MSE Trading Report for Week ending 10 September 2021

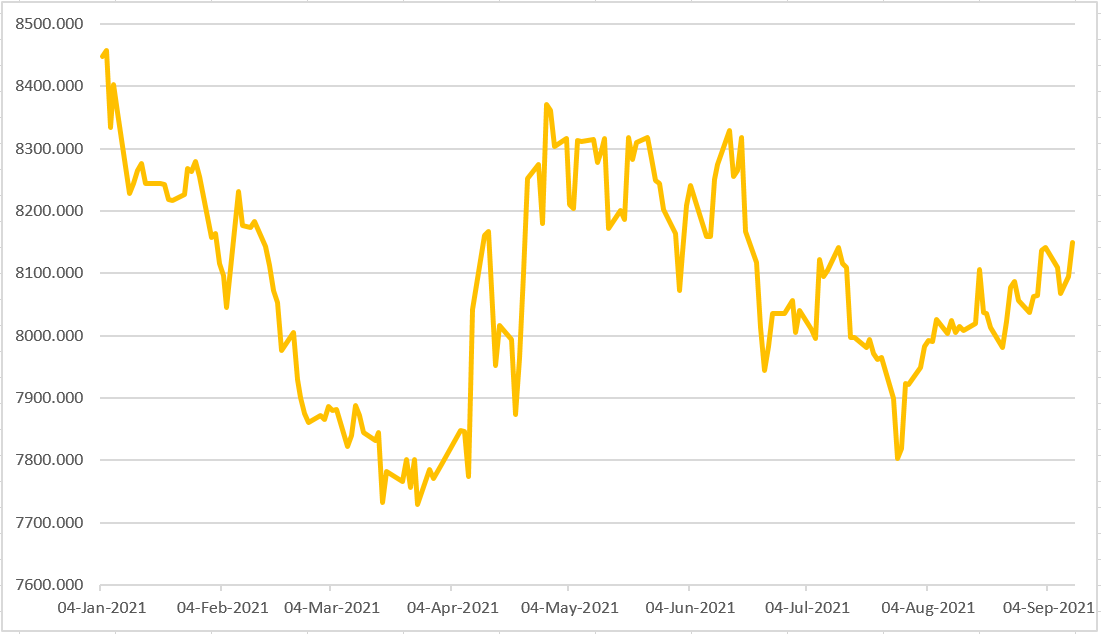

| MSE Equity Total Return Index: |

| Highlights: |

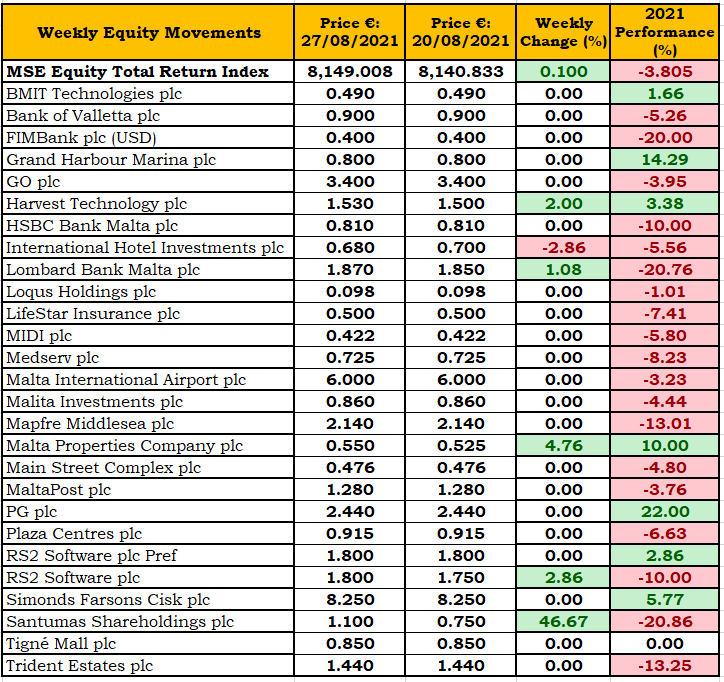

- The MSE Equity Total Return Index advanced by 0.1%, to end the second week of September at 8,149.008 points. Fourteen equities were active during this short trading week, in which overall turnover was less than €0.5m. Five equities gained in value, while another eight closed unchanged. The equities which closed in the green were; Lombard Bank Malta plc, RS2 Software plc, Santumas Shareholdings plc, Malta Properties Company plc and Harvest Technology plc.

- Santumas Shareholdings plc was the week’s top performer, as four deals worth a total of €17,000, yielded an increment of 46.7%, to close at €1.10.

- Meanwhile, Malta Properties Company plc, was also active on four separate occasions in which 9,100 shares changed hands. The equity closed the week at €0.55 – a gain of 4.8%.

- In the banking industry, Bank of Valletta plc was yet again the most liquid equity during this week’s trading sessions, accounting for almost a fourth of total trading value. Despite this, the equity closed the week unchanged at €0.90.

- Elsewhere, HSBC Bank Malta plc was active over three trades worth €4,605, but closed unchanged at €0.81.

- The only active equity in this industry to register a price fluctuation was Lombard Bank Malta plc. This equity featured in two trades worth a total of €32,351 and closed the week 1.1% in the green at €1.87.

- IT companies Harvest Technology plc and RS2 Software plc both had positive weekly performances. The former traded only once and saw 10,000 shares change ownership, while the latter registered a turnover of slightly less than €35,000 over six deals. The respective equity prices at the end of yesterday’s session read €1.53 and €1.80.

- International Hotel Investments plc was the sole equity to close the week in the red. Two deals worth a mere combined total of €677 resulted in a 2.9% drop in price, to close at €0.68

- Malta International Airport plc (MIA) shares were also active but registered no price fluctuations, as nine trades across 12,200 shares were recorded. The equity closed at €6. Yesterday the company announced that over 407,000 passengers travelled through MIA in August. This figure is equivalent to 50% of the traffic which the airport handled in August 2019. Every flight operated from MIA carried an average of 111 passengers, which is 28% lower than the average for August 2019 of 155 passengers. August’s traffic result was influenced by solid performance of markets such as France and Poland, while the United Kingdom outperformed Italy and regained the top spot after having last ranked first in April 2020.

- GO plc and BMIT Technologies plc both traded on 10 occasions but closed unchanged at €3.40 and €0.49, respectively. GO plc registered a turnover €98,760, while BMIT Technologies plc registered a turnover of €46,457.

- In the Corporate Bond Market, 44 bond issues were active as 165 trades worth nearly €1.7m were executed. The 3.8% Hili Finance Company plc Unsecured € 2029 was the most active issue, as 25 deals worth a staggering €373,100 were executed, to close at par. Another Hili Finance plc bond issuance followed suit, as the 3.85% Hili Finance Company plc Unsecured € 2028 registered a turnover of €96,146, to close at €101.01. On the week the MSE Corporate Bonds Total Return Index lost 0.25% to close at 1,146.90.

- In the Sovereign Debt Market turnover almost reached €1.81m over 40 deals. The 4.65% MGS 2032 was the most liquid issue, as five deals worth just less than €0.8m were traded. The MSE MGS Total Return Index declined by 0.06%, as it closed at 1,099.40.

- In the Prospects MTF market activity was spread across five issues, as turnover reached €61,308. The greatest turnover was registered in the 5% Luxury Living Finance plc € Secured Bonds 2028, as a singular deal of €30,300 was concluded. This issue closed at €101. On the other hand, the 5% FES Finance plc Secured € 2029 followed, as four deals were recorded, to close at €99.50.

| Upcoming Events | ||||

| Best Performers: | ||||

| 22 SEP 2021 | MT: Trident Estates plc – Half Yearly Results | 1. STS | +46.67% | |

| 2. MPC | +4.76% | |||

| 29 SEP 2021 | MT: Simonds Farsons Cisk plc – Half Yearly Results | 3. RS2 | +2.86% | |

| Worst Performers: | ||||

| 1. IHI | -2.86% | |||

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]