MSE Trading Report for Week ending 07 January 2022

| MSE Equity Total Return Index: |

| Highlights: |

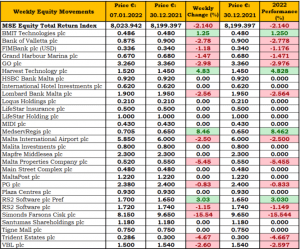

The MSE Equity Total Return Index started the year in negative territory, as activity across 19 equities yielded an overall drop of 2.1%, to close the week at 8,023.942 points. Only four equities headed north, while 12 closed in the opposite direction. Total turnover tallied to €706,016.

Medserv Regis plc from the oil and gas services industry, headed the list of gainers, as its share price rose by €0.055 or 8.5% to €0.705. This increase pushed the equity to a level last seen four months ago. A total of 121,690 shares were traded over eight transactions, with a weekly low of €0.64 and a high of €0.705. The company announced that its subsidiary, Middle East Tubular Services Limited (METS), has successfully been awarded a contract by a new client, Dubai Petroleum, for the provision of Machining Services on a call out basis. The contract is for a preliminary period of three years with an option for Dubai Petroleum to extend for a further two-year period under the same terms and conditions.

The share price of the telecommunications equity, GO plc, dropped by 3%, as 11 transactions on a volume of 33,328 shares dragged the price to the €3.26 level. The equity generated a turnover of €108,766. On the other hand, its subsidiary company BMIT Technologies plc, saw their share price increase by 1.3%, to close at €0.486. BMIT generated a total turnover of €170,790, making it the most liquid equity of the week.

In the financial sector, Bank of Valletta plc traded 1.2% higher yesterday, partially offsetting Tuesday’s negative performance of 3.9%. The equity closed the week at €0.875, 2.8% lower when compared to the previous week. A total turnover of €94,582 was registered.

HSBC Bank Malta plc closed the week unchanged at €0.92 after three transactions on Thursday erased declines in the previous two trading sessions. The equity generated €127,486 in turnover across 141,283 shares.

Both Lombard Bank Malta plc and FIMBank plc headed south on Friday. Lombard stumbled to the €1.90 level, 2.6% lower, as a result of one transaction of 5,500 shares. Meanwhile FIMBank slid by 1.2%, as two transactions of 24,234 shares closed the equity at $0.336.

In the property sector, Trident Estates plc and Malta Properties Company plc (MPC) each traded once during the week with both equities closing in the red. A single trade involving 1,502 Trident Estates plc shares dragged the share price by 2.6%, to close at €1.50. On the other hand MPC closed at €0.52, a 5.5% week-on-week decline, after a mere 150 shares were traded.

VBL plc traded flat for most of the week at the €0.30 level. Yesterday, the equity’s share price lost 4.7%, as a result of two trades in which 30,000 shares changed hands, to close at €0.286.

International Hotel Investments plc traded flat at €0.62, as one transaction of trivial volume was executed.

Hili Properties plc had a similar performance, as it closed unchanged at €0.27. Four transactions of 35,250 shares were executed.

Hili Finance plc announced that it has submitted an application to the Malta Financial Services Authority requesting the admissibility to listing of €50m Unsecured Bonds redeemable in 2027. Subject to obtaining regulatory approval, the bonds will be available for subscription by all categories of investors through authorised financial intermediaries.

Simonds Farsons Cisk plc (SFC) was the most volatile equity during the week. The company’s equity price traded between a weekly high of €9.65 and a low of €8.05. SFC shares closed at the €8.15 level, a week-on-week drop of 15.5%. Seven transactions on a volume of 1,083 shares were executed.

Similarly, Malta International Airport plc (MIA) and Grand Harbour Marina plc (GHM), traded lower as a result of a single trade for each equity. On Wednesday, 1,000 MIA shares were traded, to close the week at €5.85, that is, 2.5% lower week-on-week. GHM declined by 1.5% to the €0.67 level, as a single trade of 200 shares was executed.

The retail conglomerate, PG plc, closed at the €2.38 mark as a sole trade of 2,000 shares dragged the share price down by 0.8%.

One transaction of 11,500 RS2 Software plc Ordinary shares, yielded a drop in price of 1.2%, to close at €1.72. On the other hand, RS2’s Preference shares advanced by 3%. On Friday, one transaction partially erased the equity’s highest traded share price of the week of €1.73, to close at €1.70.

Harvest Technology plc was one of the few positive performers. Four transactions involving the exchange of 15,000 shares pushed the equity price up by 4.8%, to close at €1.52.

In the fixed-income market, the MSE Corporate Bonds Total Return Index declined by 0.2%, to 1,147.288 points. A total of €2.4m in turnover was generated, as activity was spread across 43 issues. The 3.5% GO plc € Unsecured 2031 was the most liquid issuance, as € 476,964.77 was generated in turnover.

The MSE MGS Total Return Index dropped by 1.7%, to close at 1,086.329 points. A total of 17 government bonds were active, with the 5.25% MGS 2030 (I) being the most liquid, as five trades worth a total of €581,928.05 were recorded.

In the Prospects MTF market seven issues were active, with total turnover tallying to €40,177 spread over 14 deals. The 4.875% AgriHoldings Plc Senior Secured € 2024 was the most liquid and generated a total weekly turnover of € 14,981, to close below par at €99.95.

| Upcoming Events | ||||

| 10 January 2022 | MT: AX Real Estate plc – Opening of offer period | Best Performers: | ||

| 11 January 2022 | MT: Bank of Valletta plc – Dividend cut-off date | MDS | +8.46% | |

| 13 January 2022 | MT: MaltaPost plc – Dividend cut-off date | HRV | +4.83% | |

| 28 January 2022 | MT: Bank of Valletta plc – Dividend payment date | RS2P | +3.03% | |

| 16 February 2022 | MT: MaltaPost plc – AGM | |||

| 16 March 2022 | MT: MaltaPost plc – Dividend payment date | Worst Performers: | ||

| SFC | -15.54% | |||

| MPC | -5.45% | |||

| VBL | -4.67% | |||

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]