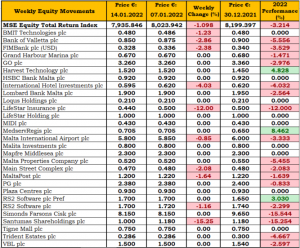

MSE Trading Report for Week ending 14 January 2022

| MSE Equity Total Return Index: |

| Highlights: |

- The MSE Equity Total Return Index sustained its downward trend, as it ended the week 1.1% lower, at 7,935.846 points. A total of 19 equities were active, out of which 11 traded lower while another eight remained unchanged. A total turnover of €1.1 million, up from €0.7m last week, was generated across 124 transactions.

- Bank of Valletta plc was by far the most liquid equity, as 51 transactions worth nearly €0.5m saw the bank’s share price slide by €0.025 or 2.9% to close at €0.85. During the week the equity traded at a weekly low of €0.80 and a high of €0.86.

- Similarly, six deals involving 85,144 FIMBank plc shares were recorded on Tuesday, as the equity reached an all-time low of €0.254. A last minute trade during Friday’s trading session involving 300 shares, saw the equity regain some of its previous losses to end the week 2.4% lower at €0.328.

- HSBC Bank Malta plc shares fluctuated between at an intra-week high of €0.92 and a low of €0.865, to close unchanged at €0.92 over 13 trades with a value of €72,049. Last Monday, the equity fell by 4.9%, but this drop was reversed on Wednesday as a result of two trades across 12,000 shares.

- GO plc held onto the €3.26 price level, as 7,850 shares exchanged ownership over three transactions. Its subsidiary, BMIT Technologies plc (BMIT) was also active, as trading activity involved four transactions worth a total of €34,327. BMIT shares lost 1.2% to close at €0.48.

- The food and beverage company, Simonds Farsons Cisk plc, concluded Tuesday’s trading day at €8.50 following two deals of 10,950 shares, after starting the week at €8.15. Three small trades on Wednesday reversed Tuesday’s gain and the equity closed the week unchanged at €8.15.

- RS2 Software plc Ordinary shares saw 15,350 shares exchange hands over two transactions, to close at €1.70, down by 1.2%. On the other hand, RS2’s Preference shares traded once on slim volume to close unchanged, also at €1.70.

- The share price of Santumas Shareholdings plc plummeted by 15.3% to close at €1.00, a level last seen in late November. Three transactions of 20,320 shares were executed.

- A single deal across small volume forced the equity value of LifeStar Insurance plc and International Hotel Investments plc to drop by 12% and 4% to close at €0.44 and €0.595, respectively.

- Hili Properties plc declined by 7.4% to end the week at €0.25 over 11 trades of 118,500 shares.

- The share price of MedservRegis plc kept hold of the €0.705 price level, as five transactions involving the exchange of 217,480 shares were recorded on Friday.

- Malta International Airport plc retracted by €0.05 or 0.9%, to close at €5.80. This was a result of eight deals on a volume of 17,100 shares.

- PG plc started off the week in the green but returned to €2.38 on Wednesday. Two trades of 3,250 shares generated a turnover of €7,760.

- Main Street Complex plc reached a 10-month low of €0.47, as two transactions of 40,000 shares dragged the share price by 2.1%.

- The local postal service company, MaltaPost plc, was active over three deals involving 10,080 shares, resulting into a 1.6% loss. MaltaPost plc shares closed the week at €1.20.

- Harvest Technology plc was involved in one small trade worth €249, as the company’s share price closed unchanged at €1.52.

- During the week, GAP Group plc announced the basis of acceptance for the issue of their latest €21m Gap Group p.l.c. 3.9% Secured Bonds 2024 – 2026 which offer period closed on January 7, 2022.

- The company received €10.8m from holders of the 2016 Bonds, representing 56.3% of the total value of 2016 Bonds outstanding as at November 26, 2021. This amount was allocated in full. The remaining balance of €10.2m was fully allocated to holders of 2016 Bonds in respect of any excess secured bonds applied for and authorised financial intermediaries by virtue of placement agreements.

- Accordingly, the outstanding amount of 2016 Bonds has been reduced to €8.4m. Trading in both bonds is expected to commence on January 18, 2022.

- In addition, Hili Finance plc announced that further information relating to their €50m 4% unsecured bonds redeemable in 2027 will be available in the prospectus which will be published following attainment of the necessary approval by the Malta Financial Services Authority. The cut-off date for Hili Ventures Group Securities Holders, which include holders of listed securities of 1923 Investments plc, Harvest Technology plc, Hili Properties plc, Premier Capital plc and the Company, being the main category of preferred applicants, is expected to be close of business on January 21, 2022 (trading session of January 19, 2022).

- The MSE Corporate Bonds Total Return Index declined by 0.07%, to close at 1,146.491 points. A total of 49 issues were active of which the 3.5% GO plc € Unsecured 2031 generated the most turnover, with a total of €0.3m traded across 15 transactions.

- On the sovereign debt front, the MSE MGS Total Return Index declined by 0.11% to 1,085.189 points. Out of the 15 active issues, the 5.25% MGS 2030 (I) was the most liquid security, as seven transactions generated a turnover of €1.2m.

- In the Prospects MTF market three issues were active. The 5.75% Pharmacare Finance plc Unsecured EUR Bonds 2025-2028 registered the highest liquidity, as total turnover amounted to €12,189.

| Upcoming Events | ||||

| 28 January 2022 | MT: Bank of Valletta plc – Dividend payment date | Best Performers: | ||

| 16 February 2022 | MT: MaltaPost plc – AGM | |||

| 16 March 2022 | MT: MaltaPost plc – Dividend payment date | |||

| 20 April 2022 | MT: Lombard Bank Malta plc – Full-year results | |||

| 26 May 2022 | MT: Lombard Bank Malta – AGM | |||

| Worst Performers: | ||||

| STS | -15.25% | |||

| LSI | -12.00% | |||

| HLI | -7.41% | |||

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]