MSE Trading Report for Week ending 25 February 2022

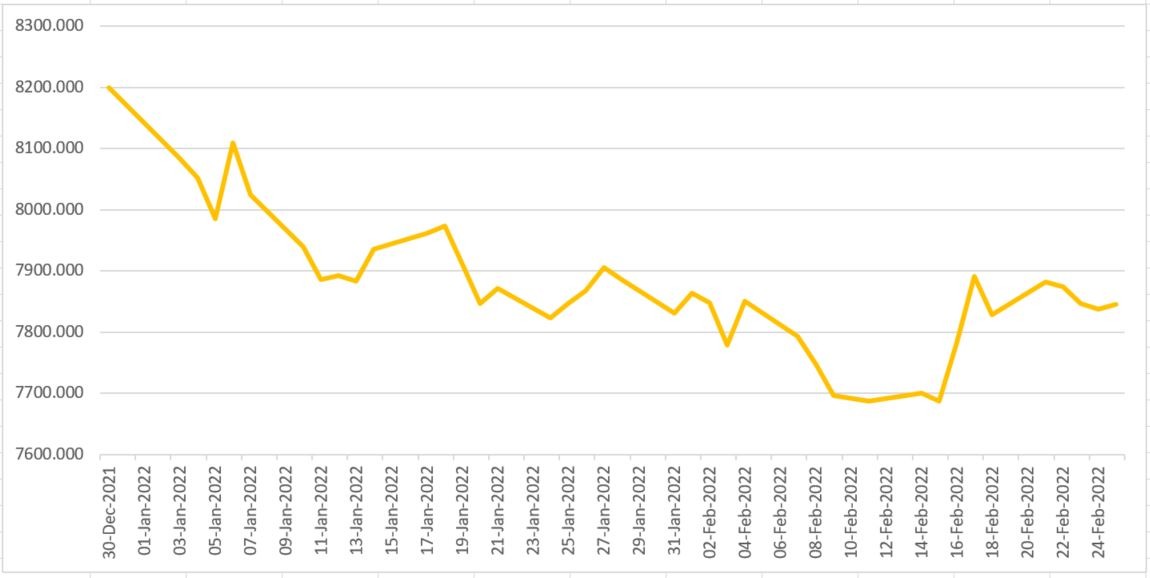

| MSE Equity Total Return Index: |

| Highlights: |

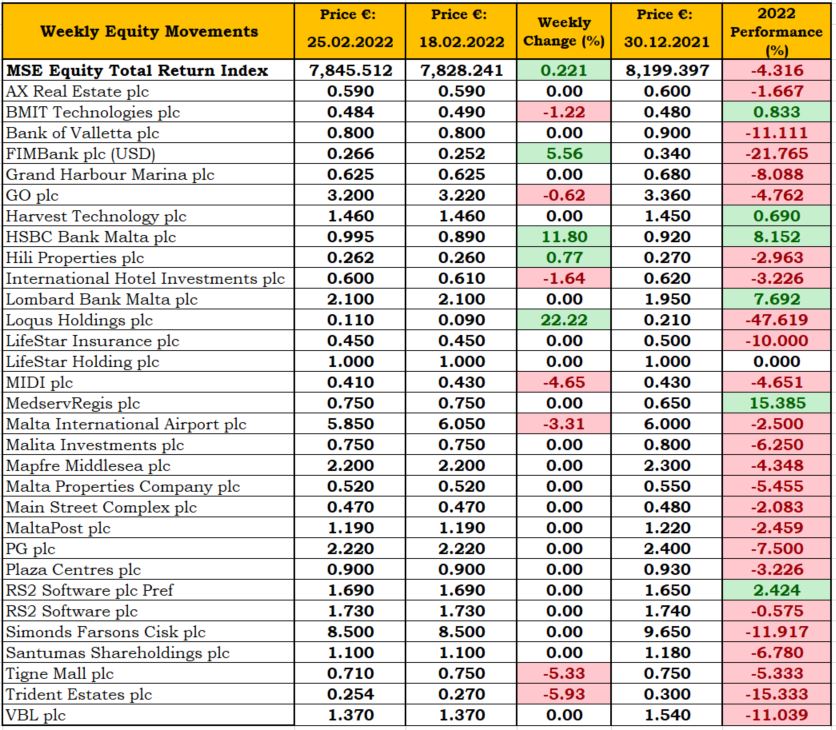

- The MSE Equity Total Return Index (MSE) closed the week higher, as it added a further 0.2% to end the week at 7,845.512 points. HSBC Bank Malta plc (HSBC) was among the gainers with a double-digit gain, as four equities closed higher while another seven declined. Turnover fell to €0.5m, down from €0.8m the previous week. Bank of Valletta plc (BOV) and BMIT Technologies plc (BMIT) dominated trading activity with over 60% of this week’s turnover taking place in these two equities.

- In the banking sector, HSBC closed the week 11.8% up at €0.995. The equity featured in 14 separate trades over which 75,606 shares changed hands.

- Last Tuesday, the board of HSBC approved the annual report and accounts for year ended December 31, 2021.

- The bank reported a profit before tax of €26.9m, an increase of €16.4m or 157%, compared to 2020. Adjusted profit before tax of €29.7m increased by €19.2m, or 184% versus 2020. The adjusted profit before tax for 2021 excludes the impact of a restructuring provision of €2.8m.

- Reported profit attributable to shareholders was €17.8m, resulting in earnings per share of €0.049 compared with €0.021 in the same period in 2020.

- Net interest income decreased by 8% to €97.8m compared to the prior year. The decrease was mainly driven by lower average yields on debt securities, tighter margins, and placement of surplus liquidity at negative rates. This was partially offset by lower interest paid on customer deposits and changes in deposit composition towards short-term placements.

- During the year, the bank reported a release of expected credit losses (ECL) of €1m, compared to a charge reported in 2020 of €25.6m. In 2020, higher ECL were booked to reflect the prevailing negative outlook and uncertainty arising from the Covid-19 pandemic. The net release in 2021 mainly reflected the performance of specific customers, rather than an improvement in the economic outlook.

- Operating costs for the year amounted to €105.4m, compared to €97.4m reported in 2020. The 2021 operating expenses include a restructuring provision of €2.8m. Excluding the restructuring provision, expenses increased by €5.2m, or 5% compared to the prior year. While the bank continued to achieve sustainable savings from the transformation programs announced in 2019 and 2021, non-staff costs increased by €9.5m. The increase in non-staff costs was driven by compliance costs due to increased monitoring, transformation expenses, regulatory fees, fraud losses, as well as higher investment in digitalisation.

- The bank’s net loans and advances to customers decreased marginally by €67.9m to €3,197m. The decrease mainly related to the corporate portfolio due to unforeseen repayments. Despite the fact that the bank continues to monitor the asset quality of non-performing loans (NPL), the bank saw an annual net increase in NPL of €36.9m. The increase in wholesale NPL is mainly driven by the downgrade of a small number of corporate customers engaged in industries impacted by the Covid-19 pandemic, while the increase in retail NPL is primarily a result of individuals requesting a moratoria extension. Customer deposits grew by 7% to €5,621m, driven by both retail and commercial deposits. The bank maintained a healthy advances to deposits ratio of 57% and its liquidity ratios remained well in excess of regulatory requirements.

- The board recommended a dividend pay-out of 45% on reported profits after tax. The final dividend will be paid on April 21, 2022 to shareholders who are on the bank’s register on March 14, 2022 subject to approval at the Annual General Meeting scheduled for April 13, 2022.

- In the same sector, FIMBank plc also closed in positive territory, despite trading only once on very small turnover. The equity’s price read $0.266 at the end of yesterday’s session – a 5.56% week-on-week gain.

- Despite being the most liquid equity for the week, BOV closed unchanged at €0.80. The share price of the banking equity traded between a weekly high of €0.81 and a low of €0.785, as 39 deals worth nearly €0.2m were executed.

- On February 23, 2022 Loqus Holdings plc announced that the directors have approved the half-yearly report of the company for the six months ended December 31, 2021. The first six months of the group’s financial year saw the group reporting record revenues and a profit before tax of over €0.9m when compared to €0.64m in 2020.

- Growth was reported in all segments with total revenue increasing by 39%, resulting in a healthy EBITDA of 29% of revenue and the company’s net cash position was reported to sum up to €2.3m. This news had a positive impact on the equity’s performance on the market, as the equity’s price appreciated by 22%, to close at €0.11.

- GO plc and BMIT both closed the week in the red. Parent company GO plc registered a drop of 0.62%, to close at €3.20, while its subsidiary slipped by 1.22%, to close at €0.484. Total turnover in the latter was however considerably higher, as €152,687 were traded across seven transactions of 315,300 BMIT shares.

- During the week, the board of Malta International Airport plc approved the Group’s financials for the year ended December 31, 2021. The local airport operator ended 2021 by recovering just 34.8% of its pre-pandemic passenger numbers. Compared to 2020, on the other hand, the airport’s traffic result for 2021 marked an increase of 45.3% and contributed to a significantly improved financial performance registered by the Group during the year under review. At €47.4m, however, the total revenue generated was 52.7% below pre-pandemic levels.

- The company’s cost-cutting programme, together with an increase in passenger traffic over 2020, led to an increase of €18.5m in earnings before interest, taxation, depreciation and amortisation (EBITDA), in parallel with an improvement of 33.3% in EBITDA margin. While the group had registered a net loss of €4.3m in 2020, a net profit of €7m was recorded in 2021.

- During the same meeting, the board officially gave the green light to an investment just shy of €40m in the construction of a new apron, covering an area of approximately 100,000 square metres. The construction of this apron, will entail the largest investment in the aerodrome infrastructure, equipping MIA with the capacity to accommodate more parked aircraft at any given time, and eventually aim to achieve further growth in passenger traffic

- Having carefully analysed the Group’s accounts and external forces that are likely to continue affecting consumer confidence and air travel in the foreseeable future, the board believes that, with an aim to safeguard the best interests of the Company as a whole and its stakeholders for the long-term, it is not prudent to recommend the payment of a dividend for the year ended December 31, 2021. This announcement led the Company to register a 3.31% drop week-on-week and to close at €5.85. The equity was active over six transactions with a total turnover of €22,294.

- In the property sector, outcomes were negative overall, as one equity registered gains, two closed unchanged, while the other three declined. Hili Properties plc traded twice for a total turnover of €6,381 to close the week 0.77% in the green at €0.262. On the contrary, Tigne’ Mall plc, VBL plc and MIDI plc all closed at the opposite end of the spectrum. The first two registered similar performances, as they dropped by 5.33% and 5.93% respectively while MIDI declined by 4.65%. Turnover was very shallow in all three equities, as weekly activity did not surpass the €4,000 mark in any singular equity. The respective prices at the end of yesterday’s session read; €0.71, €0.254 and €0.41.

- The two active non-moving property equities were Malta Properties Company plc and Santumas Shareholding plc, as these closed at €0.52 and €1.10 respectively. The former saw 3,870 shares change hands over three separate deals while the latter traded only once for a total turnover of €5,005. Malta Properties Company plc announced that its board is to meet on March 17, 2022 to consider and approve the company’s audited financial statements for the financial year ended December 31, 2021 and the declaration of a final dividend, which will be recommended to the company’s annual general meeting.

- International Hotel Investments plc was active over three separate deals worth a total of €16,204. These transactions yielded a negative outcome, as the equity lost 1.64%, to close at €0.60.

- Elsewhere, Simonds Farsons Cisk plc, Lifestar Holding plc and PG plc were all active but closed unchanged at €8.50, €1 and €2.22 respectively.

- In the fixed income market, the MSE MGS Total Return Index edged marginally higher by nearly 10 basis points, as political tensions on the international front sent shockwaves across equity markets. As a result, investors sought safety in high quality assets. A total of 43 transactions worth €1m were executed.

- In the corporate bond market, 52 issues were active, as turnover jumped to €3.4m. The 3.9% Plaza Centres plc Unsecured 2026 was the most traded bond, as seven deals worth €1.4m were recorded. On the week the MSE Corporate Bonds Total Return Index declined by 20 basis points.

- Last Thursday, Hili Ventures plc announced the basis of acceptance in respect of its issue of €50m 4% Unsecured Bonds redeemable in 2027, issued at par. The bonds are expected to be admitted to listing on the Official List of the MSE on March 4, 2022 and trading is expected to commence on March 7, 2022.

- In the Prospects MTF Market two issues were active over four transactions worth €14,350. The 4.75% KA Finance plc Secured Callable Bonds 2026 – 2029 was the most active issue, as it traded at €93.50.

| Upcoming Events | ||||

| 16 March 2022 | MT: MaltaPost plc – Dividend Payment Date | Best Performers: | ||

| 23 March 2022 | MT: Mapfre Middlesea plc – Full Year Results | LQS | +22.22% | |

| 13 April 2022 | MT: HSBC Bank Malta plc – AGM | HSB | +11.80% | |

| 20 April 2022 | MT: Lombard Bank Malta – Full Year Results | FIM | +5.56% | |

| 29 April 2022 | MT: Mapfre Middlesea plc – AGM | |||

| 26 May 2022 | MT: Lombard Bank Malta – AGM | Worst Performers: | ||

| TRI | -5.93% | |||

| TML | -5.33% | |||

| MDI | -4.65% | |||

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]