MSE Trading Report for Week ending 1 October 2021

| MSE Equity Total Return Index: |

| Highlights: |

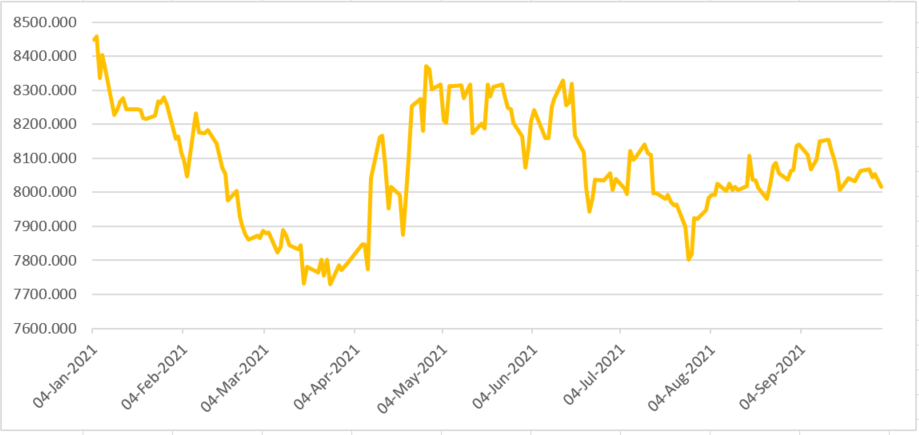

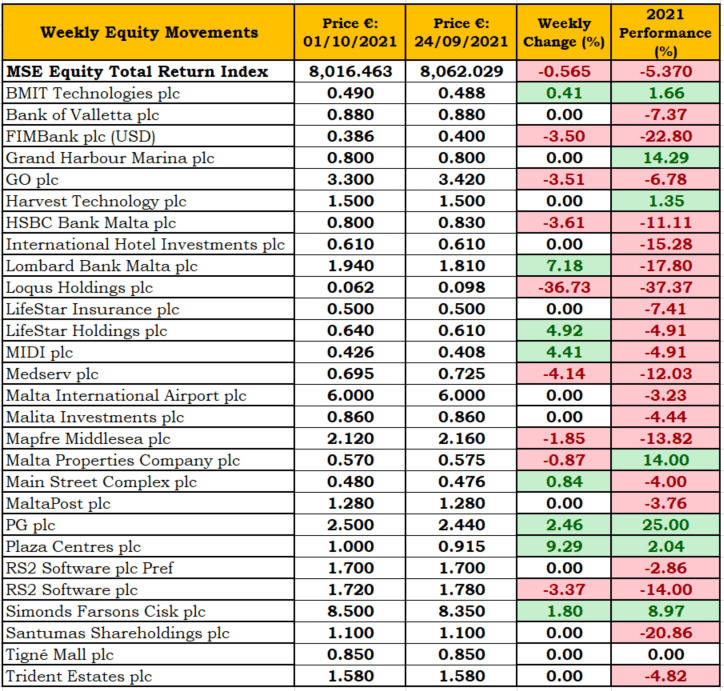

- The MSE Equity Total Return Index (MSE) experienced a drop of 0.6% during this week’s trading and closed at 8,016.463 points. Twenty-one equities were active, as eight increased, eight declined, while five closed unchanged. The drop in the MSE was mainly attributed to the declines experienced by HSBC Bank Malta plc (HSBC), GO plc, and RS2 Software plc (RS2) which are among the large caps. Since the beginning of the year the MSE is down by 5.4%.

- HSBC saw its shares slide, as three thin trades sent the equity lower to €0.80, a week-on-week decline of 3.6%. The banking equity traded at a weekly high of €0.83. HSBC is currently trading 11.1% lower on a year-to-date basis.

- In the telecommunications sector, GO plc shed 3.5%. The company saw its shares trade nine times across 6,949 shares to close the week at €3.30. On the contrary, its subsidiary BMIT Technologies plc recorded a gain of 0.4%. Trading volume reached 48,800 shares across four transactions, to finish at €0.49.

- On the positive side, this week’s best performing equity was Plaza Centres plc, as the share price of the shopping complex jumped 9.3% to close at the €1.00 price level. Four trades of 11,750 shares were executed.

- On Thursday, the board of the company announced that it has extended the offer to purchase its 3.9% unsecured bond until December 31, 2021 at a maximum price of €104.50 per bond.

- In the banking industry, Bank of Valletta plc closed flat at €0.88, after trading at a weekly high of €0.89. The bank’s equity was the most liquid, as 230,119 shares changed ownership over 17 trades worth over €202,000.

- Similarly, Lombard Bank plc experienced an increase of 7.2%, as four trades with a trading value of €17,827 pushed the bank’s equity price to the €1.94 price level.

- During the week, International Hotel Investments plc, Malta International Airport plc and Harvest Technology plc all closed unchanged at €0.61, €6.00 and €1.50 respectively.

- Following the publication of positive results, the shares of Simonds Farsons Cisk plc advanced 1.8% to €8.50, as four trades across 1,680 shares were recorded. The food and beverage manufacturing company is up 9% on a year-to-date basis.

- The board of Simonds Farsons Cisk plc approved the group’s unaudited financial statements and Interim Directors’ Report for the six months ended July 31, 2021. The Group registered a turnover of €41.6 million during the first six months of the current financial year, a 13% improvement over the same period of last year, during which turnover totalled €36.8 million. Increased turnover was experienced across all business sectors, being most pronounced in the franchised food operations, where almost all outlets were closed for much of the prior year period. Profit before tax for the period amounted to €5.2 million, compared with €1.6 million for the equivalent period last year, resulting from the improved operating margins. Earnings per share attributable to shareholders improved from €0.053c in the first half of financial year 2021 to €0.163c in the comparative period of financial year 2022.

- The board declared an interim dividend to shareholders from retained profits amounting to €1.5 million, equivalent to €0.05 per share, which dividend will be distributed on October 20, 2021 to the ordinary shareholders who will be on the register of members of the company as at October 6, 2021.

- PG plc shares increased 2.5% this week. The retail conglomerate’s equity was traded seven times across 7,519 shares. The company’s share price closed the week at €2.50.

- PG plc announced that the Annual General Meeting will be held remotely on October 21, 2021.

- Loqus Holdings plc was this week’s worst performing equity, as one small trade with a value of €115 across 1,847 shares on Friday dragged the price 36.7% lower to the €0.062 price level.

- Malta Properties Company plc’s board announced that its subsidiary BKE Property Company Limited entered into a promise of sale agreement to sell and transfer to Excel Investments plc a complex in the corner of Triq Salvu Psaila Street in Birkirkara. The consideration for the sale and purchase of the Property is €8 million.

- Last Tuesday, Mizzi Organisation Finance plc published a prospectus in relation to a new bond issue. The company aims to raise €45m through this bond which will carry a coupon of 3.65%. The bond matures in 2031 but can be called earlier as from 2028. The bond’s proceeds will be predominantly allocated towards refinancing some of the bank borrowings of Mizzi Organisation, a property development in Blata l-Bajda, where the company already has a presence, and the refurbishment of the Arkadia complex in Gozo. The bond issue will be available through an intermediaries’ offer and closes on Friday, October 8.

- The MSE MGS Total Return Index declined by 1%, to end the week at 1,091.805 points. The best performing government bond was the 2.1% MGS 2039 (I) which experienced an increase of 0.2% in its price over the past week, to end at €113.50. On the downside, the 5.25% MGS 2030 (I) suffered the biggest decline, as it dropped by 2.2% to end the week at €140.81.

- The MSE Corporate Bonds Total Return Index ended the week 0.04% higher at 1,151.774 points. The 4% MIDI plc Secured € 2026 ended the week as the best performer, gaining 1.9% to close at the €105 price level. On the other hand, the 4% Merkanti Holdings plc Secured € 2026 suffered the biggest drop, as it declined by 3.2% to close at €100.17.

- In the Prospects MTF market, activity was spread across four issues, as turnover amounted to €123,321. The 5% Busy Bee Finance plc Unsecured € 2029 was the most liquid, as weekly turnover reached €62,321 as a result of three transactions and closed the week at €101.50.

| Upcoming Events | ||||

| Best Performers: | ||||

| 20 October 2021 | MT: Simonds Farsons Cisk Dividend Distribution | 1. PZC | +9.29% | |

| 2. LOM | +7.18% | |||

| 3. LSH | +4.92% | |||

| Worst Performers: | ||||

| 1. LQS | -36.73% | |||

| 2. MDS | -4.14% | |||

| 3. HSB | -3.61% | |||

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]