MSE Trading Report for Week ending 6 August 2021

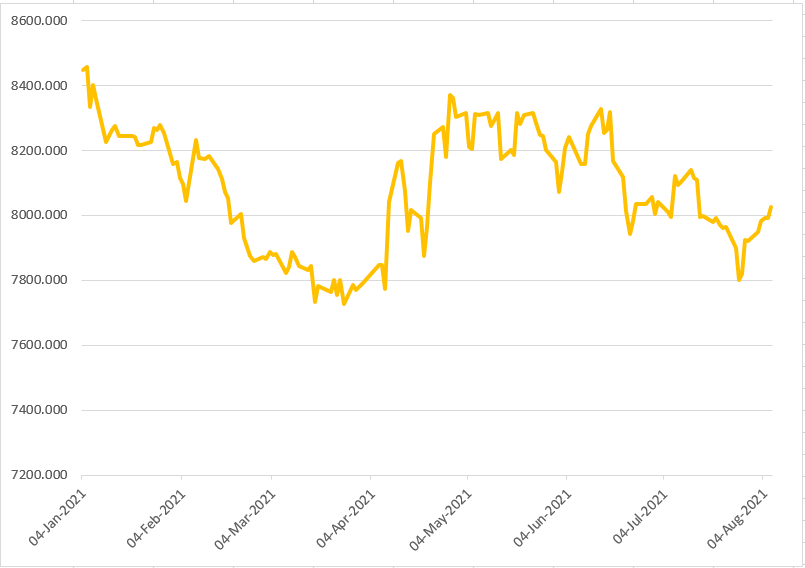

| MSE Equity Total Return Index: |

| Highlights: |

- The MSE Equity Total Return Index (MSE) closed the week in the green, with a 1.3% increase to finish at 8,025.668 points. Strong gains by HSBC Bank Malta plc (HSBC), GO plc and Malta International Airport plc (MIA) pushed the equity index higher. Total weekly turnover dropped to €0.3m. Nineteen equities were active, 11 of which gained, five declined, while three remained unchanged.

- Following positive results published by HSBC on Monday, the bank’s equity trended higher to end the week at the €0.83 price level, a week-on-week increase of 5.1%. Trading value reached €17,967.

- Last Monday, HSBC approved the Group’s and the Bank’s interim condensed financial statements for the six-month period ended June 30, 2021. Profit before tax increased by €15.6m to €17.5m due to positive performance reported by the life insurance subsidiary and lower expected credit losses booked in relation to the bank’s lending portfolio. Favourable market movements impacting the life insurance subsidiary increased the bank’s revenue by 16%. Furthermore, company costs increased by €1.1m during the first six months, when compared to the same period last year.

- Expected credit losses decreased by €6.8m to €1.9m, whilst customer deposits increased by €57m and the lending function of the bank decreased marginally by €8.9m. The company also announced that no interim dividend will be distributed.

- Looking at some important financial ratios, profit attributable to shareholders of €11.4m for the first six months resulted in a substantial increase in earnings per share of €0.032, compared with €0.003 in the same period in 2020. Return on equity increased to 4.7% for the six months ended June 30, 2021 compared with 0.5% for the same period in 2020.

- In the banking sector, Bank of Valletta plc (BOV) shares eased by 0.6%. The bank’s equity recorded 11 transactions of 39,592 shares, with a trading value of €35,470. BOV shares finished the week at €0.895 and is currently trading 5.8% lower on a year-to-date basis.

- Malta International Airport plc (MIA) gained 1.6% during the week, as 3,179 shares changed hands over three trades. MIA shares are also up 1.6% year-to-date.

- The equity of Simonds Farsons Cisk plc ended the week 0.6% higher. This increase resulted from 12 trades across 4,373 shares. The company’s shares closed the week at the €8.30 price level.

- GO plc advanced by 1.8% to close at a weekly high of €3.46. This increase resulted due to five trades involving 6,078 shares. The telecommunications company’s price dropped on Monday, but increases on Tuesday and Wednesday saw the equity’s performance turn positive for the week.

- RS2 Software plc (RS2) bounced back after last week’s dip. The company saw its shares increase by 2.3% to close the week at €1.76. The equity is down 12% on a year-to-date basis.

- RS2 announced that its board is scheduled to meet on August 17, 2021 to consider, and if thought fit, approve the Group’s and the Company’s condensed interim financial statements for the six-month period ended June 30, 2021.

- PG plc ended the week in the green, as the equity gained 1.9%. The retail conglomerate’s shares regained some of the loss experienced during last week’s trading sessions. The company’s shares are up by 10% since January.

- Tigné Mall plc shares gained 24% on low volumes during Friday’s session. Two transactions with a trading value of €3,750 were recorded.

- Last Thursday, the board considered and approved the unaudited condensed interim financial statements of the company for the first six months of the year. Despite a tough time due to Covid-19 restrictions imposed between March and April, the shopping mall still managed to register a profit after tax of €757,858. This profit represents a year-on-year increase of 2.8%, although when compared with 2019, the profit is still considerably lower.

- Over the first six months, revenue and earnings per share increased to €2.6m and €0.013 respectively. The directors also declared an interim net dividend payment of €378,929 equivalent to €0.0067 per share. The interim dividend will be paid on September 3, 2021 to shareholders on the Company’s register at close of business on August 20, 2021.

- The MSE MGS Total Return Index declined by 0.1%, to end the week at 1,116.226 points. The 2.3% MGS 2029 was the best performer, as it gained 2.9%, while the 2.1% MGS 2039 suffered the biggest decline, as it dropped by 4.9%.

- The MSE Corporate Bonds Total Return Index ended the week 0.1% higher at 1,140.242 points. The 4.35% Hudson Malta plc Unsecured € Bonds 2026 gained 2.5% and ended the week as the best performer. On the other hand, the 6% AX Investments plc € 2024 suffered the biggest drop, as it declined by 1.6%

- In the Prospects MTF market, activity was spread across six issues, as turnover amounted to €132,390. The 5% JD Capital plc € Unsecured Bonds 2028 was the most liquid, as weekly turnover reached over €52,000.

| Upcoming Events | ||||

| Best Performers: | ||||

| 6 AUG 2021 | MT: BMIT Technologies plc – Half-Yearly Results | 1. LQS | +56.80% | |

| 2. TML | +23.97% | |||

| 9 AUG 2021 | MT: GO plc – Half-Yearly Results | 3. MDI | +11.11% | |

| Worst Performers: | ||||

| 10 AUG 2021 | MT: Malta International Airport plc – Half-Yearly Results | 1. TRI | – 12.50% | |

| 2. MLT | – 1.83% | |||

| 3. LOM | – 1.08% | |||

| Price (€): 06.08.2021 | Price (€): 30.07.2021 | Weekly Change (%) | 2021 Performance (%) | |

| MSE Equity Total Return Index | 8,025.668 | 7,921.403 | 1.316 | -5.261 |

| BMIT Technologies plc | 0.496 | 0.490 | 1.22 | 2.91 |

|---|---|---|---|---|

| Bank of Valletta plc | 0.895 | 0.900 | -0.56 | -5.79 |

| FIMBank plc (USD) | 0.358 | 0.358 | 0.00 | -28.40 |

| Grand Harbour Marina plc | 0.600 | 0.600 | 0.00 | -14.29 |

| GO plc | 3.460 | 3.400 | 1.76 | -2.26 |

| Harvest Technology plc | 1.580 | 1.590 | -0.63 | 6.76 |

| HSBC Bank Malta plc | 0.830 | 0.790 | 5.06 | -7.78 |

| International Hotel Investments plc | 0.650 | 0.650 | 0.00 | -9.72 |

| Lombard Bank plc | 1.840 | 1.860 | -1.08 | -22.03 |

| Loqus Holdings plc | 0.098 | 0.063 | 56.80 | -1.01 |

| LifeStar Insurance plc | 0.540 | 0.540 | 0.00 | 0.00 |

| MIDI plc | 0.400 | 0.360 | 11.11 | -10.71 |

| Medserv plc | 0.750 | 0.750 | 0.00 | -5.06 |

| Malta International Airport plc | 6.300 | 6.200 | 1.61 | 1.61 |

| Malita Investments plc | 0.805 | 0.820 | 1.83 | -10.56 |

| Mapfre Middlesea plc | 2.120 | 2.120 | 0.00 | -13.82 |

| Malta Properties Company plc | 0.525 | 0.525 | 0.00 | 5.00 |

| Main Street Complex plc | 0.488 | 0.488 | 0.00 | -2.400 |

| MaltaPost plc | 1.240 | 1.240 | 0.00 | -6.77 |

| PG plc | 2.200 | 2.160 | 1.85 | 10.00 |

| Plaza Centres plc | 0.890 | 0.850 | 4.71 | -9.18 |

| RS2 Software plc Preference Shares | 1.800 | 1.800 | 0.00 | 2.86 |

| RS2 Software plc | 1.760 | 1.720 | 2.33 | -12.00 |

| Simonds Farsons Cisk plc | 8.300 | 8.250 | 0.61 | 6.41 |

| Santumas Shareholdings plc | 1.390 | 1.390 | 0.00 | 0.00 |

| Tigné Mall plc | 0.750 | 0.605 | 23.97 | -11.77 |

| Trident Estates plc | 1.400 | 1.600 | 12.50 | -15.66 |

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]