MSE Trading Report for Week ending 25 March 2022

| MSE Equity Total Return Index: |

| Highlights: |

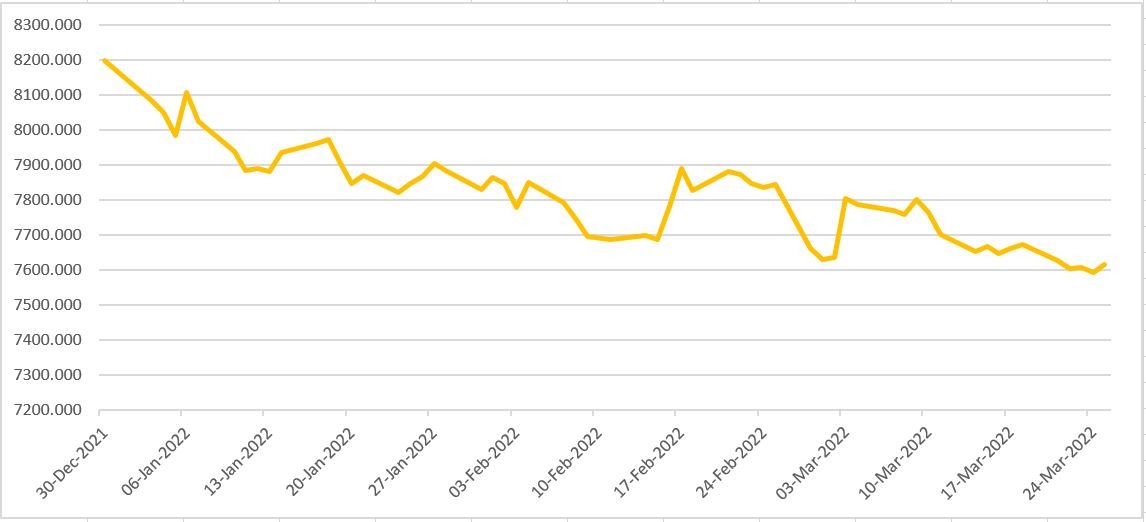

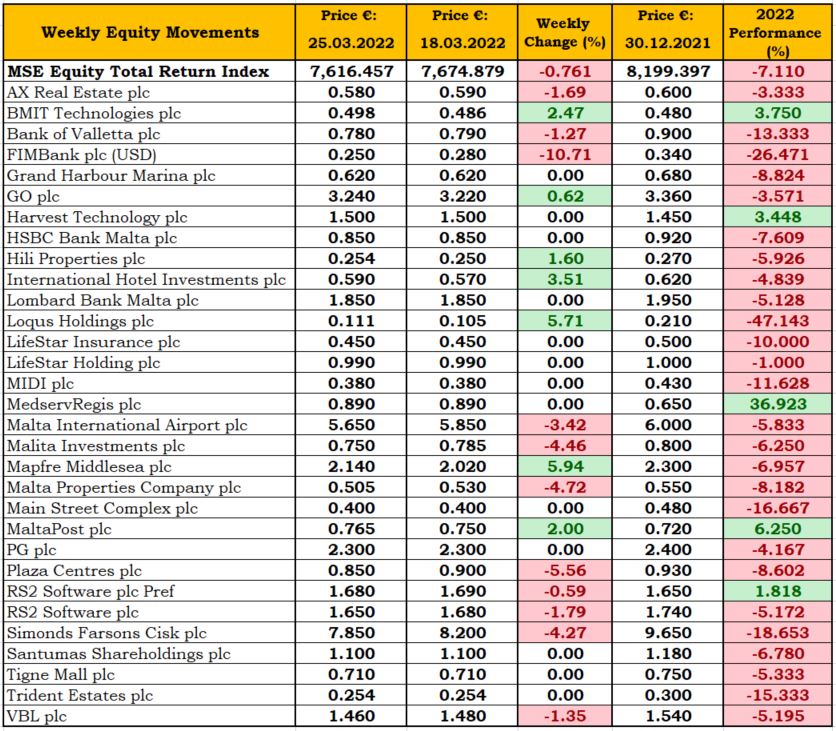

- The MSE Equity Total Return Index (MSE) added to the previous week’s loss, as it closed 0.76% lower at 7,616.457 points. A total weekly turnover of just €0.4m was generated over 89 transactions. Out of 21 active equities, seven headed north while another 12 closed in negative territory.

- Bank of Valletta plc (BOV) surrendered the previous week’s gain with a 1.3% decline to return to €0.78. A total of 55,229 shares exchanged hands across 18 trades, as the equity’s price moved between a weekly high of €0.80 and a low of €0.77.

- Last Tuesday, the board of BOV approved the annual report and financial statements for financial year ended December 31, 2021. The board also resolved that the audited financial statements be submitted for the approval of the shareholders at the forthcoming AGM which will be held remotely on June 2, 2022.

- The bank reported profit before tax of €80.7m, versus the previous year’s figure of €15.2m. The underlying operating performance of the bank demonstrates a resilient income stream with good recovery from the impact of the pandemic in 2020 and growth in some areas, which was partly offset by higher costs. The much stronger profitability benefited from a net release of Expected Credit Losses reflecting better economic conditions relative to 2020 and individual client asset improvements.

- The total operating income was up 4.9% to €242.9m. The bank’s revenues mostly recovered from 2020 lows, as net interest income held up overall and net commission income grew strongly, however foreign exchange income was down due to continued lower turnover. Total costs were €195.6m, increasing by €25.2m or 14.8%, inclusive of strategy costs which were up by €7.3m year-over-year.

- The total assets of the group reached €14.4bn as at December 2021 – an increase of 11.2% over the previous year. Customer deposits grew by €904.6m.

- The group’s treasury investment portfolio increased by €260m year-on-year. The increase relates to highly-rated securities. Net loans and advances increased by €335.3m, or 6.9%, during the year and stood at €5.2b as at December 31, 2021. The group liquidity ratio stands at 444%, reflecting high deposit growth over the year which outpaced the demand for loans.

- Moreover, the CET 1 ratio increased from 20.9% to 21.9%, and the total capital ratio improved from 24.5% to 25.5%. as at end of December 2021.

- During 2021, a gross interim dividend of €0.0264 per share amounting to €15.4m (net ordinary dividend of €0.0172 per share amounting to €10m) was authorised and paid on January 28, 2022. However, the board does not intend to recommend a final dividend for financial year 2021, which is in line with the continuous efforts of the board to maximise long-term shareholder value in the bank.

- Malta International Airport plc (MIA) registered the highest liquidity of €78,692. MIA traded 13 times over 13,847 shares, recording a 3.4% fall in its share price. The equity ended the week at €5.65, down by 5.8% on a year-to-date basis.

- RS2 Software plc preference shares were active after seven dormant weeks. A sole trade of 2,900 shares pushed the share price 0.6% lower, to close at the €1.68 level. Similarly, the company’s ordinary shares declined by 1.8% to end the week at €1.65, as a result of a single trade involving 1,177 shares.

- Last Thursday, RS2’s board announced that it has been made aware of a firm intention by a shareholder to acquire a substantial shareholding, not less than 10%, from one other shareholder, in RS2 Software plc.

- The share price of the food and beverages company, Simonds Farsons Cisk plc retracted by 4.3% to close at €7.85. The equity was active across a single trade on slim volume.

- GO plc traded flat all week until a single transaction on Thursday moved the share price higher, finishing the week at €3.24, up by 0.6%. Last Wednesday, GO announced that it concluded a transaction resulting in the subscription of 76% shareholding in SENS Innovation Group Limited. The shares have now been issued by SENS in favour of the company, in view of which SENS has become a majority-owned subsidiary of the company. Meanwhile, the AGM of GO plc will be held remotely on May 25, 2022.

- BMIT Technologies plc (BMIT) closed higher with a 2.5% gain, to a price of €0.498. The equity traded six times, as 100,900 shares changed hands.

- Last Thursday, BMIT announced that the company’s AGM will be held remotely on May 24, 2022.

- M&Z plc added another 2% to the previous week’s gain, reaching €0.765. In total, 22,500 shares changed ownership over two transactions.

- Similarly, three deals of 18,248 International Hotel Investments plc shares resulted into a 3.5% increase in price, as it closed the week at €0.59.

- Mapfre Middlesea plc headed the list of gainers, as it registered a 5.9% increase in price. The equity closed at €2.14, down by 7% from a year-to-date perspective. Total weekly turnover stood at €10,914 over two deals involving 5,100 shares.

- Last Wednesday, the board of Mapfre approved the audited financial statements for the financial year ended December 31, 2021. It resolved that these audited financial statements be submitted for the approval of the shareholders at the forthcoming AGM on April 29, 2022.

- The board will recommend, for the approval of the AGM, the payment of a final net dividend of €2.4m, equivalent to a gross dividend of €0.0304012 per share. If approved, the dividend will be paid on May 24, 2022 to the shareholders registered at close of business on May 11, 2022.

- On the other hand, FIMBank plc was the worst performing equity, as two trades of 16,000 shares dragged the share price by 10.7%. The bank finished the week at the $0.25 price level.

- Both VBL plc and HSBC Bank Malta plc (HSBC) were active and closed unchanged at €0.254 and €0.85, respectively. A total of 10,000 VBL shares were executed across a single trade whilst 14,384 HSBC shares were traded over three deals.

- A total of 89,614 Malita Investments plc shares were traded over 11 transactions. The equity fell by 4.5%, as it closed at €0.75.

- Malta Properties Company plc registered a negative 4.7% movement in price, as it closed at €0.505. Five deals on trivial volume were executed.

- Last Monday, MPC announced that it has entered a promise of sale and purchase agreement with a+ Investments Ltd. Pursuant to the agreement, the vendor promised and bound itself to sell and transfer to the company which promised to purchase and acquire an office complex in Ta’ Xbiex.

- By virtue of an agreement made on October 7, 2021 the company assigned its rights arising from the agreement to SGE Property Company Limited. SGE is a wholly-owned MPC group company.

- Pursuant to an amendment to the agreement, the consideration for the sale and acquisition of the property was reduced by €175,000, from €8.75m to €8.575m, of which the sum of €875,000 was paid by way of deposit on account of the price on the execution of the agreement. The balance of €7.7m was paid on the execution of the final deed of sale and was partially financed through bank financing obtained by SGE.

- The property will now form part of the MPC group property portfolio, resulting in the MPC group receiving rental income in terms of lease agreements attributable thereto.

- MaltaPost plc lost 4.4% to close the week at €1.10. Since the beginning of the year the equity has only recorded negative weekly performances and is down by nearly 10%. A total of 8,136 shares were exchanged across five transactions.

- Plaza Centres plc lost ground after three deals of 21,400 shares dragged the share price by 5.6%, to close the week at €0.85.

- Loqus Holdings plc gained 5.7% to finish the week at €0.111. A total of 2,000 shares exchanged ownership over a single transaction.

- The MSE MGS Total Return Index registered a 0.8% decline, reaching 1,034.011 points. Out of 18 active issues, the 4.1% MGS 2034 (I) was the most liquid bond, as turnover reached €0.9m. The bond closed the week at €128.94, as a result of five transactions.

- The MSE Corporate Bonds Total Return Index eased by 0.1%, to close at 1,134.747 points. Out of the 43 active bonds, the 3.75% Premier Capital plc Unsecured € 2026 registered the highest turnover of €0.3m, as 11 transactions were executed.

- Mercury Project Finance plc announced on Wednesday that it has been granted regulatory approval by the MFSA for the issue and admissibility to listing on the official list of the MSE.

- In the Prospects MTF Market, five securities were active on a total of 14 trades. The most liquid bond was the 5% Busy Bee Finance plc Unsecured € 2029 after six trades generated a turnover of €41,600.

| Upcoming Events | ||||

| 13 April 2022 | MT: HSBC Bank Malta plc – AGM | Best Performers: | ||

| 20 April 2022 | MT: Lombard Bank Malta – Full Year Results | MMS | +5.94% | |

| 29 April 2022 | MT: Mapfre Middlesea plc – AGM | LQS | +5.71% | |

| 26 May 2022 | MT: Lombard Bank Malta – AGM | IHI | +3.51% | |

| Worst Performers: | ||||

| FIM | -10.71% | |||

| PZC | -5.56% | |||

| MPC | -4.72% | |||

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]