MSE Trading Report for Week ending 20 August 2021

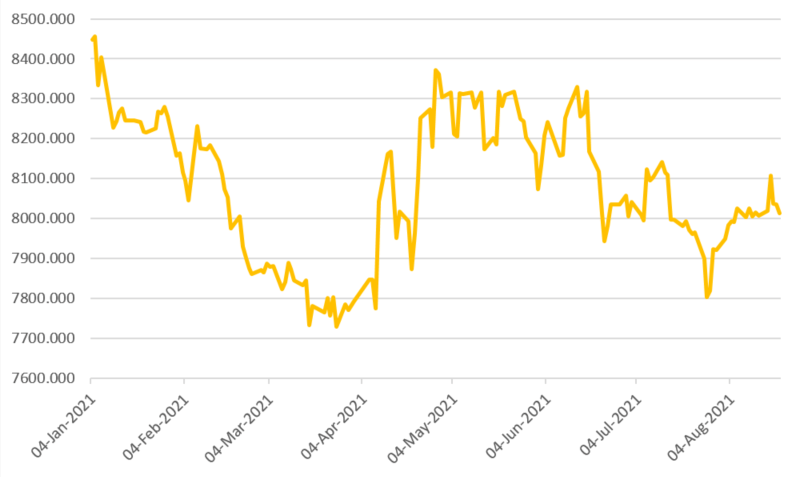

| MSE Equity Total Return Index: |

| Highlights: |

- The MSE Equity Total Return Index (MSE) closed the week marginally higher, with a 0.1% increase, to finish at 8,012.603. Gains in FIMBank plc, Bank of Valletta (BOV), Mapfre Middlesea plc and PG plc pushed the equity index higher. Total weekly turnover declined to €0.5m. Sixteen equities were active, as four gained, eight declined, while four remained unchanged.

- In the banking sector, BOV rebounded from last week’s loss, as it gained 0.6%. The bank’s equity recorded 15 trades of 83,189 shares, with a trading value of €74,556. BOV shares finished the week at the €0.895 price level, and is currently trading 5.8% lower since January.

- HSBC Bank Malta plc experienced a loss of 1.3%. This decline was a result of four trades involving 4,900 shares. The equity closed the week at the €0.79 price level and is down by 12.2% on a year-to-date basis.

- The share price of FIMBank plc jumped 11.7% on Tuesday. Four trades with a mere value of $2,997 pushed the equity’s price to $0.40. The equity did not trade for the rest of the week.

- Following last week’s price dip, GO plc closed flat at €3.40, as 11 trades with a trading value of €95,037 were recorded.

- BMIT Technologies plc saw its equity trend 2% lower over the past week, with a trading volume of 235,183 shares changing ownership. Total trading value tallied up to €114,666. The equity closed at the €0.48 price level.

- Harvest Technologies plc closed 4.5% lower, as two trades recorded late into Friday’s session dragged the share price lower to finish the week at €1.48.

- Two trades on Wednesday and Thursday saw RS2 Software plc (RS2) shares close unchanged at the €1.76 price level. Trading value for RS2 shares was €9,512.

- The board of RS2 approved the condensed interim financial statements for the period ended June 30, 2021. The company registered revenues from its principal activities of €12.1m compared to €10.1m during the same period last year and a profit before tax of €2.1m compared to €1.5m last year. On consolidating all of its activities, the Group generated revenues of €18.3m and registered a profit before tax of €2.8m against a loss before tax €3.1m last year. On the costs side, the Group saved on overheads and sales and marketing expenses. The directors decided not to distribute any dividends, as further investment will be done to enhance their business.

- PG plc climbed 3.6% during the week, with trades between Tuesday and Thursday ensuring that the company ended at the €2.28 price level. On a year-to-date basis, the equity is up by 14%.

- Trident Estates plc was amongst this week’s worst performers, as the equity experienced a drop of 5.7% with thin volumes being involved. The share price closed at the €1.48 price level. This price level represents a 10.8% decline on a year-to-date basis.

- The MSE MGS Total Return Index declined by 0.2%, to end the week at 1,112.145 points. No government bonds experienced an increase in their price over the past week, while on the downside, the 5.2% MGS 2031 (I) suffered the biggest decline, as it dropped by 1% to end the week at €146.53.

- The MSE Corporate Bonds Total Return Index ended the week 0.3% lower at 1,143.365 points. The 4.25% Mercury Projects Finance plc Secured 2031 gained 2.5% and ended the week as the best performer at the €104 price level. On the other hand, the 4.65% Smartcare Finance plc Secured Bonds 2031 suffered the biggest drop, as it declined by 4.6% to close at €101.02.

- In the Prospects MTF market, activity was spread across 12 issues, as turnover amounted to €195,736. The 5% Luxury Living Finance plc € Secured Bonds 2028 was the most liquid, as weekly turnover reached €65,000 over four transactions and closed at €100.

| Upcoming Events | ||||

| Best Performers: | ||||

| 23 AUG 2021 | MT: Malita Investments plc – Half Yearly Results | 1. FIM | +11.73% | |

| 2. PG | +3.64% | |||

| 25 AUG 2021 | MT: PG plc – Half Yearly Results | 3. BOV | +0.56% | |

| 31 AUG 2021 | MT: International Hotel Investments plc – Half Yearly Results | Worst Performers: | ||

| 1. LSI | -7.41% | |||

| 2. TRI | -5.73% | |||

| 3. HRV | -4.52% | |||

| Price (€): 20.08.2021 | Price (€): 13.08.2021 | Weekly Change (%) | 2021 Performance (%) | |

| MSE Equity Total Return Index | 8,012.603 | 8,007.572 | 0.06 | -5.42 |

| BMIT Technologies plc | 0.480 | 0.490 | -2.04 | -0.42 |

|---|---|---|---|---|

| Bank of Valletta plc | 0.895 | 0.890 | 0.56 | -5.79 |

| FIMBank plc (USD) | 0.400 | 0.358 | 11.73 | -20.00 |

| Grand Harbour Marina plc | 0.600 | 0.600 | 0.00 | -14.29 |

| GO plc | 3.400 | 3.400 | 0.00 | -3.96 |

| Harvest Technology plc | 1.480 | 1.550 | -4.52 | 0.00 |

| HSBC Bank Malta plc | 0.790 | 0.800 | -1.25 | -12.22 |

| International Hotel Investments plc | 0.650 | 0.650 | 0.00 | -9.72 |

| Lombard Bank plc | 1.870 | 1.870 | 0.00 | -20.76 |

| Loqus Holdings plc | 0.098 | 0.098 | 0.00 | -1.01 |

| LifeStar Insurance plc | 0.500 | 0.540 | -7.41 | -7.41 |

| MIDI plc | 0.414 | 0.414 | 0.00 | -7.59 |

| Medserv plc | 0.750 | 0.750 | 0.00 | -5.06 |

| Malta International Airport plc | 6.00 | 6.250 | -4.00 | -3.23 |

| Malita Investments plc | 0.830 | 0.830 | 0.00 | -7.78 |

| Mapfre Middlesea plc | 2.140 | 2.120 | 0.94 | -13.01 |

| Malta Properties Company plc | 0.530 | 0.550 | -3.64 | 6.00 |

| Main Street Complex plc | 0.488 | 0.488 | 0.00 | -2.40 |

| MaltaPost plc | 1.240 | 1.240 | 0.00 | -6.77 |

| PG plc | 2.280 | 2.200 | 3.64 | 14.00 |

| Plaza Centres plc | 0.860 | 0.900 | -4.44 | -12.25 |

| RS2 Software plc Preference Shares | 1.800 | 1.800 | 0.00 | 2.86 |

| RS2 Software plc | 1.760 | 1.760 | 0.00 | -12.00 |

| Simonds Farsons Cisk plc | 8.500 | 8.500 | 0.00 | 8.97 |

| Santumas Shareholdings plc | 0.750 | 0.750 | 0.00 | -46.04 |

| Tigné Mall plc | 0.750 | 0.750 | 0.00 | -11.77 |

| Trident Estates plc | 1.480 | 1.570 | -5.73 | -10.84 |

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]