MSE Trading Report for Week ending 19 August 2022

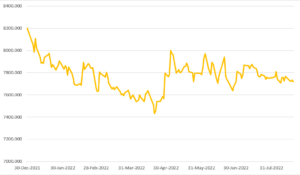

| MSE Equity Total Return Index: |

| Highlights: |

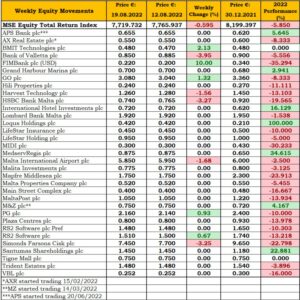

The MSE Equity Total Return Index finished the week in the red, lower by 0.6% at 7,719.732 points. A total of 16 equities were active, as losers and gainers tallied to five each. During this four-day trading week, total turnover stood at just €0.27m.

Simonds Farsons Cisk plc joined the list of losers, as it closed 3.3% lower at €7.45. This was the result of 1,656 shares executed across four transactions, worth a total of €12,381.

Malta International Airport plc fell to a three-month low of €5.85 during yesterday’s session, ending the week lower by 1.7%. A total of 8,218 shares changed ownership across six transactions.

In the financial services sector, Bank of Valletta plc headed the list of fallers, as it closed 4% lower, reaching a two-month low of €0.85. This was the outcome of 62,305 shares spread across 11 transactions. The decline since the beginning of 2022 now stands at 5.6%.

Its peer, HSBC Bank Malta plc (HSBC) followed suit, as five transactions of 45,522 shares dragged the equity into negative territory. HSBC finished the week 3.3% lower at €0.74. From a year-to-date perspective, the equity declined by 19.6%.

On the other hand, FIMBank plc was the best performing equity, closing 10% higher. The banking equity was active across five deals worth $21,604, closing the week at $0.22 – but still a third lower of what the banking equity was worth at the beginning of the year.

Last Thursday the board of FIMBank plc met and approved the consolidated interim financial statements for the six-month period ended June 30, 2022.

The group’s net operating revenues were in line with the same period last year, at $22m. Net interest income rose by $1.3m, a year-on-year increase of 10%, to $14m, as policy makers are gradually normalising their monetary policies, allowing the group to widen its lending margins. Net fees and commission income at $5.6m was at the same levels of the prior year.

The group incurred revaluation losses on trading assets and other debt securities of $2.2m, compared to a $1.7m gain recorded in the same period last year. The group received $3.8m in dividends from its investment in the unlisted sub-fund, compared to $1m recorded in June 2021.

Operating expenses for the six months under review stood at $18.7m, down by 10% from same period last year.

As several risks materialised, the group increased its net provisions by $4.4m, primarily for the legacy non-performing clients. On a positive note, the group recovered $0.9m from previously written-off debt. On the other hand, $1.6m of assets were written-off, on which the group had no reasonable expectations of recovering the contractual cash flows. For the period under review, the group reported a loss after tax of $2.9m, compared to a $981k gain registered in 2021.

APS Bank plc was the most liquid equity, as it generated a total weekly turnover of €65,592. The equity was active across 16 deals involving 100,929 shares. Despite trading at a weekly low of €0.64, the equity kept the previous week’s closing price of €0.655.

Similarly, no movement was noted in the share price of Mapfre Middlesea plc which finished the week at €1.75. A single transaction of 1,046 shares was executed.

International Hotel Investments plc was active but closed unchanged at €0.72. This was the outcome of a single transaction of 2,731 shares.

In the property sector, all three active equities closed the week unchanged on a single trade. Hili Properties plc ended the week at the €0.24 price level, as 4,166 shares exchanged hands.

A total of 2,500 Malta Properties Company plc shares were traded, keeping the previous week’s share price of €0.52. Meanwhile, Trident Estates plc was active on negligible volume of just 94 shares, closing flat at €1.48.

In the IT services sector, Harvest Technology plc was the only equity to register a decline, closing 1.6% lower at €1.26. This was the outcome of a single deal involving 3,360 shares.

BMIT Technologies plc fully recovered from the previous week’s decline, gaining 2.1% to its share price. Two transactions of 10,300 shares were executed, to end the week at €0.48.

RS2 Software plc Ordinary shares traded twice over 1,300 shares. The equity closed the week at the €1.51 price level.

Telecommunications company GO plc, was up by 1.3% as 4,045 shares changed ownership over four deals. The equity ended the week at a two-month high of €3.08. On a year-to-date basis the equity is still down by 8%.

PG plc had another positive week, as it closed 0.9% higher at €2.16. A total of 1,100 shares were spread across two transactions, generating a total weekly turnover of €2,376.

The board of Santumas Shareholdings plc announced that it is scheduled to meet on August 31, 2022 to consider and approve the company’s audited financial statements for the year ended April 30, 2022.

Main Street Complex plc announced that the board is scheduled to meet on August 22, 2022 to consider and approve the interim financial statements of the company for the six-month period ended June 30, 2022 and to consider the distribution of an interim dividend to shareholders.

The MSE MGS Total Return Index declined slightly by 0.04% to close at 953.203 points. A total of six issues were active, one of which headed north, while another four closed in the opposite direction. The 3% MGS 2040 (I) issue was the best performer, as it closed marginally higher at €103.75. On the other hand, the 4.65% MGS 2032 (I) lost 0.64%, ending the week at €118.82.

The MSE Corporate Bonds Total Return Index registered a 0.16% increase, as it reached 1,155.925 points. Out of 45 active issues, 13 advanced, while another 18 lost ground. The 6% AX Investments Plc € 2024 headed the list of gainers, as it registered a 2.5% increase in price, reaching the €104 price level. Conversely, 6% MedservRegis plc € 2020-2023 S1 T1 ended the week 3.9% lower at €96.09.

In the Prospects MTF market, seven issues were active. The 5% Luxury Living Finance plc € Secured Bonds 2028 was the most active, as it generated a total weekly turnover of €55,000.

| Upcoming Events | ||||

| 19 Aug 2022 | MT: Plaza Centres plc – Dividend Payment Date | Best Performers: | ||

| 25 Aug 2022 | MT: AX Real Estate plc – AGM | FIM | +10.0% | |

| 25 Aug 2022 | MT: PG plc – Full-Year Results | BMIT | +2.13% | |

| 26 Aug 2022 | MT: MedservRegis plc – Interim Results | GO | +1.32% | |

| 29 Aug 2022 | MT: International Hotel Investments plc | |||

| 29 Aug 2022 | MT: Grand Harbour Marna plc – Interim Results | Worst Performers: | ||

| 30 Aug 2022 | MT: M&Z plc – Interim Results | BOV | -3.95% | |

| 31 Aug 2022 | MT: Harvest Technology plc – Dividend Payment Date | HSBC | -3.27% | |

| SFC | -3.25% | |||

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. Jesmond Mizzi Financial Advisors Limited is acting as sponsoring brokers for the upcoming BNF Bank plc bond issue. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]