malta International Airport plc recorded a total weekly turnover of €0.2m, as 30,478 shares were spread over 18 deals. A 0.8% increase in price was recorded, as it closed €0.05 higher at €6.40. From a year-to-date perspective, the equity is trading 3.2% higher.

- The most liquid equity was RS2 Software plc, as it generated almost 60% of this week’s turnover. Last Thursday, the equity reached a 15-month low of €1.71, but managed to recover most of the lost ground, as it closed at €1.90. A total of 325,141 shares changed hands across 13 transactions, dragging the price by 1% into the red.

- Simonds Farsons Cisk plc headed the list of fallers with a 5.2% change in price, ending the week at €8.25. This translated into a €0.45 change in price. Six deals involving 2,878 shares were executed.

- Last Friday, Trident Estates plc held the 21st Annual General Meeting. The income statement and statement of financial position for the year ended January 31, 2021 and the reports of the directors and the auditors thereon were received and approved.

- MIDI plc headed the list of gainers with a double-digit change of 15.7%. Two deals involving 7,233 shares pushed the price to €0.428.

- Last Friday, International Hotel Investments plc (IHI) published the financial analysis summary.

- During the first half of 2020, the Group reacted swiftly to the COVID-19 pandemic and implemented a broad range of health and safety measures while ensuring the continued viability of the Group.

- Revenue in FY2021 is projected to increase by €24.9m to €116.8m on account of an expected improvement in hospitality business and the consolidation of Golden Sands Resort Limited’s results following the acquisition by IHI of the remaining 50% shareholding thereof in February 2021.

- The management expects Corinthia St Petersburg and Corinthia London to recover faster than the other hotels mainly due to domestic tourism.

- Such increase in revenue is expected to reverse a negative EBITDA of €3.8m registered in FY2020 to a positive balance amounting to €11m.

- Notwithstanding, after accounting for depreciation and amortisation of €30.3m, finance costs of €24.8m and other net expense items amounting to €3.4m, the Group is projected to report a loss before taxation of €47.5m compared to €90.4m in the prior year.

- Total assets in FY2021 are projected to amount to €1,569m, an increase of €25m from a year earlier.

- Property, plant and equipment is projected to increase by €80.8m while cash and cash equivalents are projected to decrease by €9.3m from €51.8m in FY2020.

- Total liabilities are projected to increase by €45.1m leading to an increase in the gearing ratio of the Group from 42% in FY2020 to 45%.

- The liquidity ratio is expected to remain relatively stable at 0.95 times compared to 0.92 times in FY2020.

- The equity was not active during the week.

- The MSE MGS Total Return Index recorded a further decline of 0.4%, reaching 1,103.40 points. All 12 active issues closed in negative territory. The 2.4% MGS 2041 (I) registered the largest decline in price of 4.5%, as it closed at €119.81.

- The MSE Corporate Bonds Total Return Index managed to recover, as it closed 0.1% higher at 1,119.56 points. Out of 28 active issues, 11 headed north while another six closed in the opposite direction. The 6% International Hotel Investments plc € 2024 registered the best performance, as it closed 2.9% higher at €105.00. Conversely, the 3.75% Bortex Group Finance plc Unsecured € 2027 closed 1.5% lower at €99.50.

- In the Prospects MTF market, five issues were active. The 5% HH Finance Plc Unsecured Euro Bonds 2023-2028 was the most liquid, as it generated a total weekly turnover of €11,343.

| Upcoming Events | ||||

| Best Performers: | ||||

| 1. MDI | +15.68% | |||

| 2. MLT | + 3.61% | |||

| 15 JUL 2021 | MT: FIMBank plc – Annual General Meeting | 3. HSB | + 1.27% | |

| 15 JUL 2021 | MT: Malta Properties Company plc – Annual General Meeting | |||

| 28 JUL 2021 | MT: Mapfre Middlesea plc – Half-Year Results | Worst Performers: | ||

| 1. SFC | -5.17% | |||

| 2. BMIT | -2.04% | |||

| 3. LOM | -1.58% | |||

| Price (€): 02.07.2021 | Price (€): 25.06.2021 | Weekly Change (%) | 2021 Performance (%) | |

| MSE Equity Total Return Index | 8,040.399 | 8,036.058 | 0.05 | -5.09 |

| BMIT Technologies plc | 0.480 | 0.500 | -2.04 | -0.42 |

|---|---|---|---|---|

| Bank of Valletta plc | 0.900 | 0.895 | 0.56 | -5.26 |

| FIMBank plc (USD) | 0.320 | 0.320 | 0.00 | -36.00 |

| Grand Harbour Marina plc | 0.660 | 0.660 | 0.00 | -5.71 |

| GO plc | 3.360 | 3.360 | 0.00 | -5.09 |

| Harvest Technology plc | 1.530 | 1.530 | 0.00 | 3.38 |

| HSBC Bank Malta plc | 0.800 | 0.790 | 1.27 | -11.11 |

| International Hotel Investments plc | 0.650 | 0.650 | 0.00 | -9.72 |

| Lombard Bank plc | 1.870 | 1.900 | -1.58 | -20.76 |

| Loqus Holdings plc | 0.097 | 0.097 | 0.00 | -2.02 |

| LifeStar Insurance plc** | 0.540 | 0.540 | 0.00 | 0.00 |

| LifeStar Holding plc | 0.600 | 0.600 | 0.00 | 20.00 |

| MIDI plc | 0.428 | 0.370 | 15.68 | -4.46 |

| Medserv plc | 0.750 | 0.750 | 0.00 | -5.06 |

| Malta International Airport plc | 6.400 | 6.350 | 0.78 | 3.23 |

| Malita Investments plc | 0.860 | 0.830 | 3.61 | -4.44 |

| Mapfre Middlesea plc | 2.140 | 2.140 | 0.00 | -13.01 |

| Malta Properties Company plc | 0.540 | 0.540 | 0.00 | 8.00 |

| Main Street Complex plc | 0.488 | 0.488 | 0.00 | -2.40 |

| MaltaPost plc | 1.200 | 1.200 | 0.00 | -9.77 |

| PG plc | 2.240 | 2.260 | -0.88 | 12.00 |

| Plaza Centres plc | 0.850 | 0.850 | 0.00 | -13.27 |

| RS2 Software plc Preference Shares* | 1.860 | 1.860 | 0.00 | 6.29 |

| RS2 Software plc | 1.900 | 1.920 | -1.04 | -5.00 |

| Simonds Farsons Cisk plc | 8.250 | 8.700 | -5.17 | 5.77 |

| Santumas Shareholdings plc | 1.390 | 1.390 | 0.00 | 0.00 |

| Tigné Mall plc | 0.750 | 0.750 | 0.00 | -11.77 |

| Trident Estates plc | 1.480 | 1.480 | 0.00 | -10.84 |

* Trading commenced on May 3, 2021

** Trading commenced on June 3, 2021.

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]