MSE Trading Report for Week ending 21 January 2022

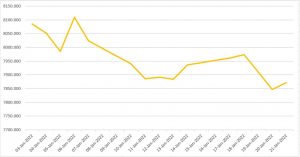

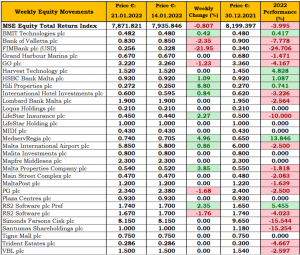

| MSE Equity Total Return Index: |

| Highlights: |

| Upcoming Events | ||||

| 28 January 2022 | MT: Bank of Valletta plc – Dividend payment date | Best Performers: | ||

| 16 February 2022 | MT: MaltaPost plc – AGM | HLI | +8.80% | |

| 16 March 2022 | MT: MaltaPost plc – Dividend payment date | MDS | +4.96% | |

| 20 April 2022 | MT: Lombard Bank Malta plc – Full-year results | MPC | +3.85% | |

| 26 May 2022 | MT: Lombard Bank Malta – AGM | |||

| Worst Performers: | ||||

| FIM | -21.92% | |||

| BOV | -2.35% | |||

| RS2 | -1.76% | |||

- The MSE Equity Total Return Index followed last week’s negative performance, closing 0.8% lower at 7,871.821 points. Out of the 15 active equities, five equities traded lower while nine advanced. Investor participation was significantly lower than the previous week, as €0.5m were exchanged across 112 trades.

- Bank of Valletta plc shares sank a further 2.4%, to finish at €0.83. The share price of the banking equity traded between a weekly high of €0.86 and a low of €0.82. A total of 119,079 shares were exchanged over 26 transactions worth €0.1m.

- HSBC Bank Malta plc (HSBC) was the most liquid equity, as €133,576 changed hands across 20 transactions. HSBC closed 1.1% higher at €0.93 after hitting a weekly high of €0.94 and a low of €0.89.

- The share price of FIMBank plc remained volatile, as it declined by 22% to a price of $0.256, making it the worst performing equity of the week. Trading volume totalled 18,803 shares over three transactions.

- over a sole transaction involving 430 shares.

- Mapfre Middlesea plc announced that the board of directors is scheduled to meet on March 23, 2022 to consider and approve the company’s audited financial statements for the financial year ended December 31, 2021 and to consider the declaration of a dividend, if any, to be recommended to the Annual General Meeting of Shareholders. No trading took place in the company’s shares this week.

- In the IT sector, RS2 Software plc Ordinary shares closed 1.8% lower at €1.67, as a result of a last-minute trade of 352 shares. The company’s Preference shares were active on Monday, as three transactions were recorded. The equity’s price climbed by 2.4% to €1.74.

- MedservRegis plc followed a positive trend during the first few trading weeks of 2022 after announcing that its subsidiary, Middle East Tubular Services Limited (METS), was successfully awarded a contract by a new client, Dubai Petroleum, for the provision of machining services on a call out basis earlier this year. The equity closed 5% higher at €0.74, a price last seen in late August. This was the result of four transactions involving 53,500 shares.

- Performances in the property market were predominantly positive, as gainers amounted to three, while only VBL plc closed unchanged at €0.286. A single transaction of 10,000 shares was executed.

- Hili Properties plc was the overall best performing equity this week. This equity erased the previous week’s decline at the beginning of the week and kept a positive trend throughout the remaining sessions to close 8.8% higher at €0.272. A total of 71,500 shares traded across seven deals.

- The company announced that although the acquisition of a commercial property located in Warsaw, Poland did not materialise, its Lithuanian subsidiary company, Premier Estates Lietuva UAB, has purchased Indev UAB for €20,850,979. This land comprises a 19,000 square metre factory which has been leased to REHAU Production LT, UAB, a leading provider of solutions to the construction, automotive and industrial industries. This asset in Lithuania increased the company’s portfolio from €115m to €135m.

- GO plc was unable to recover from a frail start to the week, closing 1.2% lower at €3.22. A total of 14,000 shares traded over nine deals. Its subsidiary, BMIT Technologies plc, reversed Monday’s negative performance on Tuesday to eventually close the week 0.4% higher at €0.482.

- The retail conglomerate, PG plc, slumped by 1.7% to a price of €2.34. This was the result of three transactions of a combined 10,600 shares traded yesterday.

- Malta International Airport plc (MIA) shares gained 0.9% to close at €5.85. A total of 7,017 shares exchanged ownership across 11 transactions.

- Last Tuesday, MIA announced its 2021 Traffic Results. MIA announced that last year 2,540,335 passengers travelled through the airport. While this full-year traffic result translates into an increase of 45.3% over 2020 figures, it marks a recovery of just 34.8% of 2019 passenger numbers.

- A look at MIA’s monthly traffic performance shows that after the first half of the year, air travel started to gain momentum on the back of increased stability and an improvement in consumer confidence, with passenger movements for the third quarter of 2021 more than tripling over the previous quarter.

- Data released by Airports Council International shows that at 33.5%, Malta’s recovery for the period between January and November 2021 still lagged behind that of Southern European peers such as Greece, Cyprus, Spain and Portugal, despite MIA’s success in retaining more than 70% of its connections for 2019 throughout the year under review.

- In the corporate bond market, the MSE Corporate Bonds Total Return Index was down by 0.2% over the week, slipping to 1,144.464 points. A total of 52 issues were active, with total turnover reaching almost €2.1 million. The 3.65% Mizzi Organisation Finance plc € Unsecured 2028-2031 was the most liquid, as 12 trades worth €0.3m were recorded.

- The 3.9% Gap Group plc Secured € Bonds 2024-2026 were admitted to the MSE’s official list and the security began trading last Tuesday. The bond finished the week at €101.50.

- In addition, St Anthony Co. plc announced that its offer of €15.5m worth of 4.55% Secured Bonds 2032 with a nominal value of €100 per bond and issued at par, has been subscribed in full. The bonds have been admitted to listing on the official list of the MSE and trading commenced yesterday. The bond issue closed the week at €102.50.

- The MSE MGS Total Return Index declined by a further 0.5%, to close at 1,080.343 points. A total of 16 government bonds were active during the week, with the 5.25% MGS 2030 (I) being the most liquid, as six trades worth a total of €0.8m were recorded. The bond closed the week at €137.72.

- In the Prospects MTF market, the 5% Luxury Living Finance plc € Secured Bonds 2028 was the only active issue, with total turnover tallying to €4,866 over a single transaction to finish at €99.30.

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]