MSE Trading Report for Week ending 08 April 2022

| MSE Equity Total Return Index: |

| Highlights: |

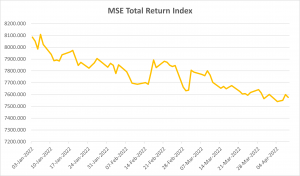

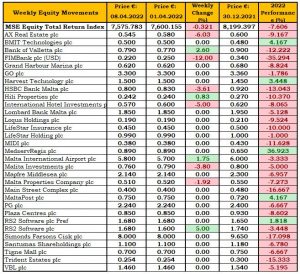

The MSE Equity Total Return Index posted a 0.3% decline as it extended its negative streak to six straight weeks, albeit larger capitalised companies registered gains. The index ended the week at 7,575.78. Six out of the 18 active equities headed south, while four gained ground.

Bank of Valletta plc (BOV) was the most liquid equity with a total of €139,440 registered in turnover. The banking equity broke a two-week losing streak and closed 2.6% higher at €0.79. BOV traded 36 times, as 181,186 shares changed hands.

RS2 Software plc Ordinary shares was the best performing equity this week. The equity reached the €1.68 price level on Thursday, after a total of 32,323 shares pushed the share price higher by 5%. The turnover in RS2’s ordinary shares exceeded €52,700.

Malta International Airport plc extended the previous week’s gain by advancing to the €5.80 level, an increase of 1.8% or €0.10. A total of 19,723 shares worth €113,259 were executed over 16 transactions.

HSBC Bank Malta plc drifted lower as 10 trades worth €23,867 were executed. The equity ended the week 3.6% lower at €0.80. HSBC is 13% lower compared to the opening price in January.

The share price of GO plc declined on both Monday and Wednesday but recovered on Thursday to ultimately end the week unchanged at €3.30. The equity was active as a result of 16,702 shares being executed across 13 deals.

A total of 4,465 BMIT Technologies plc shares were traded but had no impact on the share price of €0.50.

AX Real Estate plc finished the week in negative territory, as two trades for a total of 2,466 shares at the end of the week dragged the share price lower by 6%. The equity closed at €0.545, down by a mere €0.035.

AX announced that during the board meeting held on April 4 2022, the board resolved to approve the audited financial statements for the year ended October 31, 2021.

The profit after tax for the year amounted to €20,011,987 when compared to €157,797 for the year 2020. During the year under review, the AX Group went through a re-organisation exercise, with the ultimate aim of consolidating the main property letting activities of the AX Group into one newly-formed division under AX Real Estate plc, and thus forming the Estates Group.

The company received dividends of €17 million from its subsidiaries. The company recognised an increase in the fair value of its investment property, the warehouses at Hardrocks Business Park and the Falcon House offices of €3,824,451.

Malta Properties Company plc erased the previous week’s gain after the share price retracted by 1.9%, ending the week at €0.51. This was the outcome of two trades on slim volume.

Mapfre Middlesea plc ended the week unchanged at €2.14 after a last minute trade of just six shares, recovered the equity’s share price. A total of 1,678 shares exchanged ownership across three trades. Mapfre announced that its forthcoming AGM will be held remotely through the company’s website on April 29, 2022.

Two contrasting sessions for the banking equity, Lombard Bank Malta plc, cancelled each other out to ultimately close the week unchanged at €1.85. The equity traded three times, generating a turnover of €4,831.

Malita Investments plc had a last minute transaction of 10,000 shares drag the share price down to €0.76, a 3.8% decline.

International Hotel Investments plc (IHI) started the week with a negative 5% change in price, dropping to €0.57. 1,529 shares were executed across three deals. IHI announced that its AGM will be held on June 9, 2022.

Hili Properties plc was one of the positive performers after having registered a 0.8% increase in its share price. The equity finished the week at €0.242 with 37,700 shares exchanging ownership across two trades.

The company announced that on March 31, 2022 it completed the promise of sale and purchase agreement dated August 25, 2015 pursuant to which it promised to acquire 100% of the issued share capital of Harbour (APM) Investments Limited, as owner of the 92,000sqm parcel of land comprising a number of sites at Benghajsa, Malta. This acquisition increases the company’s portfolio from €155m to €180m.

The board of Hili Properties plc is scheduled to meet on April 27, 2022 to consider, and if deemed appropriate, approve the company’s consolidated annual financial statements for the financial year ended December 31, 2021.

A sole transaction of 5,000 Tigne Mall plc shares left the price at the €0.70 price level. Similarly, no movement was noted for the food and beverage company, ending the week at €8. Simonds Farsons Cisk plc registered a single trade of 10,000 shares.

The other non-movers for the week were M&Z plc and LifeStar Insurance plc shares, having traded at €0.75 and €0.45, respectively.

The worst performing equity for the week was FIMBank plc. The equity slipped to $0.22, down by 12%. A total of 110,500 shares worth just $21,315, changed ownership over seven transactions. FIMBank fell by 35% from a year-to-date perspective.

MIDI plc announced that its forthcoming AGM will be held remotely on June 16, 2022.

The board of Plaza Centres plc is scheduled to meet on April 27, 2022 to consider and if thought fit, approve the group’s financial statements for the financial year ended December 31, 2021.

Grand Harbour Marina plc’s board announced that it is scheduled to meet on April 18, 2022 to consider and if deemed appropriate, approve the company’s financial statements for the financial year ended December 31, 2021. The board shall also consider whether to declare and make a recommendation to the shareholders for the payment of a dividend.

The MSE MGS Total Return Index drifted 1% lower to 1,019.258 points, registering a turnover of €1.36m. The largest turnover of the week was generated in the 5.25% MGS 2030 (I) as six trades for a value of circa €0.3m were executed. The issue ended the week at €129.78.

The MSE Corporate Bonds Total Return Index gained 0.5% to finish at 1,136.771 points, as turnover reached €2.76m over 56 active issues. The most liquid bond was the 4.25% Best Deal Properties Holding plc Secured € 2024, generating a total turnover of €0.35m across eight deals and ending the week at €104.50.

In the Prospects MTF market 10 issues were active, as 28 trades worth €0.15m exchanged hands. The 4.75% KA Finance plc Secured Callable Bonds 2026-2029 was the most liquid issue as turnover reached just above €51,400. The bond closed the week at €95.00.

| Upcoming Events | ||||

| 13 April 2022 | MT: HSBC Bank Malta plc – AGM | Best Performers: | ||

| 20 April 2022 | MT: Lombard Bank Malta – Full Year Results | RS2 Ordinary | +5.00% | |

| 29 April 2022 | MT: Mapfre Middlesea plc – AGM | BOV | +2.60% | |

| 26 May 2022 | MT: Lombard Bank Malta – AGM | MIA | +1.75% | |

| Worst Performers: | ||||

| FIM | -12.00% | |||

| AXRE | -6.03% | |||

| IHI | -5.00% | |||

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]