MSE Trading Report for Week ending 23 December 2021

| MSE Equity Total Return Index: |

| Highlights: |

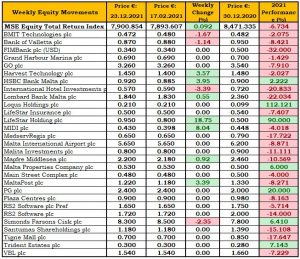

The Malta Stock Exchange (MSE) Equity Total Return Index closed the four-day trading week marginally higher, as the share prices of the two major banks moved in opposite direction. The local equities’ index closed at 7,900.854 points. Turnover increased to over €0.5m, as 17 equities were active.

In the banking sector, the share price of HSBC Bank Malta plc advanced by 4% to the €0.92 level. Earlier in the week HSBC shares traded at €0.85. A total of 68,130 shares were traded over 16 deals. On a year-to-date perspective, the equity is up by 2.2%.

Lombard Bank Malta plc also closed the week in positive territory, with a 0.6% gain to end the short trading week at the €1.84 price level. Seven trades of 6,165 shares were executed.

On the flip side, Bank of Valletta plc (BOV) failed to keep up with the performance of its peers. BOV shares turned negative on Wednesday, to end the week 1.1% lower at the €0.87 price level. A total of 103,447 shares were traded over 18 deals, with a turnover of €89,165.

Meanwhile, one trade of 500 shares in the final hours of trading on Thursday, sent the share price of LifeStar Holding plc higher by nearly 19%. The share price of the insurance provider traded between a weekly low of €0.80 and a high of €0.95, this week’s closing price.

On a similar note, six trades involving 10,627 Mapfre Middlesea plc shares, pushed the share price to the €2.20 level, hence 0.9% higher on the week.

Telecommunications company GO plc, closed the week unchanged at €3.26, as the equity failed to keep Monday’s gain and closed in negative territory on Wednesday. Eight deals involving 12,951 shares were executed.

PG plc was the most liquid equity, with a total turnover of €105,282. This was the result of seven transactions involving 43,849 trades. PG failed to hold on to an intra-week high of €2.42 and closed flat at €2.40.

Malta International Airport plc (MIA) closed flat at €5.65 after touching a weekly low of €5.60 on Monday, while it recovered during the week’s final trading session. A total of 2,357 MIA shares changed hands across six transactions.

In the IT sector, RS2 Software plc (RS2) Ordinary shares closed flat at the €1.72 level, after 9,200 shares exchanged hands across four transactions. This week RS2 updated the market with the group’s performance since the beginning of the year and expectations for the next financial year. In 2021, RS2 added new countries to its client base in both Asia Pacific (APAC) and Latin America (LATAM). In APAC, the group is engaged in deploying new customers on its cloud in Singapore, Indonesia and Australia, while in LATAM the group increased its customer base in Brazil as well as Columbia.

The company added that the 2021 financials show strong top line growth, with existing business matching the published projections, despite imposed lock downs. Overall top line numbers will be delayed, primarily due to a delay in the launch of the Independent Sales Organisation (ISO) business in the United States. The ISO business sells payment services to merchants on behalf of banks and financial institutions. The delay was caused by a decision taken by a sponsor bank, which the group had an agreement with, to exit the acquiring business entirely. The company added that the US subsidiary has successfully secured a new sponsor, allowing the company to execute the ISO business in Q1 2022.

The launch of the group’s financial services sector, following the successful acquisition of its EMI license, had to be moved to the first quarter of 2022 due to unexpected circumstances related to terminal certification.

The company added that with the on boarding of new clients, RS2 has more than doubled the volume of transactions processed on the RS2 Smart Processing platform during 2021 when compared to those processed in the recent past. This increase is expected to continue to progress with a gradual increase from RS2’s current clients as well as the on boarding of new clients.

RS concluded that despite the delays in expected revenue, all other projected revenues were met, which thereby allowed the group to turn around the financial performance for the year into a respectable profit.

In the same sector, BMIT Technologies plc shed 1.7% to close the week at €0.472. Fifteen trades worth €75,400 were executed.

On the contrary, Harvest Technology plc traded 3.6% higher following a sole trade involving 4,729 shares. The equity closed the week at the €1.45 level.

In the property sector, MIDI plc closed 8% higher at €0.43. Six deals involving 81,500 shares were executed. The company announced that it entered in a non-binding memorandum of understanding with AC Enterprises Limited to explore the possibility of establishing a joint venture with respect to the development of Manoel Island. Discussions are ongoing and if an agreement is reached regulatory and shareholder approvals are required.

Malta Properties Company plc and VBL plc, closed the week unchanged at the €0.53 and €0.30 price levels respectively.

A sole trade consisting of 15,000 shares, dragged the share price of International Hotel Investments plc to the €0.57 level, making it the worst performing equity of this week. The share price of the hotels’ operator declined by 3.4% and is down by 21% since the beginning of the year.

Meanwhile, Maltapost plc closed in the green, as four trades of 26,000 shares pushed the price 3.4% higher to the €1.22 level. Earlier this week the company approved the audited financial statements for year ended September 30, 2021. These will be submitted for approval at the AGM which will be held remotely on February 16, 2022.

Revenue increased by 11% to €37.9m when compared to €34.1m last year. Total expenses also increased to €35.8 compared to €31.7m in 2020, driven by increases in international postal tariffs as well as significant increases in airfreight costs. The company recorded a pre-tax profit of €2.4m, a decline of 15% when compared to 2020. Earnings per share remained constant, and as a result the board of Maltapost plc proposed a final dividend of €0.04 per share.

Simonds Farsons Cisk plc declined by 2.4%, as 520 shares changed ownership across one transaction. The equity closed €0.20 lower at €8.30.

This week the shares of Hili Properties plc have been admitted to the official list of the MSE and were available for trading from December 22, 2021.

Over the week, the MSE Corporate Bonds Total Return Index fell marginally to 1,145.816 points. A total of 49 issues were active, with total turnover reaching €1.6m. The 3.65% Mizzi Organisation Finance plc € Unsecured 2028-2031 corporate bond was the most liquid, with 14 transactions worth €137,195 recorded.

The MSE MGS Total Return Index gained 10 basis points to 1,103.271 points. Nine government bonds traded, with the 4.1% MGS 2034 (I) being the most liquid. Three transactions comprising of €341,545 were executed.

Five issues were active in the Prospects MTF market, with a total volume of €68,755 distributed over seven trades. The most liquid security was the 5.35% D Shopping Malls Finance plc € Unsecured 2028, which achieved a total weekly turnover of €37,363 and closed at €94.35.

We wish all our readers a Happy Christmas.

| Upcoming Events | ||||

| 10 January 2022 | MT: AX Real Estate plc – Opening of offer period | Best Performers: | ||

| 11 January 2022 | MT: Bank of Valletta plc – Dividend cut-off date | LSR | +18.75% | |

| 13 January 2022 | MT: MaltaPost plc – Dividend cut-off date | MDI | +8.04% | |

| 28 January 2022 | MT: Bank of Valletta plc – Dividend payment date | HSB | +3.95% | |

| 16 February 2022 | MT: MaltaPost plc – AGM | |||

| 16 March 2022 | MT: MaltaPost plc – Dividend payment date | Worst Performers: | ||

| IHI | -3.39% | |||

| SFC | -2.35% | |||

| BMIT | -1.67% | |||

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]