MSE Trading Report for Week ending 27 August 2021

| MSE Equity Total Return Index: |

| Highlights: |

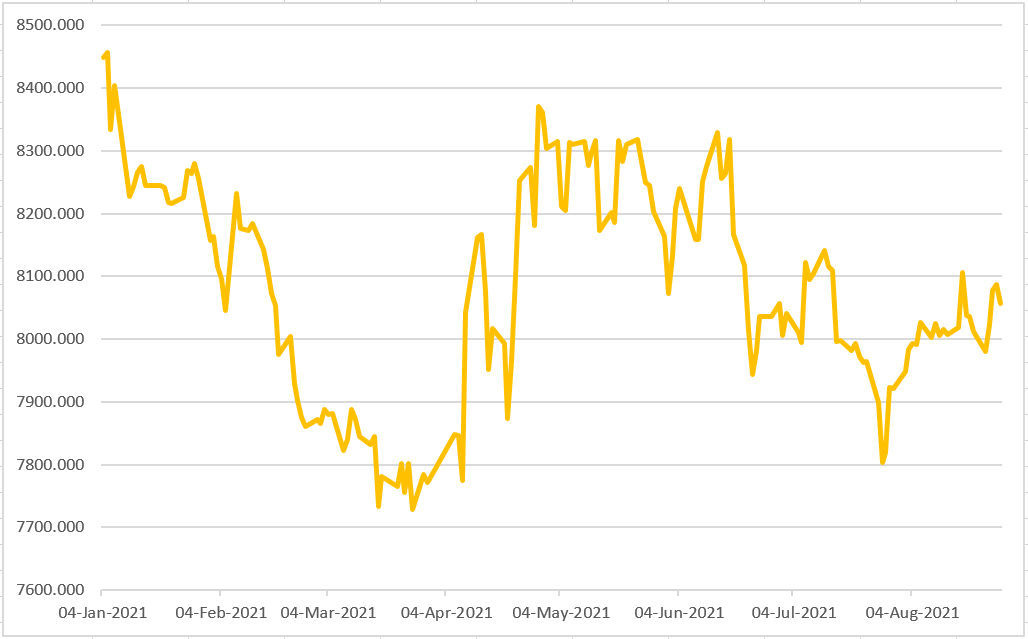

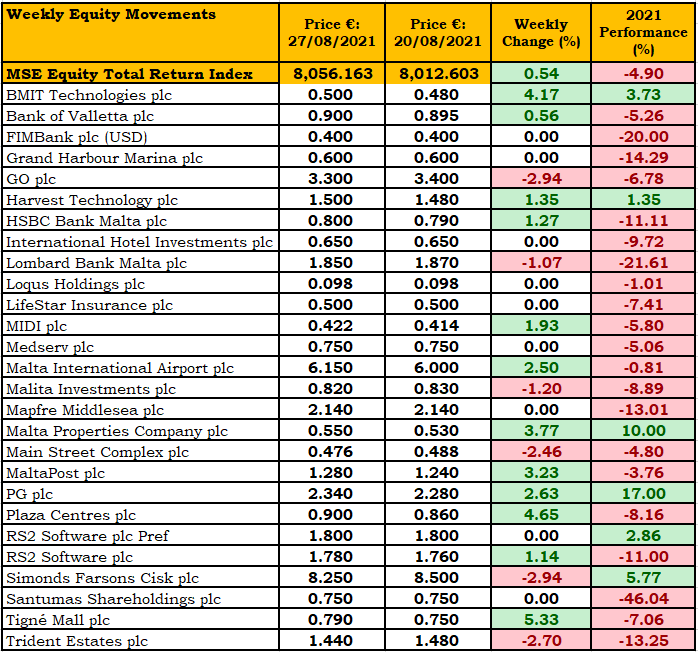

- The MSE Equity Total Return Index (MSE) added another 0.5%, to end the final full week of August at 8,056.163 points. Sentiment was generally positive, as 12 equities moved higher while the MSE turned negative yesterday following three days of gains. Among the large caps, Malta International Airport plc (MIA) was the best performer while several property companies posted noteworthy gains. Likewise, equities in the IT sector headed higher. Following this week’s gain, the year-to-date loss on the MSE is just shy of 5%.

- In the banking sector, HSBC Bank Malta plc (HSBC) shares gained 1.3%, as the banking equity closed at €0.80. During the week 11 trades worth nearly €25,000 were executed. The share price of HSBC is still down by 11% since the beginning of the year.

- Bank of Valletta plc gained another 0.6%, to end the week at €0.90 on improved demand, as trading volume increased to just over 145,000 shares up from 83,000 shares last week. The equity’s price traded between a weekly low of €0.895 and a high of €0.915.

- Lombard Bank Malta plc shares closed the week 1% lower at €1.85, as two thin trades were executed. Last Thursday, the bank announced the half-yearly results for 2021, during which the banking group recorded a profit before tax of €5.4m, compared to €5m during the same period last year. The Group’s operating income increased to €32.7m up from €29m the previous year, while the bank’s cost-to-income ratio stood at 60.2%. Meanwhile, customer deposits increased to €982.5m while loans and advances to customer increased to €644.3m.

- In the IT sector, BMIT Technologies plc shares closed the week 4.2% higher at €0.50, as the equity finished three trading sessions higher while it shed 0.8% mid-week. Trading volume declined to 137,000 shares from 235,200 shares last week.

- In the same sector, Harvest Technology plc gained 1.4% to return to the €1.50 level. One transaction worth €5,000 was recorded.

- RS2 Software plc (RS2) shares closed higher by 1% at €1.78 while the week’s first trade was executed at last week’s close of €1.76. During the week 6,000 RS2 shares were traded over two deals.

- GO plc shares turned negative, as the telecoms company ended the week 3% lower at €3.30, as it failed to hold on to the weekly high of €3.40. Twelve deals worth €95,000 were executed.

- MIA shares gained 2.5% following a 4% decline last week. The equity’s price traded between a weekly high of €6.30 and a low of €6.15, this week’s closing price. A total of 8,400 shares changed hands over six transactions.

- Meanwhile, Simonds Farsons Cisk plc shed nearly 3% or €0.25, as the share price of the equity settled at €8.25, after trading at a weekly high of €8.40 on Thursday. Since the beginning of the year, the share price of the equity is up by nearly 6%.

- The board of Simonds Farsons Cisk plc announced that they will be meeting on September 29, 2021 to consider and approve the group’s and company’s interim accounts for the half-year ended July 31, 2021. Furthermore, the board will also consider the distribution of an interim dividend on all ordinary shares.

- PG plc shares jumped by 2.6%, after positive half-yearly results were announced during Wednesday’s trading session. The news sent the equity nearly 2% higher while an additional 1% gain was added on Thursday, to end the week at €2.34. A total of 14,500 shares changed ownership over seven deals.

- The board of PG plc approved for publication its Annual Report and the audited consolidated financial statements for the year ended April 30, 2021 and resolved to propose the same for the approval of the shareholders at the upcoming AGM to be held on October 21, 2021.

- Turnover for the year ended April 30, 2021 amounted to €129.5m – up from €120m last year, representing a growth of 7.9%. Overall gross profit percentages decreased marginally from 15.7% in 2020 to 15.4%. This reduction reflected the rental waivers and a reduction in franchise operations in-store sales, that typically carry higher margins. The profit after taxation for the year under review amounted to €10.6m, an increase of 9.4% over the 2020 comparative of €9.7m. The Group generated a net cash flow from operating activities of €13.1m, compared to €15.5m in 2020, while equity increased by 13.3% to €49m.

- PG plc shares are up by 17% since the beginning of the year.

- In the Corporate Bond Market, 43 bond issues were active as 168 trades worth nearly €2m were executed. The short-dated 6% Pendergardens Developments plc Secured € 2022 Series II was the most active issue, as five deals worth €335,000 were executed, to close at €101.51. The 5% Mediterranean Investments Holding plc Unsecured € 2022 followed, as 12 transactions worth €215,000 were recorded. The recently issued 3.5% GO plc Unsecured € Bonds 2031 closed the week at €104.50, as 170,000 nominal changed hands. On the week the MSE Corporate Bonds Total Return Index gained 0.6%.

- In the Sovereign Debt Market turnover reached €1.1m over 47 deals. The 4.5% MGS 2028 was the most liquid issue, as six deals worth €0.3m were traded. The MSE MGS Total Return Index shed 1% on the week.

- In the Prospects MTF market activity was spread across seven issues, as turnover reached €60,000. The 4.875% AgriHoldings Plc Senior Secured € 2024 was the most traded, as the issue closed at €100.50.

| Upcoming Events | ||||

| Best Performers: | ||||

| 30 AUG 2021 | MT: MIDI plc – Half Yearly Results | 1. TML | +5.33% | |

| 2. PZC | +4.65% | |||

| 31 AUG 2021 | MT: International Hotel Investments plc – Half Yearly Results | 3. BMIT | +4.17% | |

| Worst Performers: | ||||

| 31 AUG 2021 | MT: Santumas Shareholdings plc – Half Yearly Results | 1. SFC | -2.94% | |

| 2. GO | -2.94% | |||

| 3. TRI | -2.70% | |||

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]