MSE Trading Report for Week ending 20 May 2022

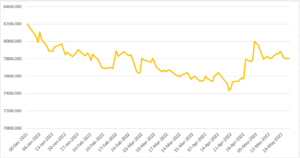

| MSE Equity Total Return Index: |

| Highlights: |

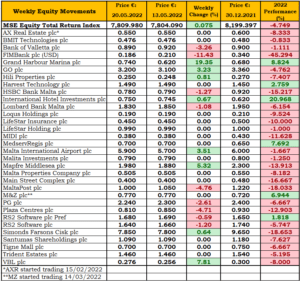

- The MSE Total Return Index registered a marginal 0.1% increase, reaching 7,809.980 points. Out of 21 active issues, eight advanced while nine lost ground. A total of 88 transactions generated a weekly turnover of just €0.3m, down from €0.7m last week.

Malta International Airport plc (MIA) recorded a weekly gain of 3.5%, recovering last week’s 2.6% decline. The equity closed at €5.90 as 9,400 shares exchanged ownership across 12 transactions.

On Tuesday, MIA disclosed the financial performance for the first quarter of the year. The quarter was off to a sluggish start, as the tightening of travel restrictions at the end of 2021 had repercussions on consumer confidence, which extended well into the new year. Passenger numbers for the first three months remained 44.1% below pre-pandemic levels.

Despite the slow start, MIA’s continued caution in relation to cash management, allowed the group to close the quarter with a revenue of €10.8m. This total was just over double the revenue the group had generated in the first quarter in 2021, when traffic had amounted to just 98,493 passenger movements.

The company experienced an increase of 26% in staff costs over the same quarter last year. This was driven by several factors including the lifting of a hiring freeze, which had been implemented at the onset of the pandemic, and the discontinuation of staff pay cuts between February and April 2021. The group’s operating expenses, on the other hand, increased by 25% as a result of a busier operation in comparison with the same period last year.

The group’s capital expenditure, which includes part of the investment in the complete overhaul of the airport food court, amounted to €1.2m. This project, the first phase of which was concluded last week, is expected to strengthen the retail and property segment, which is an important contributor to the group’s revenues. MIA turned around the loss of €3.1m it had registered in the first three months in 2021 to a profit before tax of €1.2m.

In the telecommunications sector, eight transactions of 18,235 GO plc shares, lifted the share price by 3.2% to the €3.20 level. The equity generated the highest total trading turnover during the week of €58,199.

In the banking sector, all four active equities ended the week in negative territory. HSBC Bank Malta plc shares edged 1.3% lower, as six trades of 10,309 shares were struck, to close at €0.78.

Likewise, Bank of Valletta plc (BOV) shares slipped by 3.3% over nine transactions worth €28,818. The banking equity closed €0.03 lower at €0.89, after trading at a weekly high of €0.92.

The bank announced that it is organising a physical meeting for shareholders together with the bank’s board and executive committee for a question and answer session. BOV shareholders can field questions regarding recent developments concerning the bank’s business, including the latest developments leading to the out-of-court settlement in the Deiulemar case. This session will be held on June 15, 2022.

FIMBank plc closed the week 11.4% lower at $0.186, as three transactions of 2,932 shares were executed.

Similarly, two transactions of 2,000 Lombard Bank Malta plc shares, pushed the equity in the red. The equity closed the week 1.1% lower at €1.83.

In the properties sector, the overall performance was positive. Four deals involving 25,450 Hili Properties plc shares lifted its share price by 0.8%, to close the week at €0.25. The company’s board announced that the AGM will be held on June 28, 2022.

A sole transaction of just 2,000 VBL plc shares pushed the share price into the green, to end the week 7.8% higher at €0.276.

AX Real Estate plc announced that the company’s AGM will be held on August 25, 2022. The equity traded flat at €0.55, over four trades worth €28,021.

Another non-mover for the week was Malta Properties Company plc, having closed at €0.505 on a single deal of 1,000 shares.

International Hotel Investments plc partially reversed the previous week’s decline, as five transactions of 36,010 shares increased the share price to the €0.75 price level, reflecting a 0.7% increase.

On the other hand, the IT services sector saw a decline in most of the active equities, as both RS2 Software plc’s Ordinary shares and Preference shares headed south. RS2 Software plc Ordinary shares closed 1.2% lower at €1.64. This was the outcome of three deals involving 6,970 shares.

RS2 Software plc Preference shares registered a 0.6% decline, as a single transaction of 2,000 shares pushed the share price lower to the €1.68 price level.

Meanwhile, BMIT Technologies plc closed the week unchanged at €0.476. The equity’s price fluctuated between a weekly high of €0.48 and a low of €0.476. Four deals of 27,000 shares were executed.

Grand Harbour Marina plc was the best performing equity, as it finished the week at €0.74. The 19.4% increase was the result of three transactions of a combined 20,750 shares.

The company resolved to distribute a gross dividend of €0.75m equivalent to €0.0375c per ordinary share. This dividend will be paid on May 30, 2022 to the ordinary shareholders who were on the company’s register of members as at close of business on May 23, 2022.

M&Z plc shares were active on Monday, with four trades across 24,308 transactions. The equity closed unchanged at €0.77.

PG plc partially reversed the previous week’s 3.6% gain, to ultimately end the week 2.6% lower at €2.24. A total of 3,600 shares exchanged hands across two transactions.

Four deals involving 1,225 Simonds Farsons Cisk plc shares resulted into a 0.6% increase in price, finishing the week at €7.85.

MaltaPost plc shares jumped by nearly 5%, to close the week at €1. This was the outcome of six deals involving 14,271 shares.

The company’s board approved the unaudited condensed consolidated interim financial statements for the six month period ended March 31, 2022. MaltaPost Group registered a profit after tax of €0.33m versus a profit of €0.89m during the same period last year.

The total revenue reduced by €4.5m to €15.7m, following a decrease in international cross-border mail and parcel volumes as well as a drop in local single and bulk mail volumes. Expenditure stood at €15m, down by €4m due to a decline in cross-border mail and parcel volumes, together with height airfreight and increased cost of terminal dues. The cost-to-income ratio rose to 95.6% due to the losses incurred to meet the Universal Postal Services Obligation.

The share price of Plaza Centres plc dropped 4.7% to €0.81, following nearly two months of inactivity. This was the result of a sole transaction worth €10,530.

Mapfre Middlesea plc shares rose by 5.3% over five transactions of 6,312 shares. Despite trading at an intra-week low of €1.85, the equity closed at €1.98.

MedservRegis plc announced that the board is scheduled to meet on June 15, 2022 to approve and publish the consolidated financial statements for the period ended December 31, 2021. The company’s AGM shall be held on July 28, 2022.

In terms of IPO activity, the board of APS Bank plc announced that it has submitted an application for the authorisation for admissibility to listing to the MFSA requesting approval to list the bank’s ordinary shares on the official list of the MSE.

The listing is being sought in connection with a proposed public issue of 100m new ordinary shares, with an over-allotment option of 10m new ordinary shares at an issue price of €0.62 per share. The new shares will be offered for subscription to the general public and preferred applicants, being directors or employees of the APS group or registered bondholders of the bank, as at close of business of May 23, 2022.

In terms of pre-allocation agreements, the bank is conditionally bound to issue 69,681,981 new shares at an average price of €0.594 per share. A total of 40,318,019 new shares which include the additional 10m new shares, will be available for subscription by the general public and preferred applicants during the offer period for the IPO.

The MSE MGS Total Return Index did not manage to maintain its positive streak as it lost 0.5%, closing at 989.575 points. Out of 17 active issues, one headed north while another 15 closed in the opposite direction. The 1.80% MGS 2051 (I) was the best performer, as it closed 0.8% higher at €93. On the other hand, the 2.2% MGS 2035 (I) ended the week 5.1% lower at €100.76.

The MSE Corporate Bonds Total Return Index lost another 0.1%, as it closed at 1,145.061 points. A total of 46 issues were active, 12 of which advanced while another 15 traded lower. The top performer was the 4.4% Von der Heyden Group Finance plc Unsecured € 2024, as it registered a 2.4% increase, ending the week at €101.40. Conversely, the 3.75% Virtu Finance plc Unsecured € 2027 lost 2%, as it dropped to the €100 price level.

In the Prospects MTF market, five issues were active. The 4.75% Gillieru Investments plc Secured Bonds 2028 was the most liquid, as the bond registered a total weekly turnover of €10,000.

| Upcoming Events | ||||

| 23 May 2022 | MT: Main Street Complex plc – AGM | Best Performers: | ||

| 24 May 2022 | MT: BMIT Technologies plc – AGM | GHM | 19.35% | |

| 24 May 2022 | MT: Mapfre Middlesea plc – Dividend Payment Date | VBL | 7.81% | |

| 24 May 2022 | MT: Malta Properties plc – Dividend Payment Date | MMS | 5.32% | |

| 25 May 2022 | MT: Simonds Farsons Cisk – Full-Year Results | |||

| 25 May 2022 | MT: GO plc – AGM | Worst Performers: | ||

| 26 May 2022 | MT: Lombard Bank Malta plc – AGM | FIM | 11.43% | |

| MTP | 4.76% | |||

| PZC | 4.71% | |||

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]