MSE Trading Report for Week ending 04 March 2022

| MSE Equity Total Return Index: |

| Highlights: |

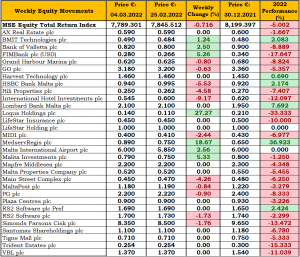

The MSE Equity Total Return Index closed the week in negative territory with a 0.7% decline to finish at 7,789.301 points. Out of the 20 active equities, seven headed north whilst 11 headed south. A total of 88 deals generated a turnover of €0.4m.

International Hotel Investments plc (IHI) was active on three trading days, with the share price falling day after day to €0.545 to end the week with a 9.2% drop.

Earlier this week, IHI informed the market regarding the hotel operation in St Petersburg, Russia. The company’s hotel with an adjoining commercial centre, have been in operation for a number of years. Following the latest events and in particular the sanctions imposed on Russia, it is expected that this may have an adverse effect on the hotel operation in St Petersburg.

The company expects that the local market will not be materially adversely affected by the recent events. The hotel operation has over the last two years, in view of travel restrictions imposed by the pandemic, had the principal source of its business originating from the local Russian market.

IHI’s interest in St Petersburg represents approximately 8% of the group’s total revenue and assets. Operating forecasts of the company’s other properties remain encouraging, confirming the company’s resilience arising from its geographic diversification.

Management will continue to closely follow the events as they unfold, in full compliance with any applicable sanctions, and shall keep the market informed of developments.

Malta International Airport plc started the week in the red, as it reached €5.80 on Monday, while it turned positive on Thursday, having closed at €6. Hence the equity gained 2.6% on the previous week’s closing price, as 11 deals worth €49,719 were executed.

In the banking industry, HSBC Bank Malta plc (HSBC) ended the week 5.5% lower, as 40,815 shares changed hands over five transactions. The equity traded higher on Thursday, but this was not enough to erase the loss it incurred in the previous days. The banking equity closed the week at €0.94. Since the beginning of the year, HSBC shares are up by 2.2%.

Bank of Valletta plc appreciated by 2.5% to reach the €0.82 level, as 19 transactions worth €72,021 were executed.

In the IT services sector, 20,000 BMIT Technologies plc shares, executed over a single deal, pushed the share price higher by 1.2% to close at €0.49.

RS2 Software plc closed Monday’s session down by 6.4% but partially reversed this loss on Thursday to close at €1.70 – translating into a week-on-week negative change in price of 1.7%. Three deals involving 3,497 shares were executed.

MedservRegis plc ended the week at €0.89, higher by 18.7%. The equity traded between a high of €0.89 and a low of €0.74, as 15,750 shares exchanged ownership across three transactions.

Malta Properties Company plc traded flat the entire week at the €0.52 price level. Three transactions worth €1,867 were executed.

Simonds Farsons Cisk plc (SFC) traded twice over 12,500 shares. This resulted in the equity joining the list of losers, as it closed 1.8% lower at €8.35. SFC was the most traded equity, as turnover reached €104,375.

Hili Properties plc ended the week at €0.25 – equivalent to a 4.6% decline. During the week the properties equity traded at a weekly high of €0.258 and a low of €0.25. Three deals involving 39,500 shares were recorded.

The retail conglomerate PG plc, was active on a single trading day. The share price fell by 1% to the €2.20 level, as a result of three trades worth €16,594.

A sole transaction of 11,500 FIMBank plc shares, pushed the share price $0.014 higher by 5.3%, to finish at the $0.28 level.

Grand Harbour Marina plc closed at €0.62 which translates to a 0.8% decline. This was a result of single trade of 2,000 shares.

Similarly, GO plc ended the week 0.6% lower, as two transactions over slim volume were executed. The share price of the telecoms operator closed at €3.18.

Tuesday’s 6.7% decline in the share price of Loqus Holdings plc, was not enough to erase Monday’s 36.4% gain. This translated into a weekly increase of 27.3% to close at the €0.14 price level, making it the best performing equity during this trading week.

Both Main Street Complex plc (MSC) and MaltaPost plc (MTP) finished the week lower, as a result of a sole transaction of trivial volume for each of the mentioned equities. MSC closed 4.3% lower at €0.45 whilst MTP declined by 0.8% to the €1.18 level.

VBL plc traded at a weekly high of €0.256 and a low of €0.252, to eventually end the week unchanged at the €0.254 price level. Three trades of 16,000 shares were executed.

The company announced that the board is scheduled to meet on March 10, 2022 to approve the company’s audited financial statements for the financial year ended December 31, 2021 and to consider the declaration of a final dividend to be recommended to the company’s annual general meeting.

In the property sector, 10 deals of 170,750 MIDI plc shares pushed the price 2.4% lower to €0.40. Meanwhile, Malita Investments plc traded three times over 18,750 shares, to close 5.3% higher at €0.79.

The MSE MGS Total Return Index closed higher at 1,063.929 points – equivalent to a 2% gain. A total of 16 bonds were active, where the 2.5% MGS 2036 (I) generated the largest turnover of €266,191, to close at €114.97.

The MSE Corporate Bonds Total Return Index lost a further 0.2%, as it reached 1,141.084 points. Out of the 50 active issues, the 4.25% Best Deal Properties Holding plc Secured € 2024 generated the highest turnover, totalling €0.3m. Overall, turnover reached €2.7m as a result of 247 transactions.

In the Prospects MTF Market, nine issues were active. The 5% JD Capital plc Unsecured € Bonds 2028 was the most liquid, as total turnover amounted to €21,530.

| Upcoming Events | ||||

| 16 March 2022 | MT: MaltaPost plc – Dividend Payment Date | Best Performers: | ||

| 23 March 2022 | MT: Mapfre Middlesea plc – Full Year Results | LQS | +27.27% | |

| 13 April 2022 | MT: HSBC Bank Malta plc – AGM | MDS | +18.67% | |

| 20 April 2022 | MT: Lombard Bank Malta – Full Year Results | MLT | +5.33% | |

| 29 April 2022 | MT: Mapfre Middlesea plc – AGM | |||

| 26 May 2022 | MT: Lombard Bank Malta – AGM | Worst Performers: | ||

| IHI | -9.17% | |||

| HSB | -5.53% | |||

| FIM | -5.26% | |||

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]