MSE Trading Report for Week ending 9 July 2021

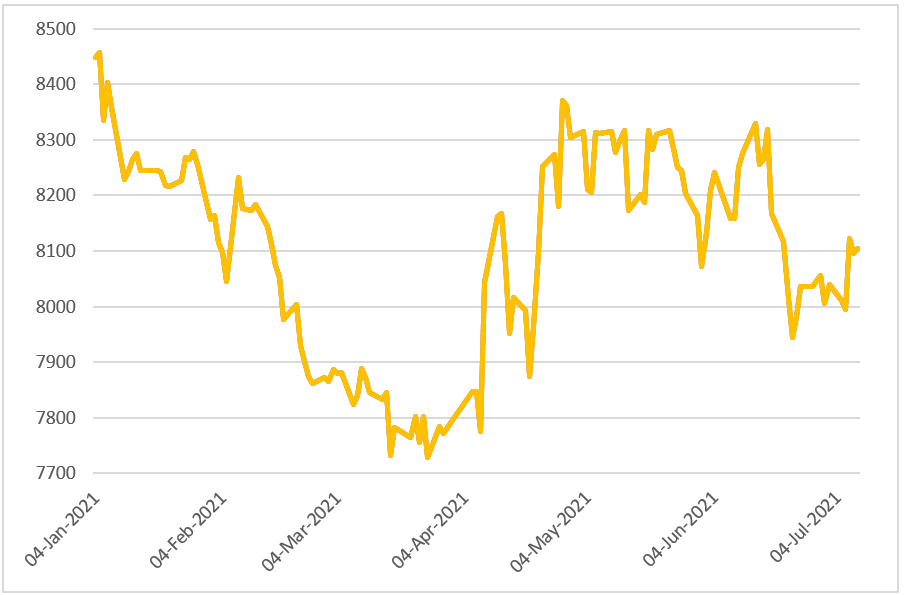

| MSE Equity Total Return Index: |

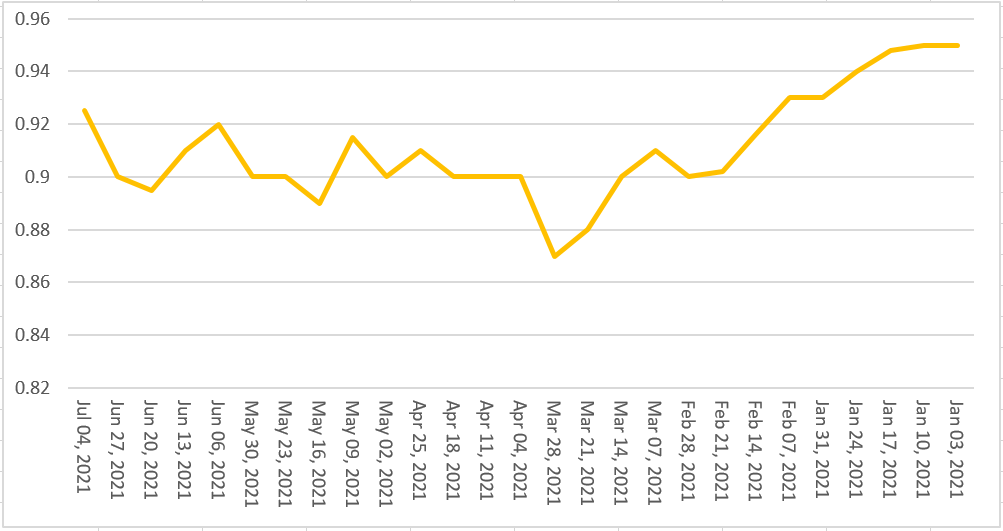

| Chart of the Week: Bank of Valletta plc |

| Highlights: |

- The MSE Equity Total Return Index climbed a further 0.8%, as it closed at 8,103.894 points. A total of 18 equities were active, of which nine closed in the green, while six closed in the opposite direction. Total weekly turnover increased by 70%, as it reached €1.53m – generated across 116 transactions.

- Over the past week, RS2 Software plc was the most liquid equity with 637,506 shares changing hands, worth approximately €1.09m. The equity continued to experience a high level of volatility, reaching a weekly low price of €1.71 during Thursday’s session, but managed to regain 0.58% yesterday to close at €1.72 – a week-on-week drop of 9.5%. Similarly, a decline of 3.2% was recorded in the company’s preference shares, having closed at €1.80 on a mere volume worth just €90.

- Looking at the banking industry, Bank of Valletta plc started off the week flat but managed to gain 2.8%, to close at €0.925. A total of five deals involving 16,136 shares were executed.

- Its peer, HSBC Bank Malta plc was slightly more liquid with 32,666 shares changing ownership across five transactions. The equity ended the week 3.8% higher, at €0.83.

- Malta International Airport plc (MIA) shares declined by 0.8% or €0.05, as the equity failed to hold on to last week’s closing price of €6.40. Trading was spread across four trading sessions as €50,000 worth of shares were traded.

Last Wednesday, MIA published the traffic results for the month of June. The anticipated reopening of tourism welcomed 190,505 passengers by the end of the month. This figure marks an improvement over the traffic handled in the previous months but translates into a drop of nearly 74% compared to June 2019.

Last month’s top drivers of passenger traffic were Italy, Germany, France, Poland, and Spain, with the Spanish market making a comeback among Malta International Airport’s five most popular destinations following the resumption of flights to Valencia and Seville in June.

A survey conducted by the European Travel Commission in May 2021 revealed that surveyed Europeans who were planning to travel in summer showed a preference for Southern European destinations including Spain, Italy, France, and Greece.

- Mapfre Middlesea plc ended the week in the green, with a 12.2% week-on-week increase. A total weekly turnover of €18,784 was spread over eight deals involving 7,898 shares. The equity closed at a year-to-date high of €2.40.

- In the IT sector, BMIT Technologies plc (BMIT) shares jumped by 4.2% as yesterday’s final deal in the closing minutes, was executed at €0.50. During the week, a total of 54,200 BMIT shares changed ownership across seven transactions.

- GO plc (GO) was the second most liquid equity, as 11 deals worth nearly €192,000 were executed. The equity traded between a weekly low of €3.30 and a high of €3.36 – the week’s closing price. As a result, GO shares closed the week flat. Trading activity took place in the opening three sessions, while no trades were recorded on Thursday and yesterday. GO shares are down by 5% since the beginning of the year.

- In the hospitality sector International Hotel Investments plc (IHI) shares gained 1.5%, to end the week at €0.66. Four deals worth €7,700 shares were recorded.

- Simonds Farsons Cisk plc shares gained 3%, or €0.25, as two deals were executed at €8.50, worth just €5,200. Meanwhile, PG plc shares gained 1%, as two trades worth €24,600 were recorded. Last Tuesday PG plc held a meeting where the Board of Directors of the company resolved to distribute a net interim dividend of €3.2m, equivalent to a net dividend of €0.02963 per ordinary share. This dividend will be paid on July 19, 2021 to the ordinary shareholders who are on the Company’s shareholders’ register as at the close of business on July 13, 2021.

- In the property sector, Trident Estates plc gained 1.35% to finish the week at €1.50, after trading at a weekly high of €1.54. Two deals of €4,300 shares were executed. Similar trading value took place in Tigne’ Mall plc shares, as one deal was executed at €0.75. Meanwhile, MIDI plc shares lost 0.5%, as the equity closed at €0.426, having recovered from a weekly low of €0.394. Malita Investments plc lost 1.7%, or €0.015, ending the week at the €0.845 price mark. Three deals of 27,000 shares were executed.

- The MSE MGS Total Return Index gained 0.3%, reaching 1,106.31 points. Out of 18 active issues, nine headed north, while a further nine headed in the opposite direction. The 2.1% MGS 2039 (I) registered a 3.8% gain, as it closed at €120. On the other hand, the 4.8% MGS 2028 (I) suffered the biggest decline, with a drop of 0.87%.

- The MSE Corporate Bonds Total Return Index ended the week marginally lower at 1,119.328 points. Out of 23 active issues, 14 had a positive performance, while another nine closed in the opposite direction. The 5.1% 1923 Investments plc Unsecured € 2024 registered the best performance, as it closed 2% higher at €103.50. Conversely, the 4% International Hotel Investments plc Unsecured € 2026 closed 2.2% lower at €99.26.

- In the Prospects MTF market, 10 issues were active. The 5% FES Finance plc Unsecured Euro Bonds 2023-2028 was the most liquid, as it generated a total weekly turnover of €70,000.

| Upcoming Events | ||||

| Best Performers: | ||||

| 15 JUL 2021 | MT: FIMBank plc – Annual General Meeting | 1. MMS | +12.15% | |

| 2. BMIT | + 4.17% | |||

| 15 JUL 2021 | MT: Malta Properties Company plc – Annual General Meeting | 3. HSB | + 3.75% | |

| 19 JUL 2021 | MT: PG plc Dividend Distribution | Worst Performers: | ||

| 1. RS2 | -9.47% | |||

| 28 JUL 2021 | MT: Mapfre Middlesea plc – Half-Year Results | 2. RS2P | -3.23% | |

| 3. HRV | -1.96% | |||

| Price (€): 09.07.2021 | Price (€): 02.07.2021 | Weekly Change (%) | 2021 Performance (%) | |

| MSE Equity Total Return Index | 8,103.894 | 8,040.399 | 0.79 | -4.34 |

| BMIT Technologies plc | 0.500 | 0.480 | 4.17 | 3.73 |

|---|---|---|---|---|

| Bank of Valletta plc | 0.925 | 0.900 | 2.78 | -2.63 |

| FIMBank plc (USD) | 0.320 | 0.320 | 0.00 | -36.00 |

| Grand Harbour Marina plc | 0.660 | 0.660 | 0.00 | -5.71 |

| GO plc | 3.360 | 3.360 | 0.00 | -5.08 |

| Harvest Technology plc | 1.500 | 1.530 | -1.96 | 1.35 |

| HSBC Bank Malta plc | 0.830 | 0.800 | 3.75 | -7.78 |

| International Hotel Investments plc | 0.660 | 0.650 | 1.54 | -8.33 |

| Lombard Bank plc | 1.870 | 1.870 | 0.00 | -20.76 |

| Loqus Holdings plc | 0.097 | 0.097 | 0.00 | -2.02 |

| LifeStar Insurance plc** | 0.540 | 0.540 | 0.00 | 0.00 |

| LifeStar Holding plc | 0.600 | 0.600 | 0.00 | 20.00 |

| MIDI plc | 0.426 | 0.428 | -0.47 | -4.91 |

| Medserv plc | 0.750 | 0.750 | 0.00 | -5.06 |

| Malta International Airport plc | 6.350 | 6.400 | -0.78 | 2.42 |

| Malita Investments plc | 0.845 | 0.860 | -1.74 | -6.11 |

| Mapfre Middlesea plc | 2.400 | 2.140 | 12.15 | -2.44 |

| Malta Properties Company plc | 0.540 | 0.540 | 0.00 | 8.00 |

| Main Street Complex plc | 0.488 | 0.488 | 0.00 | -2.40 |

| MaltaPost plc | 1.240 | 1.200 | 3.33 | -6.77 |

| PG plc | 2.260 | 2.240 | 0.89 | 13.00 |

| Plaza Centres plc | 0.850 | 0.850 | 0.00 | -13.27 |

| RS2 Software plc Preference Shares* | 1.800 | 1.860 | -3.23 | 2.86 |

| RS2 Software plc | 1.720 | 1.900 | -9.47 | -14.00 |

| Simonds Farsons Cisk plc | 8.500 | 8.250 | 3.03 | 8.97 |

| Santumas Shareholdings plc | 1.390 | 1.390 | 0.00 | 0.00 |

| Tigné Mall plc | 0.750 | 0.750 | 0.00 | -11.76 |

| Trident Estates plc | 1.500 | 1.480 | 1.35 | -9.64 |

* Trading commenced on May 3, 2021

** Trading commenced on June 3, 2021.

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]