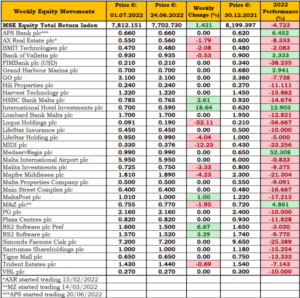

MSE Trading Report for Week ending 01 July 2022

| MSE Equity Total Return Index: |

| Highlights: |

Last Thursday BNF Bank plc announced the issuance of a new €15m unsecured subordinated bonds with a coupon of 4.5% and maturing in 2032 with a call option from the fifth anniversary onwards. The issuer will have an over-allotment option of an additional €5m if the bond is oversubscribed. This bond offer will be available from July 7, and will close on July 22, 2022 or earlier.

In terms of equities, the MSE Equity Total Return Index (MSE) finished the week in the green with a 1.4% gain. A total of 104 transactions worth nearly €0.6m were executed across 20 transactions, with the majority of trading taking place in APS Bank plc. Ten equities declined, while a double-digit gain in International Hotel Investments plc (IHI) was the main contributor to lift the local equities’ index in positive territory. During the month of June, the MSE declined by nearly 1% while during the second quarter it gained 2%.

IHI was the best performing equity, partially recovering the previous week’s loss by gaining 18.6%. The equity closed the week at €0.70 after trading at a weekly low of €0.62. During the second quarter of the year, IHI advanced by 3.3% and is up by 13% since the beginning of the year.

In the banking sector, Bank of Valletta plc (BOV) eased by 0.5%, as 84,866 shares changed ownership across 12 deals. BOV shares closed the week at the €0.93 level. During the second quarter the banking equity gained 21%.

Its peer, HSBC Bank Malta plc traded flat on Monday, while a last-minute transaction of 100 shares during yesterday’s session, increased the share price by 2.6%. The banking equity finished the week at €0.785.

APS Bank plc was the most liquid equity, after 42 transactions of 550,224 shares worth €364,319 were executed. The equity ended the week unchanged at the €0.66 level.

Mapfre Middlesea plc shares finished the week 4.2% lower at €1.81. The share price of the insurance company declined by 15% during the second quarter.

Meanwhile, no movement was noted in the share price of FIMBank plc, as two trades worth $141 kept the share price at the $0.21 level.

LifeStar Holdings plc ended the week 4% lower at €0.95, after trading at a weekly low of €0.20. Four deals of 1,716 shares were executed.

In the IT sector, RS2 Software plc ordinary shares (RS2) and RS2 Software plc preferences shares (RS2P) ended the week in the green. RS2 shares were active on Monday and added 3.3% to the previous week’s closing price. The equity finished the week at €1.57.

Similarly, RS2P ended the week at €1.60, higher by 6.7% on a sole transaction.

RS2 held its AGM on Monday, where all the resolutions were approved.

On the other hand, BMIT Technologies plc declined by 2.1%, ending the week at €0.47. This was the outcome of two transactions involving 15,000 shares.

Loqus Holdings plc was the worst performing equity, as a single deal of 861 shares dragged the share price 52% lower to €0.091.

A single transaction of 574 MaltaPost plc shares, added 1% to the share price, up to €1.01.

Negative sentiment hit equities in the property sector, as four out of five active equities closed the week in negative territory. Malta Properties Company plc was the only equity which ended the week unchanged at the €0.50 level. This was the result of a sole deal of trivial volume.

The share price of AX Real Estate plc fell by 1.8% to €0.55. A total of 24,400 shares exchanged hands across eight transactions. When compared to the previous month, the equity advanced by 1%.

MIDI plc closed 12.2% lower at €0.33. A total of 60,300 shares exchanged ownership across seven deals.

Two transactions of 17,000 Malita Investments plc shares pushed the share price lower by €0.025 or 3.3%. The property equity ended the week at the €0.725 level.

A single deal of 1,750 Trident Estates plc shares dragged the share price 0.7% lower, finishing the week at €1.43.

Main Street Complex plc closed unchanged, as three transactions of 11,090 shares had no impact on the closing price of €0.40.

Likewise, Simonds Farsons Cisk plc remained unchanged, as three transactions of 1,770 shares were executed. The equity closed the week at €7.20.

M&Z plc traded once, as 9,250 shares changed hands. The outcome was a 1.95% decline to €0.755.

| Upcoming Events | ||||

| 08 July 2022 | MT: Tigne Mall plc – Dividend Payment Date | Best Performers: | ||

| 11 July 2022 | MT: PG plc – Dividend Payment Date | IHI | +18.64% | |

| 15 July 2022 | MT: AX Real Estate plc – Dividend Payment Date | RS2P | +6.67% | |

| 28 July 2022 | MT: Mapfre Middlesea plc – Interim Results | RS2 | +3.29% | |

| 28 July 2022 | MT: MedservRegis plc – AGM | |||

| Worst Performers: | ||||

| LQS | -52.11% | |||

| MDI | -12.23% | |||

| MMS | -4.23% | |||

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. Jesmond Mizzi Financial Advisors Limited is acting as sponsoring brokers for the upcoming BNF Bank plc bond issue. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]