MSE Trading Report for Week ending 05 August 2022

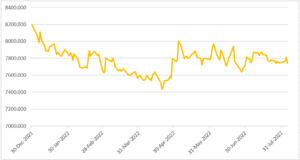

| MSE Equity Total Return Index: |

| Highlights: |

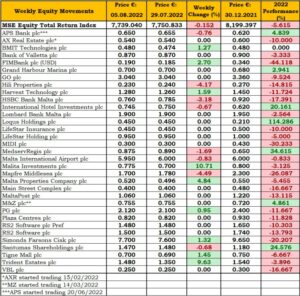

The MSE Equity Total Return Index (MSE) slipped 0.2% to finish at 7,739.040 points, as it closed lower for the fourth week in succession. Out of 22 active equities, nine gained while another eight equities closed lower. During the week, trading activity declined, as turnover dropped to €0.3m. Since the beginning of the year the MSE is down by 5.6%.

Malta International Airport plc (MIA) headed south, as eight deals of 9,468 shares dragged the share price 0.8% lower to €5.95. MIA generated the highest turnover amongst all active equities, totalling €56,531.

International Hotel Investments plc partially erased the previous week’s decline, after the share price slid by 0.7% to €0.745. This was the outcome of three transactions of 11,600 shares. From a year-to-date perspective, the equity is up by 20.2%.

In the banking sector, Bank of Valletta plc shares closed at the €0.87 price level, after trading at a weekly high of €0.90. Trading activity was lower than usual, as six trades of 8,711 shares were recorded.

The share price of HSBC Bank Malta plc (HSBC) shed 3.2%, to close at €0.76. HSBC shares exchanged ownership 13 times, with trading turnover reaching €29,751. On a year-to-date basis, the banking equity is down by 17.4%.

The board of HSBC approved the group’s and the bank’s interim condensed financial statements for the six-month financial period ended June 30, 2022. The group registered a profit after tax of €15.5m, an increase of €4m over the same period in 2021.

Fees and commissions and trading income increased by €1.9m. This was mainly a result of higher credit card usage, account fees and growth in transaction banking revenues within the commercial banking business, including good progress made on foreign exchange income resulting in higher trading income.

Net interest income decreased by €3.2m to €46.2m, compared to €49.4m in the same period in 2021. This was a result of lower interest rates, as margins continued to tighten and some of the excess liquidity was placed at negative rates. Customer deposits increased by €652m compared to the same period last year and operating expenses increased by €5.3m to €57.4m, compared with €52.2m in the same period in 2021.

Similarly, APS Bank plc (APS) trended 0.8% lower to €0.65. APS shares were active across 14 trades on a trading volume of 43,482 shares worth €28,513. Although the bank’s share price dropped, it remains 4.8% higher than its initial public offering price of €0.62.

On the contrary, FIMBank plc shares advanced by 2.7% to close the week at $0.19. Two deals involving the exchange of 97,500 shares were executed.

Mapfre Middlesea plc (MMS) headed the list of fallers, after recording a decline of 4.5% or €0.08. A total of 6,428 shares exchanged hands four times. Since the beginning of the year, the equity is down by 26%.

MMS registered a profit before tax for the first six months of 2022 of €11.8m, compared to €11m recorded during the comparative period last year. During the period the group registered a profit after taxation of €8.1m, up from €7.6m last year.

General business gross premium written increased by 8.6% from €41.3m in 2021 to €44.9m. Long term gross premium written by the group registered a downward movement of 9.9% to €151.8m, compared to €168.4m in 2021. The board of MMS did not propose the payment of an interim dividend.

In the IT services sector, BMIT Technologies plc (BMIT) closed higher by 1.3% at €0.48. A total of five transactions generated €15,595 in turnover.

The board of BMIT approved the group’s interim unaudited financial statements for the six-month period ended June 30, 2022. The group’s revenue amounted to €12.6m, compared to €12.8m in the first half of 2021. This marginal decline of just over 1% was a result of a number of challenges characterised by increased technological and competitive pressures, customer and project delays, as well as by global issues with hardware lead times.

The marginal drop in revenue this year, resulted in a similar reduction in the cost of sales which decreased from €6.8m to €6.6m, preserving gross profit margins at 48%. The lifting of Covid-19 restrictions increased activity, led to a marginal increase in administrative expenses from €1.6m to €1.7m. The slight drop in revenue and increase in costs resulted in a reported EBITDA of €5.4m compared to €5.7m last year.

Similarly, Harvest Technology plc (HRV) gained 1.6%, as one deal of 500 shares was executed at €1.28.

The board of HRV approved the company’s interim financial statements for the six-month period ended June 30, 2022. The group registered a profit after tax of €0.7m, down from €1.2m during the same period last year. The group’s revenue increased by €0.3m to €8.3m. Based on the updated forecasts, the group is expected to achieve higher revenues in 2022 and profit before tax is expected to be around the €3m mark.

The company resolved to distribute an interim net dividend of €455,613, equivalent to €0.02 per share. The payment of the dividend shall be affected by not later than August 31, 2022.

RS2 Software plc Ordinary shares were active yesterday in the final hour of trading, as the equity closed the week unchanged at €1.50. Two trades involving 5,599 shares were executed.

In the property industry, Malita Investments plc registered the best performance of 10.7%. A total of 9,600 shares were active across one deal, ultimately ending the week at €0.775.

The share price of Trident Estates plc gained 9.6% to €1.48, as three thin trades were recorded.

Malta Properties Company plc managed to end the week at a weekly high of €0.52, higher by 4.8%. Six transactions worth just €3,500 were executed.

The share price of AX Real Estate plc closed unchanged, as 7,400 shares were traded over a single trade. The equity ended the week at €0.54.

Similarly, MIDI plc kept the previous week’s share price of €0.30. This was the result of three transactions worth €20,020.

On a negative note, Hili Properties plc and Santumas Shareholdings plc shares closed in negative territory, contracting by 4.2% and 0.7% to close at €0.23 and €1.47, respectively.

Last Thursday, Hili Properties plc announced that it has acquired 75% of the issued share capital of Baneasa Real Estate S.R.L., owner of MIRO office building in Bucharest. The company also agreed to enter into a sales and purchase agreement for the acquisition of the remaining 25% in two years’ time.

This investment is part of the company’s vision to make positive impact on the communities in which they invest through sustainable buildings. This asset in Romania increases the company’s portfolio from €173.8m to €234.2m and extends the total leasable area to approximately 119,000 sqm across 23 properties.

A sole transaction of 8,200 GO plc shares did not alter the share price of the telecoms company, as the equity closed the week at €3.04.

PG plc shares rebounded from its previous week’s decline, as the equity registered a 1% increase, closing at €2.12. Total turnover in the equity amounted to €16,485 across three deals.

MedservRegis plc shares extended its decline for the second consecutive week, to close at €0.875.

MedservRegis plc announced that Eni Cyprus Ltd has extended the current contract with Medserv Cyprus Limited, a subsidiary of the company, for the provision of operational base support services in Cyprus for an additional 12 months until June 2023.

Simonds Farsons Cisk plc added a further 1.3% to the previous week’s gains, finishing the week at €7.70. In total, 660 shares changed ownership over three deals.

Two transactions of 2,600 Tigne Mall plc shares resulted into a 1.5% increase in the share price, as it closed the week at €0.70.

The board of Tigne Mall plc met last Thursday and approved the unaudited condensed interim financial statements of the company for the six months ended June 30, 2022.

During the period under review, the company’s profit after tax doubled to €1.6m over the same period in 2021. This improvement is mainly the result of uninterrupted collection of rent, higher revenues from the car park and lower finance costs.

The directors have also declared an interim net dividend payment of €750,000 equivalent to €0.013 per nominal share which will be paid on September 2, 2022.

In the bond market, MSE MGS Total Return Index rose by 0.5%, as it reached 958.229 points. Out of 12 active issues, 10 closed higher, while none declined. The 3.40% MGS 2042 (I) R headed the list of gainers, as it closed 2% higher at €110.17.

The MSE Corporate Bonds Total Return Index rose by a further 0.5%, adding to last week’s 0.3% increase. The index closed at 1,158.333 points. A total of 56 issues were active, as 21 registered gains while 15 lost ground. The best performance was recorded by the 4.35% SD Finance plc Unsecured € 2027, as it closed 2% higher at €102. Conversely, the 4.25% CPHCL Finance plc Unsecured € 2026 lost 2.6%, ending the week at €99.02.

In the Prospects MTF market, three bonds were active, generating a total turnover of €20,140. The 5% Luxury Living Finance plc € Secured Bonds 2028 was the most liquid with a total weekly turnover of €9,950.

| Upcoming Events | ||||

| 09 Aug 2022 | MT: GO plc – Interim Results | Best Performers: | ||

| 10 Aug 2022 | MT: Malta Properties Company plc – Board Meeting | MLT | +10.7% | |

| 18 Aug 2022 | MT: FIMBank plc – Interim Results | TRI | +9.63% | |

| 19 Aug 2022 | MT: Plaza Centres plc – Dividend Payment Date | MPC | +4.84% | |

| 25 Aug 2022 | MT: AX Real Estate plc – AGM | |||

| Worst Performers: | ||||

| MMS | -4.49% | |||

| HLI | -4.17% | |||

| HSB | -3.18% | |||

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. Jesmond Mizzi Financial Advisors Limited is acting as sponsoring brokers for the upcoming BNF Bank plc bond issue. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]