MSE Trading Report for Week ending 24 September 2021

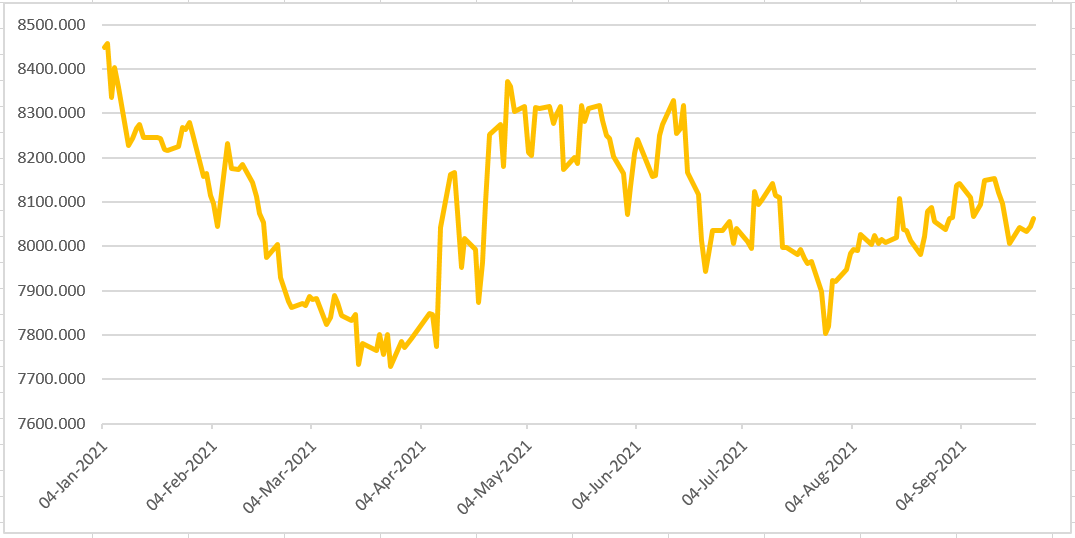

| MSE Equity Total Return Index: |

| Highlights: |

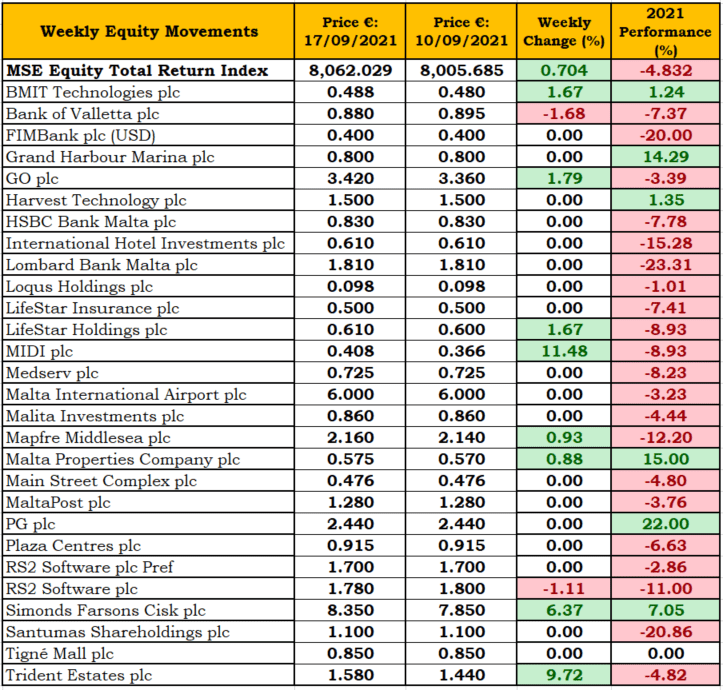

- The MSE Equity Total Return Index gained 0.7% and closed at 8,062.029 points. Fifteen equities were active, as two equities declined and eight gained. The rise in the equity index was mainly due to strong trading performance by MIDI plc, Simonds Farsons Cisk plc, and GO plc. Several other equities helped push the equity index higher.

- MIDI plc was this week’s best performing equity up by 11.5%, as two trades with a trading value of €2,024 during Monday’s trading session were recorded. The equity did not trade for the rest of the week and closed at €0.408.

- Bank of Valletta plc (BOV) shed 1.7% to close at the €0.88 price level. The bank’s equity was involved in 11 trades across 95,829 shares. BOV’s current price level is 7.4% lower on a year-to-date basis.

- GO plc jumped by 1.8%, as eight trades with a total trading value of €12,253 ensured that the shares of the telecommunications company closed the week in the green, at €3.42.

- BMIT Technologies plc saw its shares increase by 1.7% during Thursday’s trading session. The equity closed at €0.488, as 170,100 shares changed ownership over six trades.

- RS2 Software plc trended 1.1% lower during the week, as four trades involving 4,092 shares were recorded. The company’s share price ended the week at €1.78 and as a result is trading 11% lower on a year-to-date basis.

- The price of Simonds Farsons Cisk plc advanced 6.4%, as 10 trades across 2,725 shares were recorded. The food and beverage company closed the week at €8.35.

- Trident Estates plc was one of this week’s best performing equities, as two mere trades with a total trading value of €2,630 pushed the equity to the €1.58 price level, a week-on-week increase of 9.7%.

- During this week, the board of Trident Estates plc approved for publication the unaudited financial statements for the six months ended July 31,2021. The group recorded revenue of €544,000 as compared to €562,000 in the same period last year. The decrease in revenue resulted due to the early termination of a lease in January 2021, on which discussions with potential tenants are under way. As a result of the reduction in revenue, gross profit decreased to €506,000 from €525,000 in 2020.

- The Group registered an increase in its administrative costs, which totalled €389,000 up from €317,000 during the same period last year. Whilst the day-to-day operational costs remained stable, the increase in expenses emanated from marketing costs being incurred for the Trident Park project, together with costs which were previously being capitalised during the early construction period and which are now being recognised in the statement of profit or loss. The Group’s tax expense during this period amounted to €54,000. The resulting net loss for the period amounted to €28,000, as compared to a net loss of €5,000 in the prior period. The board did not propose the payment of an interim dividend.

- The MSE MGS Total Return Index declined by 0.1%, to end the week at 1,102.299 points. The best performing government stock was the 3.3% MGS 2024 (I) which experienced an increase of 1% in its price over the past week, to end at €111.12. On the downside, the 5.1% MGS 2029 (I) suffered the biggest decline, as it dropped by 1.2% to end the week at €137.95.

- The MSE Corporate Bonds Total Return Index ended the week 0.1% higher at 1,151.313 points. The 4.25% Mercury Projects Finance plc Secured 2031 ended the week as the best performer, gaining 1.7% to close at the €104.70 price level. On the other hand, the 4.8% Mediterranean Maritime Hub Finance plc € 2026 suffered the biggest drop, as it declined by 2.1% to close at €101.75.

- In the Prospects MTF market, activity was spread across two issues, as turnover amounted to €49,580. The 5% Busy Bee Finance plc Unsecured € 2029 was the most liquid, as weekly turnover reached €42,580 as a result of three transactions and closed the week at €101.50.

| Upcoming Events | ||||

| Best Performers: | ||||

| 29 SEP 2021 | MT: Simonds Farsons Cisk plc – Half Yearly Results | 1. MDI | +11.48% | |

| 2. TRI | +9.72% | |||

| 3. SFC | +6.37 | |||

| Worst Performers: | ||||

| 1. BOV | -1.68% | |||

| 2. RS2 | -1.11% | |||

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]