MSE Trading Report for Week ending 03 June 2022

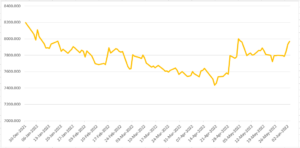

| MSE Equity Total Return Index: |

| Highlights: |

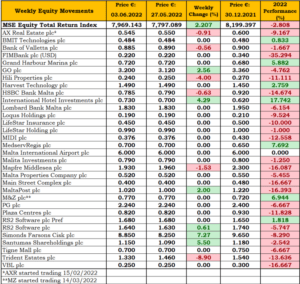

The MSE Equity Total Return Index (MSE) gained 2.2% to end the week at 7,969.143 points. A total of 17 equities were active, six of which headed north while another six closed in the opposite direction. Weekly turnover increased by €0.2m to €0.7m and was generated across 134 transactions.

Simonds Farsons Cisk plc (SFC) headed the list of gainers with a 7.3% increase, as the equity closed at €8.85. During the week SFC shares fluctuated between a weekly low of €7.50 and a high of €9. A total of 19 deals worth €94,593 were executed. Last Thursday, the board announced that the AGM will be held remotely on June 23, 2022.

SFC resolved to recommend for the approval of the AGM the capitalisation of €1.8m from the company’s retained tax-exempt earnings for the purpose of issuing up to 6m fully paid-up ordinary shares of a nominal value of €0.30 per share, representing one bonus share for every five shares held.

On Tuesday, the MFSA approved the application for admissibility to listing of 6m ordinary shares of a nominal value of €0.30 per share as well as the proposed changes to the Memorandum and Articles of Association.

International Hotel Investments plc partially recouped the previous week’s loss, as the equity’s price jumped by 4.3%. Eight transactions involving 91,288 shares were recorded, as the equity finished closed the week at €0.73.

Among the large caps, GO plc shares joined the list of gainers, as the equity added €0.08 or 2.6% to finish the week at €3.20. This was the outcome of 12 transactions of 27,401 shares.

Meanwhile, the active banking equities finished the week in the red. Bank of Valletta plc traded at a weekly low of €0.86 and closed the week 0.6% lower at €0.885. This was the outcome of 20 transactions worth €90,195. Last Thursday, the bank announced that the board approved all the resolutions on the AGM’s agenda.

Likewise, the share price of HSBC Bank Malta plc (HSBC) eased by 0.6% to close at €0.785. HSBC was the most liquid equity, after a total of 32 transactions involving 210,539 shares generated a turnover of €159,319.

Last Tuesday, HSBC reported a profit before tax of €4.8m for the first quarter of the year, down by €5.1m compared to the €9.9m profits reported in same period last year. The decrease is a result of lower profit reported by the insurance subsidiary of €4.9m, reflecting the unfavourable market impact. Revenues were €6.2m lower than those reported in the first three months last year and net interest income decreased as a result of tighter margins and an increase in cash placements at negative rates.

The bank reported improvements in net fee income driven by increased activity across cards and payments and a strong performance in foreign exchange income. Expected credit losses were broadly maintained at the levels booked as at end of 2021. A marginal release was booked for the retail business in view of the improvement in customers’ performance.

The bank continued to implement effective cost management discipline resulting in lower operating expenses of €1.1m than those reported in the same period in 2021. Cost savings continued to be realised through the implementation of the prior year’s transformation programme. Lower regulatory fees also contributed to the reduction in expenses.

Net loans and advances to customers were marginally lower than those reported as at December 31, 2021. Customer deposits increased by €122m compared to December 31, 2021. The bank’s liquidity position remained strong and regulatory capital ratios continued to exceed regulatory capital requirements.

Malta International Airport plc (MIA) closed flat at €6 after trading at a weekly low of €5.95. Fifteen deals worth €110,060 were executed.

Trading activity in retail conglomerate PG plc was spread over four deals of 4,563 shares. The equity traded flat at €2.24.

In the property sector, Santumas Shareholdings plc was the only positive performer. The equity advanced by 5.5%, finishing the week at €1.15. Two trades of just 469 shares were executed.

Trident Estates plc headed the list of fallers, as 2,767 shares changed hands across three transactions. The equity closed at €1.33, translating into an 8.9% weekly decline. The Board announced that the company’s AGM will be held remotely on June 24, 2022.

Four trades involving 53,000 Hili Properties plc shares resulted into a 4% decline in the share price. The equity ended the week at the €0.24 price level.

Similarly, the share price of AX Real Estate plc declined by 0.9% to close at €0.545. This was the outcome of a sole transaction worth €8,175.

Malta Properties Company plc traded flat at €0.52, as two trades of 1,730 shares were recorded. The company announced that it has been granted approval by the MFSA for the admissibility to listing on the official list of the MSE of a bond issuance programme of up to €50m which allows the company to issue up to a maximum of €50m in value of bonds in one or more tranches up till June 1, 2023. The MFSA has also approved a base prospectus relating to the said programme. Pursuant to the programme, final terms have also been issued offering the first series and tranche under the programme. The offer is in relation to €25m 4% secured bonds maturing in 2032. The bonds are expected to be listed on the official list of the MSE on July 07, 2022.

RS2 Software plc Ordinary shares (RS2) registered a 0.6% positive movement to end the week at the €1.64 price level. Earlier this week RS2 shares traded at a weekly low of €1.56. This was the result of four deals involving 6,950 shares.

Two contrasting sessions for BMIT Technologies plc cancelled out each other, to ultimately close the week unchanged at €0.484. Turnover in the equity reached €12,888 across two trades.

Last Monday, the share price of MaltaPost plc fell by 7.3%, as two deals of 19,000 shares pushed the share price lower to the €1.02 level.

Mapfre Middlesea plc extended its losing streak, as it shed a further 1.5% to €1.93. A turnover of €1,100 was generated over three trades.

No movement was noted in the share price of Tigne Mall plc, having traded at €0.70 over a negligible volume of 699 shares.

In terms of IPO activity, yesterday afternoon APS Bank plc closed the offer period of the bank’s IPO on the day of its opening. The bank took this decision on the back of strong demand from the investing public.

Meanwhile, on Tuesday, Mediterranean Investments Holding plc (MIH) announced that it has received regulatory approval for the issue of the €30m 5.25% MIH Unsecured bonds 2027. The bond issue will be available to maturing bondholders of the 5% MIH unsecured bond 2022 and existing bondholders of the 5.5% MIH unsecured bonds 2023.

LifeStar Insurance plc and LifeStar Holdings plc announced that the companies’ AGM will be held on June 24, 2022.

The MSE MGS Total Return Index declined by 1.1%, as it closed at 977.496 points. A total of 15 issues were active, two of which advanced while 13 closed in the red. The 1.80% MGS 2051 (I) was the best performer, as it closed 3.2% higher at €96. On the other hand, the 2.5% MGS 2036 (I) lost 3%, ending the week at par.

The MSE Corporate Bonds Total Return Index closed 0.5% lower, as it reached 1,139.515 points. Out of 55 active issues, 20 registered gains while another 22 lost ground. The 4.65% Smartcare Finance plc Secured € 2031 headed the list of gainers, as it closed 3% higher at €103. Conversely, the 6% AX Investments Plc € 2024 closed 2.9% lower at €100.01.

In the Prospects MTF market, nine issues were active. The 5.75% Pharmacare Finance plc Unsecured EUR Bonds 2025-2028 was the most liquid with a total turnover of €17,700.

| Upcoming Events | ||||

| 08 June 2022 | MT: Lombard Bank Malta plc – Dividend Payment | Best Performers: | ||

| 09 June 2022 | MT: International Hotel Investments plc – AGM | SFC | +7.27% | |

| 14 June 2022 | MT: FIMBank plc – AGM | STS | +5.50% | |

| 15 June 2022 | MT: Bank of Valletta plc – Shareholders Meeting | IHI | +4.29% | |

| 16 June 2022 | MT: MIDI plc – AGM | |||

| 16 June 2022 | MT: Malita Investments plc – AGM | Worst Performers: | ||

| 17 June 2022 | MT: Tigne Mall plc – AGM | TRI | -8.90% | |

| HLI | -4.00% | |||

| MMS | -1.53% | |||

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]