MSE Trading Report for Week ending 08 July 2022

| MSE Equity Total Return Index: |

| Highlights: |

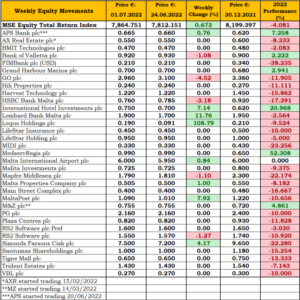

The MSE Equity Total Return Index closed another week in the green, as it reached 7,864.751 points – equivalent to a 0.7% weekly change. During the period, a total of 18 equities were active, eight of which headed north while five closed in the opposite direction. Total weekly turnover amounted to €1.5m, generated across 108 transactions.

Seven deals involving 137,695 International Hotel Investments plc (IHI) shares, lifted the share price 7.1% higher. Ultimately, the equity closed the week at €0.75. Since the beginning of the year, IHI has advanced by 21%.

Malta International Airport plc ended the week with a positive 0.8% movement in its share price, closing the week at €6. Turnover in MIA stood at €50,810, generated executed across six deals.

In the banking sector, Bank of Valletta plc traded at a weekly low of €0.89 and closed the week at €0.92. This translated in a 1.1% decline in the share price, as 19 transactions worth a total of €246,022 were executed.

Its peer, HSBC Bank Malta plc, joined the list of losers, as three deals in which 7,140 shares changed hands, eased the share price by 3.2% to €0.76.

APS Bank plc (APS) locked a weekly gain of 0.8%, to close at €0.665, in the final minutes of trading yesterday. The banking equity recorded a volume of 508,630 shares across 33 deals worth €335,830. The board of APS announced that it is scheduled to meet on July 28, 2022, to consider and approve the consolidated interim financial statements for the first half of 2022 and consider the declaration of an interim dividend.

Lombard Bank Malta plc was the most liquid equity, as seven trades generated €508,582 in turnover. The equity advanced by 11.8% to €1.90.

No movement was noted in the share price of BMIT Technologies plc, having traded at €0.47 on six transactions worth €75,670.

RS2 Software plc ordinary shares ended the week in the red, having retracted by 1.3% to €1.55, following four transactions involving 33,100 shares. On the other hand, RS2 Software plc preference shares were not active.

A 7.9% gain was witnessed over a single trade involving 5,000 MaltaPost plc (MTP) shares, which closed at €1.09.

During the week, MTP published an update to the market relating to the interim financial statements for the six months ended March 31, 2022. Since a number of years, the company has been highlighting the negative impact on its financials of the Universal Service Obligation (USO) while it was also requesting the approval of the Malta Communications Authority (MCA) to review certain postal tariffs.

Repeated requests to the MCA have been made to redress this unsustainable situation as the USO services are being delivered at a loss and stand to contribute towards a material negative impact on the company’s profitability at year end.

GO plc lost 4.5%, as a single trade of just 62 shares was executed. The equity ended the week at €2.96.

On the other hand, Malta Properties Company plc gained 1%, closing at €0.505. This was the result of a sole deal worth a mere €31.

Last Thursday AX Real Estate plc traded three times across 8,010 shares. The previous week’s share price of €0.55 was not altered. Likewise, two transactions for a total of 10,500 Hili Properties plc shares, kept the share price at the €0.24 level.

Three transactions involving 3,008 Simonds Farsons Cisk plc shares, pushed the share price up by €0.30 or 4.2%. The equity finished the week at the €7.50 level.

Retail conglomerate, PG plc, traded four times over 9,493 shares. The equity ended the week unchanged at €2.16, as two contrasting sessions cancelled each other out. Similarly, M&Z plc kept the previous week’s share price of €0.755 on a sole transaction of 1,050 shares.

Mapfre Middlesea plc declined further, as two deals for a combination of 6,140 shares eased the share price by 1.1% to €1.79.

Loqus Holdings plc was the best performing equity, as five deals of 74,845 shares pushed the share price 109% higher. The equity closed the week at €0.19.

Last Thursday, the board of Izola Bank plc announced that it has submitted an application to the MFSA requesting authorisation for admissibility to listing on the Official List of the MSE of up to €14m 5% unsecured subordinated bonds of a nominal value of €100 per bond, redeemable on September 15, 2032, or, earlier, on a designated early redemption date falling in the years 2027 to 2032, as the Issuer may determine.

The MSE Corporate Bonds Total Return Index lost ground, as it closed 0.11% lower at 1,144.416 points. Out of 58 active issues, 28 registered gains while another 17 closed in the red. The 4.65% Smartcare Finance plc Secured € 2031 headed the list of gainers, as it closed 2.8% higher at €103. Conversely, the 4.8% Mediterranean Maritime Hub Finance plc Unsecured € 2026 lost 4%, as it closed at €97.01.

The MSE MGS Total Return Index advanced by 0.56%, as it reached 939.769 points. A total of 12 issues were active, 11 of which traded higher while just one declined. The best performance of a 3.9% increase was recorded by the 2.1% MGS 2039 (I) as it closed at €90. On the other hand, the 1.50% MGS 2045 (I) ended the week 8.6% lower at €80.

In the Prospects MTF market, five issues were active, recording a total turnover of €95,500. The 4.875% AgriHoldings plc Senior Secured € 2024 was the most liquid, as a total weekly turnover of €49,000 was generated.

| Upcoming Events | ||||

| 08 July 2022 | MT: Tigne Mall plc – Dividend Payment Date | Best Performers: | ||

| 11 July 2022 | MT: PG plc – Dividend Payment Date | LQS | +108.8% | |

| 15 July 2022 | MT: AX Real Estate plc – Dividend Payment Date | LOM | +11.76% | |

| 28 July 2022 | MT: Mapfre Middlesea plc – Interim Results | MTP | +7.92% | |

| 28 July 2022 | MT: MedservRegis plc – AGM | |||

| Worst Performers: | ||||

| GO | -4.52% | |||

| HSBC | -3.18% | |||

| RS2 | -1.27% | |||

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. Jesmond Mizzi Financial Advisors Limited is acting as sponsoring brokers for the upcoming BNF Bank plc bond issue. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]