MSE Trading Report for Week ending 13 May 2022

| MSE Equity Total Return Index: |

| Highlights: |

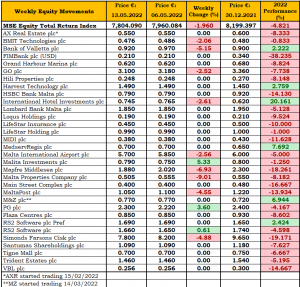

- The MSE Equity Total Return Index declined by 2%, as it closed at 7,804.09 points. A total of 18 equities were active, three of which headed north, while another nine closed in the opposite direction. Weekly turnover totalled to €0.65m across 119 transactions.

- Malta International Airport plc (MIA) recorded the highest liquidity with a total turnover of €232,493. The share price declined further, despite the positive traffic results announced for the month of April. The equity registered a 2.6% decline, as 16 transactions involving 40,170 shares were executed. MIA shares closed the week at €5.70.

- Last Wednesday, the company held its Annual General Meeting (AGM) where all resolutions were considered and approved.

- Furthermore, the company announced the traffic results for April. The month brought busier days for MIA, as 513,979 passengers travelled through the terminal during the month. This figure marks a recovery of 78.7% of pre-pandemic passenger numbers, which is the strongest monthly recovery MIA has registered so far.

- Reaching 77.8%, the seat load factor (SLF) for the month of April was just 5.6% below pre-pandemic levels, indicating that there was an encouraging demand for travel. Several factors, including the launch of the airport’s summer flight schedule together with the easing of Malta’s entry restrictions on April 11, were important contributors to April’s positive results.

- The Easter period was possibly the strongest driving factor where MIA welcomed 133,267 passengers. The best-performing markets for the month remained unchanged from March, as Italy continued to top the leader board with 114,707 passenger movements, followed by the United Kingdom, France, Germany, and Poland.

- April’s traffic augurs well for the upcoming months, even though recently published data for the first quarter of the year shows that Malta’s recovery still lagged behind that of its Mediterranean competitors.

- While Malta has eased many of its travel restrictions in recent weeks, survey results published by the European Travel Commission in April 2022 showed that 56% of Europeans who were planning to travel in summer had already chosen their destination.

- Bank of Valletta plc (BOV) headed south by 5.2% or €0.05 to end the week at €0.92 after trading at a weekly low of €0.835. A total of 24 transactions of 87,779 shares were executed.

- The bank’s AGM is scheduled to be held remotely on June 2, 2022.

- Its peer, HSBC Bank Malta plc advanced to €0.82 on Wednesday but this gain was fully erased on Thursday, as the equity failed to hold on to this week’s high. The equity ended the week unchanged at €0.79. A total of 11 deals involving 26,519 shares resulted into a total turnover of €21,191.

- In the IT services sector, BMIT Technologies plc (BMIT) and RS2 Software plc Ordinary shares (RS2) were the only active equities. The share price of BMIT eased by 2.1% to the €0.476 level. A total of 16,000 shares exchanged ownership across three transactions.

- On the other hand, RS2 gained 0.6% to close the week at €1.66. A total of 21,050 shares exchanged hands over seven deals.

- Malta Properties Company plc (MPC) was the worst performer overall. MPC registered a 9% negative change in its share price as a result of a single trade on trivial volume. The equity closed the week at €0.505.

- Malita Investments plc was the best performing equity, after three last minute transactions pushed the equity out of negative territory. Ten transactions of 71,700 shares were executed, to close at €0.79, higher by 5.3% on the week.

- On the other hand, AX Real Estate plc and Hili Properties plc ended the week unchanged at €0.55 and €0.248 respectively.

- Last Thursday, Hili Properties plc announced a performance update following the initial public offering (IPO) in 2021, where the company acquired and secured acquisitions in Lithuania, Latvia and Benghajsa in Malta.

- The performance of the property portfolio during the first quarter of 2022 was solid, with revenues reaching €2.4m. Earnings before interest, tax and depreciation (EBITDA) for the first quarter of 2022 stood at €1.5m and the EBITDA to revenue ratio has improved from 60% as at December 31, 2021 to 65% as at March 31, 2022.

- The company’s cash reserves are positive, also given that the utilisation of the IPO proceeds is still underway. The board remains committed to the execution of the plans set out in the company’s prospectus dated October 25, 2021.

- International Hotel Investments plc added to the previous week’s loss, after the share price declined by 2.6% to close at €0.745. The equity fell to the €0.71 level on Monday, but partially recovered the loss on Thursday. This was the outcome of eight deals of 23,900 shares.

- Simonds Farsons Cisk plc was active on three trading days, declining further each day. The equity ultimately closed at €7.80, lower by 4.9%. A total of 11,360 shares exchanged hands six times.

- GO plc closed the week 2.5% lower at €3.10 after it failed to hold to this week’s high price of €3.20. A total of 18,873 shares changed hands over 14 deals.

- The retail conglomerate, PG plc, added 3.6% to its share price last Tuesday as a result of three transactions involving 5,650 shares. The equity closed at €2.30.

- MaltaPost plc fully erased the previous week’s gain, after two transactions of 5,500 shares dragged the share price by 4.6%. The equity finished the week at €1.05.

- Two deals in Mapfre Middlesea plc shares pushed the share price 6.9% lower to €1.88.

- Loqus Holdings plc announced that as part of a re-organisation exercise aimed at streamlining operations, its subsidiary Loqus Consulting Ltd shall be merged with Loqus Services Ltd.

- This shall happen following a share transfer whereby the company shall transfer its shareholding in Loqus Consulting Services amounting to 9,375 Ordinary B shares to Loqus Services Ltd. The company holds the totality of Ordinary shares issued in Loqus Services Ltd, with the exception of one share which is held by another group company.

- Furthermore, the merger shall happen following a share transfer whereby Loqus Services Ltd shall acquire from Mr David Spiteri Gingell 3,125 Ordinary A shares in Loqus Consulting Ltd.

- Upon the proposed merger by acquisition taking effect, Loqus Services Ltd, as the acquiring company, shall succeed to all the assets, rights, liabilities and obligations of Loqus Consulting Ltd, which, in turn, shall cease to exist. Loqus Consulting Ltd is currently non-operational and therefore the above transaction is intended solely for streamlining the Group’s operations.

- The MSE MGS Total Return Index managed to offset its previous week’s decline, as it closed 0.1% higher at 994.684 points. Out of 15 active issues, nine registered gains while seven traded lower. The 2.1% MGS 2032 (IV) headed the list of gainers with a 1.8% change in price, to close at €101.78. On the other hand, the 4.45% MGS 2032 (II) lost 1%, ending the week at €123.62.

- The MSE Corporate Bonds Total Return Index ended the week in negative territory, as it closed 0.1% lower at 1,146.129 points. A total of 58 issues were active, 19 of which advanced while another 16 closed in the red. The best performance of a 4% increase was recorded by the 4.5% Shoreline Mall plc Secured € 2032, as it closed at €98.85. Conversely, the 5.1% 6PM Holdings plc Unsecured € 2025 lost 2.4%, to close at €100.02.

- In the Prospects MTF market, nine issues were active. The 5.75% Pharmacare Finance plc Unsecured EUR Bonds 2025-2028 was the most liquid, as total weekly turnover stood at €17,435.

| Upcoming Events | ||||

| 19 May 2022 | MT: Malta Properties Company plc – AGM | Best Performers: | ||

| 23 May 2022 | MT: Main Street Complex plc – AGM | MLT | 5.33% | |

| 24 May 2022 | MT: BMIT Technologies plc – AGM | PG | 3.60% | |

| 24 May 2022 | MT: Mapfre Middlesea plc – Dividend Payment Date | RS2 | 0.61% | |

| 24 May 2022 | MT: Malta Properties plc – Dividend Payment Date | |||

| 25 May 2022 | MT: Simonds Farsons Cisk – Full-Year Results | Worst Performers: | ||

| 25 May 2022 | MT: GO plc – AGM | MPC | -9.01% | |

| 26 May 2022 | MT: Lombard Bank Malta plc – AGM | MMS | -6.93% | |

| BOV | -5.15% | |||

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]