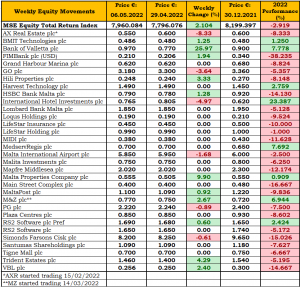

MSE Trading Report for Week ending 06 May 2022

| MSE Equity Total Return Index: |

| Highlights: |

The MSE Equity Total Return Index extended its positive performance, having advanced another 2.1% to reach 7,960.084 points. Activity in the equities’ market increased, as €1.05m was traded, up from €0.8m last week. Gainers outnumbered fallers, as out of 20 active equities, 11 headed north and six posted losses.

Bank of Valletta plc (BOV) headed the list of gainers after ending the week at the €0.97 price level, up by 26% or €0.20. This gain came on the back of an agreement between BOV and the curators of the bankruptcy of the Deiulmar group whereby, without admission of any liability on either part, the bank will pay the sum of €182.5m to the curators in full and final settlement of the disputes and of all claims that had been made by the curators against the bank. The bank will henceforth be in a more secure capital position overall and will be better placed to carry out its business with confidence and sustainability.

In addition, last Thursday the bank published its interim directors’ statement. The BOV group delivered a profit before tax of €22m for the first quarter of the year, up by €12.7m from the same period in 2021. This improvement reflects, the ongoing but as yet incomplete recovery from the COVID-19 pandemic, which was further underpinned by encouraging economic activity.

The group’s revenues in the first quarter were €58.4m, up by 5% over the comparable period last year. This is mainly due to consistent growth in lending, particularly home loans, coupled with increased revenues from payments and card business.

Operating costs for the first three months were higher by 3% versus the same period in 2021, mainly attributable to higher employee compensation costs driven by an increase in headcount as well as the group’s contribution to the Deposit Guarantee Scheme linked to higher customer deposit levels.

A net Expected Credit Losses reversal of €7m contributed to profitability in the first quarter of 2022. This reflected more favourable economic circumstances positively affecting the expected performance of specific sectors, and individually significant exposures coupled with better collateralised positions. Furthermore, a charge of €4.8m was taken in the quarter with respect to long outstanding non-performing loans, supporting the group’s prudent approach. The bank continues to actively assess its expected credit losses as economic prospects evolve.

During the second quarter of 2022, the bank intends to continue strengthening its Minimum Requirement for Own Funds and Eligible Liabilities (MREL) position in line with ongoing regulatory requirements. The planned issuance of a senior preferred bond on the international market will be specifically undertaken to meet the MREL target for the foreseeable future.

During the week a total of 780,128 BOV shares exchanged ownership across 104 transactions. The bulk of trading took place on Wednesday, as investors digested the news and activity spiked in the opening minutes of trading.

The share price of HSBC Bank Malta plc closed the week higher by 1.3% at €0.79. Nine transactions involving 38,049 shares were executed.

FIMBank plc was active twice last Tuesday with a total of 127,884 shares being executed. The share price advanced by 1.9% to end the week at $0.21.

A total of 5,720 Malta International Airport plc shares exchanged hands across five transactions during the week. The share price eased by 1.7% to close at €5.85.

Likewise, International Hotel Investments plc lost ground and closed at the €0.765 level. Seven deals worth €31,413 were executed, as the equity declined by 5% over the week.

GO plc traded seven times over 5,902 shares, as the equity’s price was down by 3.6% and closed the week at €3.18.

BMIT Technologies plc was active only yesterday, as 18,800 shares exchanged ownership across two deals. The equity registered a 1.3% positive change in its share price, closing at €0.486.

RS2 Software plc Ordinary shares was the only equity in the IT services sector to end the week unchanged. Four transactions of 10,646 shares kept the share price at €1.65. RS2 Software plc Preference shares was active on a single deal of 18,000 shares, after a month of inactivity. The preference shares finished the week at €1.69, higher by 0.6%.

In the property sector, AX Real Estate plc shed 8.3% of its previous week’s share price, ending the week at €0.55, lower by €0.05. This was the outcome of a sole transaction of 95,000 shares.

A sole deal of 500 Hili Properties plc shares pushed the share price 3.3% higher to the €0.248 level. Similarly, Malta Properties Company plc gained 9.9%, as turnover reached €26,103 over six transactions of 50,230 shares. The equity closed the week at €0.555.

Tridents Estates plc and VBL plc also joined the list of gainers. The equities registered a 4.3% and a 2.4% positive change, to ultimately finish the week at €1.46 and €0.256 respectively.

Santumas Shareholdings plc was active but closed unchanged at €1.09. A total of four deals involving 5,082 shares were executed.

A negative 0.6% change was noted in the share price of Simonds Farsons Cisk plc, having traded once at €8.20 over a negligible volume of 10 shares.

M&Z plc closed the week at €0.77. The equity gained 2.7% as a result of nine transactions of 42,018 shares.

Retail conglomerate, PG plc, traded twice as 5,154 shares changed hands. The outcome was a 0.9% decrease in price to €2.22.

Four transactions of 20,250 MaltaPost plc shares pushed the share price higher by 0.9% to the €1.10 level.

Grand Harbour Marina plc closed unchanged, as four transactions of 7,750 shares had no impact on the closing price of €0.62. The board announced that it shall be meeting on May 16, 2022 to consider whether to declare and pay an interim dividend to its shareholders.

Meanwhile, the MFSA notified the market that last Monday it suspended the listing and trading of the securities of MedservRegis plc, for the company’s failure to publish the last annual audited financial statements within the periods stipulated in the Capital Markets Rules.

The suspension is valid for a period of 10 working days with effect from May 02, 2022 until May 13, 2022. This suspension may be terminated prior to the expiration of the 10-day period should MedservRegis plc publish the abovementioned documents in the interim.

In the fixed income market, the MSE Corporate Bonds Total Return Index remained unchanged, to close at 1,146.852 points. Out of the 60 active bonds, gainers amounted to 22, while 18 declined. In total, €3.44m worth of corporate bonds were traded. The best performing issue was the 4% Shoreline Mall plc Secured € 2026, as it registered a 4.2% gain to close at €99.25.

The MSE MGS Total Return Index trended lower, as 15 active bonds pushed the index lower to 994.114 points, down by 1.1%. A turnover of €3.65m was generated. The most liquid bond was the 5.2% MGS 2031 (I), which registered €0.73 in turnover, to close at €128.09.

In the Prospects MTF Market, three issues were traded, with the most active being the 4.75% Gillieru Investments plc Secured Bonds 2028. This week it generated a total turnover of €7,200 over three deals to close at par.

| Upcoming Events | ||||

| 11 May 2022 | MT: Malta International Airport plc – AGM | Best Performers: | ||

| 19 May 2022 | MT: Malta Properties Company plc – AGM | BOV | 25.97% | |

| 23 May 2022 | MT: Main Street Complex plc – AGM | MPC | 9.90% | |

| 24 May 2022 | MT: BMIT Technologies plc – AGM | TRI | 4.29% | |

| 24 May 2022 | MT: Mapfre Middlesea plc – Dividend Payment Date | |||

| 24 May 2022 | MT: Malta Properties plc – Dividend Payment Date | Worst Performers: | ||

| 25 May 2022 | MT: Simonds Farsons Cisk – Full-Year Results | AXR | 8.33% | |

| 25 May 2022 | MT: GO plc – AGM | IHI | 4.97% | |

| 26 May 2022 | MT: Lombard Bank Malta plc – AGM | GO | 3.64% | |

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]